Are you looking to navigate the complexities of a business transfer agreement? Crafting the perfect letter template can make all the difference in ensuring a smooth transaction. In this article, we'll outline the key elements to include, helping you protect your interests while facilitating a successful transfer. So, grab a cup of coffee and read on to discover how to create an effective business transfer agreement letter!

Parties Involved and Contact Information

The business transfer agreement involves two key parties: the Seller, an entity transferring ownership of the business, and the Buyer, an entity acquiring the business. Each party must provide comprehensive contact information, including full legal names, business addresses, and primary contact numbers. For the Seller, this may include the registered business address, an email for correspondence, and the name of a designated representative for negotiations. For the Buyer, similar details must be outlined, ensuring clear communication channels during the transfer process. This information establishes a foundation for the agreement, highlighting the roles and responsibilities of both parties as they navigate the complexities of the business transfer.

Description of the Business and Assets

The business in question, a thriving retail operation located in downtown San Francisco, specializes in organic food products. Established in 2010, it has secured a loyal customer base, boasting over 5,000 active members in its loyalty program. The assets up for transfer include over 2,000 square feet of prime commercial real estate, equipped with modern fixtures and a state-of-the-art point-of-sale system. Additional tangible assets encompass an inventory valued at approximately $250,000, encompassing a diverse range of organic products, from fresh produce to specialty groceries. Valuable intangible assets include the business's established brand reputation, digital presence with 10,000 social media followers, and proprietary customer relationship management software, which enhances customer engagement and retention. This transfer not only represents a change in ownership but also an opportunity for growth in a booming market that prioritizes sustainability and health-conscious options.

Terms and Conditions of Transfer

The business transfer agreement outlines detailed terms and conditions essential to the transfer of ownership of a company or business entity. Key components include the transfer of assets such as property, equipment, and intellectual property rights valued at specific amounts. Defined terms specify the effective date of transfer, typically marking the completion timeline, such as 30 days post-signature. Responsibilities for liabilities such as outstanding debts or contractual obligations are allocated between the seller and buyer. Regulatory compliance with local business regulations, particularly concerning zoning laws and tax implications, is critical. Confidentiality clauses protect sensitive business information during negotiations. Dispute resolution procedures, including arbitration or mediation, are established to address potential conflicts post-transfer. Finally, the agreement includes governing law provisions, often aligning with the jurisdiction where the business operates, ensuring clarity on applicable laws.

Financial Arrangements and Payment Terms

In a business transfer agreement, financial arrangements and payment terms are critical elements that define the monetary aspects of the transaction. The total purchase price of the business, including the value of tangible and intangible assets such as inventory, real estate, and intellectual property, must be clearly specified. Payment terms, which can include an initial deposit followed by installment payments or a full upfront payment, should outline due dates for each payment and acceptable payment methods, such as bank transfers or checks. Consideration should also be given to potential financing options, where the seller might offer seller financing or third-party loans. Additionally, any conditions tied to milestone payments based on future performance metrics or completion of specified tasks may need detailing. Lastly, the implications of late payments, such as interest rates applied to overdue amounts, should be included to ensure both parties understand their financial obligations within the agreement.

Confidentiality and Non-Disclosure Agreement

A Confidentiality and Non-Disclosure Agreement (NDA) serves as a crucial legal document that protects sensitive information exchanged between parties during a business transfer. This agreement typically outlines the specific confidential information, which may include trade secrets, financial data, and proprietary processes. The duration of the confidentiality obligation often extends beyond the term of the agreement, with a common period being three to five years. Jurisdictions vary regarding the enforceability of NDAs, with some regions requiring the designation of clearly marked confidential information. Potential exceptions to confidentiality may apply in instances such as court orders or public domain information. Additionally, the agreement should specify the legal recourse available for breach, including monetary damages and injunctive relief, to ensure both parties can seek appropriate remedies.

