Are you diving into the exciting world of real estate? Whether you're buying your first home or an investment property, having a solid purchase agreement is crucial. This document not only outlines the terms of your transaction but also protects your interests throughout the buying process. Ready to learn more about crafting the perfect real estate purchase agreement?

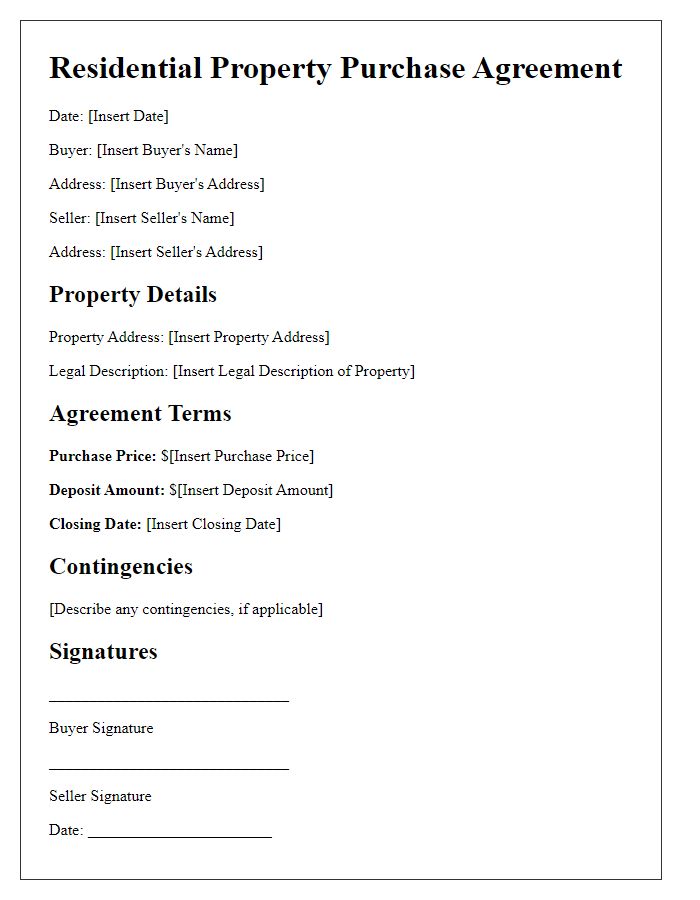

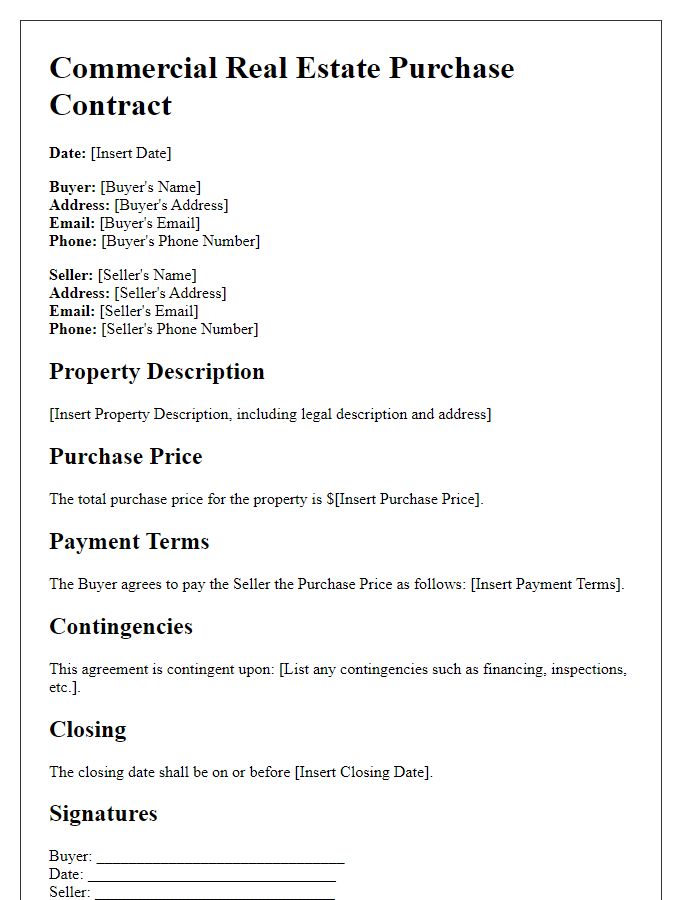

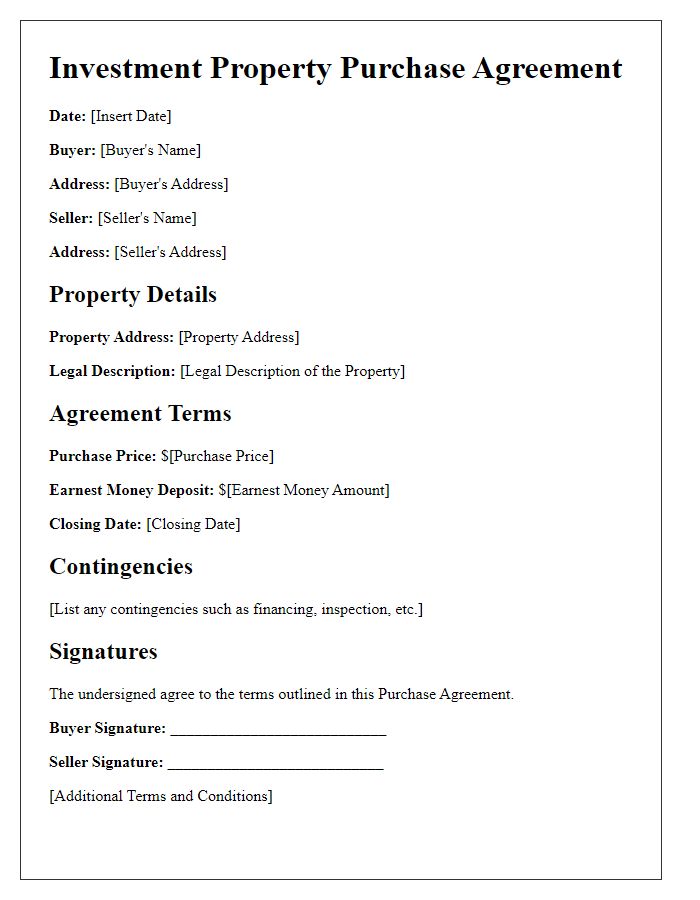

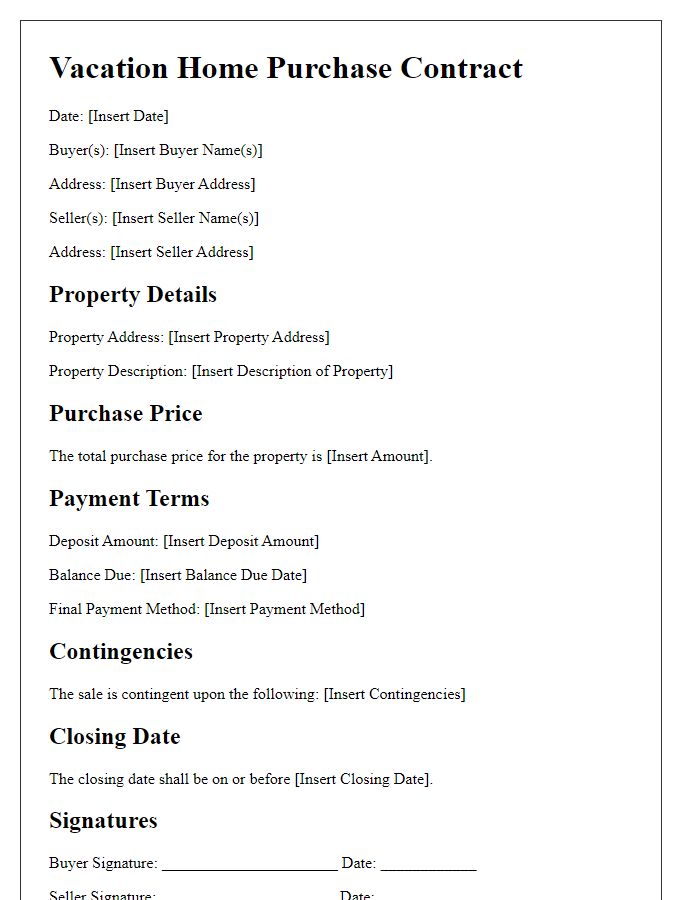

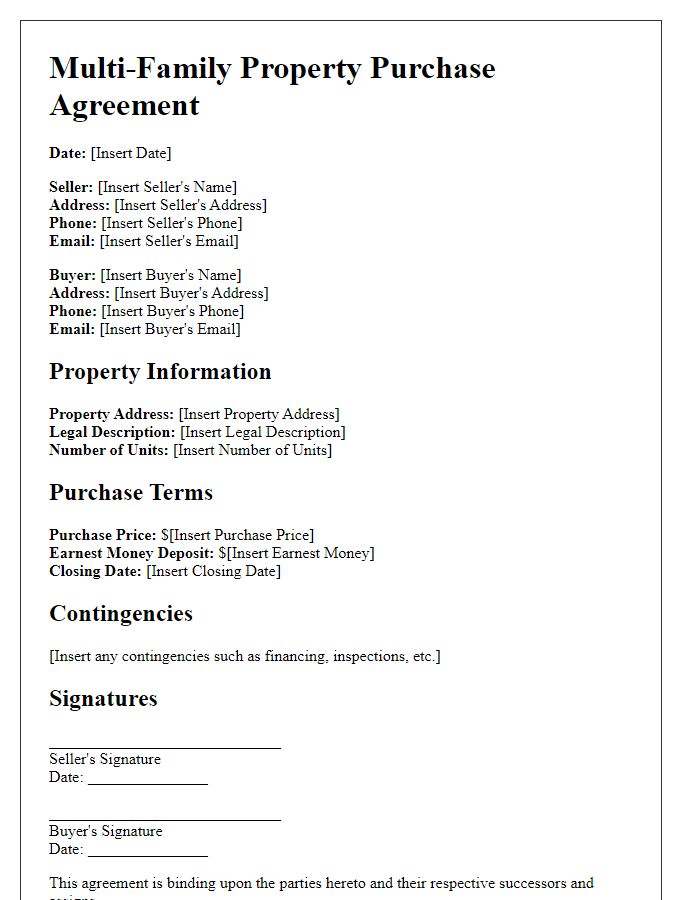

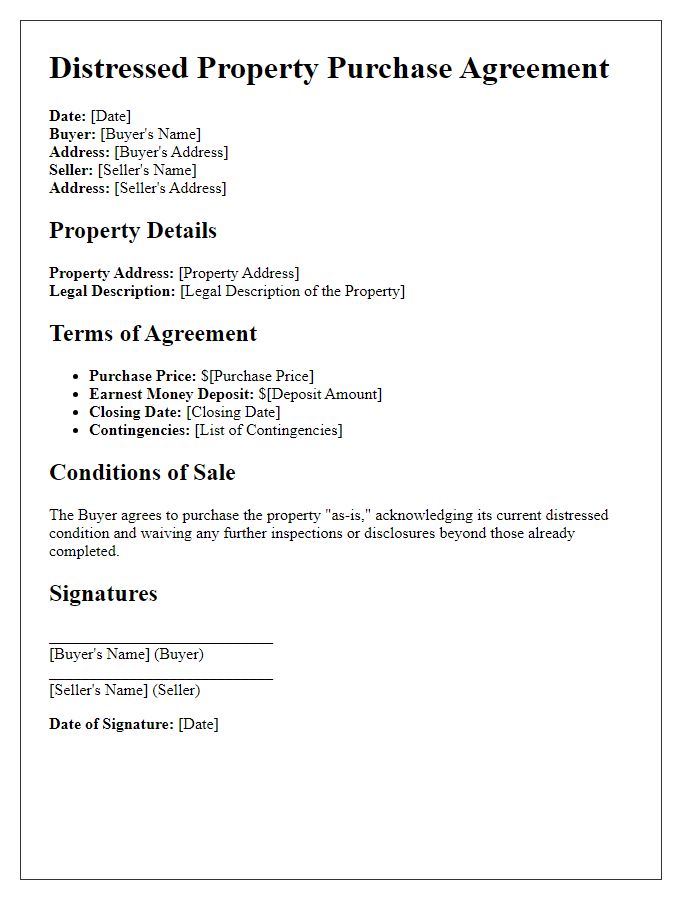

