Are you curious about how to navigate the complexities of capital gains tax calculations? Whether you're preparing for tax season or simply looking to understand your financial obligations better, grasping the nuances of capital gains can seem daunting. In this article, we'll break down the essential components involved in calculating your capital gains tax and provide you with a handy letter template to request the necessary information. So, grab a cup of coffee and let's dive into the detailsâread on to simplify your tax journey!

Clear Identification of Parties

Clear identification of parties involved in a capital gains tax calculation request includes the taxpayer's full name, address, and taxpayer identification number (such as Social Security Number for individuals or Employer Identification Number for businesses), along with the tax authority's name and contact information. Furthermore, the relevant dates of the transaction, property description (such as address or legal description of the property), and any applicable case or reference numbers should be included. This clear identification facilitates accurate communication and processing by the tax authority, ensuring that the necessary documentation is readily associated with the specific taxpayer's request.

Detailed Transaction Information

Request for capital gain tax calculation requires precise transaction information for accurate assessment. Key details include acquisition dates, sale dates, and amounts, which determine the holding period and profit or loss. Documentation should highlight purchase prices and selling prices of assets, such as stocks or real estate. Consider specifying unique identifiers like property addresses, stock ticker symbols, or transaction IDs to streamline calculations. Each transaction's basis, including adjustments for improvements or selling expenses, is essential to establish a clear capital gain or loss scenario. Collecting this data ensures compliance with regulations set by tax authorities, like the Internal Revenue Service (IRS) in the United States, facilitating a seamless calculation process.

Specific Tax Period

To determine capital gains tax accurately, detailed evaluation of the specific tax period is crucial. Capital gains, arising from the sale of assets such as stocks, real estate, and other investments, are typically calculated based on the difference between acquisition cost and selling price during a defined period. For instance, assets sold between January 1, 2022, and December 31, 2022, would necessitate tracking initial purchase values, dates of acquisition, and final sale values for precise calculation. Tax rates differ depending on the holding period; short-term gains from assets held for one year or less may be taxed at ordinary income rates, while long-term gains from assets held for more than one year enjoy lower tax rates. Proper documentation, including Form 1099-B and transaction records, is essential for substantiating figures presented to tax authorities like the IRS.

Request for Documentation or Clarification

Requesting documentation for capital gains tax calculation requires specific information. Taxpayers must provide detailed records of asset sales, including dates, sale prices, purchase prices, and associated costs. Accurate documentation significantly influences the calculation of taxable gains or allowable losses. For instance, selling a property in New York City (where property taxes are highest) or trading stocks on the New York Stock Exchange may require different considerations. Additionally, understanding exemptions, such as the primary residence exclusion (up to $250,000 for individuals), can affect overall tax liability. Clear communication with the tax authority enhances the accuracy of tax filings and helps prevent potential audits and penalties.

Contact Information and Deadline

Capital gains tax calculations require accurate and detailed information for precise estimations. Factors such as sale price (total amount received from the sale of an asset), purchase price (initial cost of the asset including commissions and fees), holding period (duration the asset was owned), and the asset type (stocks, real estate, collectibles) play crucial roles. Furthermore, documentation of investment costs, improvements made to real estate, and any applicable exemptions (like the primary residence exclusion) are necessary. Deadline for submission may vary based on tax jurisdiction, typically aligning with annual tax filing dates, such as April 15 in the United States. Missing the deadline could result in penalties or interest on unpaid taxes.

