Are you looking to enhance your cooperative audit practices? Implementing effective auditing strategies can not only ensure compliance but also foster trust among members. By embracing transparency and collaboration, cooperatives can streamline their operations and improve financial health. Dive deeper into this topic and discover practical tips and insights to optimize your cooperative's audit process!

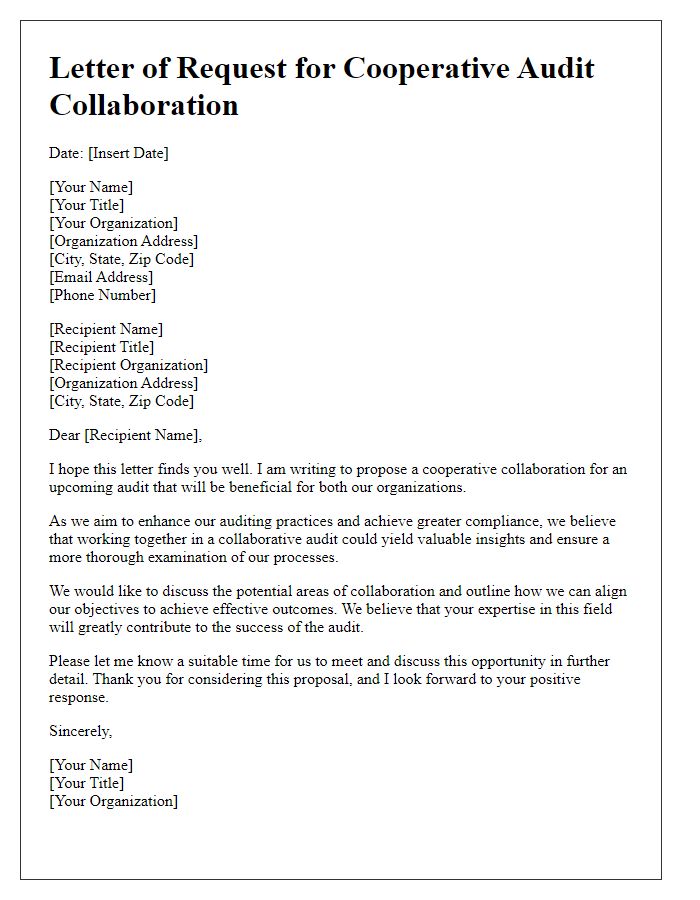

Introduction and Purpose Statement

Cooperative audit practices aim to enhance transparency and accountability within organizations through structured evaluation processes. The introduction outlines the necessity for regular audits to ensure compliance with established regulations and standards. Purpose statements emphasize the commitment to identifying areas for improvement while fostering a culture of integrity and trust. Such practices benefit stakeholders, including board members, employees, and community members, by providing insights into financial health and operational efficiency. Implementing these audits promotes a proactive approach towards risk management and strengthens the overall governance framework.

