Are you gearing up to create an effective audit plan and seeking a template for approval? Crafting a well-structured letter can set the tone for your project's success and ensure that all necessary stakeholders are on the same page. In this article, we'll discuss essential elements to include in your audit plan approval letter, from outlining objectives to identifying key roles. So, let's dive in and explore how to streamline your audit processâkeep reading for tips and a handy template!

Subject Line and Title

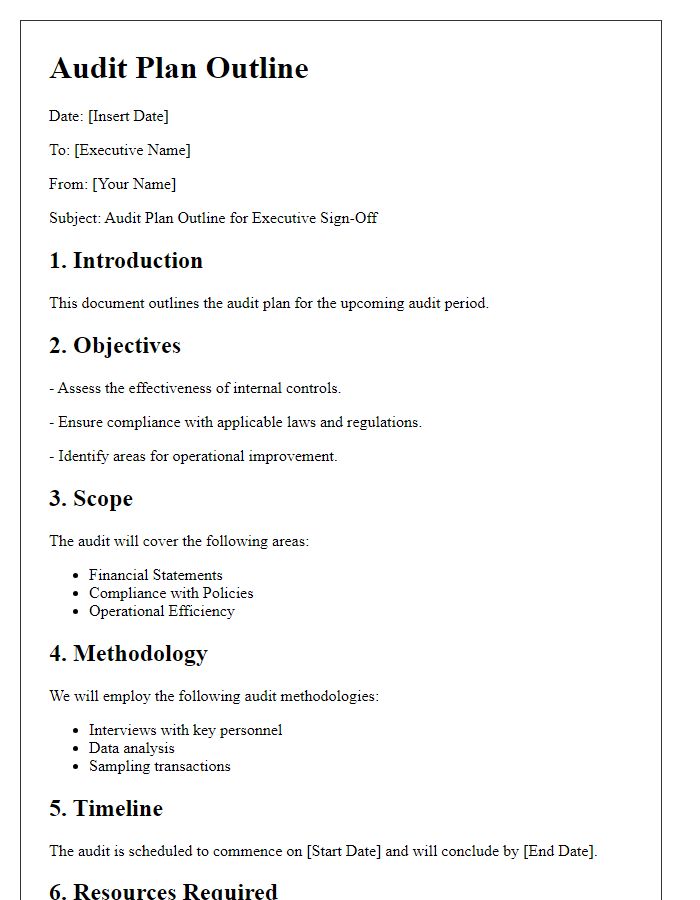

An audit plan outlines the strategy to assess compliance and effectiveness in specific areas. The plan should include key objectives, methodologies, and timelines. Objective examples can include ensuring accurate financial reporting or evaluating internal controls. Methodologies may involve sampling techniques or data analysis. Timelines should specify each audit phase, like planning, fieldwork, and reporting, often spanning several weeks or months. Subject lines, such as "Request for Approval of Audit Plan for Q4 2023," help clarify the purpose. Title examples could be "Comprehensive Audit Plan for Financial Year-End Review.

Audit Objectives and Scope

The audit objectives for the upcoming financial assessment at XYZ Corporation encompass evaluating compliance with established regulatory frameworks, specifically focusing on the Generally Accepted Accounting Principles (GAAP) and the Sarbanes-Oxley Act. This audit will cover the fiscal year 2022, examining transactions exceeding $100,000 within the procurement department, as well as a comprehensive review of the internal control systems in place at the corporate headquarters located in New York City. The scope includes assessing the effectiveness of these controls in mitigating risks associated with financial misreporting, as well as identifying any weaknesses that could lead to potential fraud. Special emphasis will be placed on revenue recognition practices in accordance with ASC 606, to ensure that all recorded revenue is accurate and reflects the underlying economic transactions.

Key Risks and Audit Criteria

An audit plan aims to identify key risks in financial operations (such as fraud, compliance issues) and establish appropriate audit criteria to mitigate these risks. Key risks include revenue recognition errors, which can lead to inflated financial statements, and operational inefficiencies that impact profitability. Audit criteria typically encompass adherence to regulatory standards (like GAAP or IFRS), proper documentation of internal controls, and accuracy in financial reporting. The audit process often includes detailed analysis of transactions, sampling techniques, and periodic reviews to ensure alignment with established benchmarks. Regular assessments can promote accountability and enhance the overall organizational governance framework.

Timeline and Milestones

An audit plan outlines essential steps for a thorough evaluation of financial practices and compliance within an organization. Key timeline milestones include the preliminary planning phase scheduled for April 1, 2024, which involves defining audit objectives, assessing risks, and allocating resources. The fieldwork phase begins on May 15, 2024, lasting several weeks, during which auditors will collect data and review financial records. A progress review meeting is planned for June 30, 2024, where findings will be discussed and adjustments to the timeline can be made if necessary. Finally, the completion of the audit report is anticipated by August 15, 2024, with a formal presentation to the executive committee scheduled for August 25, 2024, marking the official timeline conclusion.

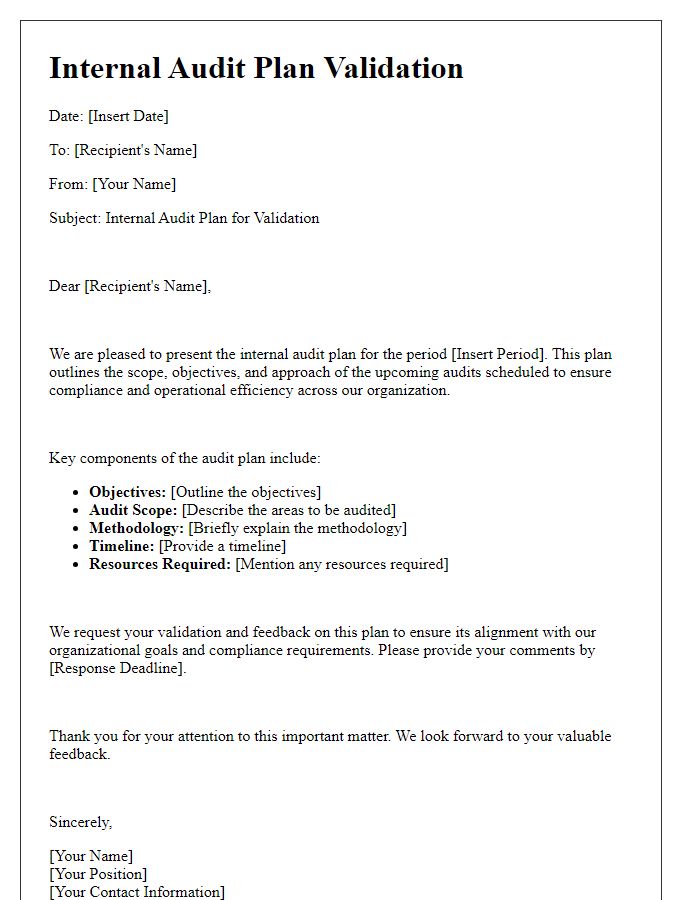

Approval and Contact Information

An audit plan outlines the specific steps and methodologies used to conduct an audit, ensuring compliance and efficiency in financial examination processes. The first section, Approval, usually contains designated signatures or endorsements required from key stakeholders such as the Chief Financial Officer (CFO) or the Audit Committee Chair, ensuring accountability and authenticity. The Contact Information section follows, detailing essential personnel involved in the audit process, including names, titles, phone numbers, and email addresses, facilitating clear communication and swift resolution of any inquiries or issues that may arise during the audit. This structure promotes transparency and reinforces a strong internal control environment.

Comments