Are you thinking about starting a new business venture and wondering if your ideas are sound? Conducting a thorough feasibility analysis is an essential step to understand the viability of your business plan and identify potential challenges. This process not only helps you assess the market demand and financial projections but also equips you with the insights needed to make informed decisions. Join us as we delve deeper into the steps of creating an effective feasibility study that could pave the way for your entrepreneurial success!

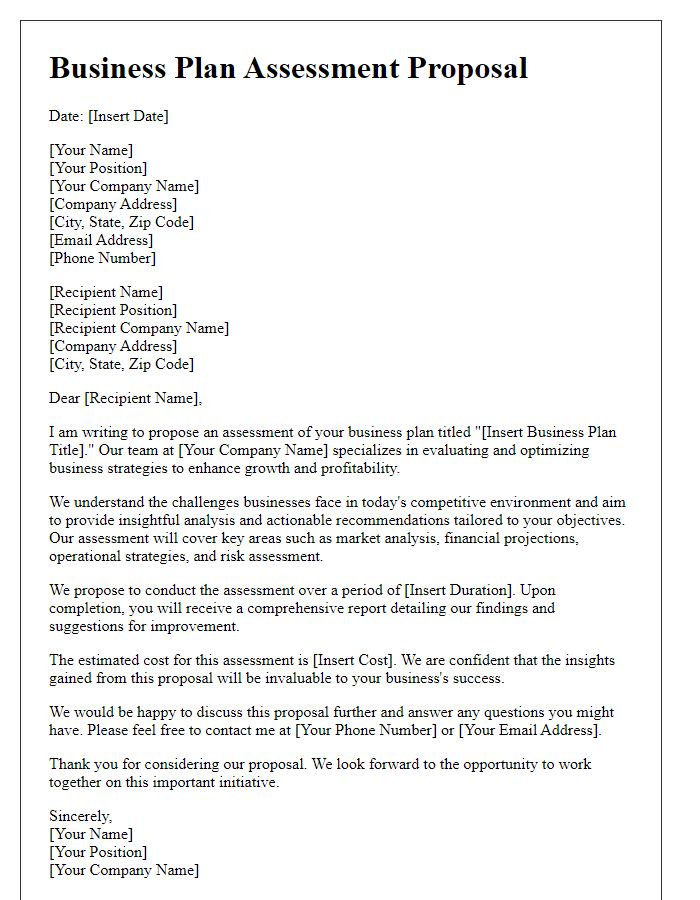

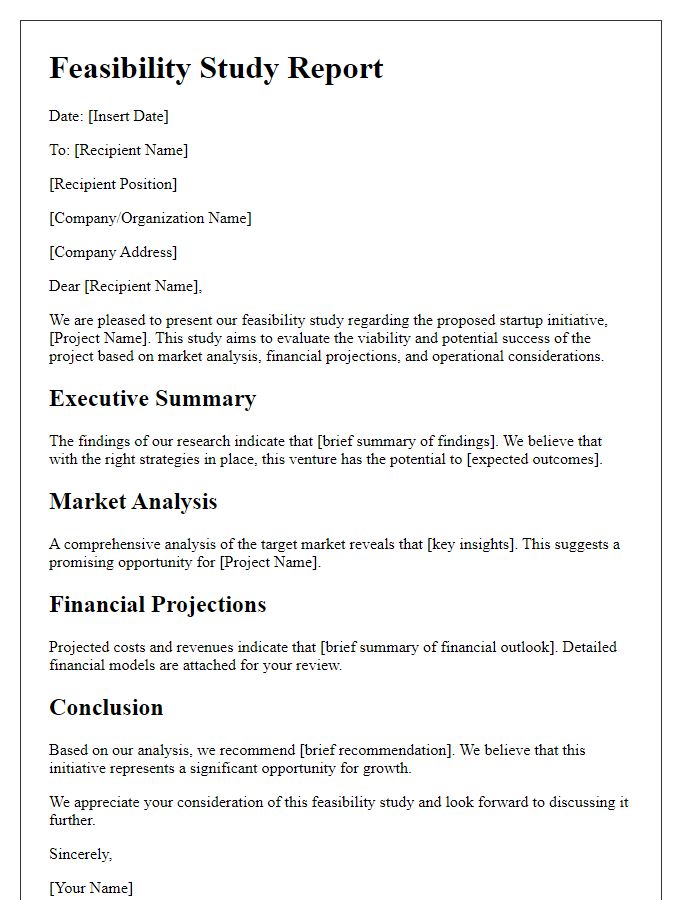

Executive Summary

The executive summary of a business plan provides a concise overview of the project, including key components such as market analysis, financial projections, and operational structure. Essential elements include the business concept, clearly defined target market demographics (age, income level, location), and unique selling proposition that differentiates the business from competitors. Financial projections should encompass estimated revenue, operating costs, and break-even analysis over a specific timeline, typically three to five years. Furthermore, operational structure outlines the necessary resources, including human capital (number of employees), physical assets (office space, equipment), and technological needs (software, hardware). Additionally, identifying potential risks, such as market volatility, regulatory changes, or supply chain disruptions, is crucial for illustrating the feasibility and sustainability of the business model. By synthesizing this information, the executive summary effectively communicates the viability and strategic direction of the proposed business to investors, stakeholders, and partners.

