Welcome to our annual audit report! We know that understanding financial matters can sometimes feel daunting, but we're here to break it down for you in a simple and engaging way. Our goal is to provide you with clear insights into our organization's financial health and operational integrity. So, grab a cup of coffee, sit back, and let's dive into the details together!

Introductory Statement

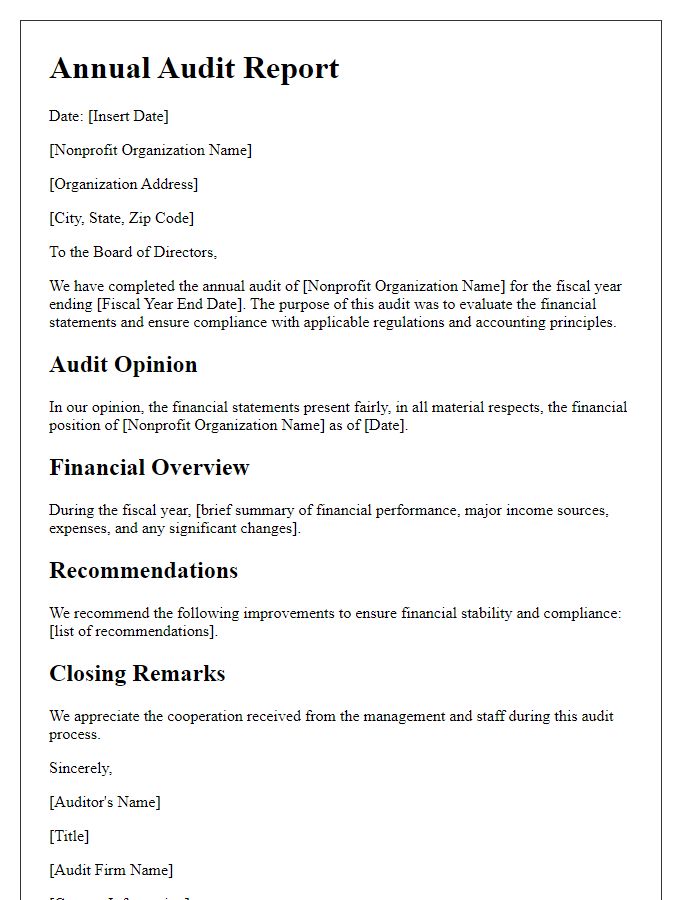

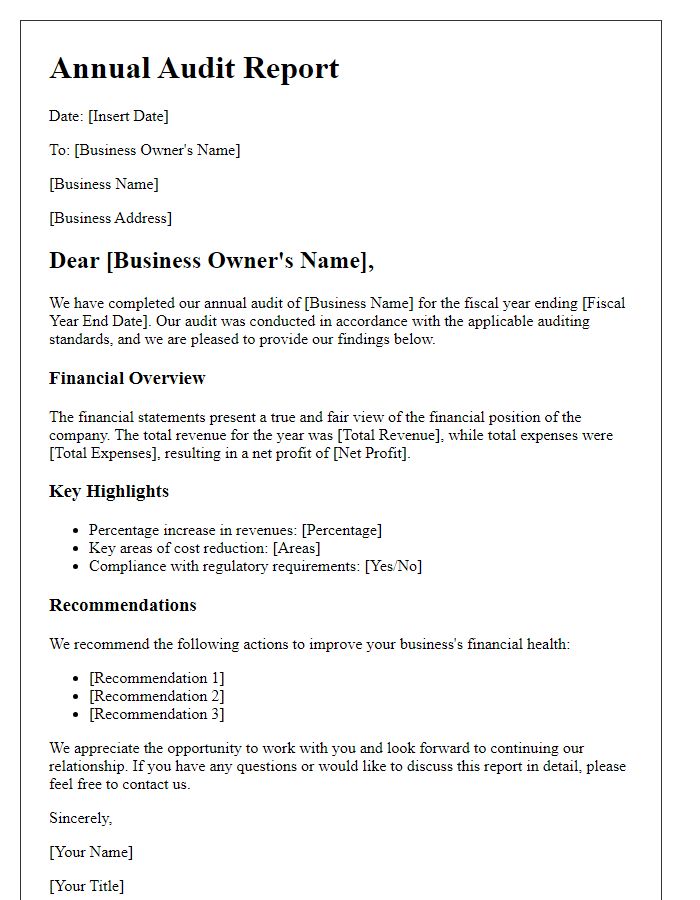

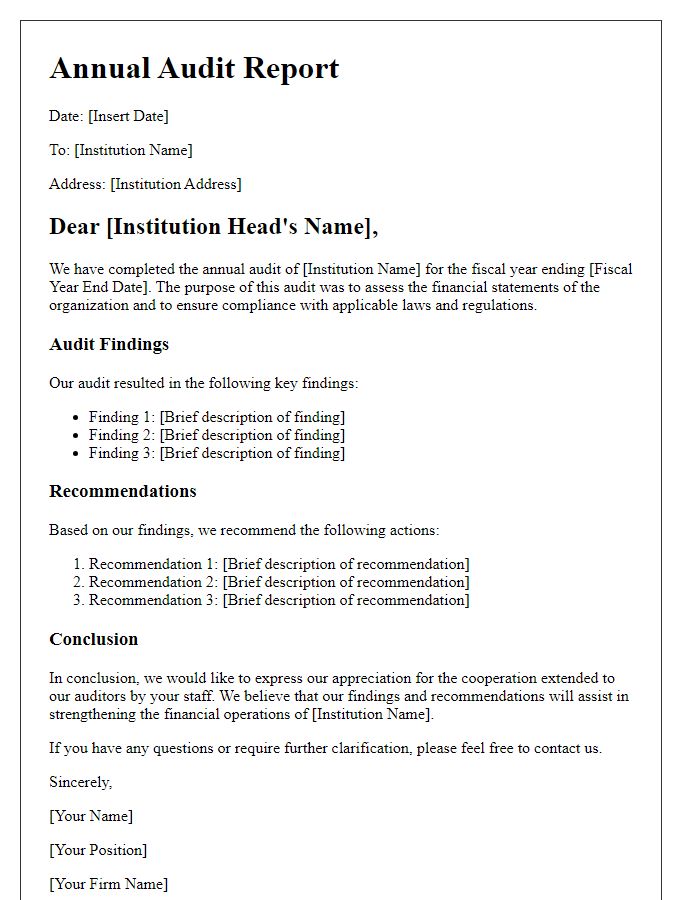

An annual audit report is a crucial document that provides an assessment of an organization's financial performance and compliance with relevant regulations. Conducted typically by independent auditors, this process ensures transparency and accountability, safeguarding stakeholders' interests. In 2023, the financial review encompassed various sectors, including revenue reporting, expense tracking, and asset management, evaluating fiscal year data from January 1st to December 31st. The report's findings, which reflect adherence to Generally Accepted Accounting Principles (GAAP), will be presented to the Board of Directors on March 15, 2024, at the corporate headquarters located in New York City. Key financial metrics were scrutinized, including total revenue of $5 million, operational expenses totaling $3 million, and net profit margin standing at 40%. The findings aim to reinforce trust among investors and enhance strategic planning for future growth.

Objective and Scope

The annual audit report aims to provide a comprehensive evaluation of the financial statements of XYZ Corporation, established in 1995 in New York City. This assessment evaluates fiscal year 2022, with a focus on ensuring compliance with Generally Accepted Accounting Principles (GAAP). A thorough examination of the company's balance sheets, income statements, and cash flow statements is conducted to detect discrepancies or irregularities. The scope of the audit covers all operational departments, including Marketing, Manufacturing, and Human Resources, encompassing over 300 transactions and accounting records from January 2022 to December 2022. Additionally, this audit aims to assess the effectiveness of internal controls implemented to mitigate risk and safeguard the assets of the organization, ensuring transparency and accountability for stakeholders such as investors, employees, and regulatory authorities.

Methodology and Procedures

