Are you looking for the perfect way to acknowledge a charitable donation in a heartfelt letter? Crafting a personalized acknowledgment can make a significant difference in how donors feel appreciated for their generosity. Not only does it confirm the receipt of their contribution, but it also strengthens the bond between the organization and its supporters. Join us as we explore effective letter templates and tips to convey gratitude in the most meaningful wayâread on for more insights!

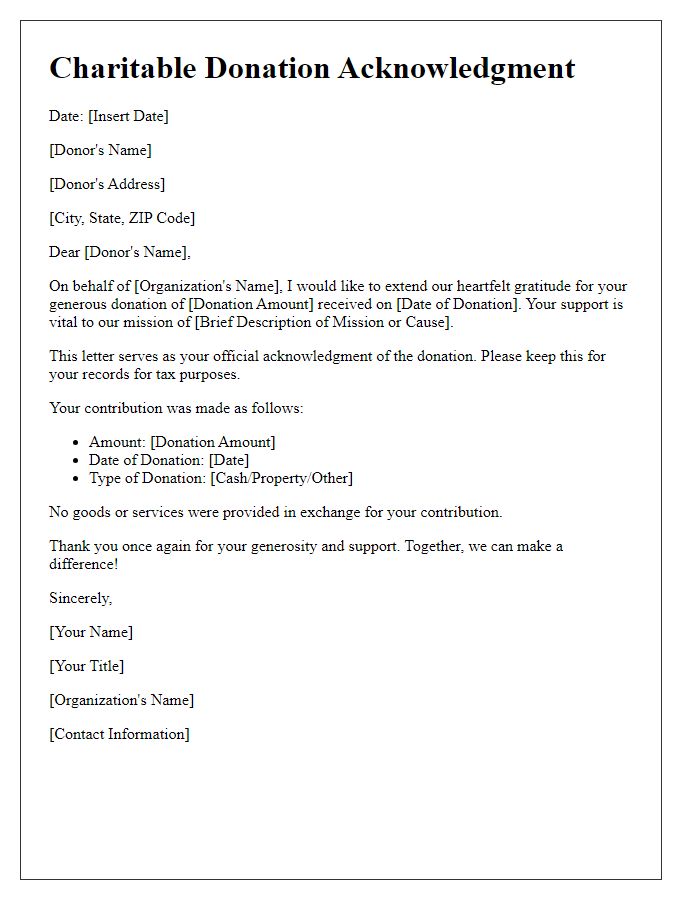

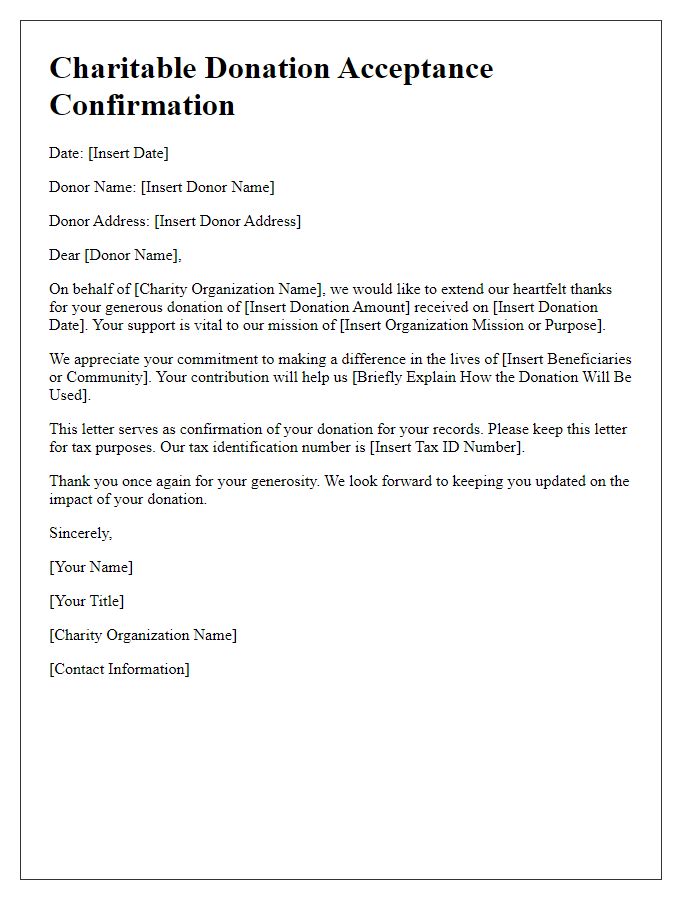