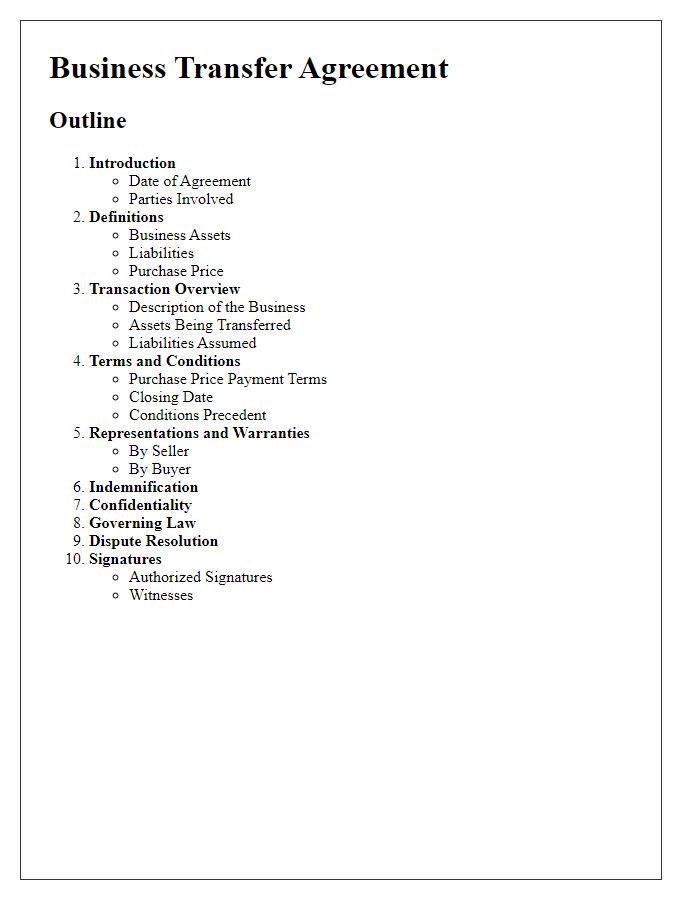

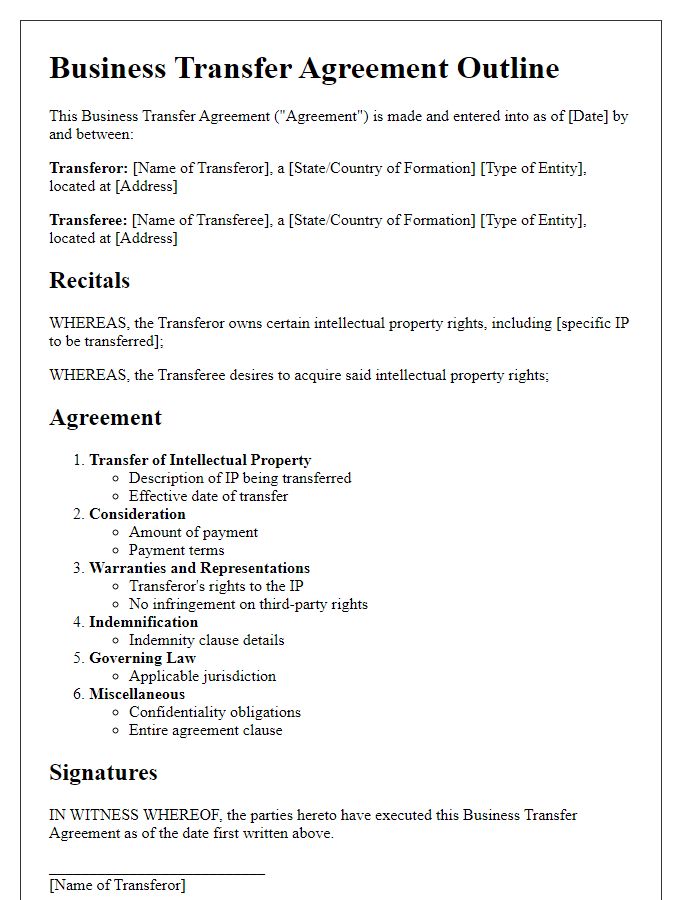

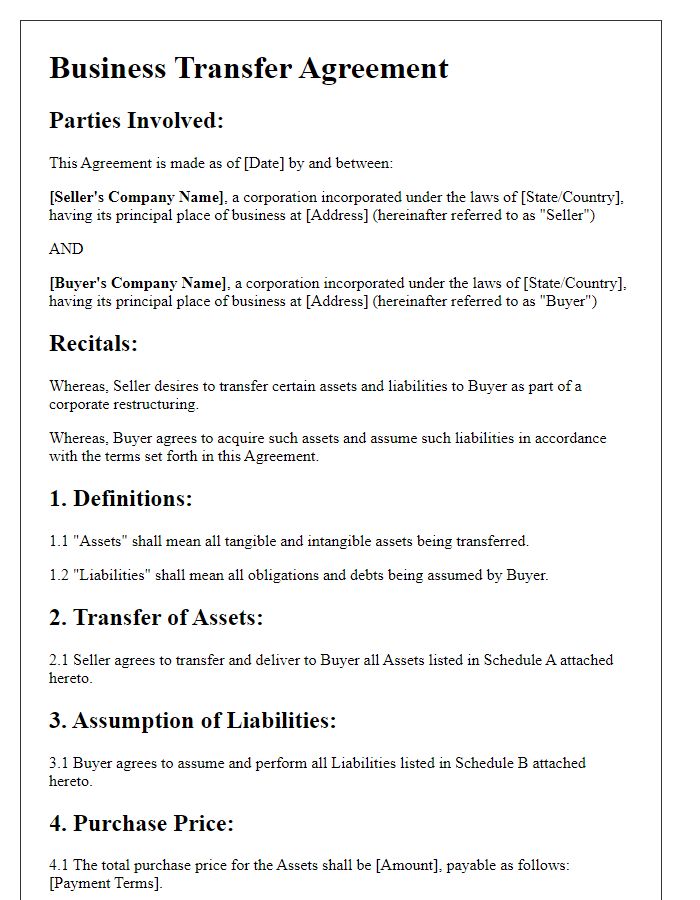

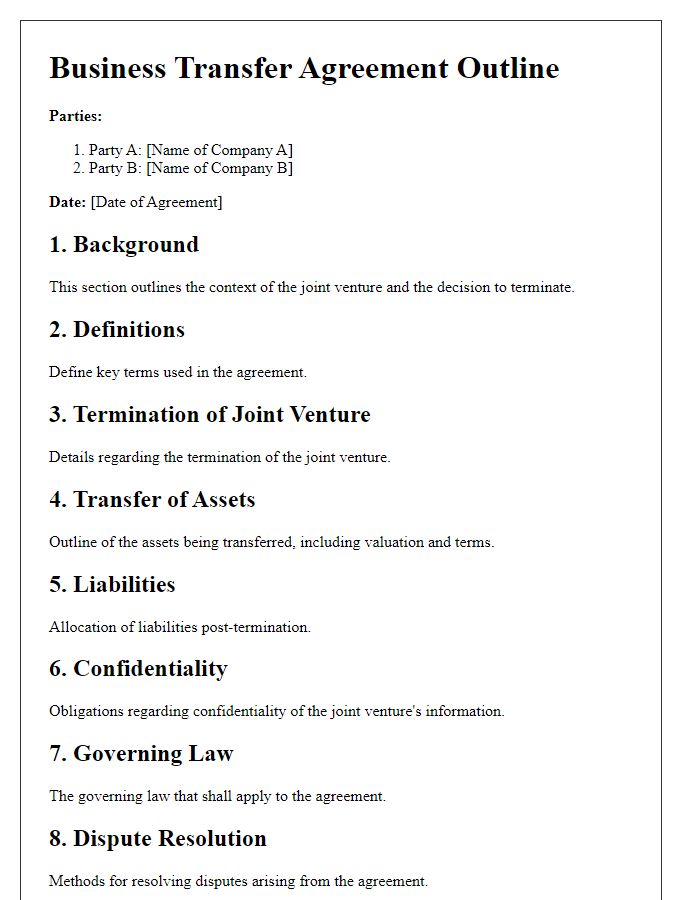

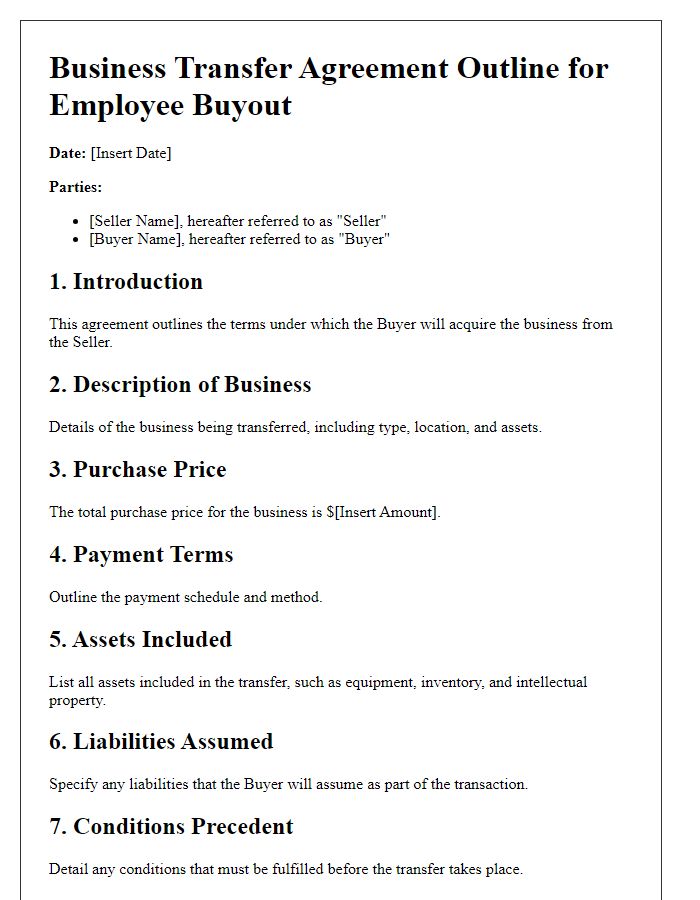

Letter Template For Business Transfer Agreement Outline Samples