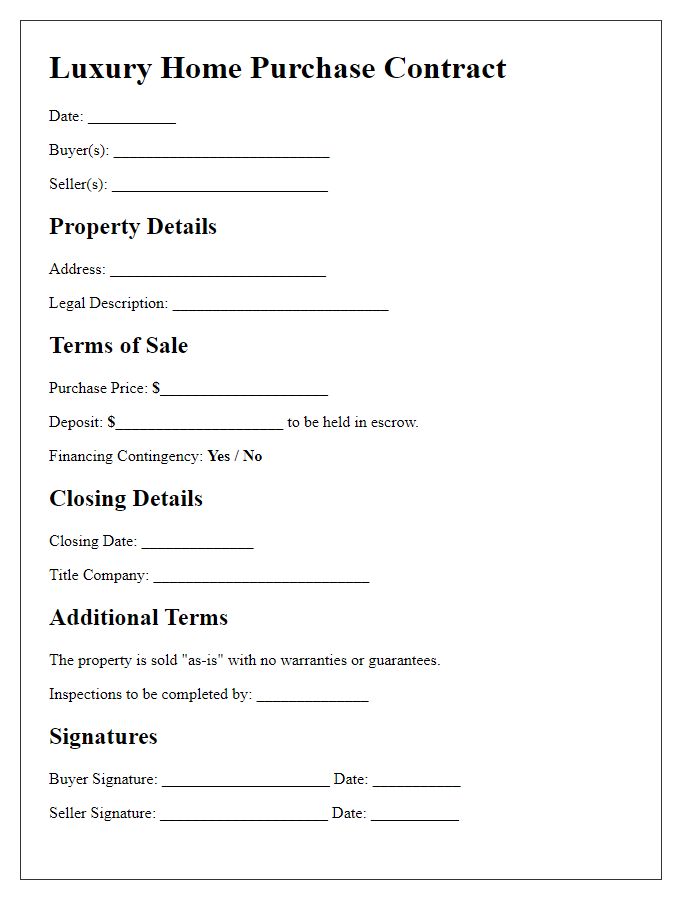

Buyer and Seller Information

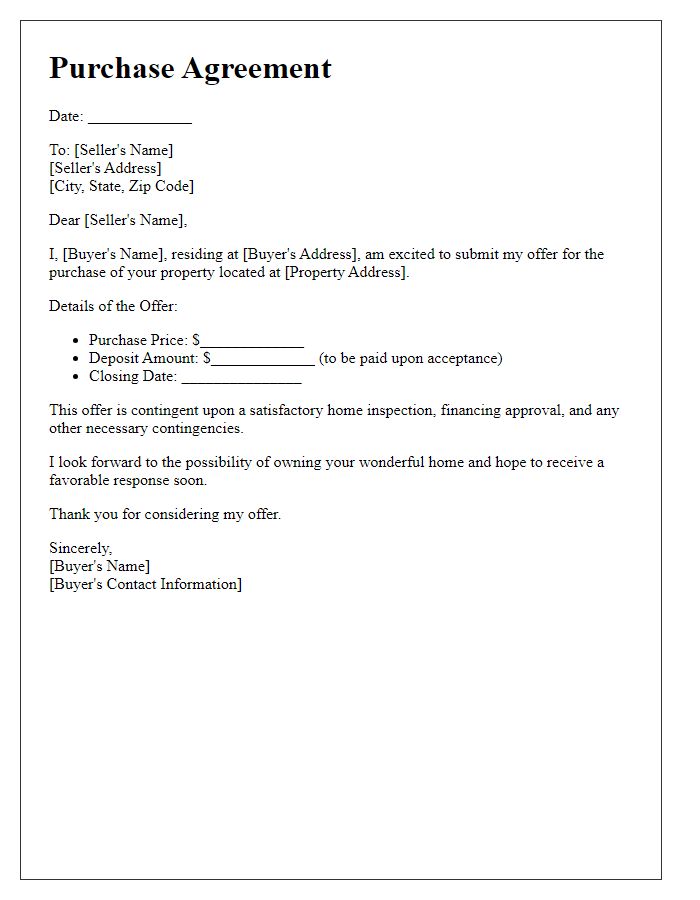

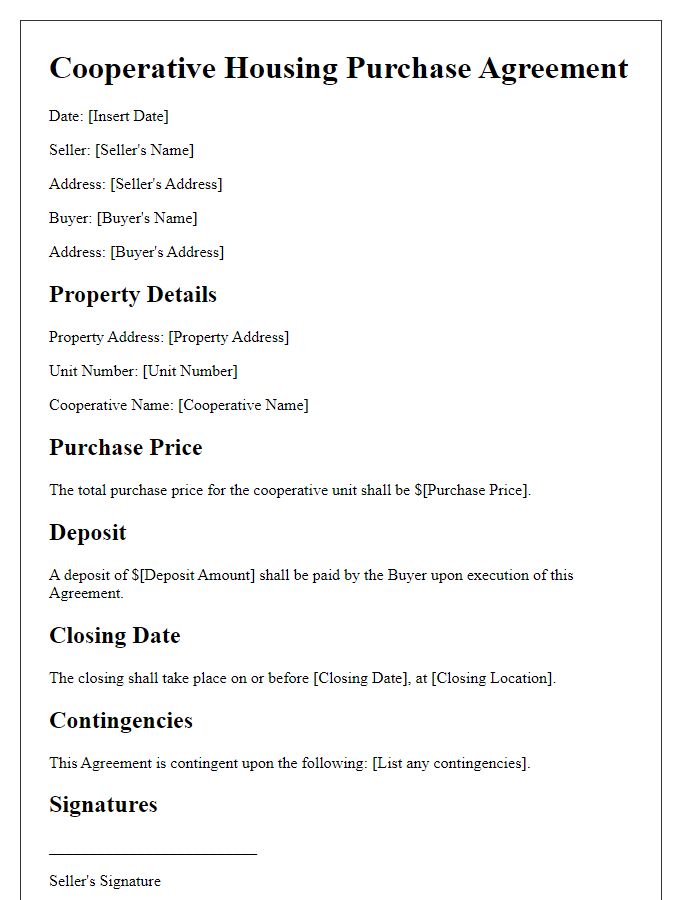

A real estate purchase agreement begins with crucial details to identify the parties involved in the transaction. Buyer information typically includes the full legal name, the current address, and contact information of the individual or entity purchasing the property, whereas Seller information includes the full legal name, current address, and contact details of the property owner. It is essential to accurately represent these details to ensure clarity and legal compliance throughout the purchasing process. Specific terms regarding the property address, purchase price, and any contingencies should follow this identification section to form a comprehensive agreement. Ensuring that both parties' information is clearly outlined aids in preventing misunderstandings and enhances the transaction's smooth progression.