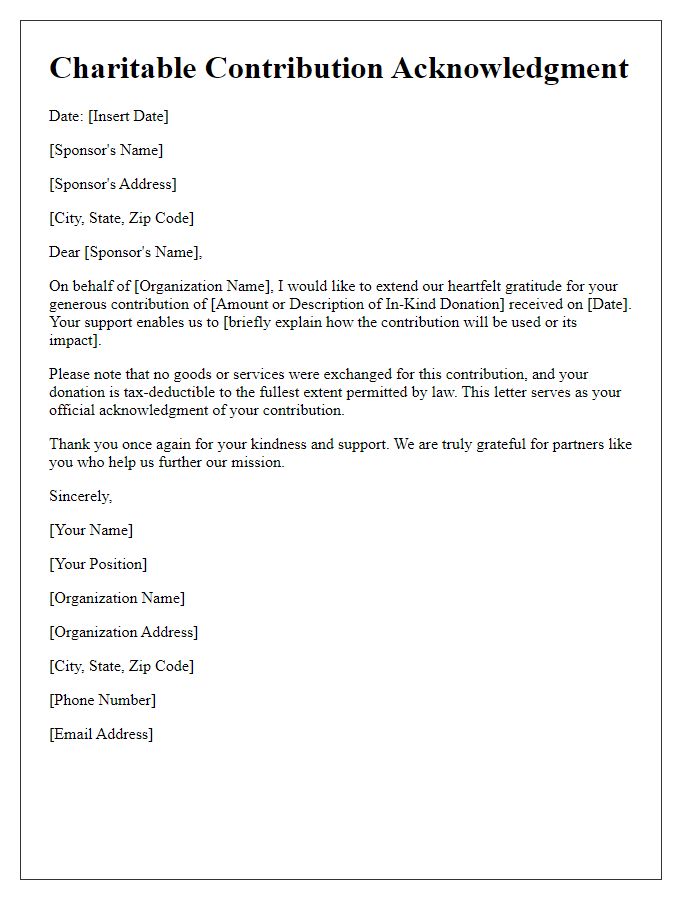

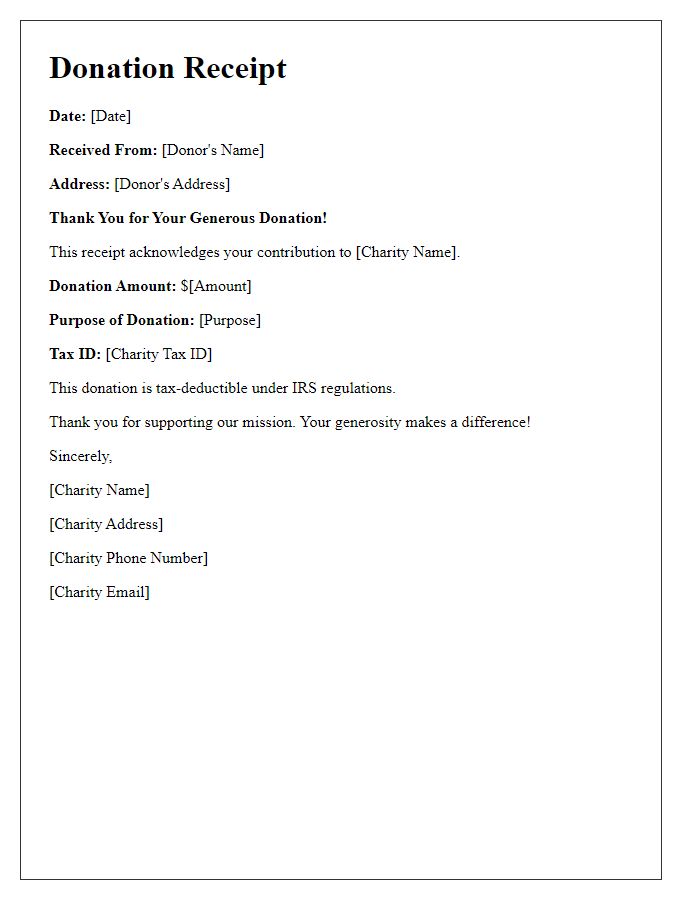

Donor Information and Contact Details

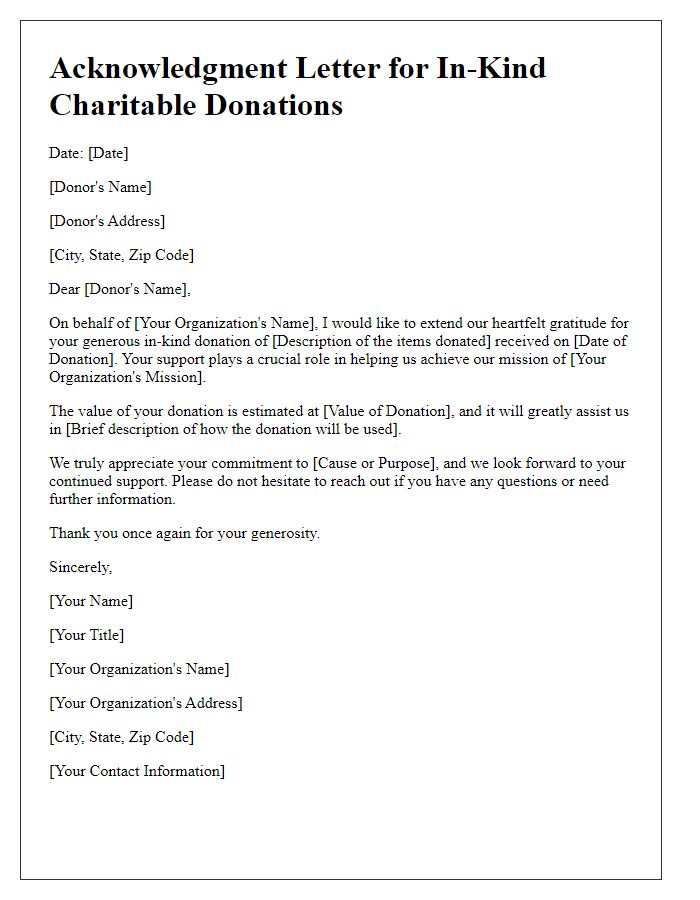

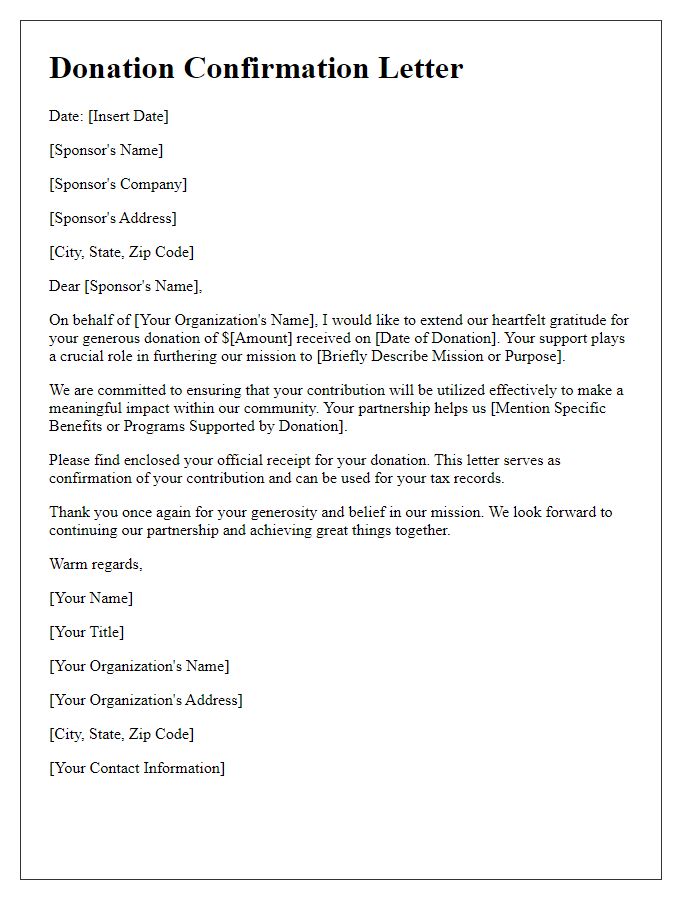

Charitable donations significantly contribute to the sustainability of nonprofit organizations and their missions. Donors, such as individuals or corporations, often provide funds or resources to support various causes. For instance, a local charity in Chicago, operating since 1990, aims to alleviate homelessness by providing shelter and food services. Acknowledging contributions formally is essential for maintaining donor relationships. The acknowledgment typically includes essential information such as donor names, contact details (including phone numbers and email addresses), donation amounts, and the purpose of the contribution. Additionally, including the charity's tax-exempt status (such as 501(c)(3) in the United States) assures donors of potential tax deductions from their contributions, enhancing the appeal of their generosity. Overall, a well-structured acknowledgment cultivates trust and ensures transparency within the charitable sector.

