Are you ready to streamline your approach to international audit coordination? This process can seem daunting, but with the right strategies and a solid template, you can navigate it with ease and confidence. By creating a clear and structured letter template, you'll facilitate communication among all stakeholders involved, ensuring everyone is on the same page. Dive into this article to discover essential tips and a customizable template designed to simplify your international audit experience!

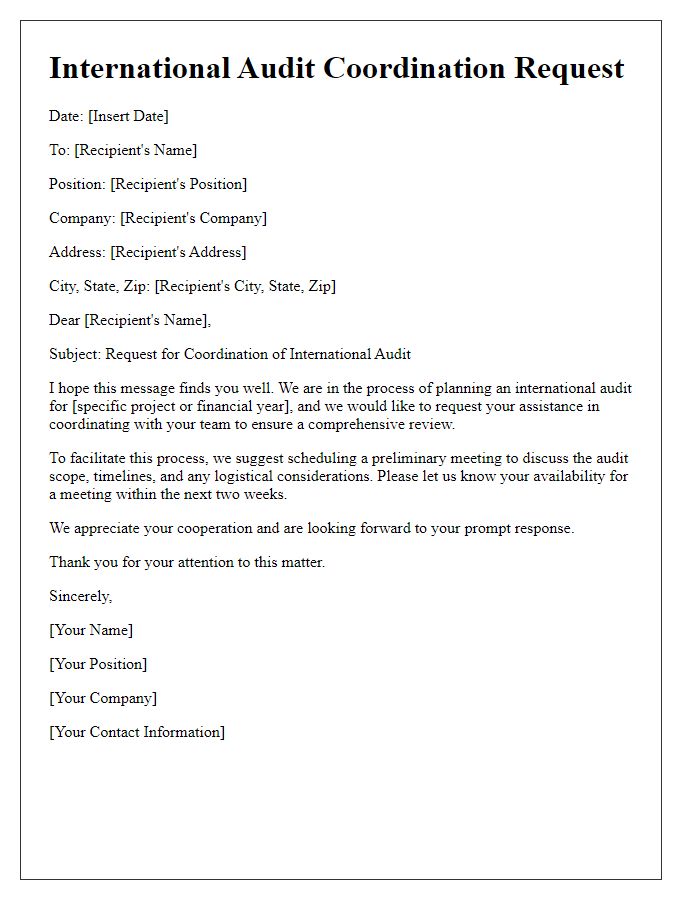

Recipient and Sender Information

International audit coordination involves meticulous communication and collaboration between entities across various countries. The recipient of correspondence typically holds a key position within an auditing firm or organization, such as the Chief Audit Executive (CAE) or Audit Manager. The sender usually represents a major corporation, potentially a multinational enterprise with operations in diverse markets. Essential details like the date, audit reference numbers, and the specific scope of the audit are crucial. Communication may also include references to international auditing standards, such as ISA (International Standards on Auditing) 600, which deals with the responsibilities regarding a group audit. Additionally, time zone considerations are important for recipients located in different geographical regions, impacting deadlines and meeting arrangements. Effective coordination ensures compliance with local regulations and successful audits across multiple jurisdictions.