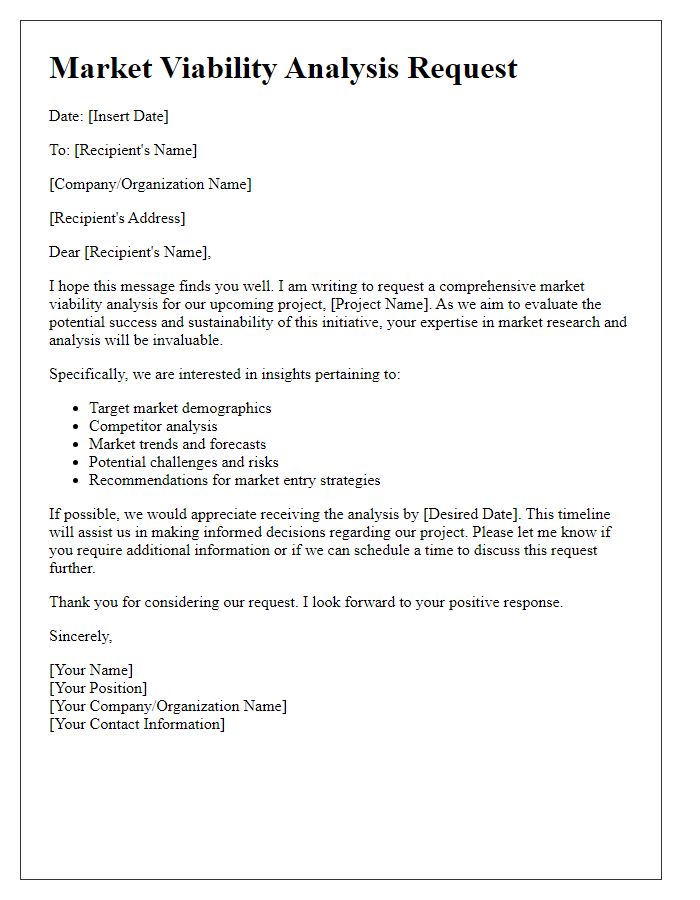

Market Analysis

The Market Analysis segment of a business plan is a critical component that assesses the business landscape and identifies potential opportunities for growth. Utilizing data from reputable sources such as IBISWorld and Statista, this analysis explores the target market demographics, including age, income level, and purchasing behaviors of consumers, which can significantly impact sales potential. Competitive analysis involves examining key players within the industry, such as local businesses and national chains, to understand market share and positioning. Additionally, trends influencing the market, including technological advancements, economic indicators, and regulatory changes, are evaluated to determine their potential effects on business operations. For instance, the rise of e-commerce has reshaped retail dynamics, compelling traditional brick-and-mortar stores to adapt strategies. Collectively, this comprehensive exploration delivers actionable insights necessary for informed decision-making and sustainable business development.

Financial Projections

Financial projections serve as a crucial component of a business plan, illustrating anticipated revenue, expenses, and profitability over a specified period, often spanning three to five years. These projections may include detailed income statements, cash flow statements, and balance sheets, grounded in data and market analysis. Key metrics such as gross margin percentage and net profit can provide insight into the financial health of the business. Assumptions regarding market conditions, customer acquisition costs, and sales growth rates should be rooted in realistic market research. Investors often scrutinize these projections, making it essential to present a thorough, well-supported analysis that addresses various scenarios, such as best-case and worst-case outcomes. Regular updates to these projections may be necessary to reflect changes in business strategies or economic conditions.

Competitive Landscape

The competitive landscape in the business plan feasibility analysis reveals a detailed examination of rival firms operating in the same market segment. Key players, such as Company A, Company B, and Company C, dominate the industry with significant market shares of 25%, 18%, and 15%, respectively. These companies offer similar products, including eco-friendly packaging solutions, addressing consumer demand for sustainable options. Market entry barriers, including high initial investment (averaging around $500,000) and stringent regulatory requirements related to environmental standards, further shape competition. Analyzing the strengths and weaknesses of competitors highlights opportunities for differentiation, especially in innovation and customer service. Recent industry reports indicate a projected annual growth rate of 12% in the eco-packaging sector, emphasizing the importance of identifying niches and areas for enhancement to achieve a competitive advantage.

Risk Assessment

Risk assessment in a business plan involves identifying potential challenges that could impact project success. Key factors include market volatility, regulatory changes, and financial uncertainties. Market fluctuations (such as economic downturns in 2020) can lead to decreased consumer demand. Regulatory shifts (like changes in trade tariffs affecting imports or exports) may increase operational costs. Financial risks include inadequate funding sources, which can hinder project implementation. Additionally, competition from emerging businesses in regions like Silicon Valley can challenge market position. Thoroughly addressing these risks enhances the robustness of the business plan, ultimately supporting sustainable growth.

Comments