Are you feeling the crunch of financial uncertainty? You're not aloneâmany people are navigating these challenging times and seeking effective strategies to regain control. A well-crafted financial crisis management plan can be your roadmap to stability and growth, providing you with the tools needed to weather the storm. Dive into our comprehensive guide to discover actionable insights that can transform your financial situation for the better!

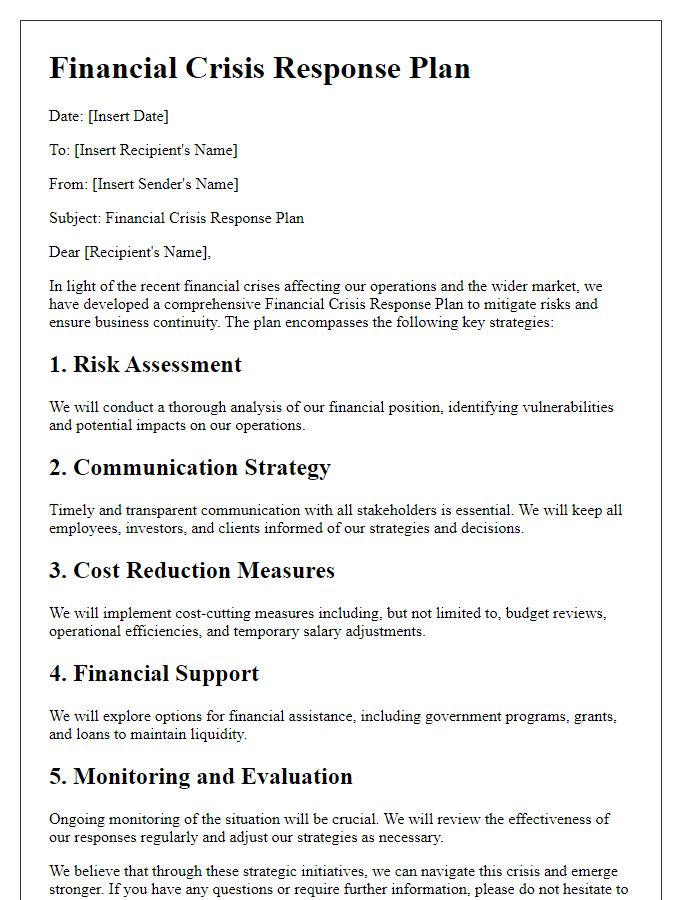

Clear communication and transparency.

Effective communication is crucial during a financial crisis, ensuring that stakeholders remain informed and engaged. Transparent messaging can mitigate panic among employees, investors, and customers. Regular updates, such as weekly reports outlining the financial state, will ensure clarity about the organization's position. Strategies should include virtual town hall meetings, where executives address concerns and answer questions directly, enhancing trust. Utilizing platforms like email newsletters or company intranets to disseminate information will allow for consistent messaging. Empathetic communication, coupled with facts, fosters a supportive environment, enabling stakeholders to understand the steps being taken to navigate the crisis and stabilize the organization's financial health.

Comprehensive risk assessment and analysis.

Comprehensive risk assessment and analysis are crucial for navigating financial crises effectively. Organizations, like multinational corporations facing economic downturns, require a detailed examination of potential vulnerabilities. Key areas include market volatility, credit risk exposure, and liquidity challenges affecting cash flow. Utilizing historical data from previous crises, such as the 2008 global financial crisis, provides valuable insights into risk factors. Implementing quantitative models can aid in forecasting potential losses and assessing capital adequacy. Regular updates and scenario analyses enable organizations to adapt strategies promptly, ensuring sustainable operations and stakeholder confidence during turbulent economic conditions.

Strong leadership and decisive action.

Strong leadership involves establishing a clear vision during financial crises, ensuring transparent communication among stakeholders, including employees and investors. Decisive action entails immediate assessment of cash flow, identification of cost-cutting measures, and prioritization of essential expenses. In 2020, many organizations adopted strategies such as workforce restructuring and renegotiating supplier contracts to maintain operational stability. Locations heavily impacted by economic downturns, like New York City, witnessed significant organizational shifts as businesses adapted to unforeseen changes. Financial crisis management strategies also frequently include building a robust contingency plan, typically covering scenarios for at least six months, along with regular status reviews to adapt practices as necessary.

