Are you grappling with pricing variance reconciliation and looking for a straightforward approach? You're not aloneâmany businesses face challenges in maintaining consistent pricing and managing discrepancies effectively. In this article, we'll break down the essentials of crafting a clear and comprehensive letter template that addresses pricing variances. So, if you're ready to streamline your reconciliation process, keep reading for some invaluable insights!

Introduction and Purpose

Pricing variance reconciliation identifies discrepancies between standard prices and actual transaction costs, crucial for accurate financial reporting. This analysis aids businesses in understanding the reasons behind cost fluctuations, enabling effective budgeting and forecasting. The primary purpose of this reconciliation process involves addressing variances stemming from factors like supplier pricing changes, volume discounts, and market fluctuations, ensuring alignment between financial expectations and real-world data. By examining these variances regularly, organizations can improve procurement strategies and enhance profitability, fostering informed decision-making and reducing financial risk.

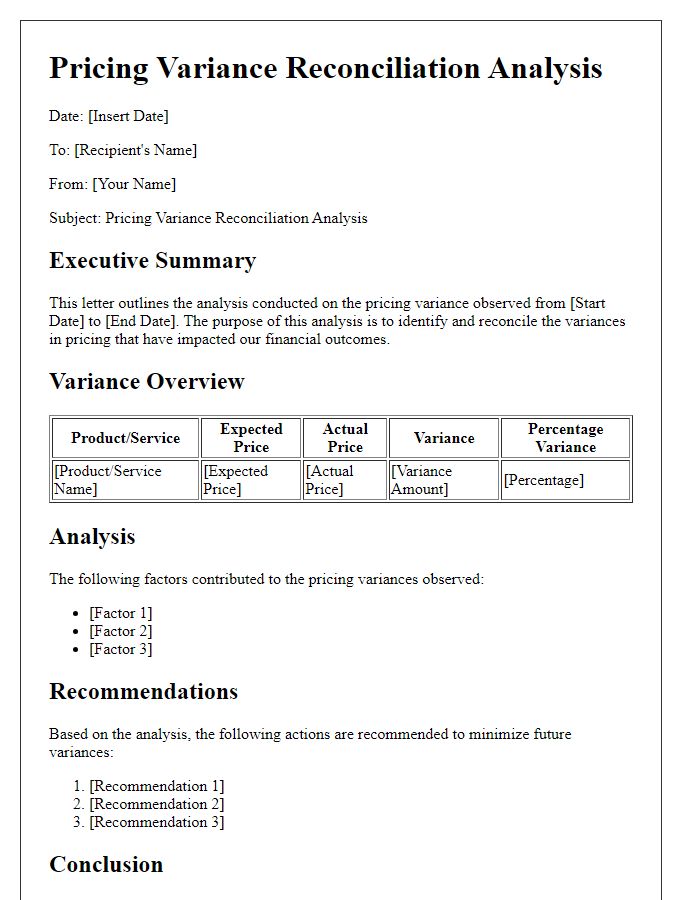

Detailed Breakdown of Variances

Pricing variance reconciliation involves analyzing discrepancies between expected prices and actual prices in financial transactions. This process is crucial for businesses in industries like retail or manufacturing, where pricing strategies heavily impact profitability. Variances can arise from multiple factors, such as fluctuations in raw material costs or unexpected discounts given during sales events. For example, an analysis of a cosmetics company may reveal a $10,000 variance in Q2 of 2023, attributed to a supplier's price increase on key ingredients. Accurate reconciliation requires tracking historical price data, identifying trends, and documenting each variance for clarity. A thorough breakdown can ensure all stakeholders understand these pricing implications, leading to more informed decision-making regarding merchandise pricing strategies.

Explanation of Factors Influencing Pricing

Pricing variance reconciliation involves analyzing discrepancies between expected and actual costs. Several factors can influence pricing, including supplier price changes, market demand fluctuations, and production costs. For instance, fluctuations in raw material prices, such as steel or oil, can impact manufacturing costs significantly, leading to price adjustments. Economic indicators like inflation rates, trade tariffs, and currency exchange rates also play crucial roles in determining pricing. Additionally, changes in competition levels and consumer purchasing behavior can further complicate pricing strategies. Understanding these factors is essential for effective pricing variance reconciliation and maintaining profitability.

Proposed Solutions and Recommendations

In response to the pricing variance experienced during the recent Q3 financial report, several proposed solutions have emerged to rectify discrepancies in cost allocations. Detailed analysis indicated a variance of approximately 15% in vendor pricing for raw materials, particularly affecting the manufacturing operations in Ohio. Implementing a quarterly review process would enhance price monitoring, ensuring alignment with market trends. Collaborating directly with key suppliers, such as Steel Innovations and Polymer Partners, may yield favorable contract adjustments, thereby stabilizing future costs. Additionally, training sessions for the procurement team on negotiated pricing strategies could lead to more informed purchasing decisions, ultimately contributing to cost efficiency across operations. Regular audits on the pricing models utilized within the enterprise software would also provide insights into adhering to budget forecasts.

Contact Information for Further Discussion

Pricing variance reconciliation is a critical process used by businesses to identify discrepancies between expected prices and actual prices paid for goods or services. This analysis assists in understanding cost variations that impact budgeting and financial forecasting. Key figures often include percentage differences (variances), absolute dollar amounts (reconciliation totals), and specific periods (monthly, quarterly, annually) to analyze trends. Stakeholders involved include finance teams, procurement departments, and suppliers, each contributing insights to resolve variances. Additionally, specific software platforms like SAP and Oracle may be utilized for data collection and reporting, ensuring accuracy in tracking these pricing changes over time.

Comments