Navigating a financial crisis can feel overwhelming, but you're not alone in this journey. In today's article, we'll break down essential steps to take when facing financial challenges, offering practical tips and emotional support to help you regain control. From budgeting and debt management to exploring assistance options, we'll equip you with the tools you need to weather the storm. Dive in to discover how to effectively tackle your financial hurdles and find peace of mind!

Clear and Concise Communication

In a financial crisis, effective communication is crucial for maintaining stakeholder confidence. Clear and concise messaging ensures that stakeholders, including employees, investors, and customers, are informed of the situation. Timely updates about financial performance, crisis management strategies, and potential impacts on operations should be conveyed transparently. For instance, outlining specific measures such as cost-cutting initiatives or restructuring plans can provide clarity. Additionally, incorporating key metrics, such as quarterly revenue declines or projected cash flow shortages, can help stakeholders grasp the severity of the situation. Consistency in communication helps establish trust and reassures stakeholders that the organization is proactively addressing challenges to stabilize its financial health.

Reassurance and Empathy

During financial crises, stakeholders often face uncertainty and anxiety regarding their financial stability and future prospects. Effective communication is essential for reassurance and empathy. Organizations must acknowledge challenges, such as decreased revenue streams and potential layoffs, that employees and clients may encounter. Offering transparent insights into management's strategy, including cost-cutting measures and potential recovery plans, can foster a sense of security. Highlighting community support initiatives and employee assistance programs can further demonstrate the organization's commitment to its workforce. Engaging stakeholders through regular updates and feedback opportunities ensures they feel valued and considered during turbulent times. A supportive approach helps cultivate trust and cohesion within the organization, essential for navigating through economic difficulties.

