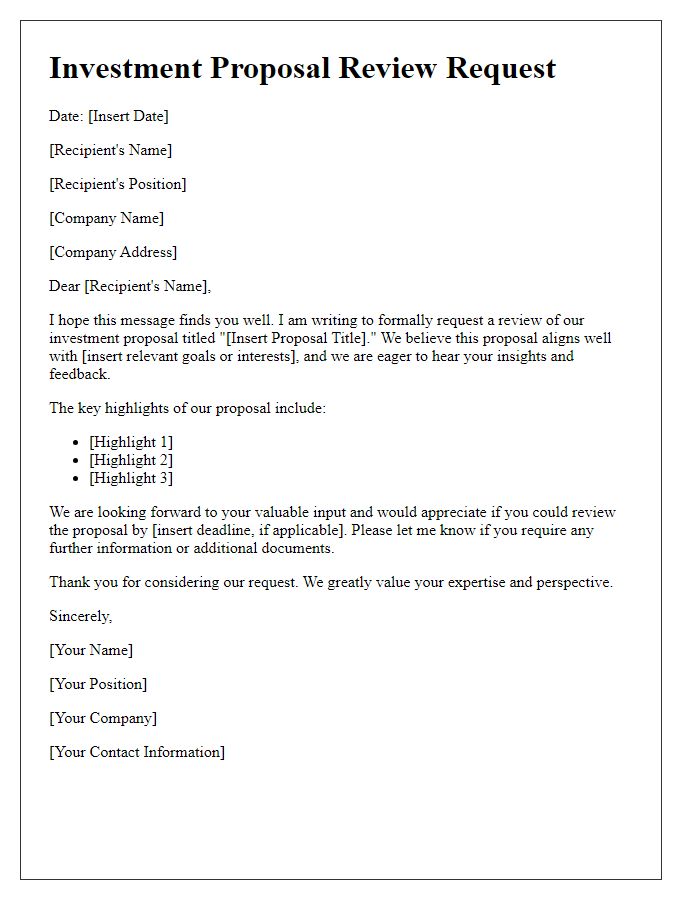

Are you looking to refine your investment proposal and maximize its potential? Crafting a compelling letter for feedback can significantly enhance your chances of success, ensuring your ideas resonate with investors. In this article, we'll explore some effective strategies for writing an impactful feedback request that not only conveys your message clearly but also sparks interest. Curious to learn how to elevate your proposal? Let's dive in!