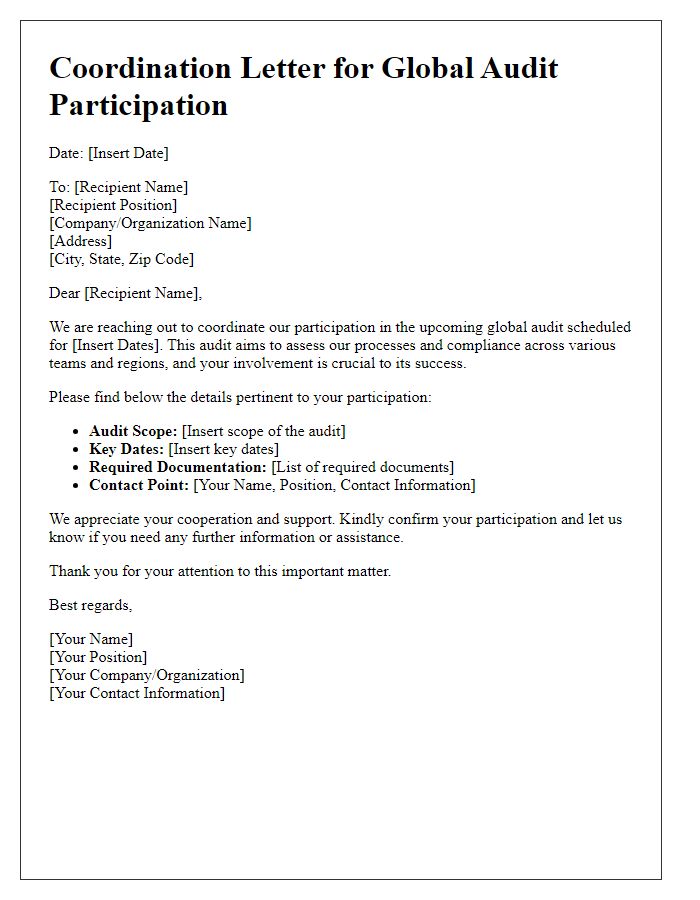

Purpose and Scope of the Audit

The purpose of the international audit involves a comprehensive evaluation of financial statements, compliance with regulations, and adherence to internal policies. Coordination among various stakeholders, including global financial teams and external audit firms, is essential to ensure consistency and transparency in the audit process. The scope encompasses reviewing financial records across multiple jurisdictions, ensuring alignment with International Financial Reporting Standards (IFRS), and assessing operational efficiencies. Key regions involved in this audit, such as North America, Europe, and Asia-Pacific, will have distinct regulatory requirements that auditors must navigate. Detailed examination of transactions exceeding specific thresholds, often around 1 million dollars, must be conducted to identify discrepancies or failures in compliance. Timely communication of findings and recommendations will facilitate improved governance and risk management practices across the organization.

Responsibilities and Roles of Parties

International audit coordination requires clear delineation of responsibilities and roles among various parties involved in the process. The audit committee, consisting of professionals from diverse backgrounds, plays a crucial role in establishing audit objectives and scope, ensuring compliance with regional regulations, such as the International Financial Reporting Standards (IFRS) or Sarbanes-Oxley (SOX). The external auditors, often affiliated with firms like Deloitte or Ernst & Young, are tasked with assessing the accuracy of financial statements while maintaining independence and objectivity. Internal teams hold the responsibility for providing necessary documentation, access to systems, and facilitating communication with stakeholders across different time zones, notably in offices located in major financial hubs such as New York, London, and Tokyo. Moreover, regulatory bodies, such as the International Accounting Standards Board (IASB), provide guidelines to ensure the audits align with global standards. Effective communication and collaboration among these parties are essential to mitigate risks and ensure a transparent audit process.

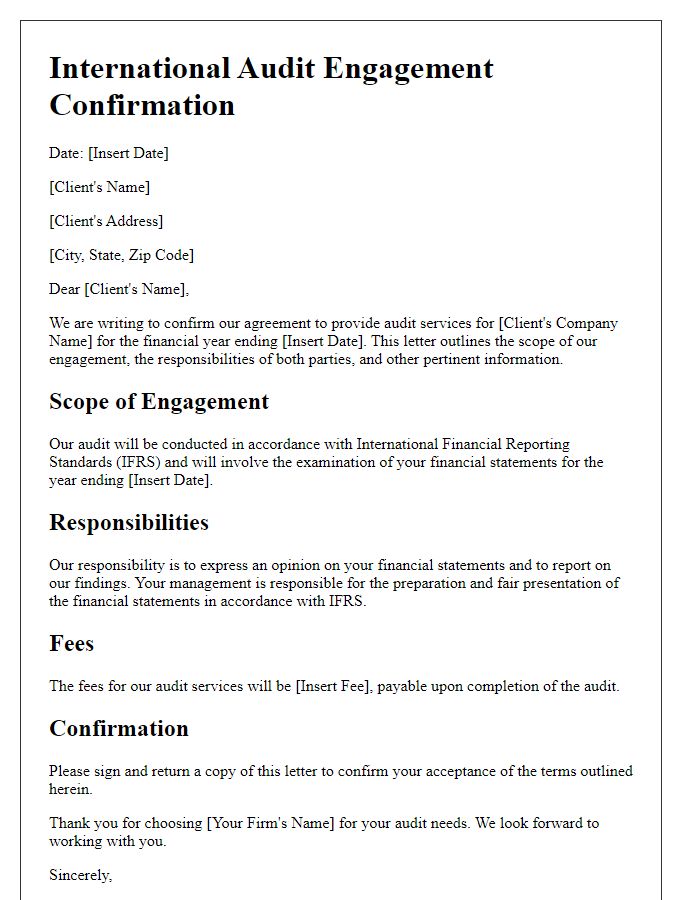

Key Dates and Deadlines

International audits require precise coordination across different time zones and regulatory environments to ensure compliance and accuracy. Critical milestones include the audit planning phase, typically initiated two months prior to the audit, allowing for necessary document preparation and personnel selection, including auditors from firms like Deloitte or Ernst & Young. Preliminary meetings often occur four weeks before the actual audit date, establishing expectations and timelines. The audit period itself generally spans three weeks, during which fieldwork takes place, involving review of financial statements and internal controls. Final reports usually conclude within two weeks after fieldwork, culminating in a review meeting where findings are discussed with stakeholders. Timely adherence to these key dates is essential for maintaining smooth operations and fulfilling international regulatory requirements.

Contact Information for Queries

International audit coordination requires clear communication among various stakeholders. Essential contact information includes names of key personnel, their roles, email addresses, and telephone numbers. For example, John Doe, Senior Auditor, can be reached at john.doe@example.com or +1-555-123-4567 for inquiries regarding audit timelines and methodologies. Additionally, Jane Smith, Compliance Officer, is available at jane.smith@example.com or +1-555-765-4321 for questions related to regulatory standards and reporting requirements. Accurate and comprehensive contact details ensure efficient resolution of queries, facilitating a smooth audit process across different time zones and regions.

Comments