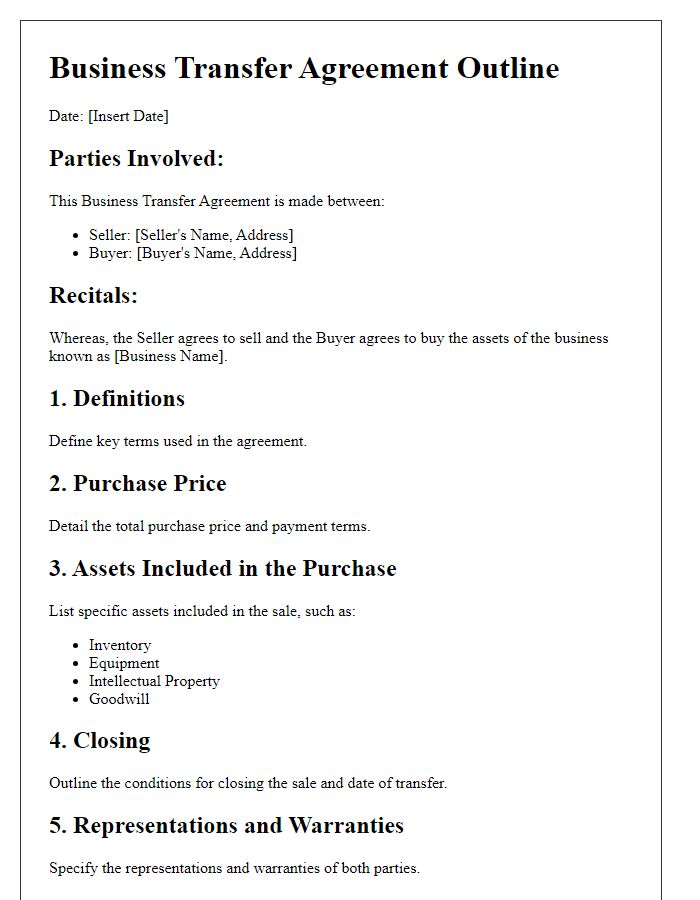

Letter template of business transfer agreement outline for asset purchase

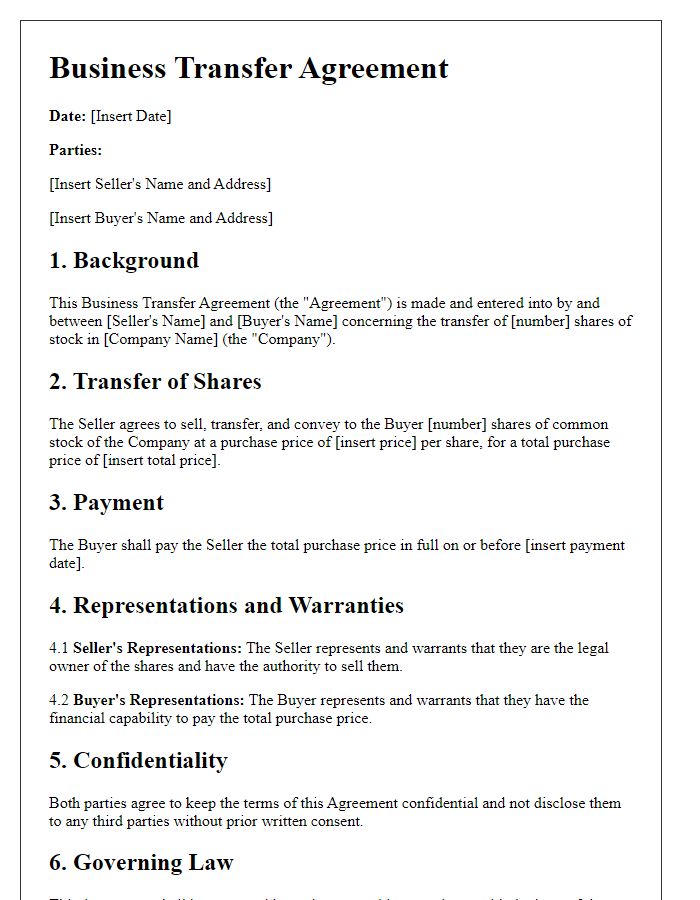

Letter template of business transfer agreement outline for stock transfer