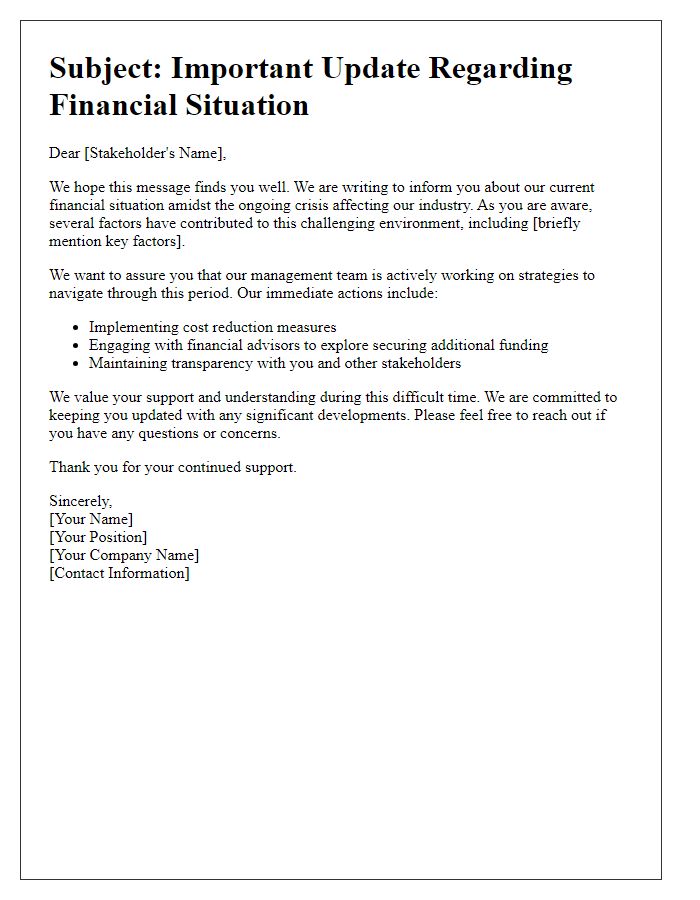

Stakeholder engagement and collaboration.

In financial crisis management, stakeholder engagement involves identifying and actively involving individuals or groups (such as shareholders, employees, suppliers, and customers) who have a vested interest in the organization's recovery. Effective collaboration focuses on transparency and communication, ensuring all parties are informed about the organization's situation and recovery plans. Regular meetings, updates, and feedback channels enhance trust and participation. Cultivating partnerships with financial advisors, industry associations, and government agencies can provide valuable resources and support. Initiatives may include joint problem-solving workshops (scheduled bi-weekly) to develop innovative solutions, exploring alternative financing options (such as microloans or venture capital), and implementing community support programs (like local fundraising events) to strengthen stakeholder ties while demonstrating commitment to mutual success.

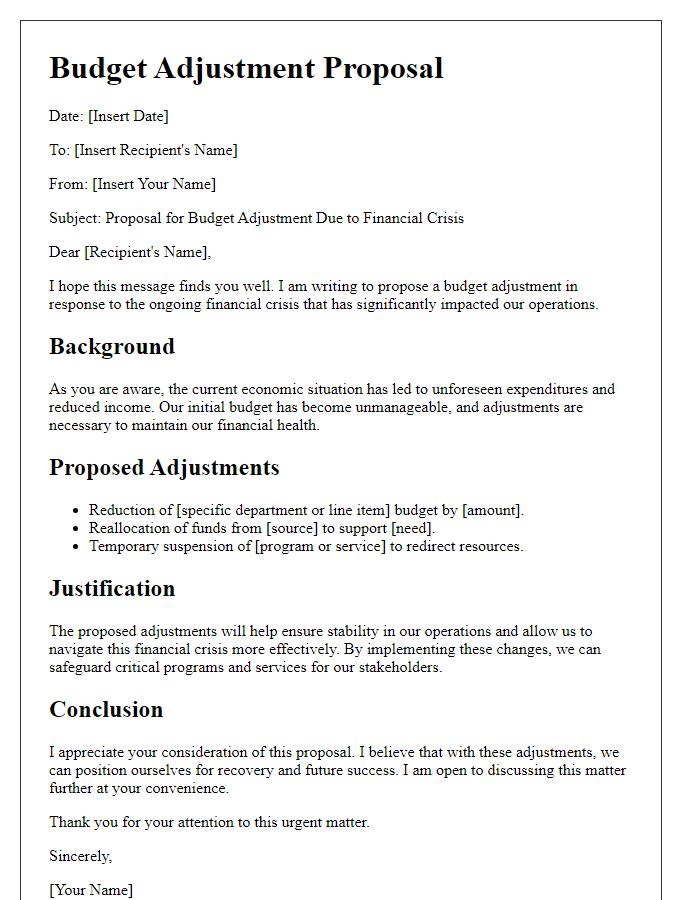

Contingency planning and flexibility.

Contingency planning serves as a crucial component in effective financial crisis management, especially amid unpredictable economic downturns. Organizations must establish a reserve fund, typically 10-20% of annual budget, to provide a financial buffer during crises. Implementing dynamic financial models allows businesses to adapt their strategies according to real-time market conditions. For instance, during the 2008 financial crisis, many firms pivoted their investment approaches by reallocating resources away from underperforming sectors, such as real estate, towards more resilient industries like technology. Flexibility in operational plans, including scaling back on non-essential expenditures, can further enhance an organization's ability to withstand financial shocks. Regular scenario analysis, considering variables like sudden drops in revenue or unexpected expenses, empowers leadership to make informed decisions swiftly. Collaborating with financial advisors ensures that businesses stay aligned with industry best practices and regulatory requirements, promoting sustainable growth even in turbulent times.

Comments