Letter Template For Capital Gain Tax Calculation Request Samples

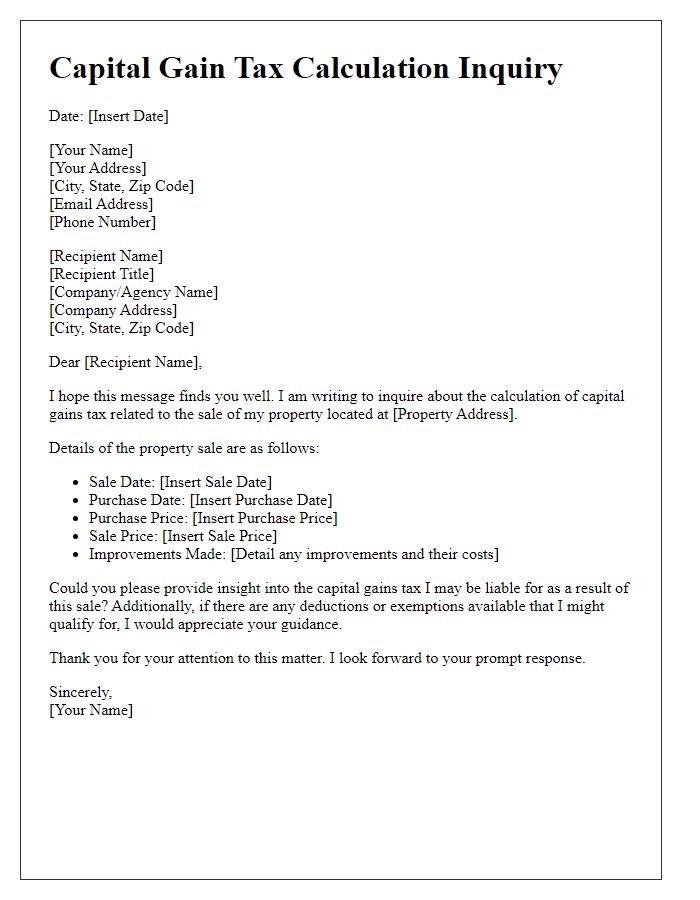

Letter template of capital gain tax calculation inquiry for property sale.

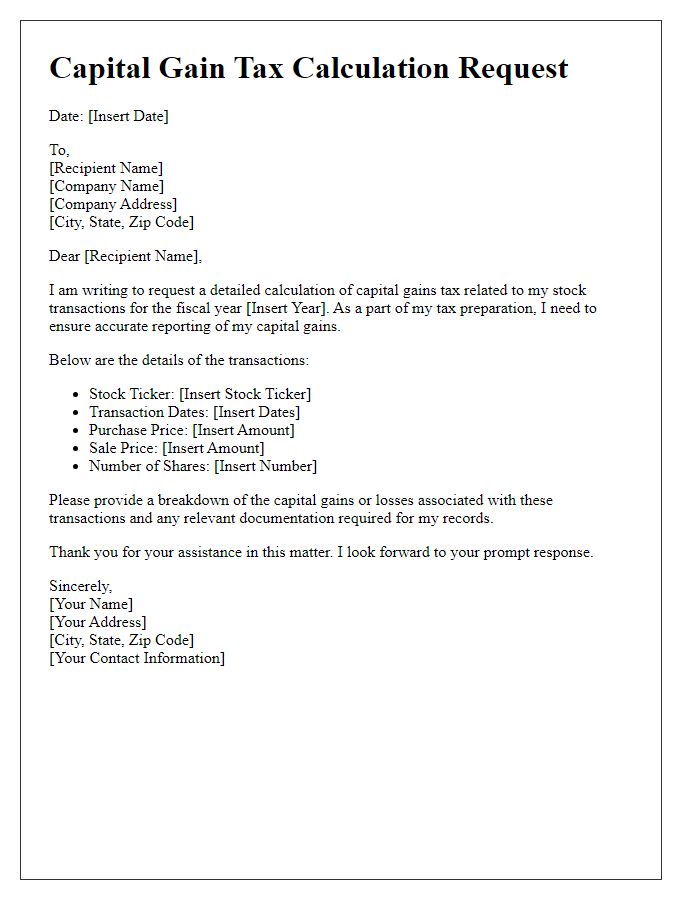

Letter template of capital gain tax calculation request for stock transaction.

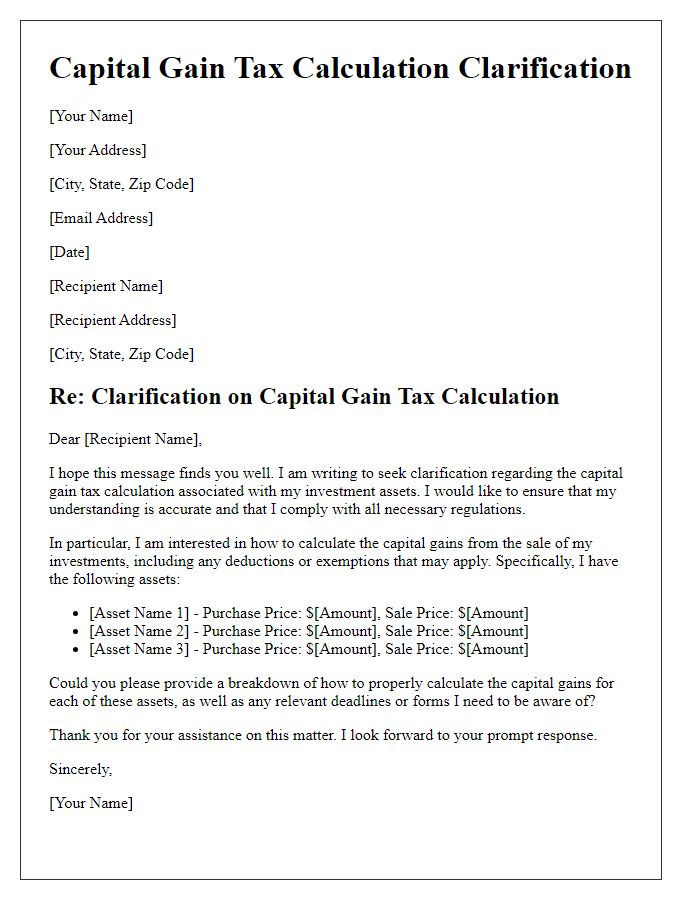

Letter template of capital gain tax calculation clarification for investment assets.

