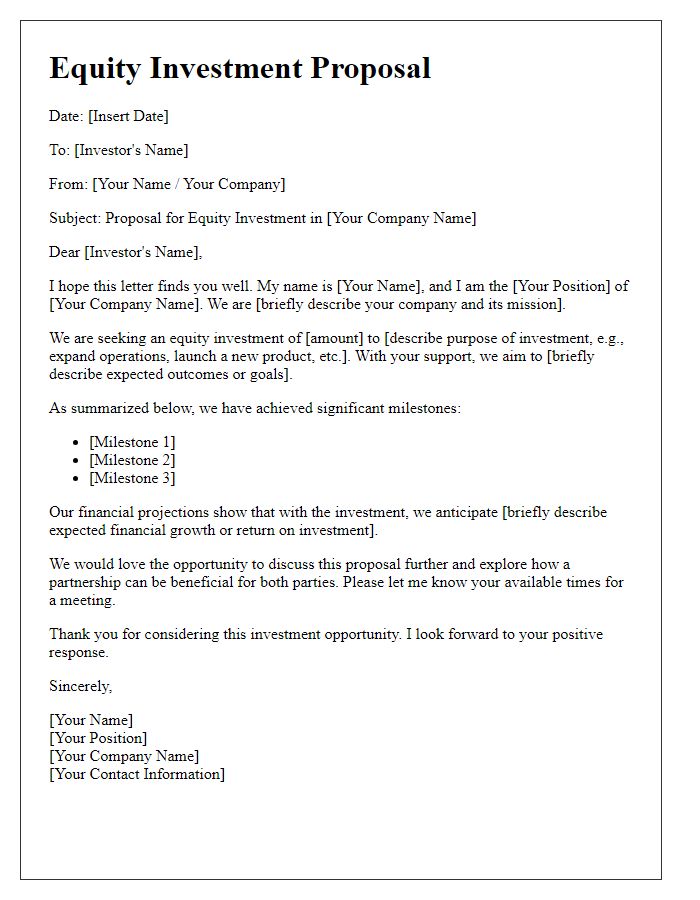

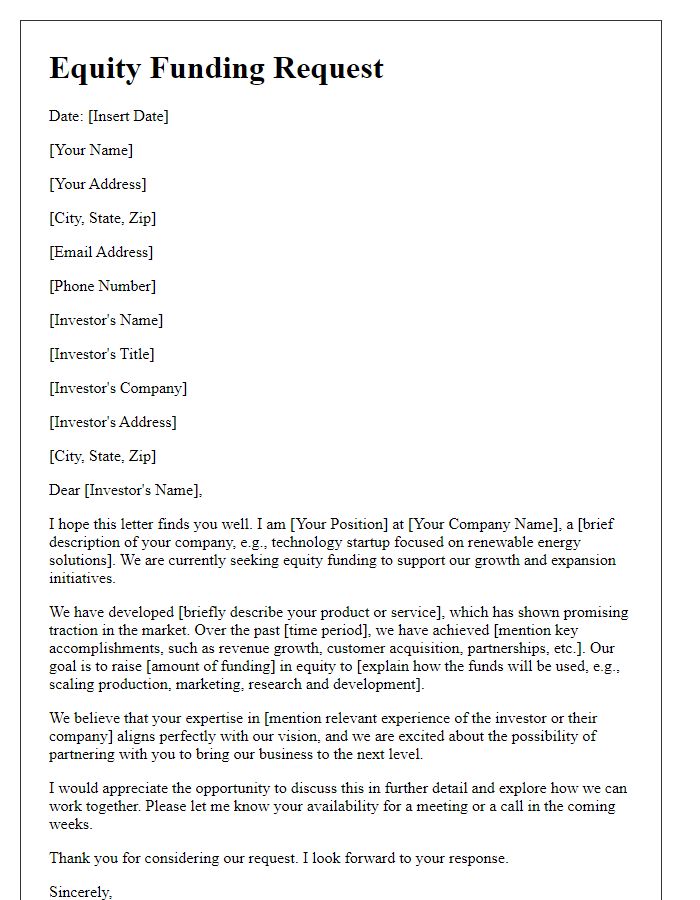

Are you looking to navigate the world of equity financing with confidence? Crafting a well-structured letter can be a game-changing step in securing the funding you need. In this article, we'll explore essential components of an equity financing letter template that can help you communicate effectively with potential investors. So, grab a cup of coffee and let's dive into the details!