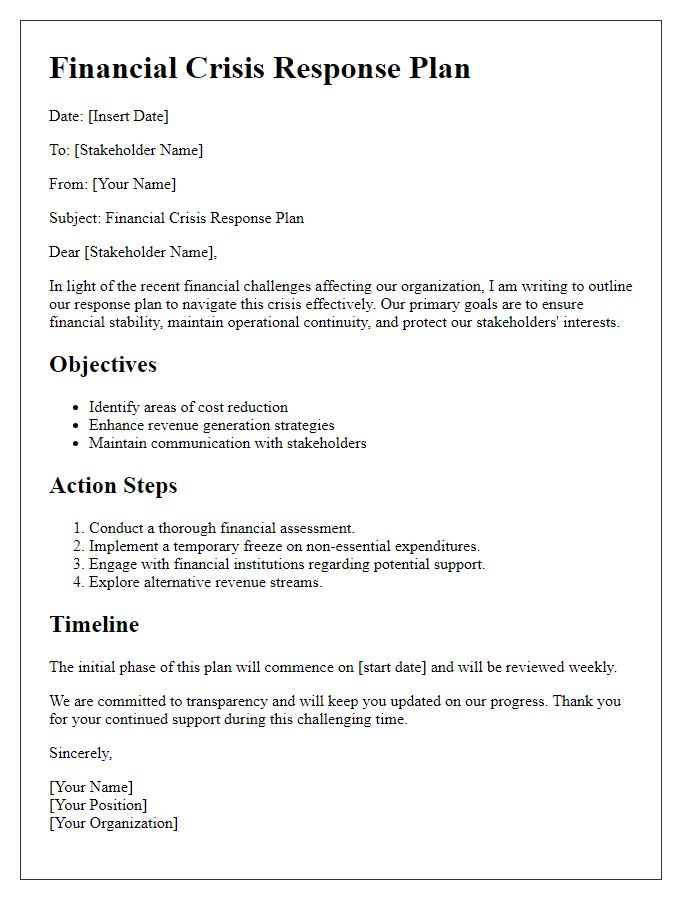

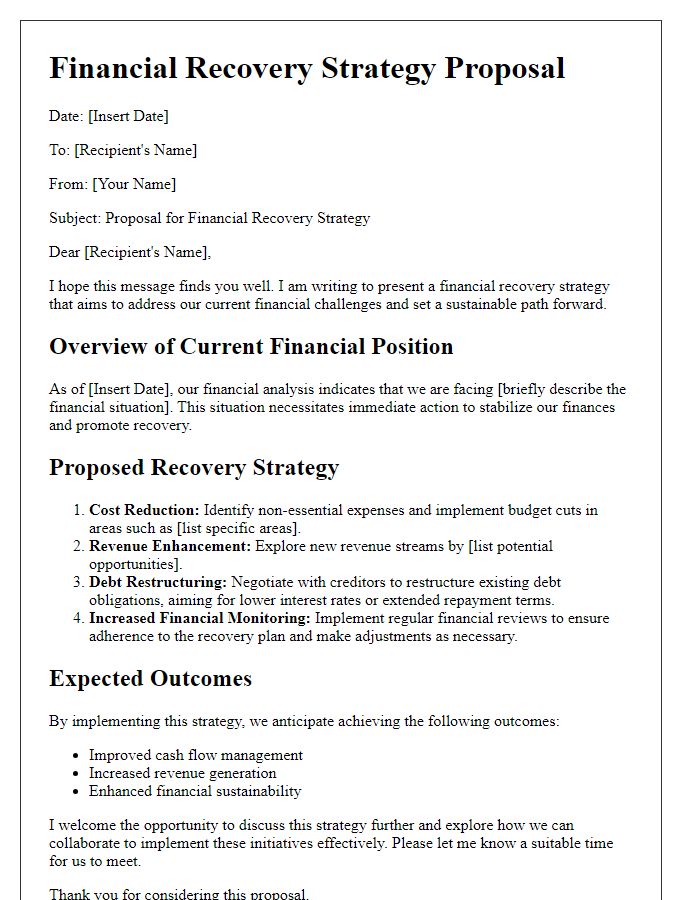

Actionable Steps and Strategy

During a financial crisis, businesses must adopt structured strategies to navigate challenges effectively. Prioritize cash flow management, focusing on detailed budget forecasts to anticipate expenses and revenue fluctuations. Implement cost-cutting measures, such as reducing non-essential expenditures and negotiating terms with suppliers, to enhance liquidity. Strengthen communication with stakeholders, ensuring transparency regarding the business's financial status and the steps being taken to mitigate risks. Explore alternative funding options, including short-term loans, government assistance programs, or crowdfunding, to secure necessary capital for survival. Develop a comprehensive crisis response plan, incorporating scenario analyses for various economic conditions, to remain agile and responsive in an ever-changing market landscape. Regularly review and adjust strategies based on real-time financial performance and market indicators to stay aligned with organizational goals.

Resources and Support Information

Financial crises can lead to significant stress for individuals and businesses alike. Accessing essential resources and support options becomes critical during these challenging times. Non-profit organizations, such as the United Way, often provide emergency financial assistance, food banks, and counseling services to help those affected. Government programs like the Small Business Administration (SBA) offer loans and grants aimed at assisting struggling enterprises. Local community support systems may include workshops focused on financial literacy and budgeting, aimed at helping individuals regain control over their finances. Additionally, financial institutions may provide deferment options on loans and mortgages, offering temporary relief to those facing hardships. Staying informed through reputable websites and local agencies ensures access to the most current and effective support available.

Contact Information for Assistance

In times of financial distress, individuals and organizations often seek assistance from various sources to navigate challenging circumstances. Local government agencies like the Department of Human Services (DHS) provide emergency financial aid programs that cater to low-income families and individuals facing unemployment, housing instability, or medical emergencies. Non-profit organizations such as the Salvation Army and United Way also offer resources that include financial counseling, food assistance programs, and utility bill help, often directed by community needs and donations. For immediate support, one can contact the National Foundation for Credit Counseling (NFCC) at 1-800-388-2227, which offers confidential budget and debt management assistance. Additionally, local banks and credit unions may have internal programs to assist customers experiencing difficulties, providing personalized financial solutions and temporary relief options.

Letter Template For Financial Crisis Management Samples

Letter template of stakeholder communication regarding financial challenges

Comments