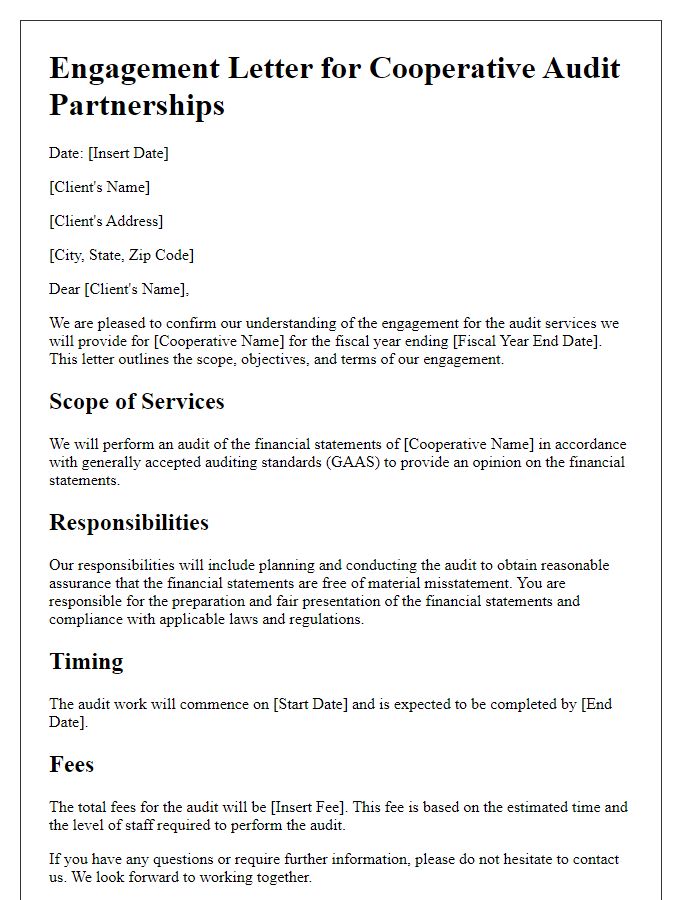

Scope and Objectives

The scope of cooperative audit practices typically encompasses the evaluation of financial statements, adherence to compliance regulations, and assessment of internal controls within member organizations. Objectives aim to ensure accuracy in financial reporting, foster transparency among stakeholders, and enhance trust within the cooperative sector. Auditors focus on analyzing accounting records, identifying risks, and recommending improvements to operational efficiencies, thereby contributing to the sustainability of the cooperative model as seen in various case studies across North America and Europe. Furthermore, cooperative audits promote accountability and support strategic decision-making processes that align with the values established by cooperative principles, such as member ownership and democratic governance.

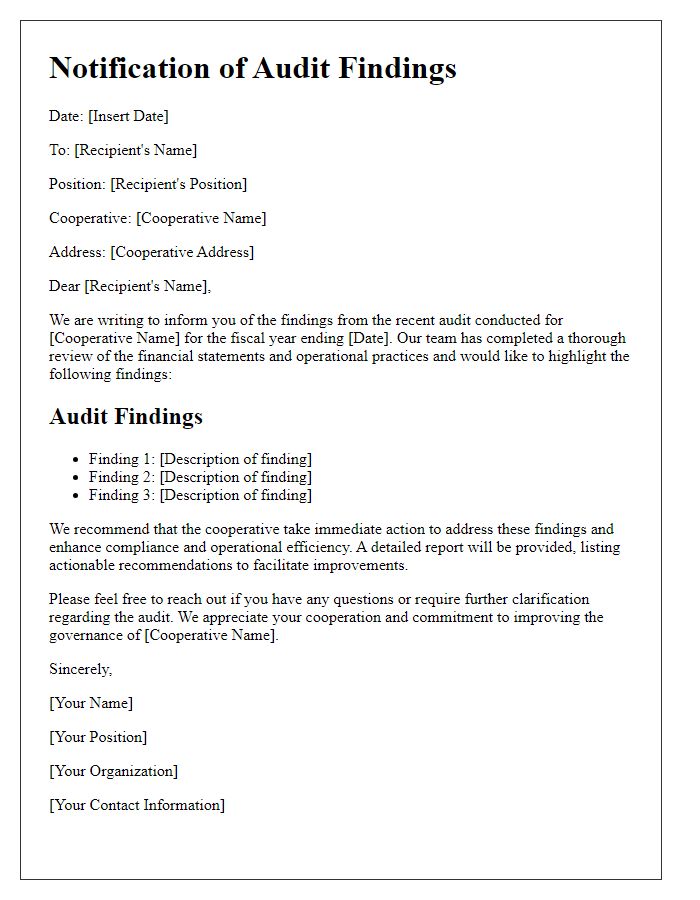

Auditor Responsibilities and Authority

In cooperative audit practices, auditors play a critical role in ensuring transparency and accountability within organizations, particularly in entities like credit unions or cooperatives. Auditors possess the responsibility to evaluate financial statements, ensuring adherence to regulations such as generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). They analyze financial transactions, scrutinize internal controls, and assess compliance with relevant laws, including the Sarbanes-Oxley Act in the United States. In addition, auditors have the authority to access all organizational records, interview employees, and review policies and procedures. Effective auditor responsibilities foster trust among stakeholders and help identify areas for financial improvement, ultimately leading to enhanced operational efficiencies and risk management strategies.

Cooperation Expectations and Client Responsibilities

Effective cooperative audit practices necessitate clear communication regarding cooperation expectations and client responsibilities. Clients must provide all relevant financial documents, including balance sheets, income statements, and tax returns, accurately reflecting their financial situation. Timely access to these documents is crucial, with a recommended lead time of at least two weeks before the audit commencement. Additionally, clients should appoint a liaison, ideally the Chief Financial Officer (CFO), to facilitate communication between the auditing team and the organization. Regular meetings, scheduled weekly, can enhance collaboration and ensure that the audit progresses smoothly. These expectations promote a productive environment, ultimately leading to a thorough and efficient audit process.

Confidentiality and Security Measures

Cooperative audit practices emphasize strict confidentiality and robust security measures to protect sensitive information. Audit teams must adhere to protocols that include encryption techniques for data transfer, ensuring only authorized personnel have access to proprietary data. Regular training sessions on information security best practices are essential, educating auditors about the importance of safeguarding client information and compliance with regulations such as GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act). Additionally, implementing secure physical environments, such as restricted access offices and secure document disposal methods, is crucial to maintaining the integrity of confidential audits. Regular security assessments and audits of IT systems help identify vulnerabilities and ensure that the latest security measures are in place.

Comments