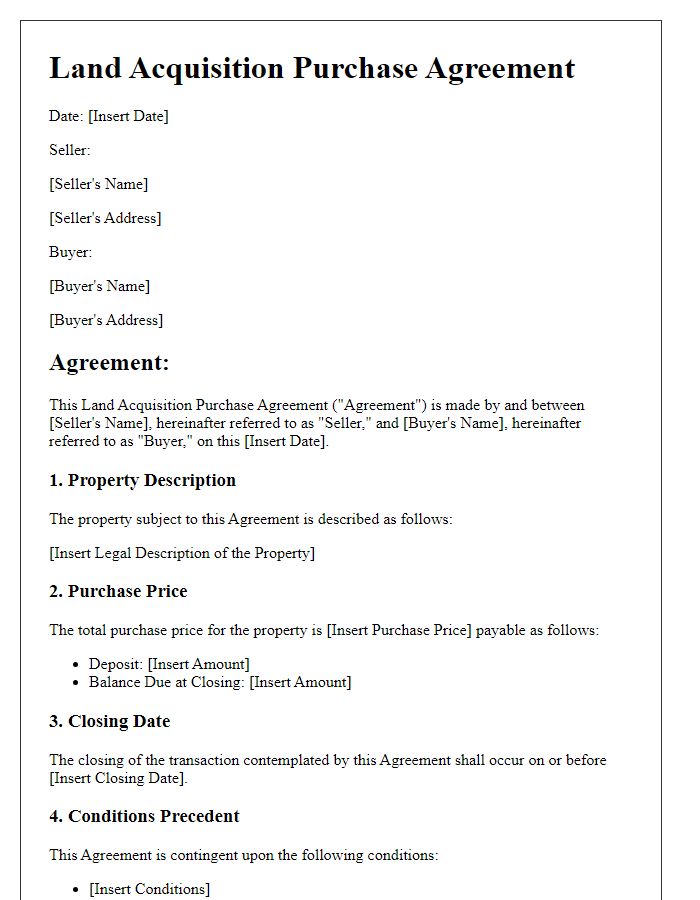

Property Details and Description

The real estate purchase agreement encompasses crucial property details and description, focusing on pivotal aspects such as the location (123 Main Street, Springfield), square footage (2,500 square feet), and property type (single-family dwelling). This specific dwelling, constructed in 2010, features four bedrooms and three bathrooms, offering ample living space for families. The property also includes a landscaped yard, garage capacity for two vehicles, and proximity to notable landmarks such as Springfield Elementary School and Downtown Shopping Center, enhancing its appeal for prospective buyers. It is essential to include details regarding zoning regulations, assessed value ($350,000), and any additional amenities like a swimming pool or energy-efficient systems to provide a comprehensive understanding of the property's value proposition in the current real estate market.

Purchase Price and Payment Terms

The purchase price for the property located at [Property Address] is set at [$Purchase Price], which shall be payable as follows: a down payment of [$Down Payment Amount] due at the signing of the real estate purchase agreement, with the remaining balance of [$Remaining Balance] to be financed through [Type of Financing, e.g., conventional mortgage, FHA loan] secured by a lien on the property. The closing date shall occur on or before [Closing Date], at which point the full purchase price will be settled in accordance with applicable laws and local regulations. Additionally, earnest money in the amount of [$Earnest Money Amount] will be held in escrow by [Escrow Agent or Company Name] until closing. All payment terms are subject to standard due diligence and financing contingencies as outlined in the agreement.

Contingencies and Inspections

Real estate purchase agreements often include essential contingencies and inspections that protect buyers and ensure property standards. Common contingencies include financing approval, where a buyer secures a mortgage from lenders such as Wells Fargo or Chase, appraisal, where the property must meet or exceed a predetermined value (typically assessed by a licensed appraiser using recent sales data), and inspection contingencies, which allow buyers to conduct thorough examinations for issues like structural integrity, electrical systems, plumbing, and pest infestations. These inspections are commonly performed by certified home inspectors, costing between $300 and $500, and usually occur within a specified timeline, typically 10 to 14 days after the offer acceptance. Sellers may include a disclosure statement detailing known issues, ensuring transparency during the negotiation process. Additionally, a review period is often established, giving buyers the ability to request repairs or credits based on inspection findings before finalizing the transaction.

Closing Date and Possession Terms

The closing date, a pivotal moment in real estate transactions, typically occurs 30 to 60 days after the purchase agreement is executed, depending on financing and inspection contingencies. The possession terms specify the timeline in which the buyer is granted access to the property, often aligning with the closing date, allowing seamless transition and occupancy. In some cases, sellers may require post-closing occupancy, thereby retaining possession of the property for an agreed period, often seen in markets like San Francisco or New York City. Clear language regarding any rental fees or security deposits in these situations helps avoid misunderstandings, ensuring smooth transfer of ownership and responsibilities.

Comments