Are you feeling overwhelmed by debt and unsure where to turn? Negotiating a debt restructuring can be a game changer, providing you with the relief you need to regain your financial footing. By effectively communicating with your creditors, you may be able to secure more manageable repayment terms and avoid the stress of constant financial strain. If you're curious about how to approach this process, keep reading to discover essential tips and a helpful letter template!

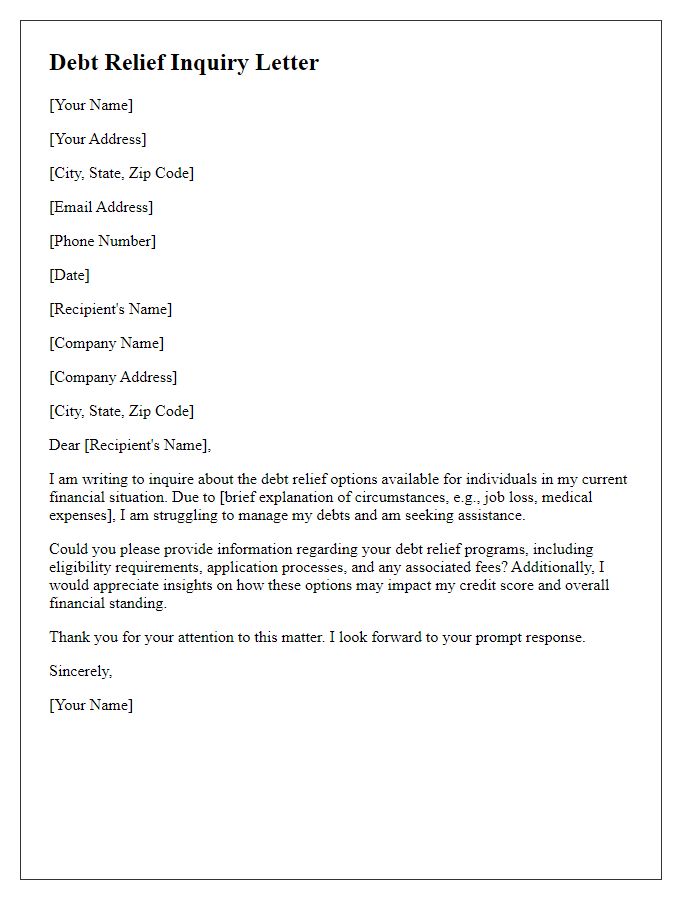

Borrower's financial situation analysis

The financial analysis of the borrower reflects critical elements such as outstanding debt, monthly income, and essential expenses. Current liabilities amount to $50,000 across various creditors, ranging from credit cards to personal loans, creating a substantial burden on monthly cash flow. Monthly income, recorded at $3,500, significantly impacts the ability to meet these obligations. Essential expenses, including rent of $1,200, utilities averaging $300, and groceries near $400, consume a substantial portion of the income. With a remaining discretionary income of roughly $1,600, factors such as healthcare costs or unforeseen emergencies create a precarious situation. The borrower's overall financial health necessitates a restructuring plan to facilitate manageable repayment terms while ensuring sustainability for future financial stability.