Clarity of Proposal

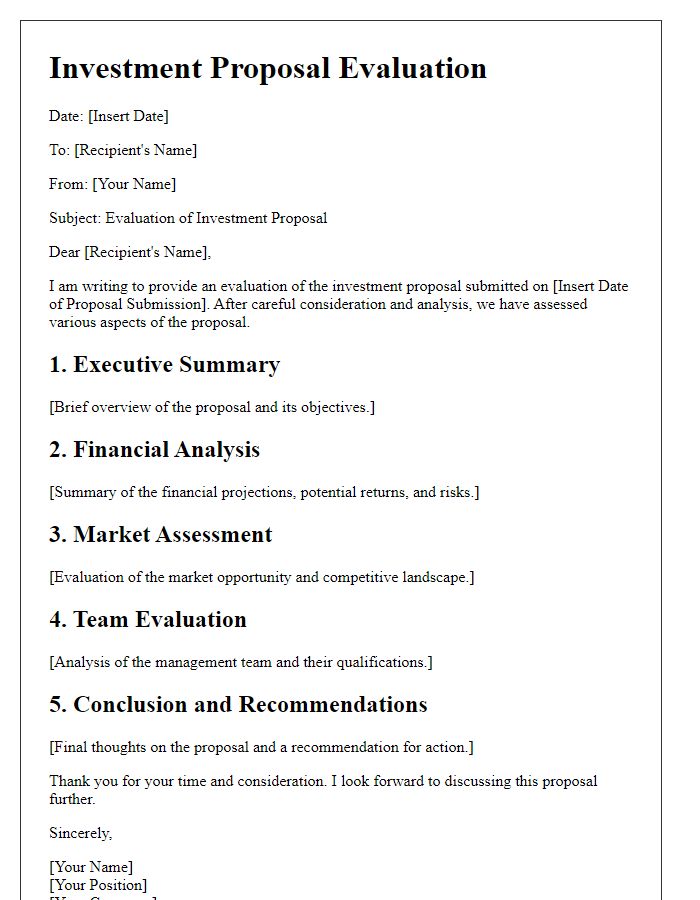

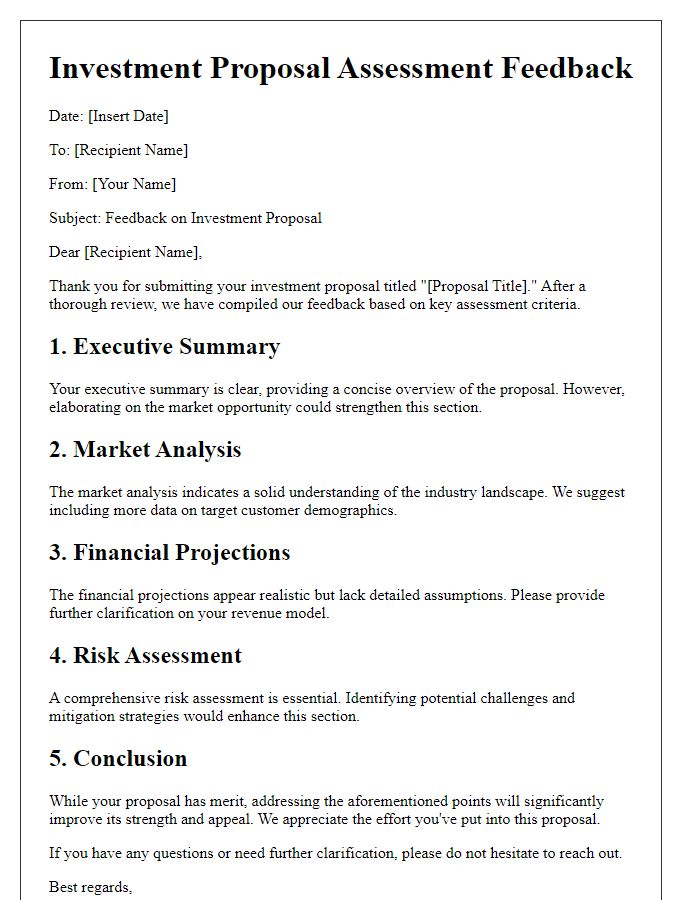

A well-structured investment proposal reveals clarity in its objectives, ensuring potential investors grasp the venture's purpose. Specific details are paramount; for instance, a clearly defined market analysis showcases the targeted demographic, such as tech-savvy millennials aged 25-35 in urban areas. Supporting financial projections, including a three-year revenue forecast alongside anticipated return on investment (ROI) metrics, provide transparency into expected profitability. Furthermore, goals delineated in a logical timeline, such as milestone achievements at the end of each quarter, enhance the proposal's coherence. Visual aids, like charts or graphs, can illustrate financial trends succinctly, solidifying understanding while aiding retention of crucial information. A clearly articulated value proposition distinguishes the investment opportunity, making it compelling for investors to engage with the proposal.

Financial Projections

Financial projections play a critical role in investment proposals, providing detailed forecasts of revenue, expenses, and profitability for a specific period, typically spanning three to five years. Accurate projections are essential for potential investors, as they outline the financial viability of a business plan and its ability to generate returns. For example, gross revenue estimates may reach $1 million in Year 1, with a gradual increase of 20% annually, driven by market expansion and strategic partnerships. Expenses can be categorized into fixed costs, such as rent for office space in New York City, and variable costs, related to production. Including key performance metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) can demonstrate operational efficiency and growth potential. Furthermore, break-even analysis illustrates when the company will cover its initial investment costs, critical for investors assessing risk. Overall, well-structured financial projections are vital tools that reflect the business's financial health and future growth opportunities.

Market Analysis

The market analysis is a crucial component of the investment proposal, providing insights into industry trends, competitive landscape, and target demographics. Detailed evaluations of market size indicate a growth of approximately 5% annually within the technology sector, projected to reach $1 trillion by 2025. Key competitors such as TechCorp and Innovate Solutions have established strong market share, emphasizing the need for differentiated offerings. Target demographics primarily include millennials and Gen Z consumers, who are increasingly investing in sustainable technology. Understanding regional variations indicates that the Northeast U.S. shows the highest demand for eco-friendly products, a trend worth noting for potential investors. Additionally, consumer behavior studies highlight a shift towards online purchasing, with e-commerce sales expected to surpass $800 billion in 2023, showcasing the importance of a robust digital strategy for market penetration.

Risk Assessment

Risk assessment in investment proposals involves analyzing potential challenges that could impact financial outcomes, including market volatility, economic downturns, and regulatory changes. Key factors like credit risk (possibility of default by borrowers) should be evaluated, particularly in sectors like real estate or startups. Additionally, operational risks (failures in internal processes) can arise from management decisions, employee errors, or technological failures. The geopolitical landscape, particularly in countries with unstable governments or fluctuating economies, can also influence returns. Proper due diligence, including analyzing historical data and conducting stress tests, is essential to provide a comprehensive understanding of the risks involved, ensuring investors make informed decisions backed by solid financial projections.

Competitive Advantage

In the competitive landscape of the technology sector, companies like Apple Inc. (market capitalization approximately $2.5 trillion) maintain robust competitive advantages due to their strong brand loyalty, innovative product ecosystems, and substantial investment in research and development (R&D). Similarly, in the renewable energy sector, firms such as NextEra Energy (traded on NYSE under the symbol NEE) leverage their first-mover advantage in wind and solar energy projects, positioning themselves favorably against emerging public and private competitors. Moreover, established distribution networks, such as Amazon's logistics system, and proprietary technologies, like Tesla's Autopilot software, serve not only as barriers to entry but also as substantial competitive moats, ensuring sustained market dominance and customer retention. These factors collectively solidify the basis for a compelling investment proposition, reflecting both the firm's unique capabilities and market positioning.

Comments