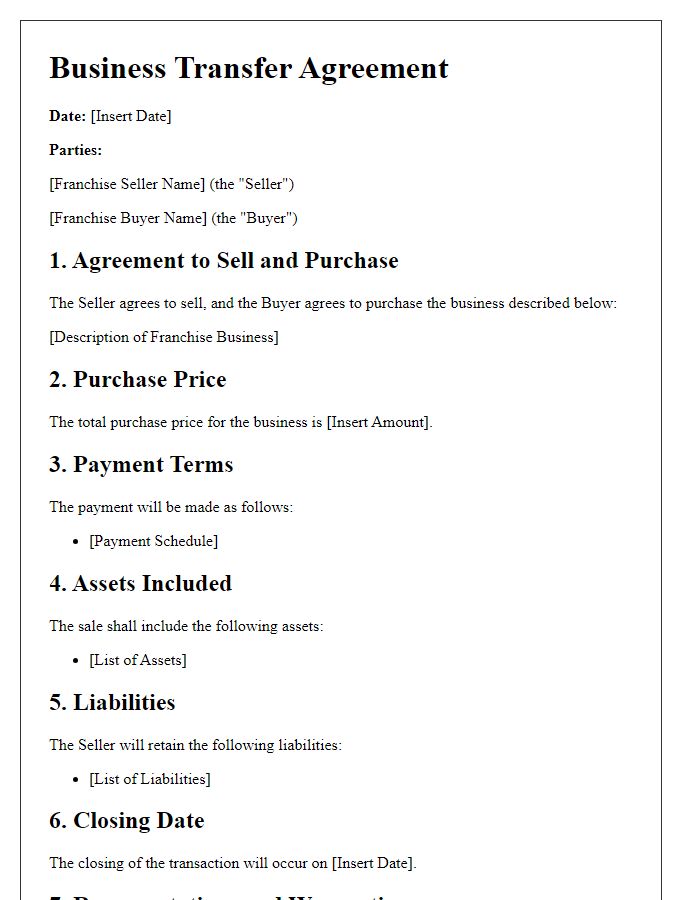

Letter template of business transfer agreement outline for franchise sale

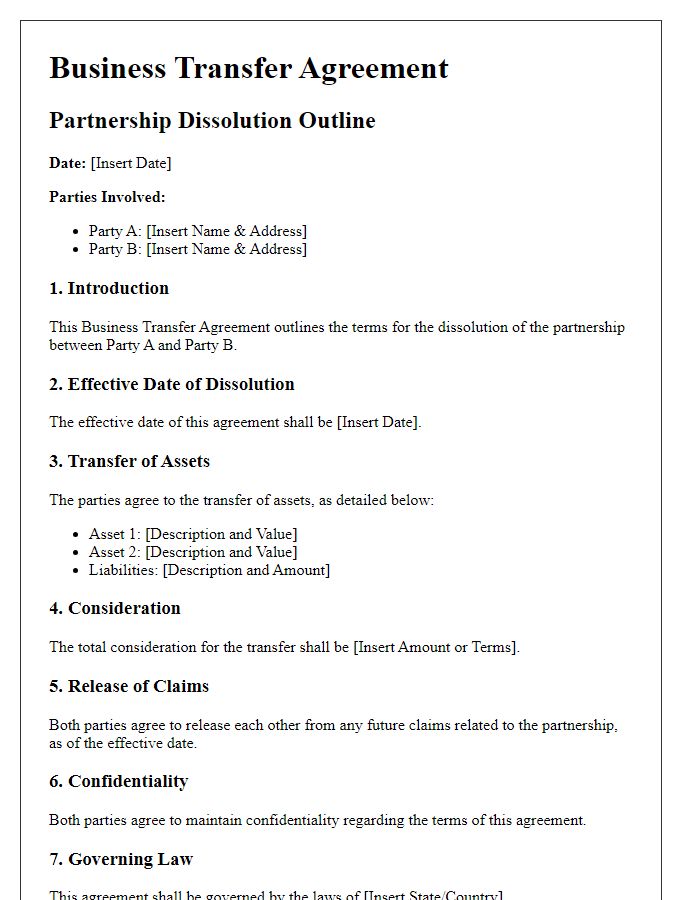

Letter template of business transfer agreement outline for partnership dissolution

