Are you navigating the complex waters of corporate finance restructuring? Whether you're a seasoned executive or a newcomer to the field, understanding the intricacies of financial realignment is essential for your organization's success. In this article, we'll explore key strategies and common pitfalls to avoid, ensuring your restructuring efforts lead to sustainable growth. So, grab a cup of coffee and join us as we delve deeper into the transformative journey of corporate finance restructuring!

Clear Objective Statement

In corporate finance restructuring, a clear objective statement is crucial for guiding the process toward financial stability and growth. The objective statement should articulate the restructuring goals, such as reducing debt burdens by 30% over the next 12 months, optimizing cash flow management to enhance liquidity positions, and improving operational efficiency to increase profit margins by 15% within two fiscal years. Additionally, the intent to renegotiate existing contracts with suppliers, improve stakeholder relations, and realign the company's strategic vision with market demands is paramount for achieving long-term sustainability. This focused approach, including identifying key performance indicators (KPIs) for measuring progress, ensures all parties involved remain aligned and committed throughout the restructuring journey.

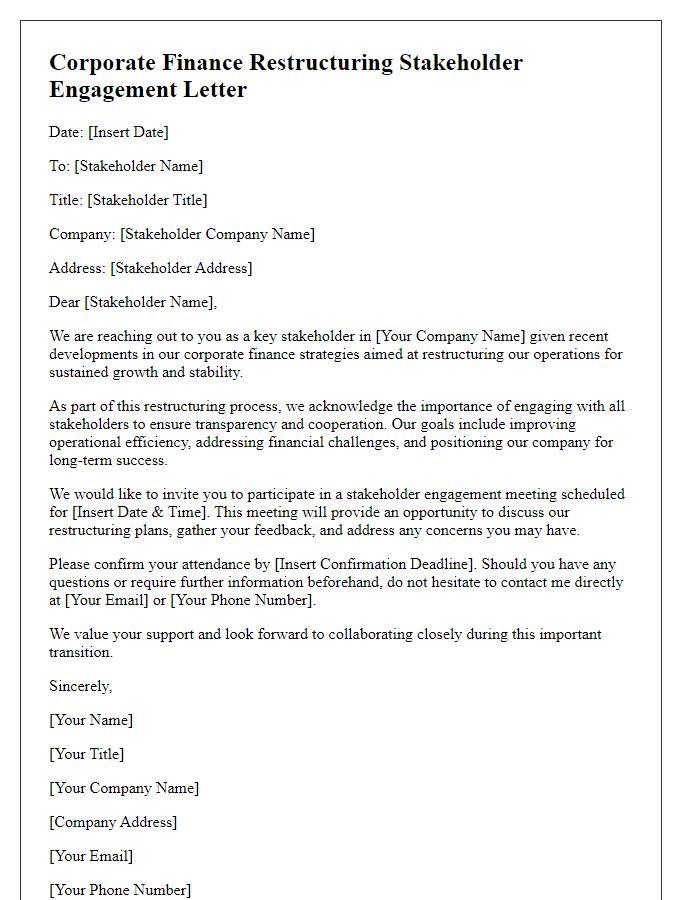

Stakeholder Communication Plan

A stakeholder communication plan for corporate finance restructuring is crucial for managing relationships with key groups during a significant transition. This plan outlines strategies for engaging with stakeholders including investors, employees, suppliers, and regulatory bodies. Clear objectives for communication are necessary, such as ensuring transparency regarding financial strategies, outlining restructuring timelines, and providing updates on progress. Key messaging should emphasize the rationale behind restructuring efforts, focusing on long-term benefits for the company's stability and growth. Regular communications, such as newsletters or webinars, can facilitate ongoing dialogue. Feedback mechanisms must be established, allowing stakeholders to voice concerns or suggestions throughout the restructuring process, fostering a sense of involvement and trust. Tracking metrics related to stakeholder engagement and sentiment can help gauge the effectiveness of the communication efforts.

Detailed Financial Analysis

Detailed financial analysis reveals critical insights into corporate finance restructuring efforts. Key metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provide a clear view of operational performance, enabling better decision-making. Analyzing leverage ratios, like the debt-to-equity ratio (averaging 1.5 in similar industries), unveils the company's financial risk. Cash flow projections, based on historical data from the last five fiscal years, indicate potential liquidity issues during the restructuring phase. Asset allocation, reflecting market valuation fluctuations, plays a vital role in identifying underperforming sectors. Additionally, revenue forecasts, derived from recent market trends and consumer behavior studies, guide strategic planning for sustaining growth and profitability post-restructuring.

Legal Compliance Adherence

Corporate finance restructuring involves intricate legal compliance adherence to ensure alignment with regulations. Regulatory bodies such as the Securities and Exchange Commission (SEC) mandate transparency in financial disclosures, impacting decisions on restructuring strategies. Debt restructuring may require adherence to the Bankruptcy Code, especially under Chapter 11, allowing firms to reorganize while protecting assets. Compliance with tax regulations, including IRS guidelines, is critical to avoid penalties when restructuring liabilities. Additionally, confidentiality agreements must support negotiations, safeguarding proprietary information during discussions with stakeholders. Engaging legal counsel specializing in corporate law is paramount to navigate complexities in jurisdictions, mitigate risks, and uphold fiduciary duties to shareholders.

Timeline and Milestones

A corporate finance restructuring process involves a series of strategic steps designed to improve a company's financial health and operational efficiency. The typical timeline for this process spans several months, structured around key milestones. Initial assessment and financial analysis occur within the first 30 days, focusing on data collection related to cash flow, revenue, and expenditures. Following this, from days 31 to 90, a comprehensive restructuring plan is developed, including cost-cutting initiatives and potential revenue enhancement strategies. By the 90 to 180-day mark, stakeholder engagement and negotiations with creditors such as banks, suppliers, and investors take place to secure necessary approvals and financial support. Implementation of the restructuring plan occurs between 180 to 360 days, which includes operational changes and monitoring progress through established key performance indicators. Finally, post-implementation review and adjustments occur after 360 days, ensuring long-term sustainability and performance improvement in areas like profitability and liquidity.

Letter Template For Corporate Finance Restructuring Samples

Letter template of corporate finance restructuring partnership invitation

Comments