Clarity in Financial Terms

Clarity in financial terms is paramount in equity financing documentation to ensure all parties understand their obligations and rights. Clear definitions of key terms such as "equity stake" (percentage of ownership), "valuation" (company worth before investment), and "dividend" (profit-sharing mechanism) facilitate informed decision-making. Transparency about "use of proceeds" specifies how the raised capital will be allocated, enhancing investor trust. Specific timelines for "funding milestones" denote crucial phases in funding, such as initial investment dates and subsequent rounds of financing. Additionally, detailed "exit strategies," including potential buyout scenarios or initial public offerings (IPOs), provide investors with expectations for future returns. Emphasizing the importance of comprehensive financial disclosures, such as annual reports and cash flow statements, ensures ongoing clarity throughout the investment relationship.

Legal Compliance and Regulations

Equity financing involves raising capital through the sale of shares in a company, necessitating strict adherence to legal compliance and regulations. Regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States mandate comprehensive disclosure requirements. Companies must file Form S-1 for registering securities and comply with the Securities Act of 1933, ensuring all material information is accurately represented to potential investors. In addition to federal regulations, state laws known as "blue sky laws" may impose further requirements regarding the sale of securities, emphasizing the need for thorough due diligence. Adhering to anti-fraud provisions is critical, as misrepresentation can lead to severe penalties, including fines or legal actions. Additionally, compliance with corporate governance standards is essential to protect investor interests and maintain firm transparency, aligning with frameworks such as the Sarbanes-Oxley Act.

Detailed Company Overview

A comprehensive company overview is crucial for equity financing documentation, providing potential investors with insight into the business's operations, structure, and market positioning. The company, XYZ Innovations, founded in 2015, specializes in renewable energy solutions, particularly solar panel technology designed for residential use. Located in San Francisco, California, the company operates in a rapidly growing industry, expected to reach a market size of $223 billion by 2026, according to industry reports. XYZ Innovations has secured strategic partnerships with major suppliers such as SunPower and Tesla, enhancing its competitive edge. The company's flagship product, the SolarMax 5000, has achieved a 25% increase in efficiency compared to traditional panels, garnering positive reviews from sources like Consumer Reports. Financially, the organization reported a revenue growth of 120% year-over-year, aiming to expand its market share beyond California to other states with favorable renewable energy incentives.

Investment Risks and Opportunities

Investment in equity financing presents various risks and opportunities for investors. Market volatility can significantly affect the stock performance of companies, with fluctuations often exacerbating uncertainty during economic downturns. Conversely, successful startups and high-growth companies offer the potential for substantial returns, often exceeding 20% annual growth rates in favorable conditions. Regulatory changes can impact investment landscapes, particularly in sectors like technology and healthcare, where government policies influence operational capabilities. Additionally, diversifying a portfolio with equity investments can mitigate risks, balancing potential losses from underperforming assets. Evaluating industry trends, company fundamentals, and competitive positioning remains crucial for informed investment decisions that leverage opportunities while managing associated risks effectively.

