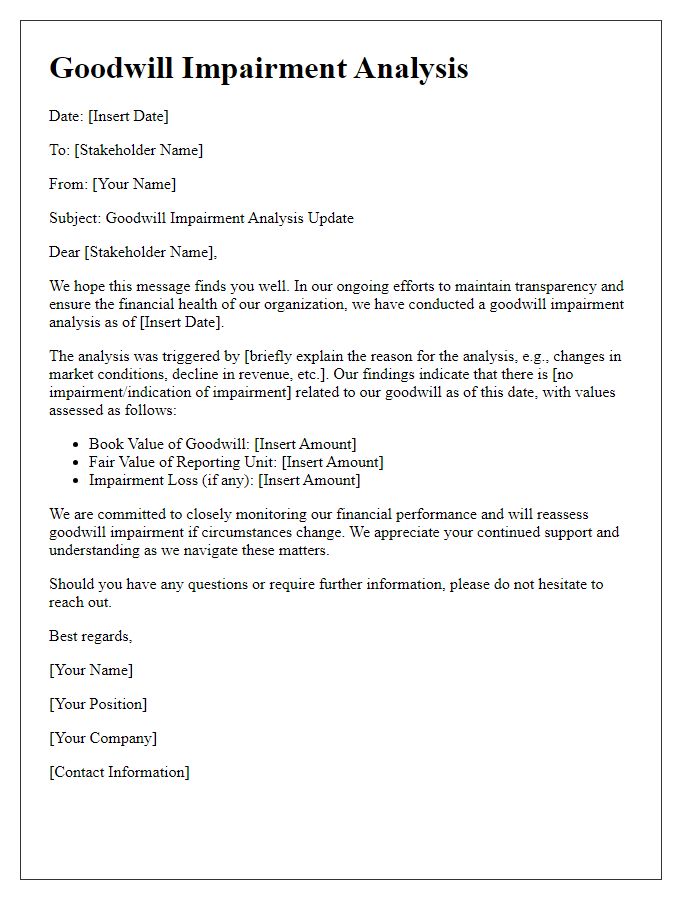

In the ever-evolving world of finance, maintaining transparency and accountability is key, especially when it comes to goodwill impairment reconciliation. This process not only reflects a company's commitment to accurate financial reporting but also helps stakeholders understand the true value of a business's intangible assets. As we dive into the nuances of this essential topic, you'll discover the importance of using a structured letter template that can streamline communications and foster trust. So, let's explore how to craft a compelling letter for goodwill impairment reconciliation that resonates with both clarity and professionalism!

