Welcome to our comprehensive guide on preparing for an audit inquiry! If you've ever felt overwhelmed by the thought of audits, you're not aloneâmany find the process daunting. But don't worry; we're here to break it down into manageable steps to help you navigate the intricacies with confidence. Ready to learn how to simplify your audit preparation? Let's dive in!

Clear Subject Line

A clear subject line for an audit inquiry preparation email should succinctly convey the purpose of the message. For instance, "Request for Audit Documentation - [Your Company Name] - [Audit Period]" provides immediate understanding of the inquiry, includes the specific entity involved, and indicates the timeframe for the requested audit documents. This helps ensure that the recipient can promptly identify the relevance to their responsibilities and prepare accordingly.

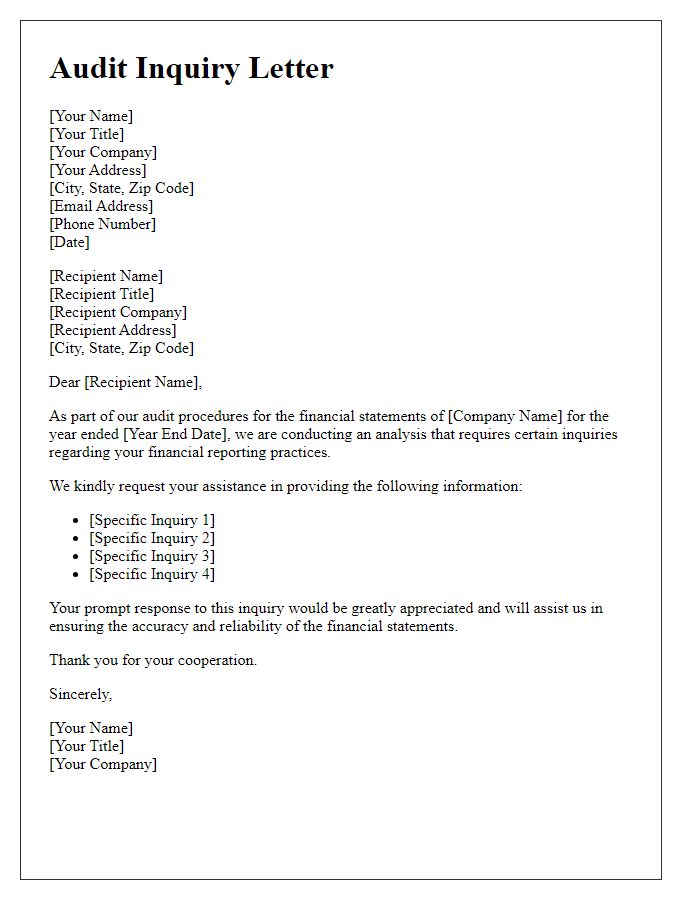

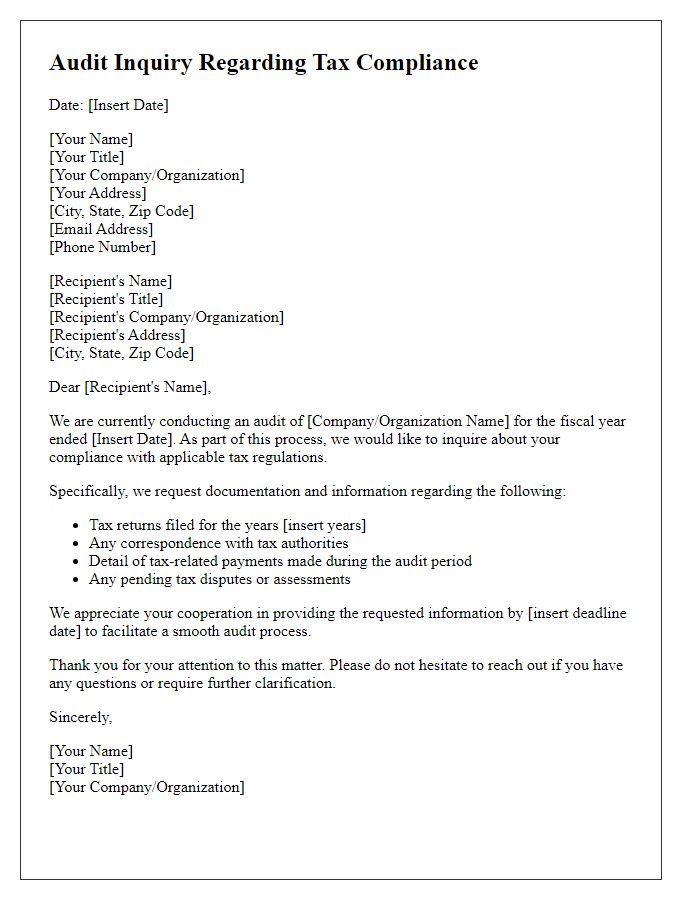

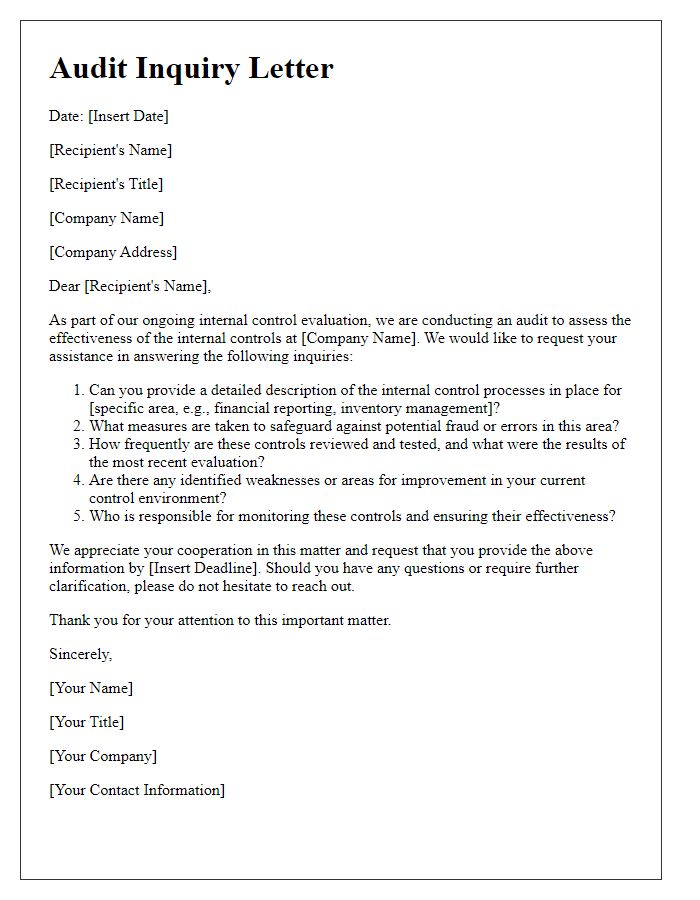

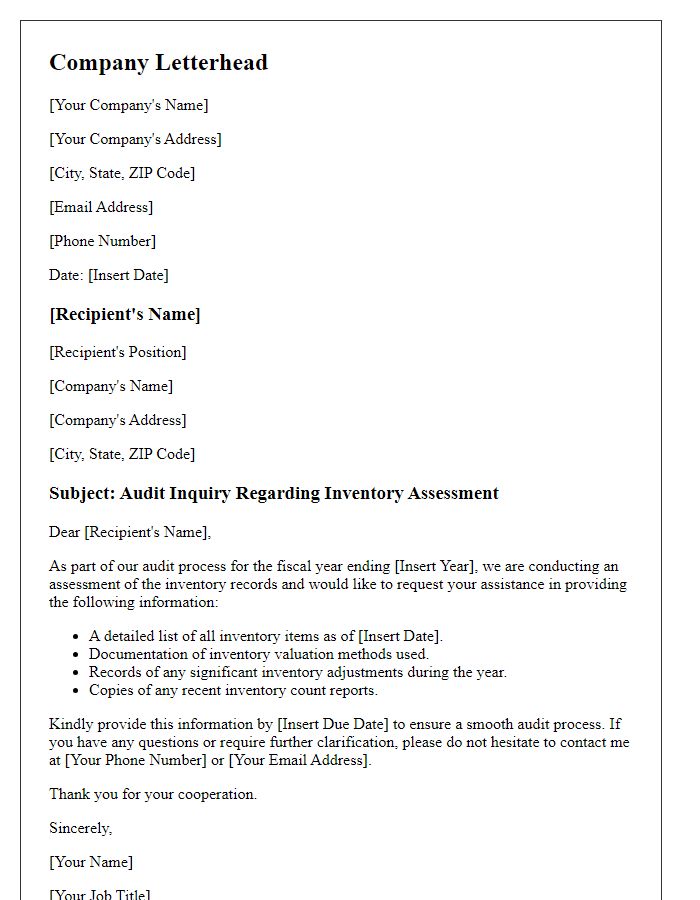

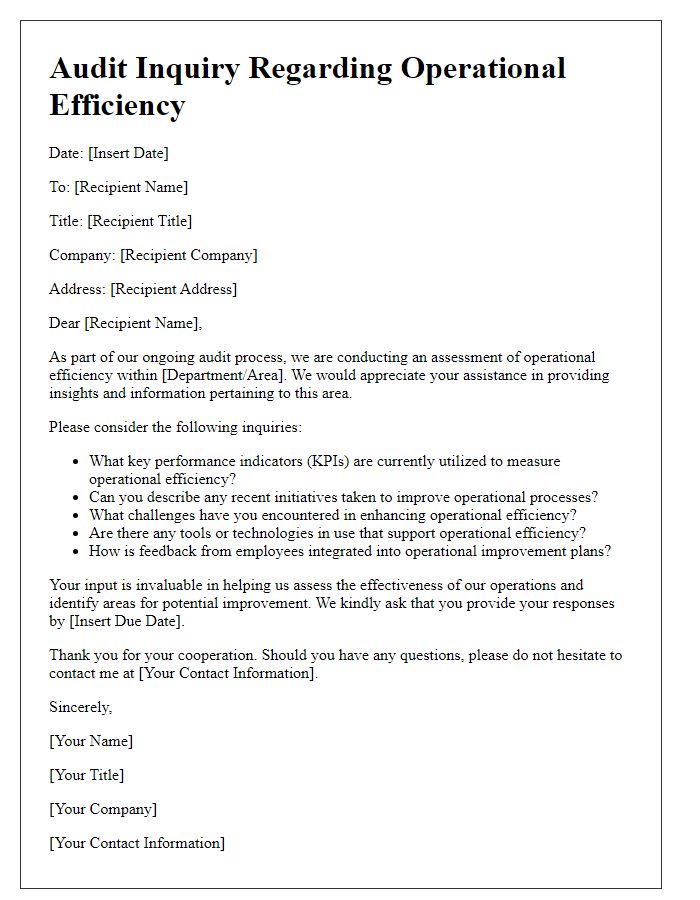

Company and Auditor Details

The preparation of audit inquiry involves collecting comprehensive company details, such as the business name, incorporation date, and registration number. Essential auditor information includes the firm name, partner in charge, and contact details. Specific financial records like fiscal year-end dates (e.g., December 31, 2023) are crucial for establishing context. Identifying audit objectives, including compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), enhances the inquiry process. Additionally, the previous year's audit findings play a significant role in tailoring inquiries, guiding the assessment of changes in internal controls and financial practices. Gathering this information is instrumental for conducting an efficient and effective audit.

