Are you feeling overwhelmed by the complexities of your financial statements? Don't worry, you're not alone! Understanding these documents is crucial for making informed decisions about your finances, and we're here to break it down for you. Dive into our article for a step-by-step guide on how to navigate your financial statements with ease!

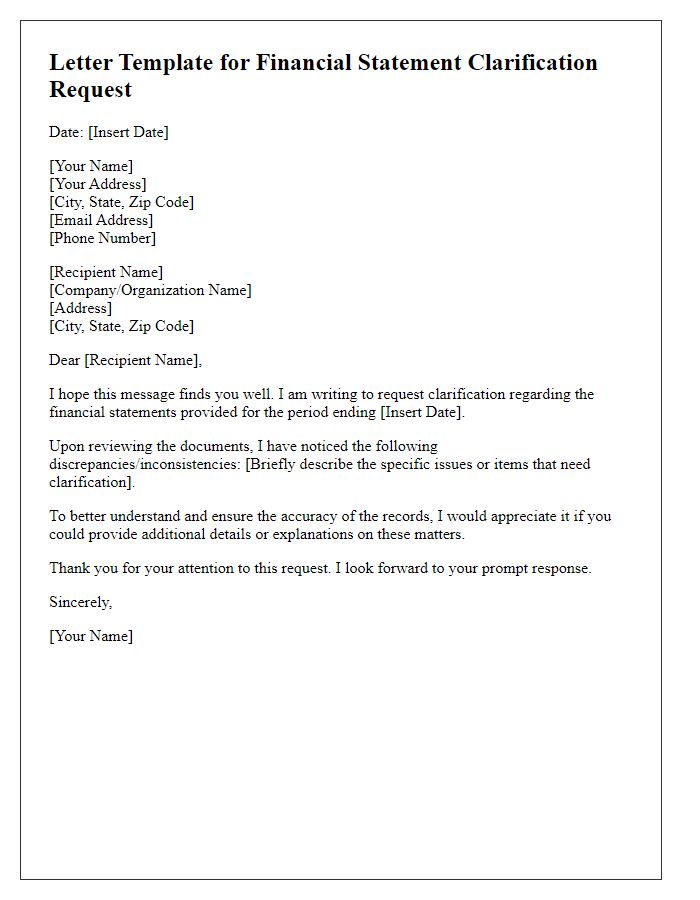

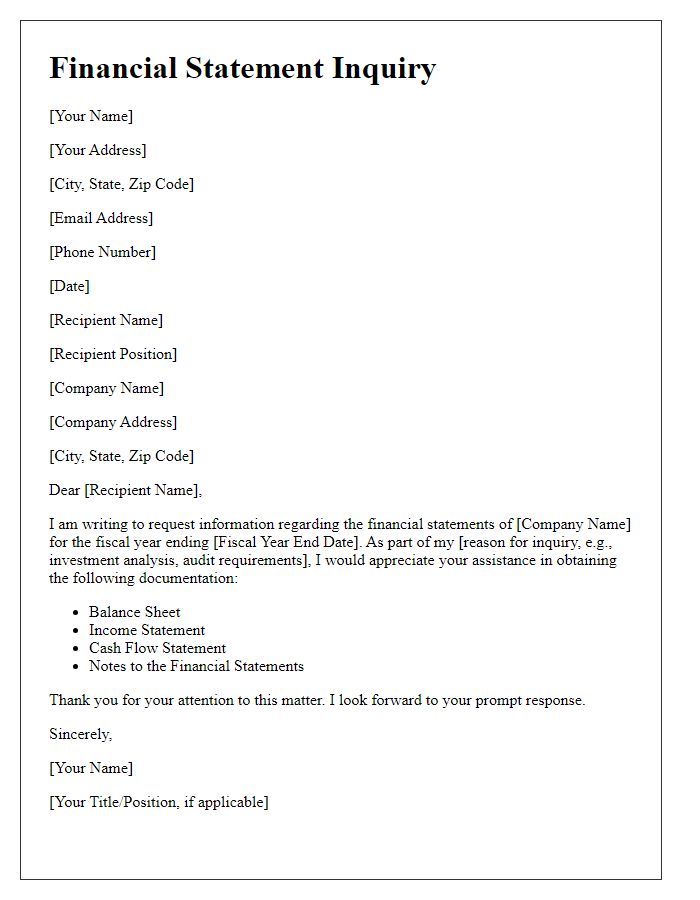

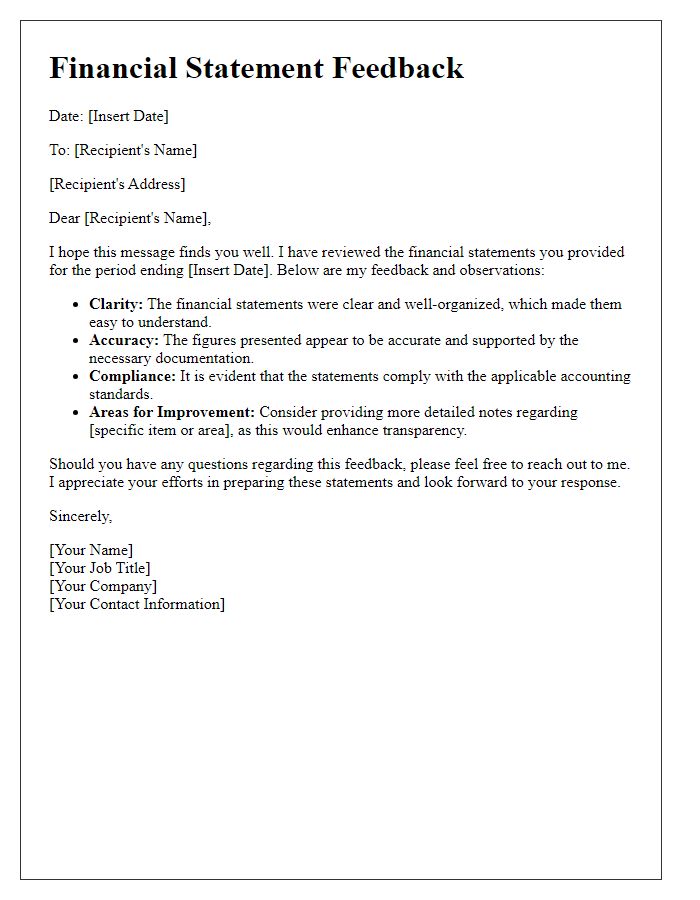

Clarity and conciseness in language.