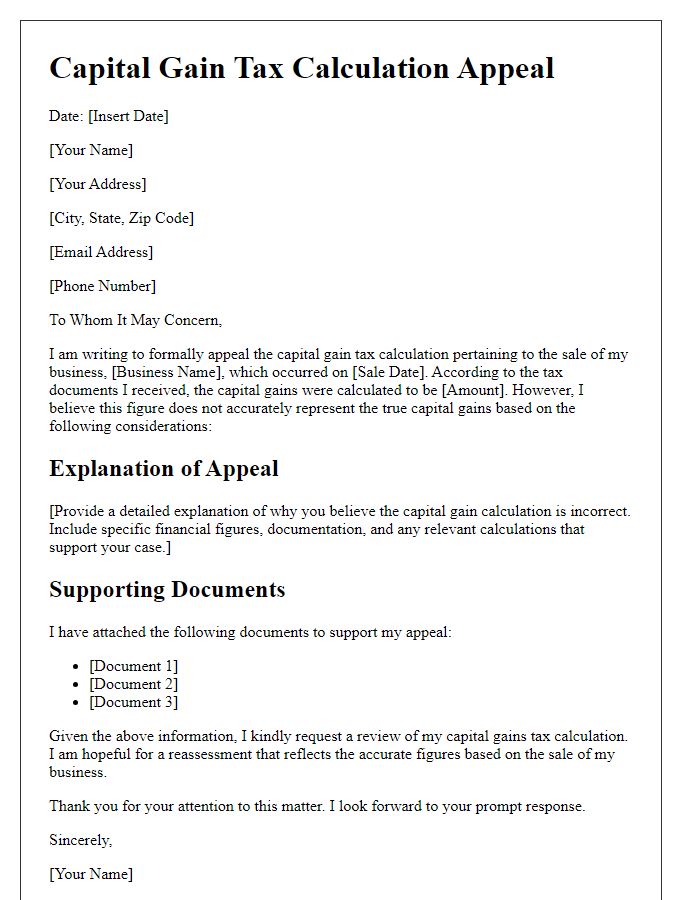

Letter template of capital gain tax calculation appeal for business sale.

Letter template of capital gain tax calculation assistance for foreign investments.

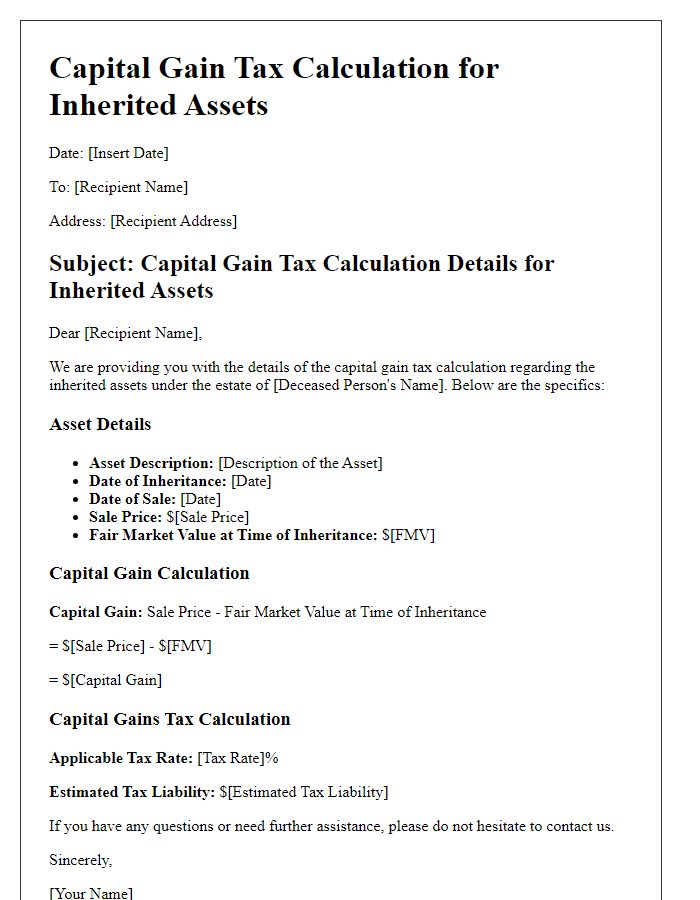

Letter template of capital gain tax calculation details for inherited assets.

