When it comes to submitting your financial KPI report, crafting the perfect letter can set the tone for your entire presentation. A well-structured letter not only communicates the essentials but also engages your audience, making your findings more memorable. It's important to convey relevant information clearly and concisely while establishing a professional connection. Ready to dive deeper into the specifics of creating an effective letter template for your financial KPI report?

Report Title and Date

The quarterly financial KPI report highlights key performance indicators crucial for assessing the company's financial health. This report, dated October 30, 2023, provides a detailed analysis of revenue growth, profit margins, and expense ratios over the past three months. Key metrics such as net profit (which stands at $2.5 million) and return on investment (ROI) at 15% are presented alongside comparative figures from the previous quarter. Additionally, top-line revenue has shown an increase of 10%, attributed to successful marketing strategies implemented across regions like North America and Europe. Insights into cash flow management indicate improvements in liquidity ratios, vital for maintaining operational stability in a fluctuating economic environment.

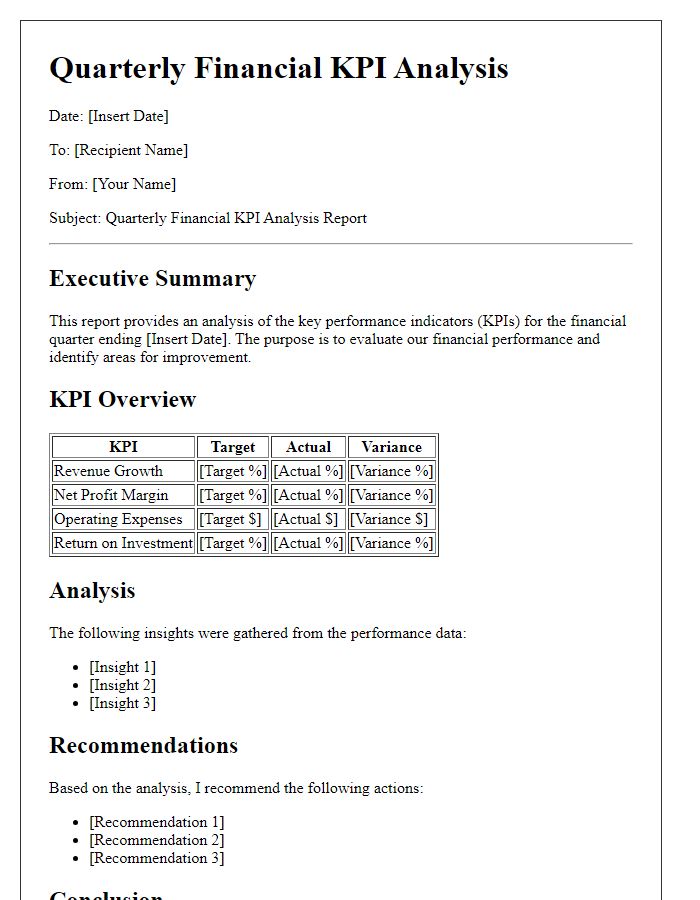

Executive Summary

Executive summaries provide concise overviews of financial Key Performance Indicators (KPIs), essential for understanding an organization's financial health. Key metrics, such as revenue growth percentages, profit margins, and cash flow figures, should be highlighted, reflecting performance against previous quarters. Specific financial events, such as mergers or market fluctuations, can affect overall results, emphasizing the importance of contextual data. Geographic locations, like North America or Europe, could be analyzed to pinpoint performance variances due to regional economic conditions. Additional notes on benchmarks or industry standards can provide insights into company positioning relative to competitors. This summary acts as a quick reference for stakeholders to assess strategic priorities and operational efficiency.

Key Performance Indicators (KPIs) Overview

Key Performance Indicators (KPIs) serve as essential metrics for evaluating the financial health and performance of an organization, providing insight into revenue generation, cost management, and overall profitability. Features such as the Gross Profit Margin (GPM), which measures the difference between revenue and the cost of goods sold, often expressed as a percentage, offer a clear picture of efficiency. Net Profit Margin (NPM) highlights the overall profitability by showcasing the net income relative to total revenue. Additionally, Return on Equity (ROE) quantifies the return generated on shareholders' equity, giving stakeholders valuable insight into the effectiveness of their investment. By analyzing these KPIs quarterly, organizations can identify trends, adjust strategies, and ultimately drive growth in competitive markets.