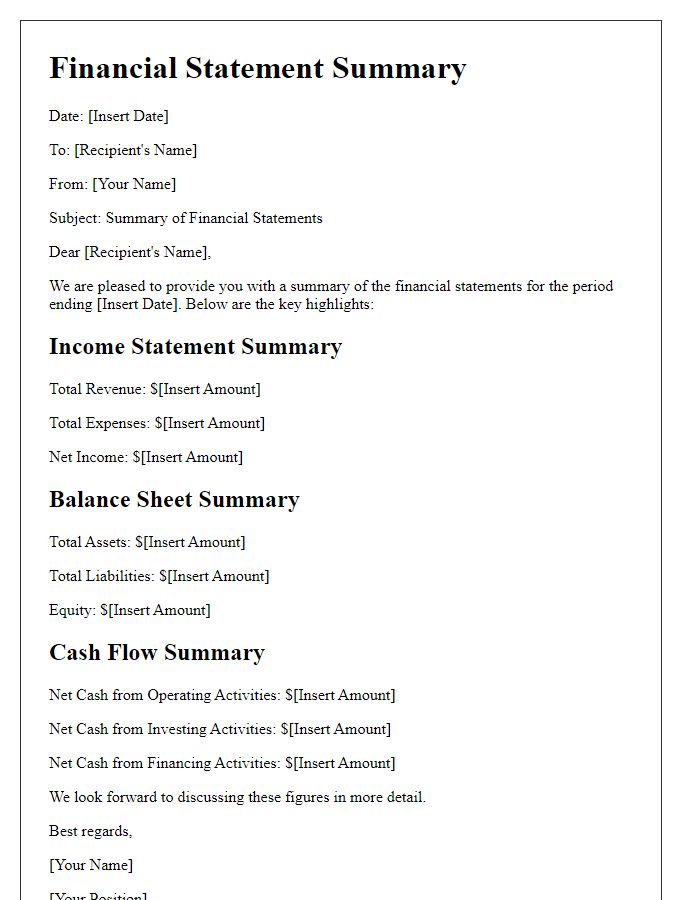

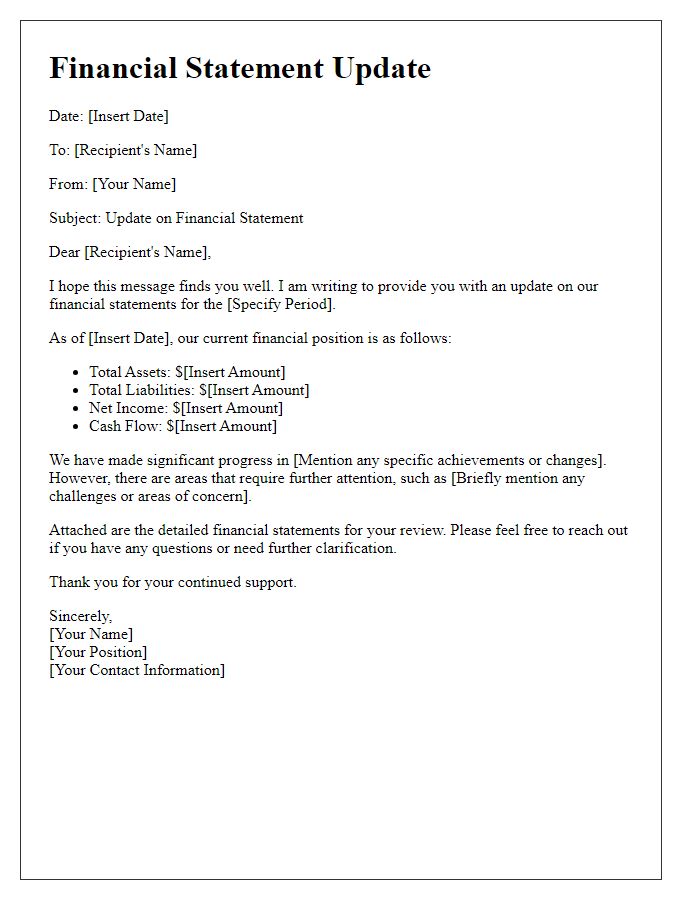

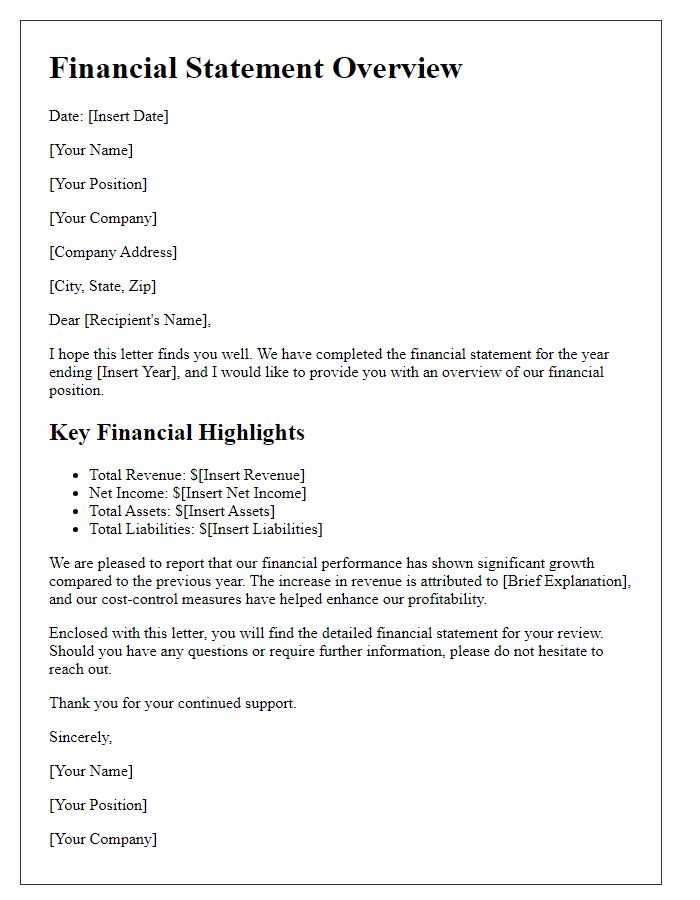

A financial statement analysis reveals key insights for stakeholders. Revenue increased by 15% year-over-year, amounting to $2 million in the last quarter, driven predominantly by enhanced product sales in North America. Operating expenses rose by 10% due to strategic investments in marketing initiatives and technology upgrades, totaling $1.5 million. The net profit margin improved to 25%, showcasing effective cost management and increased operational efficiency. Additionally, cash flow from operations reached $500,000, reflecting robust financial health and liquidity. These metrics illustrate the organization's potential for sustainable growth and profitability in the upcoming fiscal year.

Structured format with headings and subheadings.

Financial Statement Explanation 1. Introduction - Purpose of the document - Overview of the financial statements 2. Financial Position - Assets - Current assets (e.g., cash, receivables, inventory) - Non-current assets (e.g., property, plant, equipment) - Liabilities - Current liabilities (e.g., payables, short-term debt) - Long-term liabilities (e.g., long-term debt, pension obligations) - Equity - Owner's equity (e.g., common stock, retained earnings) 3. Income Statement - Revenue - Breakdown of different revenue streams (e.g., product sales, service income) - Expenses - Operating expenses (e.g., cost of goods sold, administrative expenses) - Non-operating expenses (e.g., interest expense, tax expense) - Net Income - Calculation of net income (revenue minus total expenses) 4. Cash Flow Statement - Cash Flow from Operating Activities - Inflows and outflows related to core business operations - Cash Flow from Investing Activities - Inflows and outflows related to investment in assets - Cash Flow from Financing Activities - Inflows and outflows related to debt and equity financing 5. Explanation of Significant Changes - Year-over-year analysis - Impact of economic factors (e.g., market trends, regulatory changes) 6. Conclusion - Summary of financial performance - Implications for stakeholders (e.g., investors, creditors)

Inclusion of relevant financial metrics.