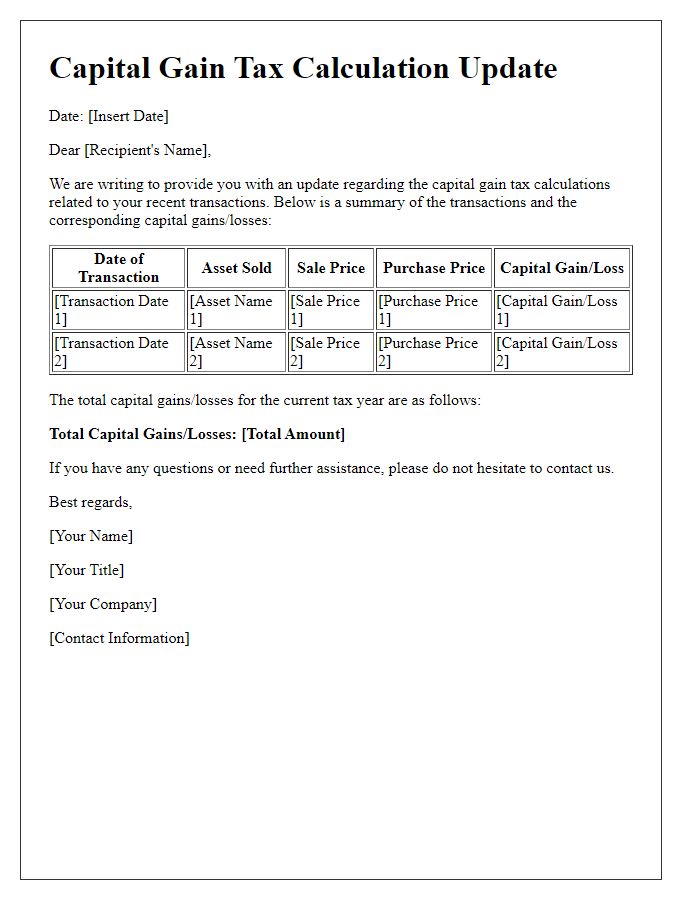

Letter template of capital gain tax calculation update for recent transactions.

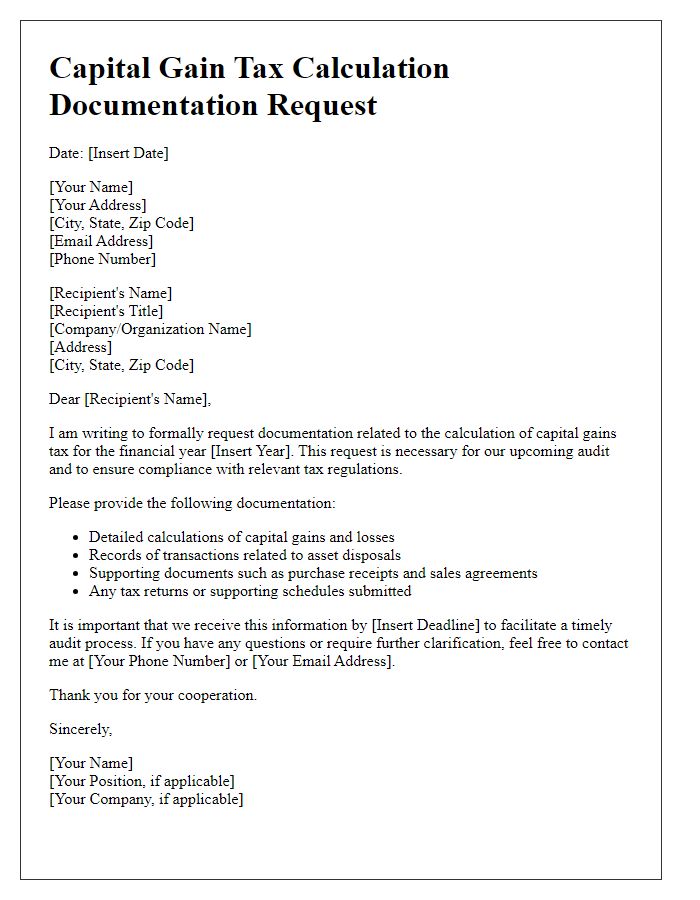

Letter template of capital gain tax calculation documentation request for audit.

Letter template of capital gain tax calculation information for tax planning.

Comments