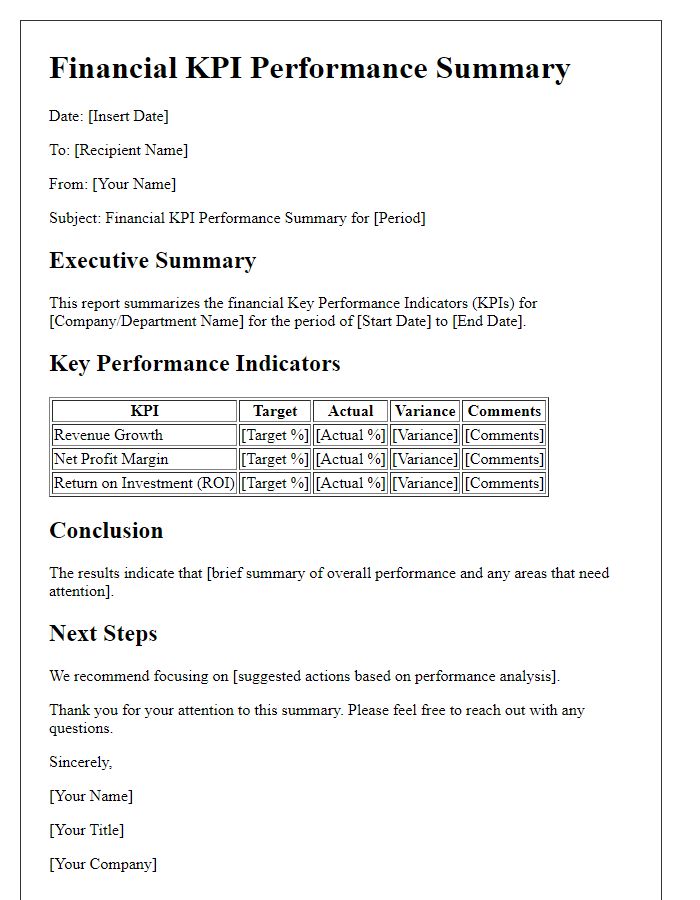

Data Analysis and Interpretation

Financial Key Performance Indicators (KPIs) serve as vital metrics for assessing a company's performance and guiding strategic decisions. Metrics such as Gross Profit Margin (approximately 40% in 2022) and Return on Investment (ROI) are crucial in measuring profitability and efficiency. Revenue growth rates, which surged by 15% in Q4 2022, signal business expansion potential. Additionally, liquidity ratios like the Current Ratio (with an ideal benchmark around 1.5) reveal the company's ability to meet short-term obligations. Data collected from quarterly financial reports must undergo thorough analysis to ensure accuracy and relevancy, aiding stakeholders in navigating fiscal strategies and investment opportunities effectively. Understanding trends in operational expenses (which increased by 10% year-on-year) offers insights into cost management and potential areas for improvement. Comprehensive interpretation of these KPIs not only informs financial health but also fosters informed decision-making processes across departments.

Actionable Insights and Recommendations

Financial Key Performance Indicators (KPIs) play a crucial role in assessing a company's fiscal health and strategic direction. Monthly reports provide insights such as revenue growth (targeting a 5% increase year-over-year), cost management (aiming for a 10% reduction in operational expenses), and gross profit margin (optimally set at 40% or higher), which reflect performance against established benchmarks. Analyzing cash flow statements reveals liquidity status, essential for addressing short-term obligations, while accounts receivable metrics help understand payment cycles, often targeting a 30-day collection period. In addition, evaluating customer acquisition costs juxtaposed with lifetime value offers strategic insight into marketing effectiveness, necessitating adjustments for sustainable profitability. Recommendations include enhancing data-driven decision-making processes to improve forecast accuracy and implementing cost-effective strategies to optimize resource allocation for future growth.

Comments