Are you considering a charity audit engagement but unsure where to start? Making sure your organization's financial practices are transparent and effective can truly set you apart in the nonprofit world. In this article, we'll explore a comprehensive letter template that not only meets auditing requirements but also enhances your credibility. Join us as we dive into essential components of this template to help your charity shine; keep reading to discover more!

Introduction and Purpose

The charity audit engagement serves a crucial role in ensuring transparency and accountability within nonprofit organizations, such as the American Red Cross and the Salvation Army. Audits are conducted to verify financial statements, ensuring compliance with established accounting standards, like Generally Accepted Accounting Principles (GAAP). This engagement is pivotal for stakeholders, including donors, board members, and regulatory agencies, to assess the financial health and operational integrity of the organization. The primary purpose of the audit is to provide an independent evaluation of financial records, which enhances trust and fosters ongoing support for charitable initiatives. Engaging a qualified auditor not only reinforces best practices but also helps in identifying areas for improvement, ultimately contributing to the charity's mission of serving the community more effectively.

Scope of Audit

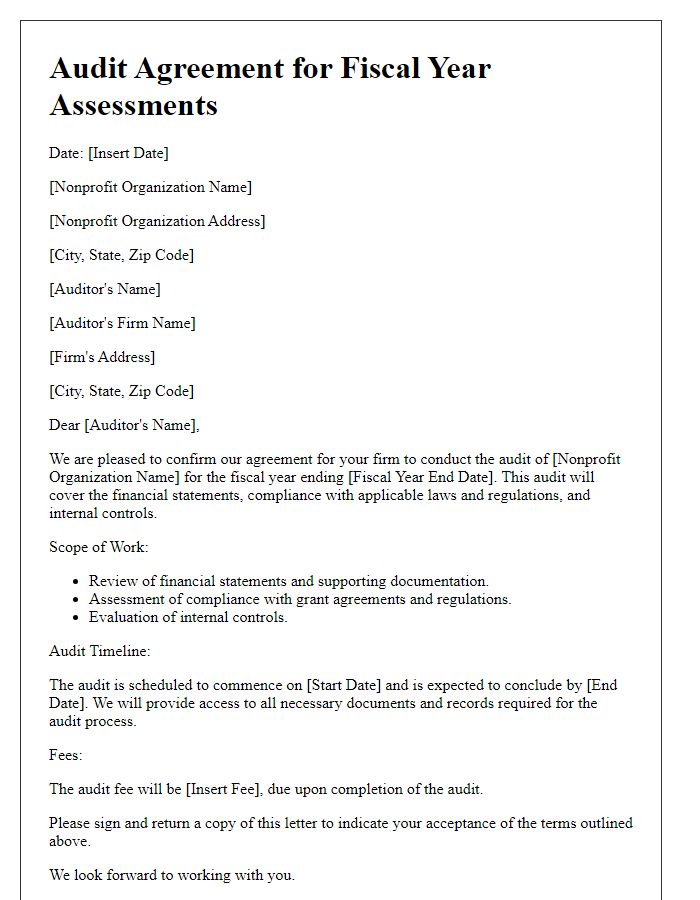

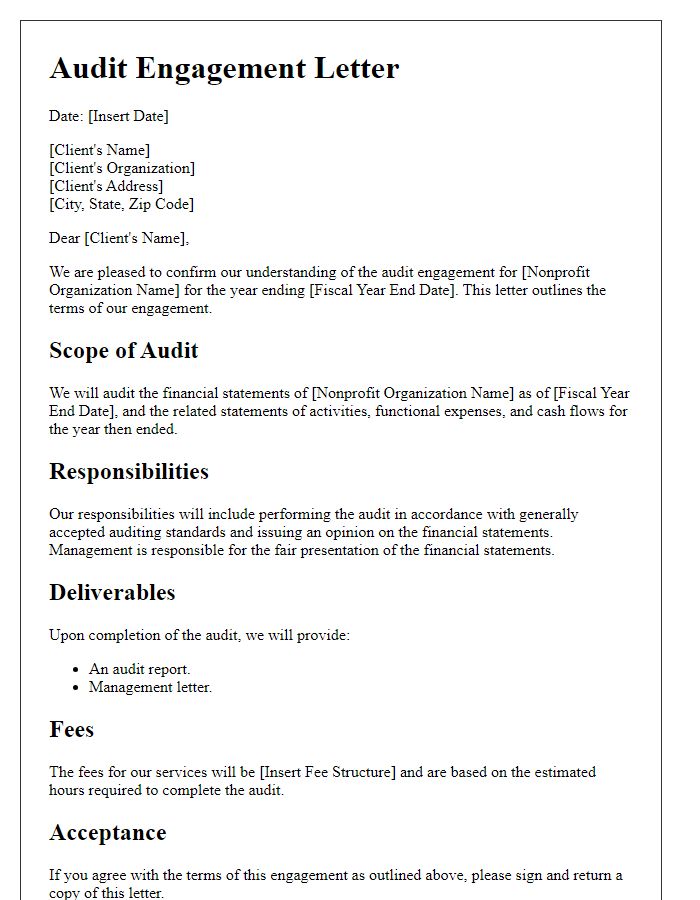

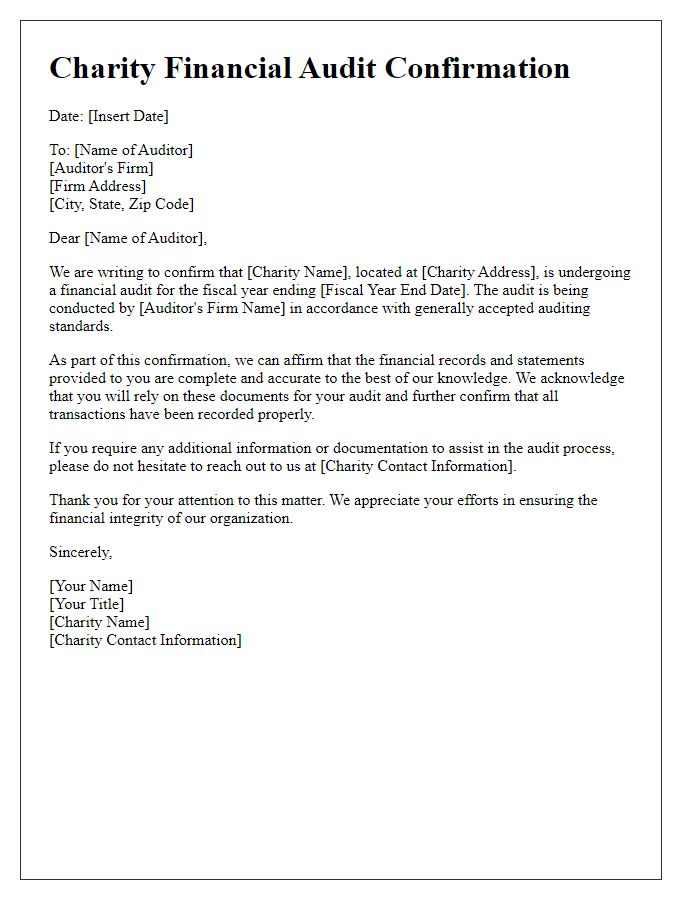

The scope of the charity audit engagement includes a comprehensive examination of financial statements, including the statement of financial position, statement of activities, and supporting notes for the fiscal year ending December 31, 2023. The audit will assess compliance with applicable accounting standards, such as FASB ASC 958, and legal requirements under the IRS regulations governing 501(c)(3) organizations. Key areas of focus encompass revenue recognition, donor restrictions, and expenses related to program services and support functions. The auditor will evaluate internal controls and risk management practices established by the charity at its headquarters located in San Francisco, California. The audit process involves preliminary planning, fieldwork, and the issuance of an independent auditor's report, ensuring transparency and accountability for stakeholders and regulatory bodies.

