When it comes to understanding revenue recognition, many businesses find themselves navigating a complex landscape rife with rules and regulations. Getting it right is crucial not just for compliance, but also for the overall financial health of your organization. In this article, we'll break down the essential concepts and provide clear guidance on how to approach this important topic. So, if you're ready to demystify revenue recognition, keep reading to explore some valuable insights!

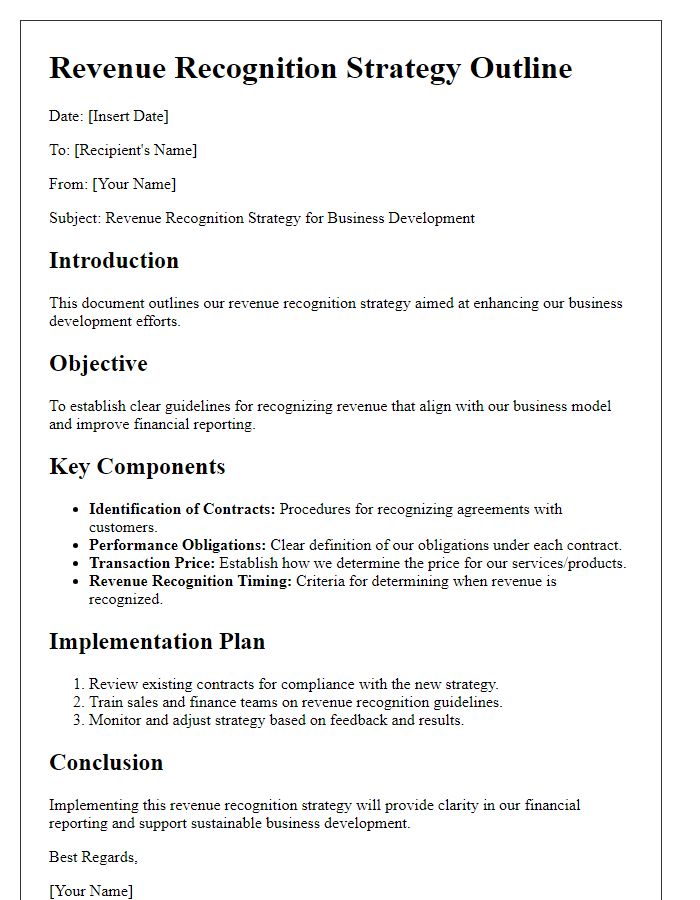

Clear Subject Line

Revenue recognition, a critical accounting principle, outlines how companies recognize income from sales or services, ensuring compliance with standards such as ASC 606 in the United States. Proper documentation involves the identification of contract terms, performance obligations, and transaction prices, which are pivotal for accurate financial reporting. For example, companies in industries like software or construction must assess when control transfers to the customer, impacting their revenue. Misinterpretations can lead to significant financial discrepancies, necessitating clarity in presentation. Regular audits and training on these standards are essential for maintaining accuracy in financial statements.

Company and Recipient Information

Revenue recognition is a crucial accounting principle that determines when revenue is recognized in financial statements, impacting company assessments and financial health. Companies, such as XYZ Corporation, based in New York City, adhere to the Generally Accepted Accounting Principles (GAAP) for accurate reporting. Revenue is recognized upon completion of deliverables, often tied to specific contracts or agreements. The recipient of this clarification, ABC Enterprises, based in Los Angeles, must understand the transaction details, which include amendments to contract terms and milestones. For instance, a software licensing agreement may specify revenue recognition at project milestones, significantly affecting cash flow projections. Clear guidelines are essential for both parties to maintain compliance and transparency in financial reporting.

Precise Revenue Recognition Query

Revenue recognition guidelines govern how businesses report their income, particularly under accounting standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). These standards stipulate that revenue should be recognized when it is earned, which usually occurs at the point of sale or when goods or services have been delivered. Key factors influencing revenue recognition include contractual obligations, performance obligations delineated in contracts, and the timing of cash flow realization. For example, in software sales, revenue might only be recognized after software deployment or customer acceptance, affecting quarterly earnings reports. Businesses must also consider ancillary factors like discounts, returns, and allowances when calculating net revenue. Proper adherence to these standards ensures accurate financial reporting and compliance during audits and assessments by regulatory bodies.

Reference to Relevant Accounting Standards

Revenue recognition plays a crucial role in accurately reporting financial performance for businesses. The relevant accounting standards, such as the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 606 and the International Financial Reporting Standards (IFRS) 15, outline the principles guiding revenue recognition. These standards emphasize the importance of identifying contracts with customers and recognizing revenue as performance obligations are satisfied. Various industries may have specific considerations, such as long-term construction contracts requiring percentage-of-completion methods or software companies recognizing revenue upon software delivery or service activation. Inaccurate revenue recognition can lead to misrepresentation of financial health, impacting investor trust and regulatory compliance. Therefore, a thorough understanding of these standards is essential for maintaining transparency and accuracy in financial statements.

Request for Detailed Explanation and Timelines

Request for clarification on revenue recognition involves detailed explanations regarding accounting principles, timelines for revenue acknowledgment, specific methodologies used, and the implications of those practices. This request typically pertains to standards like ASC 606 (Accounting Standards Codification) which governs the recognition of revenue in various industries including technology and manufacturing. Precise timelines are crucial; they often denote when revenue is officially recognized upon the completion of specific performance obligations, which can impact financial statements and tax considerations. Such clarifications are essential for stakeholders to understand their financial positions accurately.

Letter Template For Revenue Recognition Clarification Samples

Letter template of revenue recognition process explanation for new employees.

Letter template of revenue recognition issues and resolutions for client discussions.

Letter template of revenue recognition practices for investor communication.

Letter template of revenue recognition adjustments notification for accounting teams.

Letter template of revenue recognition overview for financial reporting.

Letter template of revenue recognition questions and answers for shareholders.

Comments