The financial statement for the fiscal year 2023 includes key metrics such as total revenue, net profit margin, and operating expenses which provide insights into the company's financial health. Total revenue, amounting to $5 million, highlights growth compared to the previous year's figure of $4.5 million, indicating a 11% increase in sales performance. The net profit margin stands at 15%, reflecting a stable profitability level crucial for investor confidence. Operating expenses, valued at $2 million, show a controlled cost management approach, ensuring resources are allocated efficiently. These metrics collectively illustrate the organization's robust financial position and strategic direction for sustainable growth in the competitive market landscape.

Contextual background and situation analysis.

Inaccurate financial statements can significantly impact a business's reputation and operations, especially for publicly traded companies like Tesla or Apple. Events such as a data breach or accounting error may lead to discrepancies in reported earnings, creating investor concerns. For instance, in 2020, the pandemic forced many businesses to revise revenue projections, resulting in significant fluctuations in stock prices. Auditors must meticulously analyze internal controls and accounting practices to ensure accurate reporting. The Sarbanes-Oxley Act of 2002 mandates stringent compliance measures, increasing accountability for financial disclosures. These dynamics create a complex environment where clarity and integrity in financial reporting are essential for maintaining stakeholder trust.

Future financial projections and action plans.

Future financial projections serve as essential tools for guiding strategic decisions in business environments. These projections typically encompass key metrics such as projected revenue growth rates, which can vary significantly by industry, for instance, technology may anticipate a 15% annual growth while retail sectors estimate around 3%. Action plans derived from these forecasts might include operational adjustments, such as cost-cutting measures, streamlining supply chains, or expanding product lines in response to market demands. Companies may also invest in digital transformation initiatives, allocating 5% of revenue to enhance online capabilities. Regular reviews of financial health, benchmarked against performance indicators like profit margins and return on investment, are crucial for adapting to evolving economic conditions, such as inflation rates that have surged by over 6% in recent years, impacting purchasing power and consumer behavior.

Comments