Responsibilities of Management

In the charity audit engagement process, management holds critical responsibilities crucial to ensuring financial integrity and compliance. Management must prepare accurate financial statements, which must reflect the organization's financial position. Additionally, they should maintain an effective internal control system designed to safeguard assets and ensure the reliability of financial reporting. Management is also responsible for adhering to relevant laws and regulations governing charity operations, such as the Charities Act 2011 in the UK. Furthermore, they should provide auditors with access to all necessary documents, records, and correspondence, including board meeting minutes and financial reports, to facilitate the audit process. Regular assessments of risks related to financial transactions and reporting must also be a priority for management, allowing for proactive identification and mitigation of potential issues.

Auditor's Responsibilities

The auditor's responsibilities during a charity audit engagement encompass several critical tasks designed to ensure compliance and transparency in financial reporting. Auditors are tasked with assessing the organization's financial statements, typically pertaining to the fiscal year ending December 31, while adhering to the Generally Accepted Accounting Principles (GAAP) applicable in the United States. This process includes examining supporting documentation for key transactions such as donations exceeding $10,000 and grants received, ensuring that funds are allocated appropriately. Furthermore, auditors evaluate internal controls over financial reporting to identify weaknesses that could impact the charity's ability to meet its obligations. The auditor's role also involves communicating with the board of directors and other stakeholders regarding significant findings and recommendations, ultimately enhancing the accountability of the charity and fostering public trust. Finally, upon completion, auditors provide an independent opinion on the fairness of the financial statements, which is crucial for donor confidence and regulatory compliance.