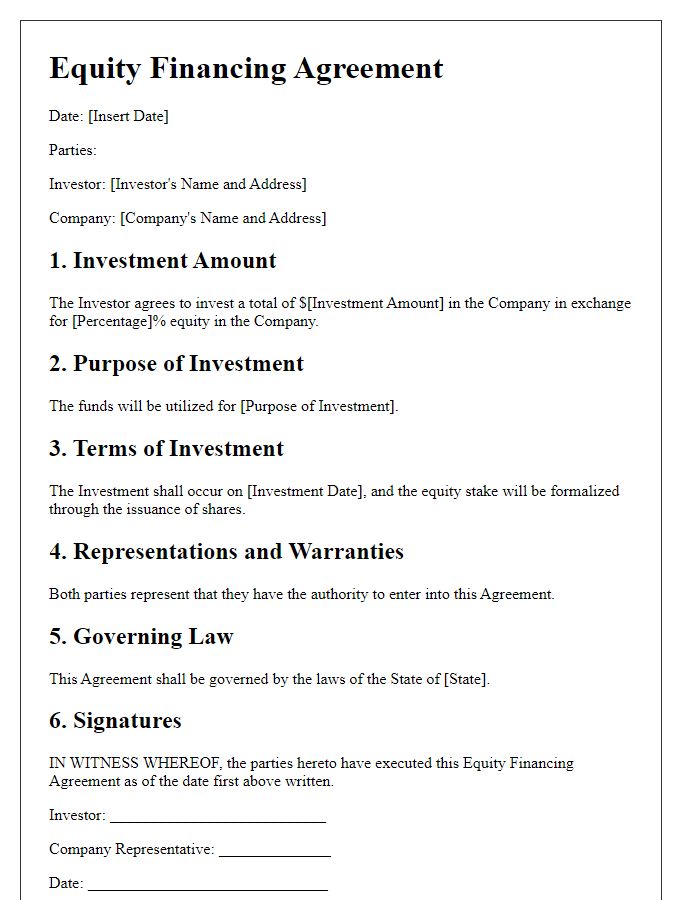

Stakeholder and Investor Communication

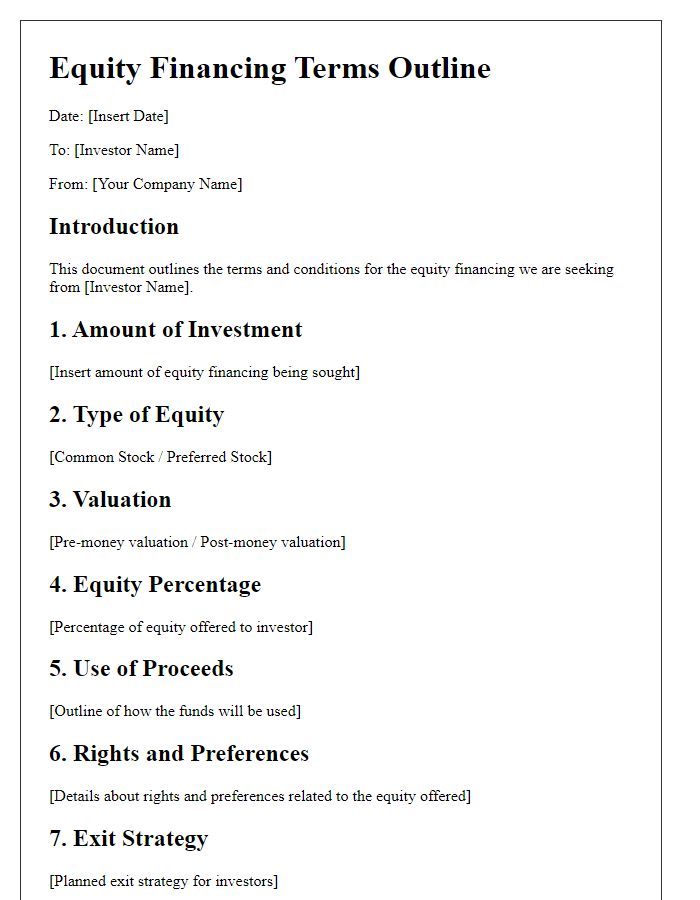

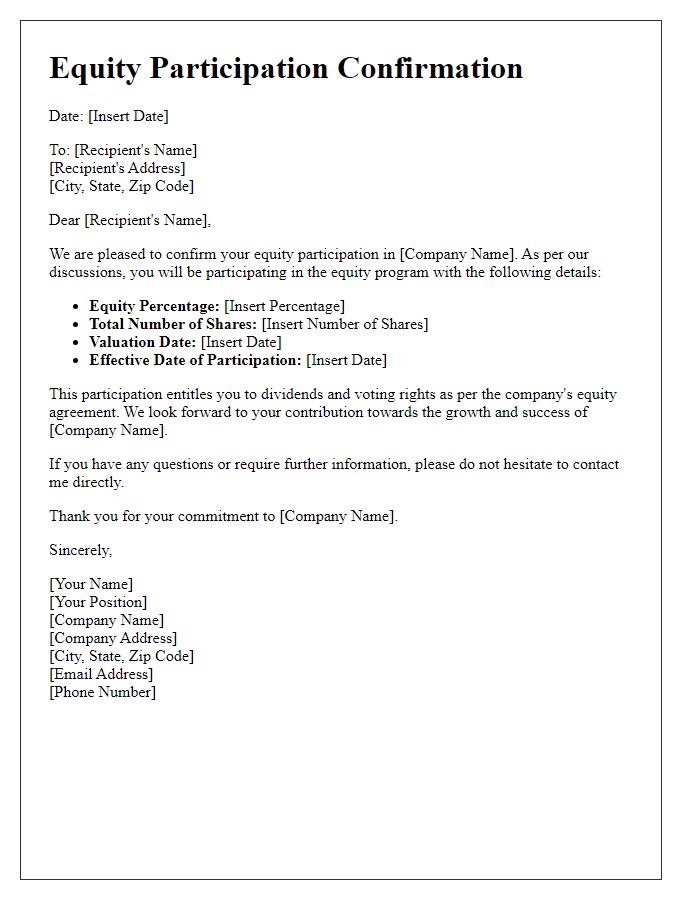

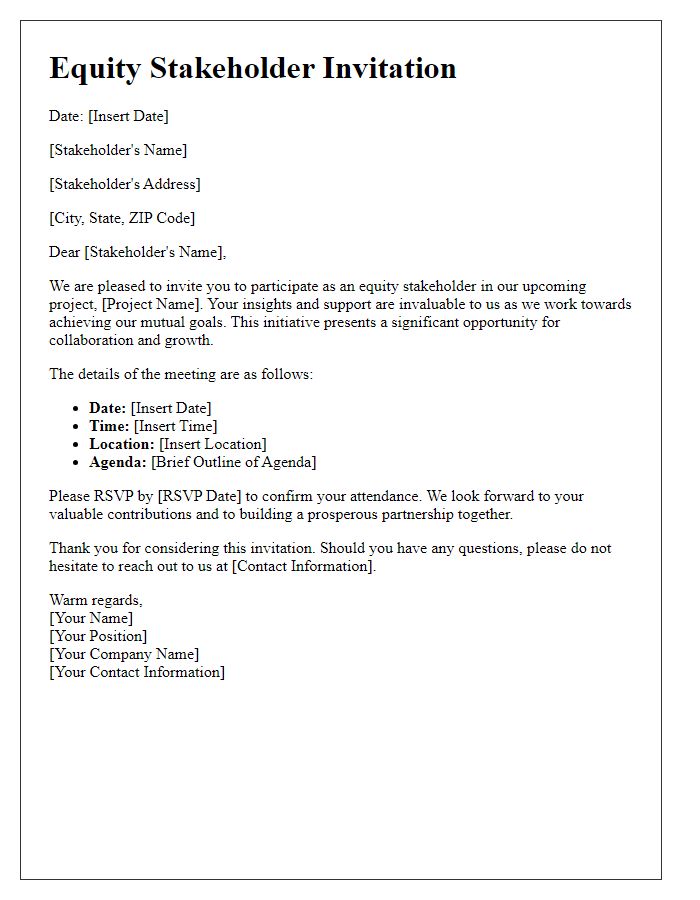

Equity financing documentation plays a pivotal role in stakeholder and investor communication, particularly in facilitating clear understanding of financial health and future prospects of a company. This documentation typically includes detailed financial statements, outlining revenue, expenses, and profit margins, which provide insights into a company's performance over specific periods, often spanning quarterly or annually. Additionally, term sheets summarize the key terms of investment agreements, presenting crucial information such as valuation and ownership percentages. A business plan might also be included, detailing market analysis, competitive landscape, and projected growth trajectories, essential for potential investors assessing the viability of investment opportunities. Clear articulation of risk factors and the proposed use of funds is critical in building trust and transparency, while also enabling investors to make informed decisions aligned with their strategic interests.

Comments