The methodology and procedures employed during the annual audit process encompass several critical steps aimed at ensuring accuracy and compliance. Initial planning involves a thorough risk assessment to identify areas requiring more scrutiny, often referencing guidelines set by the International Auditing and Assurance Standards Board (IAASB). The auditor's team analyzes historical financial data (e.g., 2022 revenue of $5 million) and internal controls within the organization, such as segregation of duties. Fieldwork includes gathering evidence through tests of transactions, confirmations with third parties like banks or vendors, and observation of relevant processes. Each audit phase concludes with compiling findings into a comprehensive report for stakeholders, including recommendations for improving internal controls and compliance with regulatory standards such as the Sarbanes-Oxley Act (SOX). The final review process ensures all findings are validated, and any discrepancies are addressed before presenting the audit conclusions to the Board of Directors.

Financial Statements and Findings

Annual audit reports, specifically detailing financial statements and findings, serve as critical assessments for organizations' financial health. The balance sheet showcases assets, liabilities, and equity positions as of December 31, 2022, highlighting discrepancies in receivables totaling $50,000. Income statements reveal revenue streams and expenses over the fiscal year, with total income reported at $1 million and expenditures at $800,000, which indicates a net income of $200,000. The cash flow statement measures liquidity, demonstrating cash generated from operations of $300,000, a crucial metric for assessing operational sustainability. In addition, identified findings include inconsistent documentation practices and internal control weaknesses that may compromise financial accuracy and compliance. Recommendations for improvement stress the necessity for quarterly reviews and enhanced training for finance personnel in adhering to Generally Accepted Accounting Principles (GAAP).

Recommendations and Conclusion

The annual audit report for 2023 highlights the need for improved financial oversight within the organization, particularly focusing on areas such as revenue recognition and expense tracking. Recommendations include implementing automated accounting software like QuickBooks, ensuring compliance with Generally Accepted Accounting Principles (GAAP), and conducting quarterly internal audits to maintain transparency. Financial leadership should prioritize training for staff on financial protocols and risk management practices to mitigate errors. Additionally, establishing a comprehensive risk assessment framework can enhance decision-making processes and improve overall organizational efficiency, leading to more accurate financial reporting. The conclusion underscores the importance of continuous improvement in financial practices, aiming for increased accountability and strategic resource allocation.

Comments