Donation Amount and Description

Charitable donations play a crucial role in supporting non-profit organizations and fueling their missions. Such contributions can vary significantly, encompassing a range of amounts from small gestures ($10 or less) to substantial gifts (thousands of dollars) that help fund programs and services. For example, a donation of $500 might cover the cost of educational materials for underserved communities, while a larger donation of $10,000 could help build a community center in areas with limited resources. Descriptions of donations also provide context, highlighting specific contributions, such as cash, equipment, or volunteer time, which in total contribute to the overall impact of the organization's efforts. Proper acknowledgment of these donations is essential to maintain transparency and trust within the donor community, fostering ongoing relationships and encouraging future support.

Charitable Organization Details

The charitable organization, established as a 501(c)(3) nonprofit entity, plays a vital role in community support initiatives, providing resources and assistance to underprivileged groups. Founded in 2005, this organization operates within the greater metropolitan area of New York City, serving over 10,000 individuals annually. Through various programs--including food distribution, educational workshops, and health services--this charity aims to enhance the quality of life for those in need. Notable events, such as the Annual Fundraising Gala held every November at the renowned Hilton Hotel in Midtown Manhattan, raise significant funds, directly impacting outreach efforts. Contributions are tax-deductible, fostering a culture of giving and community involvement, essential for sustaining ongoing projects and expanding services.

Terms and Conditions

Charitable donation agreements serve as vital documents outlining the relationship between donors and nonprofit organizations. These agreements often include terms and conditions detailing the donation amount, which could range from small contributions of $10 to substantial gifts exceeding $10,000, and the intended use of the funds by the organization, such as community outreach programs or disaster relief efforts. Specific provisions may also address tax deductions, ensuring donors understand their eligibility based on IRS regulations established in 2021. In addition, clauses regarding donor recognition, such as naming opportunities for major gifts at specific facility locations, enhance transparency and foster ongoing partnerships between contributors and the charity. Legal language should clearly articulate the limitations and expectations surrounding the donation to prevent future disputes, thereby fostering trust and facilitating philanthropic activity.

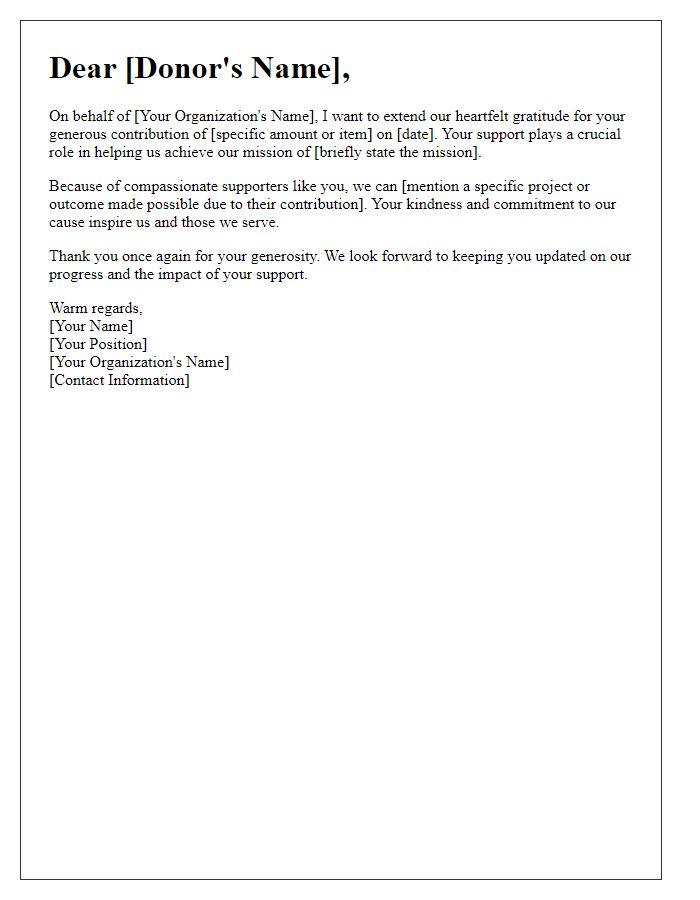

Gratitude and Follow-up Statement

Charitable donations significantly impact nonprofit organizations and the communities they serve. Acknowledgment of contributions fosters ongoing relationships between donors and recipients. This communication typically includes expressions of gratitude, detailing the specific donation amount, intended purpose (such as education, health care, or disaster relief), and the date received. Nonprofit entities like the American Red Cross or Habitat for Humanity often send formal letters to confirm donations, reinforcing transparency and accountability. Furthermore, including information on how the funds will be utilized encourages donor engagement and trust. Regular follow-up updates about the outcomes achieved due to the donation can inspire future giving and strengthen community bonds.

Comments