Reporting and Communication

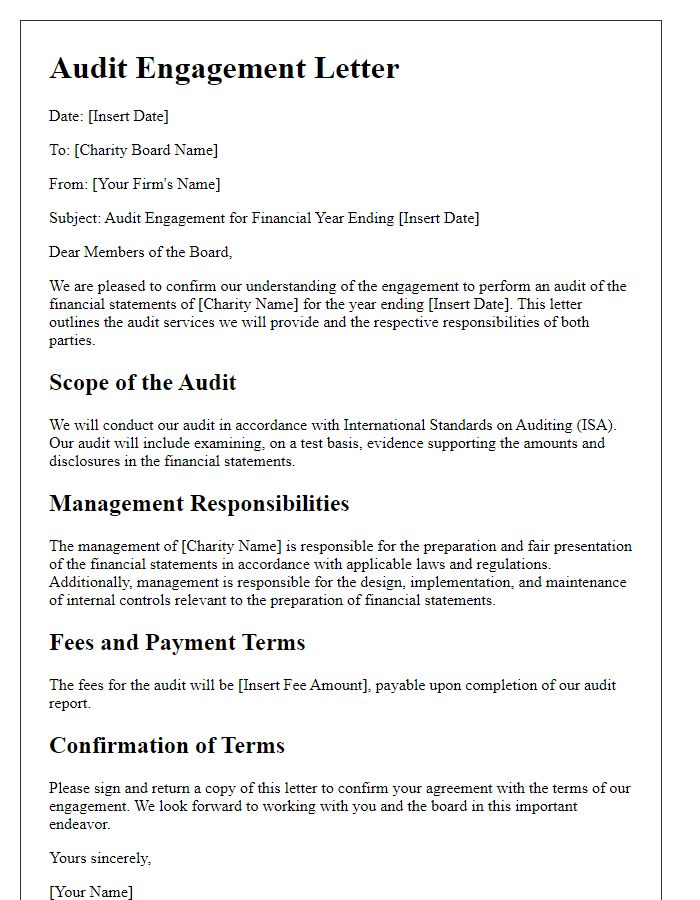

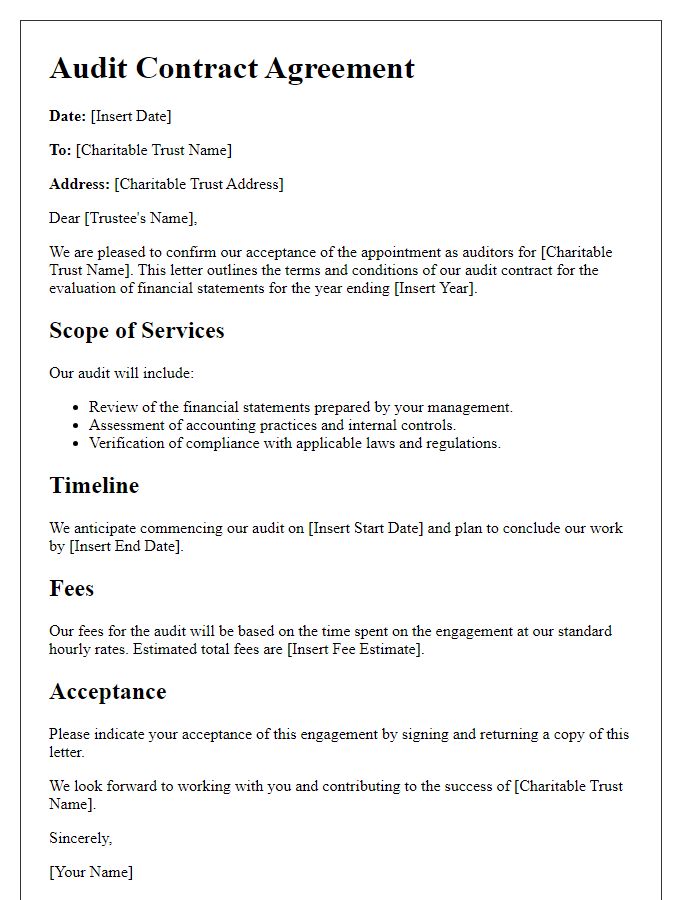

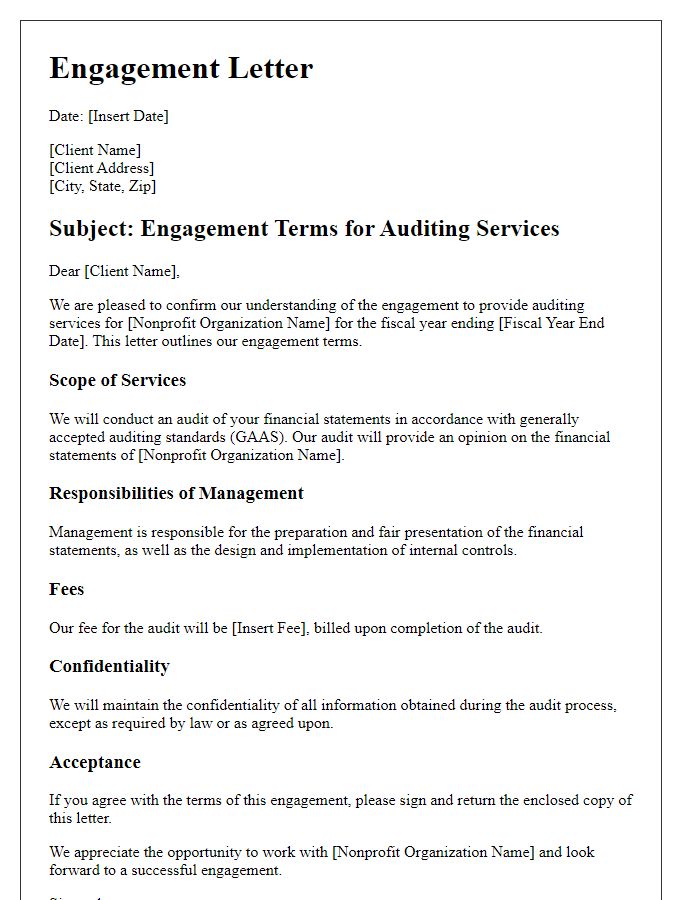

The charity audit engagement requires clear reporting and communication throughout the process to ensure transparency and accountability. Key documents include the engagement letter, which outlines the scope of the audit, objectives, and responsibilities of both the auditor and the charity, such as the Financial Statements of 2023, which should adhere to the Generally Accepted Accounting Principles (GAAP). Regular communication updates, scheduled meetings, and interim reports keep stakeholders informed about progress and address any identified risks or concerns. The final audit report, submitted by the audit firm, MNP LLP, specifies findings related to the charity's financial health and compliance with regulatory frameworks like the Charities Act 2011, ultimately guiding management decisions and supporting ongoing trust with donors and beneficiaries alike.

Letter Template For Charity Audit Engagement Samples

Letter template of audit agreement for nonprofit fiscal year assessments

Comments