Letter template of business transfer agreement outline for merger acquisition

Letter template of business transfer agreement outline for intellectual property transfer

Letter template of business transfer agreement outline for corporate restructuring

Letter template of business transfer agreement outline for joint venture termination

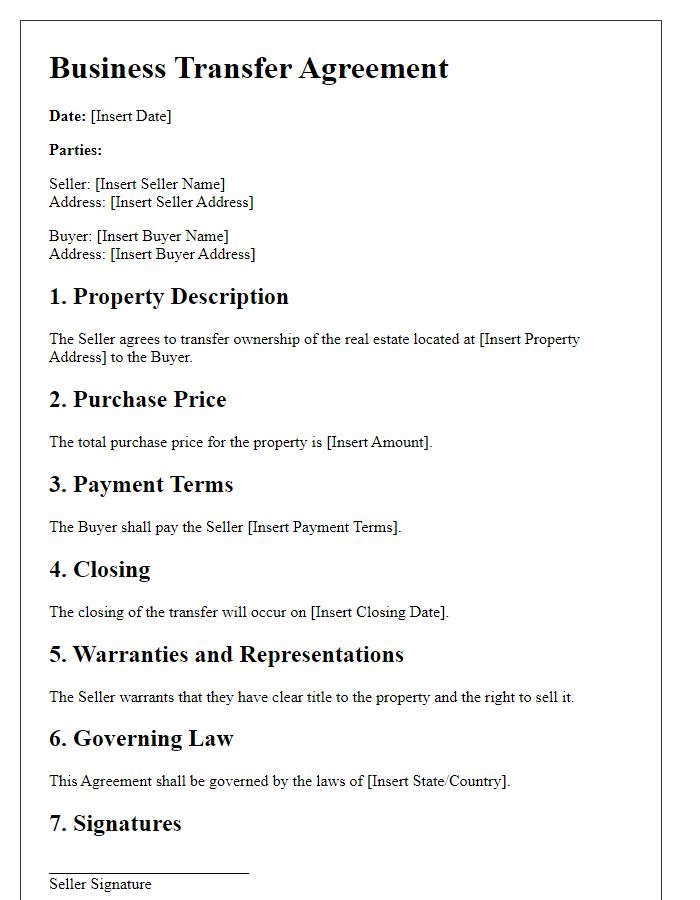

Letter template of business transfer agreement outline for real estate transfer

Comments