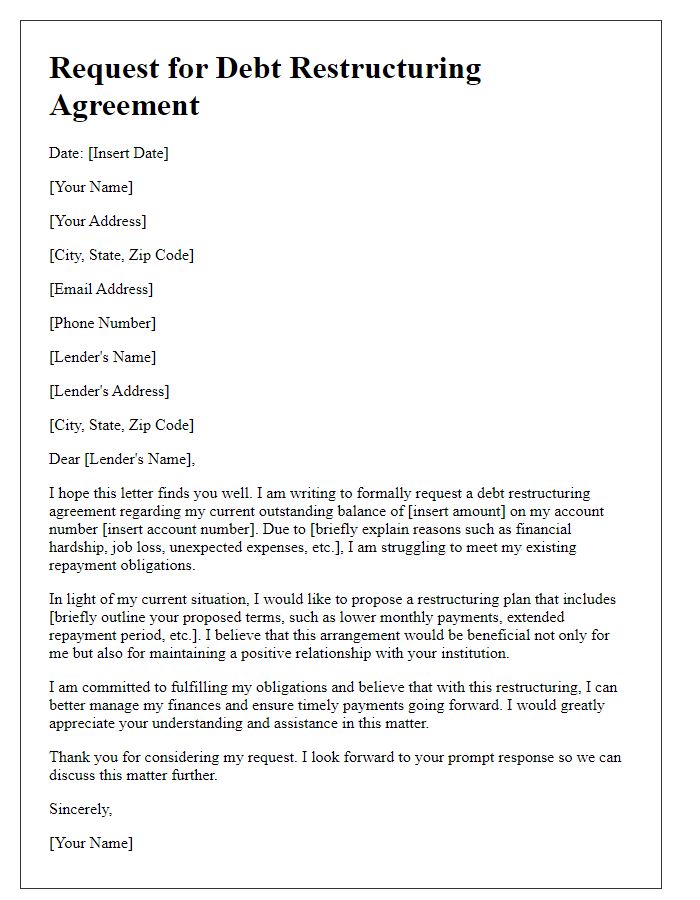

Clear, concise opening statement

Debt restructuring negotiations require careful consideration of financial obligations and strategic communication. A clear and concise opening statement should outline the intent to discuss potential modifications of existing debt agreements, emphasizing cooperation to achieve mutually beneficial outcomes. Highlighting the importance of maintaining a positive relationship and expressing a commitment to fulfilling responsibilities can set a constructive tone for the discussions. Acknowledging current financial hardships and the necessity for adjustment can illustrate a genuine desire to find a solution that satisfies both parties, ensuring a collaborative atmosphere throughout the negotiation process.

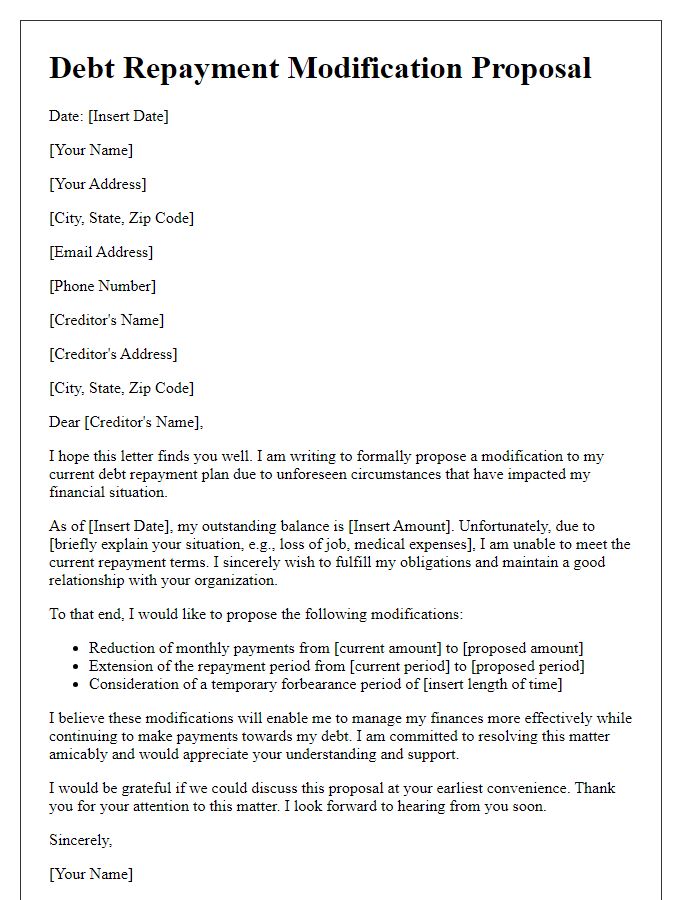

Proposed restructuring terms

Debt restructuring negotiation often requires clear communication of proposed terms to ensure mutual understanding and facilitate agreement. Key components include the overall debt amount, interest rates, repayment timelines, and any concessions or adjustments being made. For instance, a debtor may propose reducing the total outstanding balance (e.g., from $500,000 to $350,000) alongside a lowered interest rate (e.g., from 8% to 5%) to ease financial burden. Additionally, extending the repayment period (e.g., from 5 years to 10 years) can help manage monthly payments, enhancing the likelihood of successful repayment. Effective proposals often include the rationale behind restructuring, referencing cash flow projections and market conditions, ensuring both parties are aligned on terms that support financial sustainability.