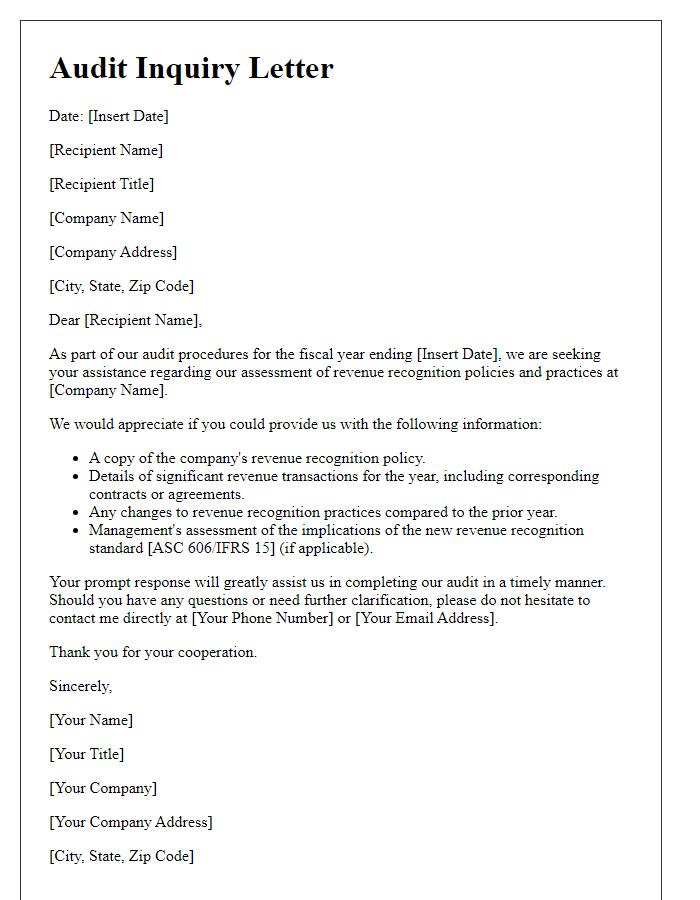

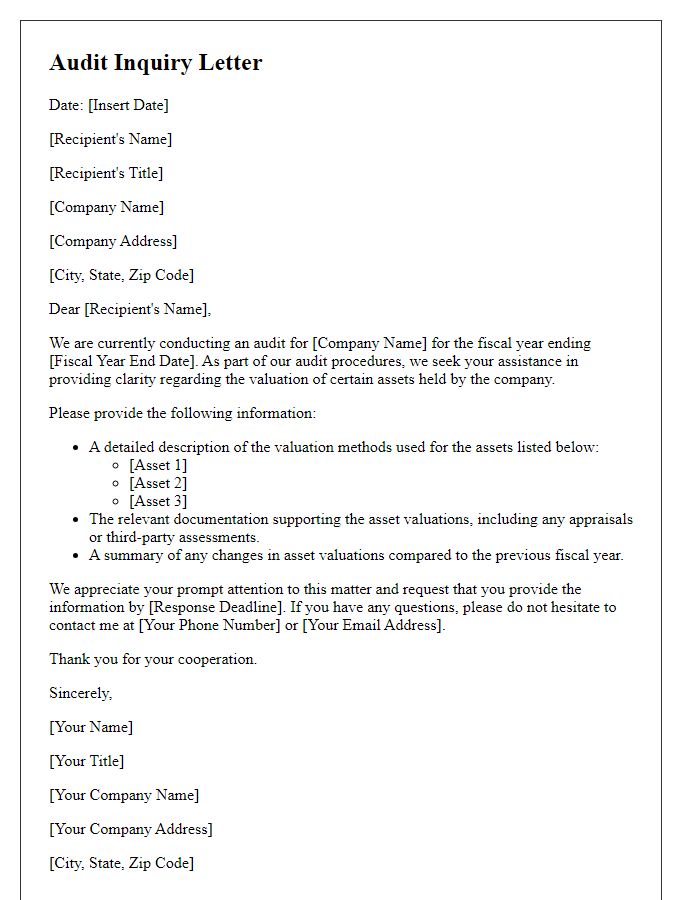

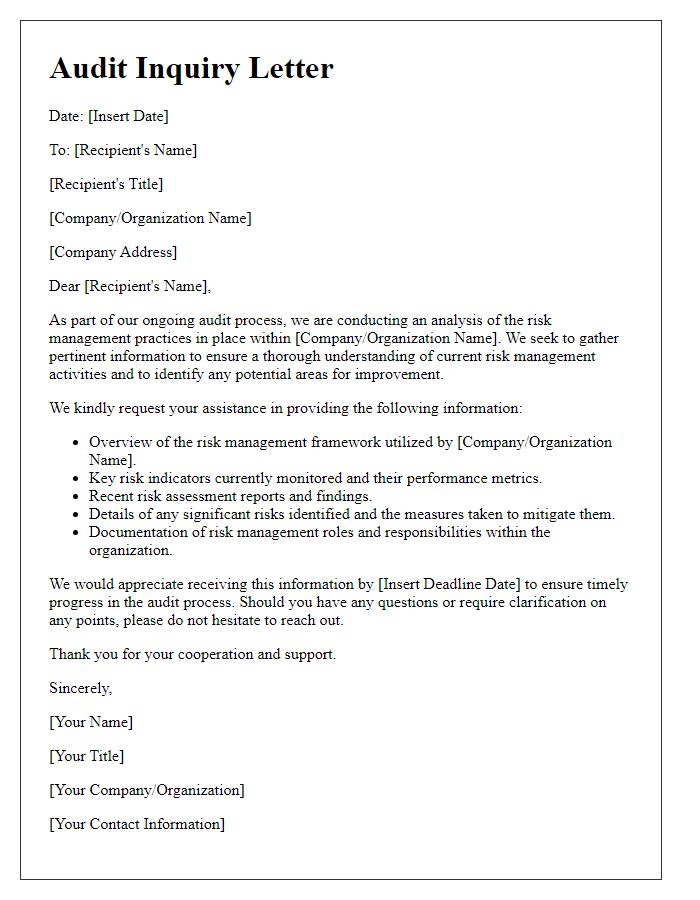

Purpose and Scope of Inquiry

Audit inquiries serve a critical purpose in evaluating financial statements and compliance with regulatory standards, ensuring accuracy and transparency. Engaging in these inquiries involves systematic examination of relevant documentation, such as bank statements, invoices, and contracts. The scope of this process typically encompasses meticulous verification of account balances, assessment of internal controls, and identification of potential discrepancies that could indicate fraud or mismanagement. Particular focus may be placed on significant transactions or events occurring during the fiscal year, along with compliance with laws such as the Sarbanes-Oxley Act of 2002, which governs corporate financial practices. The inquiry aims to provide stakeholders, including investors and regulatory bodies, with confidence in the integrity of financial reporting.

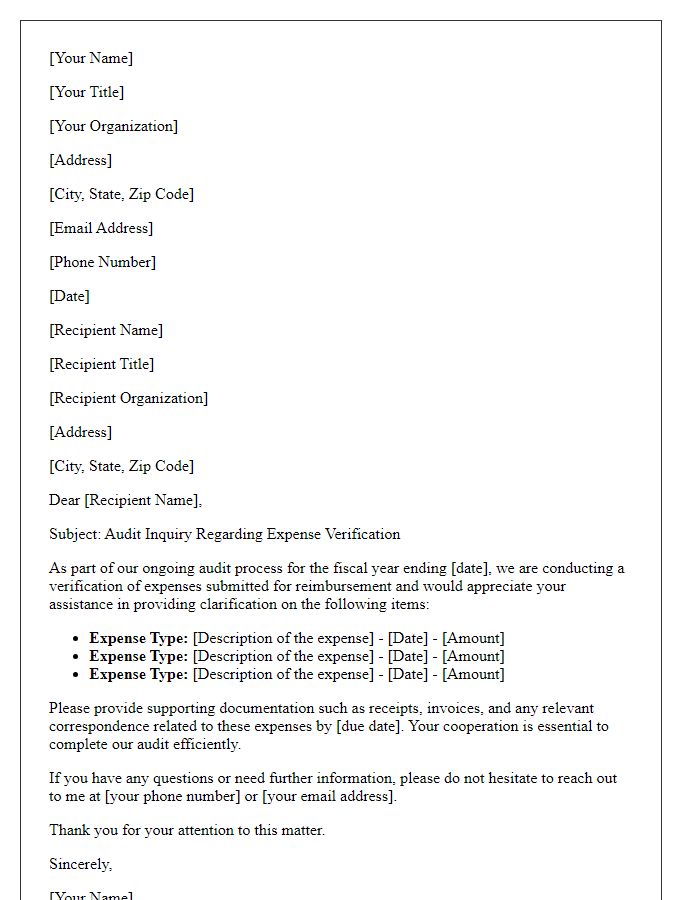

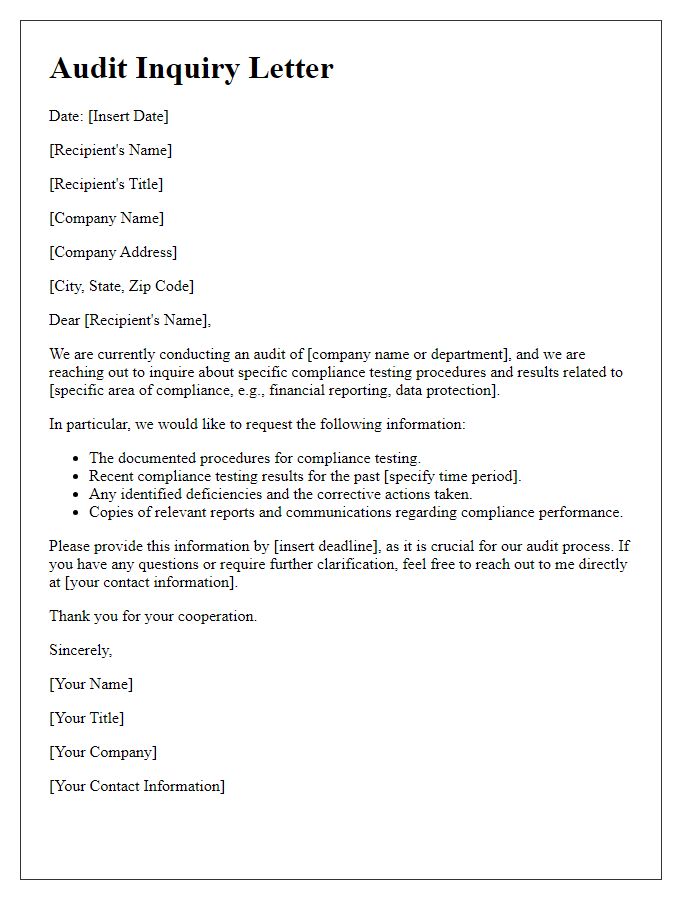

Specific Information Requested

Audit inquiries typically require specific information, such as financial records, policy documentation, and compliance reports. Essential documents include the most recent financial statements, detailed transaction records spanning the last fiscal year, and any internal control policies in place at the organization (for instance, any risk assessment documentation conducted). Furthermore, evidence of compliance with governmental regulations (like the Sarbanes-Oxley Act for publicly traded companies), board meeting minutes, and correspondence with external auditors may be requested. Additionally, any pending legal issues or contingent liabilities that could impact financial statements should be disclosed to ensure a comprehensive audit process.

Deadline and Contact Information

Preparation for audit inquiries involves meticulous organization regarding deadlines and contact information. Auditors often set deadlines for specific information requests, which can vary typically from one week to thirty days, depending on the complexity of the audit. Accurate contact information, including names, phone numbers, and email addresses of relevant personnel in departments such as Finance or Compliance, is crucial for effective communication during the audit process. For example, the Chief Financial Officer (CFO) may need to be involved for financial-related inquiries, while the Compliance Officer might provide insights on regulatory matters. Properly documenting this information ensures timely responses and fosters a collaborative environment during the audit.

Comments