Demonstrated willingness to cooperate

Demonstrated willingness to cooperate can significantly influence debt restructuring negotiations, especially for individuals or businesses facing financial hardship. A proactive approach in communication with creditors, such as banks or financial institutions, showcases a commitment to finding mutually beneficial solutions. Providing financial documentation, such as income statements, bank statements, or balance sheets, can help creditors understand the current financial situation. Expressing openness to various restructuring options, including extended payment terms, reduced interest rates, or even debt forgiveness in certain cases, increases the likelihood of favorable outcomes. Building rapport through regular updates and transparent discussions lays a foundation for trust, enhancing collaboration throughout the negotiation process. Ultimately, a cooperative attitude can lead to more manageable debt terms and a pathway towards financial recovery.

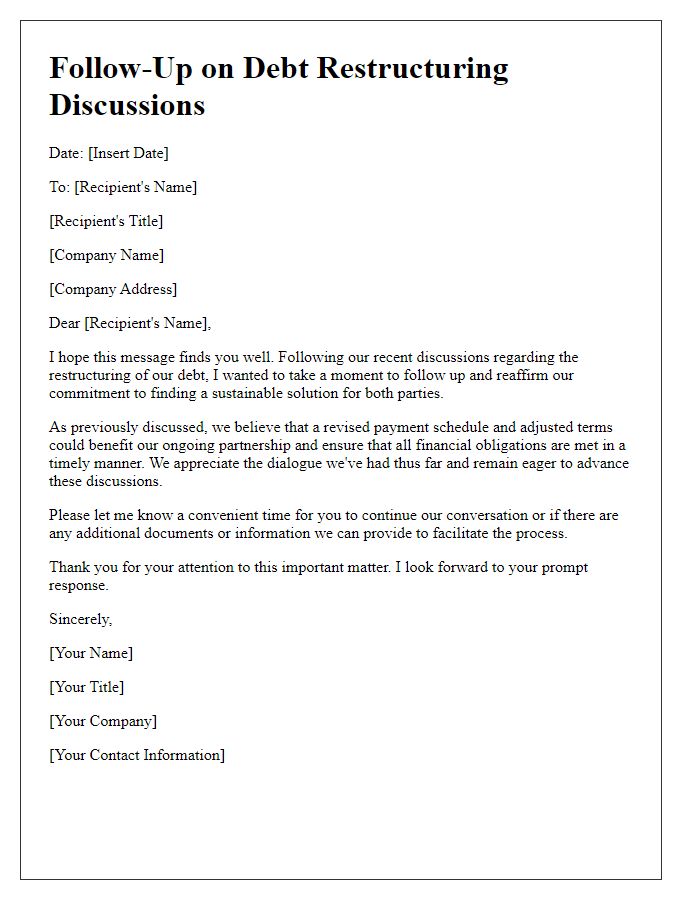

Request for a meeting or response

Debt restructuring negotiations require careful consideration of financial obligations and stakeholder interests. A key component of this process is initiating communication with creditors or financial institutions to request a meeting to discuss restructuring options. Businesses, especially small and medium enterprises (SMEs), may face challenges due to cash flow constraints triggered by economic downturns or unexpected expenses. Successful debt restructuring can help alleviate financial pressure, allowing businesses to reorganize payment schedules and interest rates, potentially through a negotiation process that aligns with legal frameworks and financial regulations. Establishing clear objectives for the meeting, such as extending loan terms or reducing interest rates, is crucial for advancing productive discussions and achieving a mutually beneficial outcome.

Comments