Asset Identification and Description

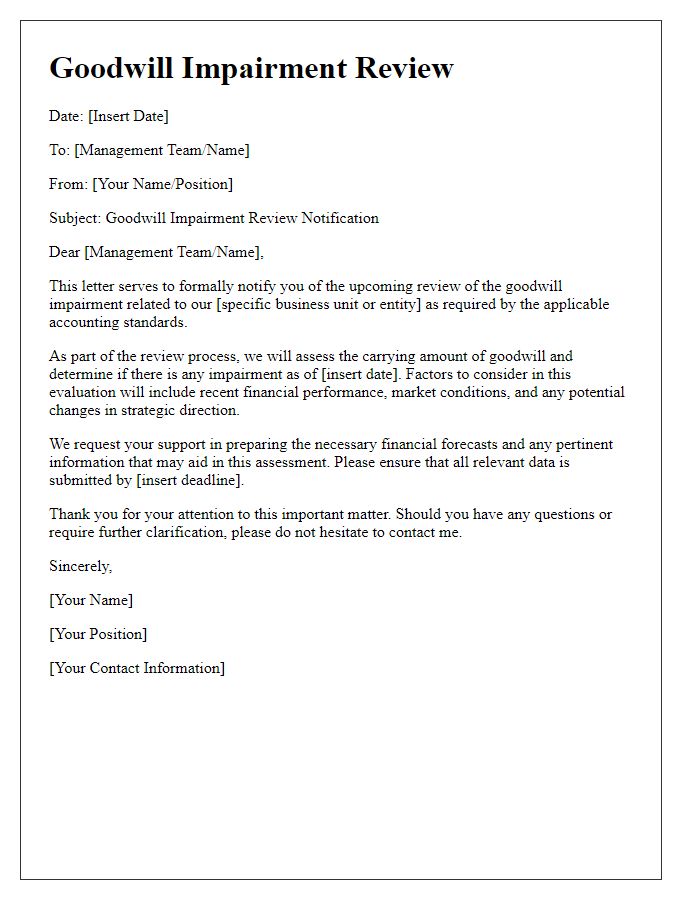

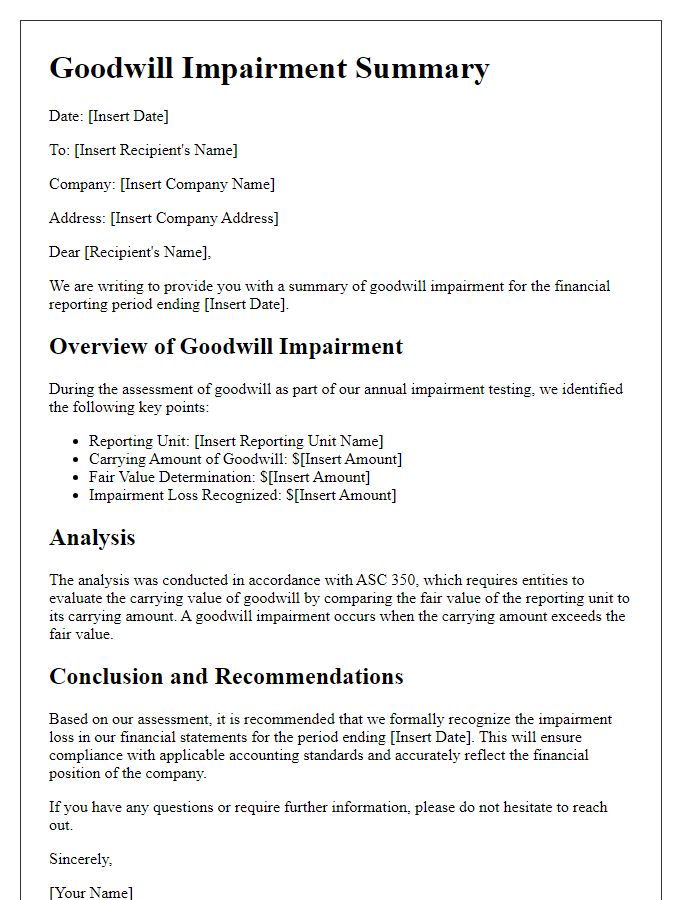

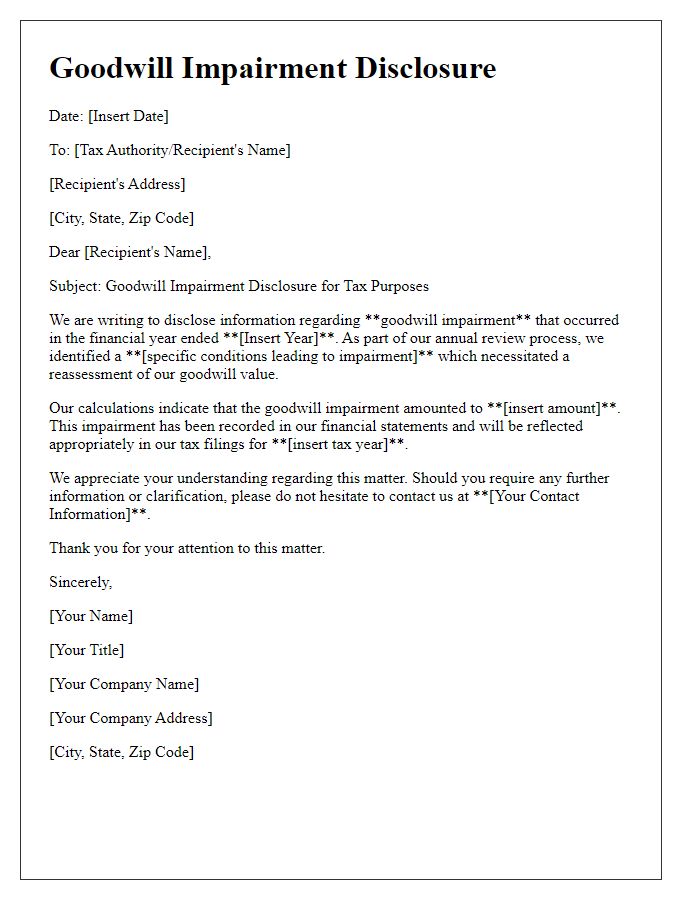

Goodwill impairment reconciliation involves a thorough assessment and identification of intangible assets, specifically goodwill associated with business acquisitions. Goodwill represents the excess purchase price over the fair value of identifiable net assets of acquired businesses, such as the acquired company's reputation, customer relationships, and proprietary technology. Each asset is assigned an identification number for tracking purposes, and a detailed description is provided, including the acquisition date, the total amount of goodwill recognized (which can often reach millions), and the reasons for any impairment, such as market fluctuations or integration challenges. Regular evaluations ensure compliance with accounting standards such as ASC 350, requiring annual impairment tests and potential adjustments to asset values reflecting current market conditions, which can significantly impact financial reporting and investment decisions.

Reason for Impairment

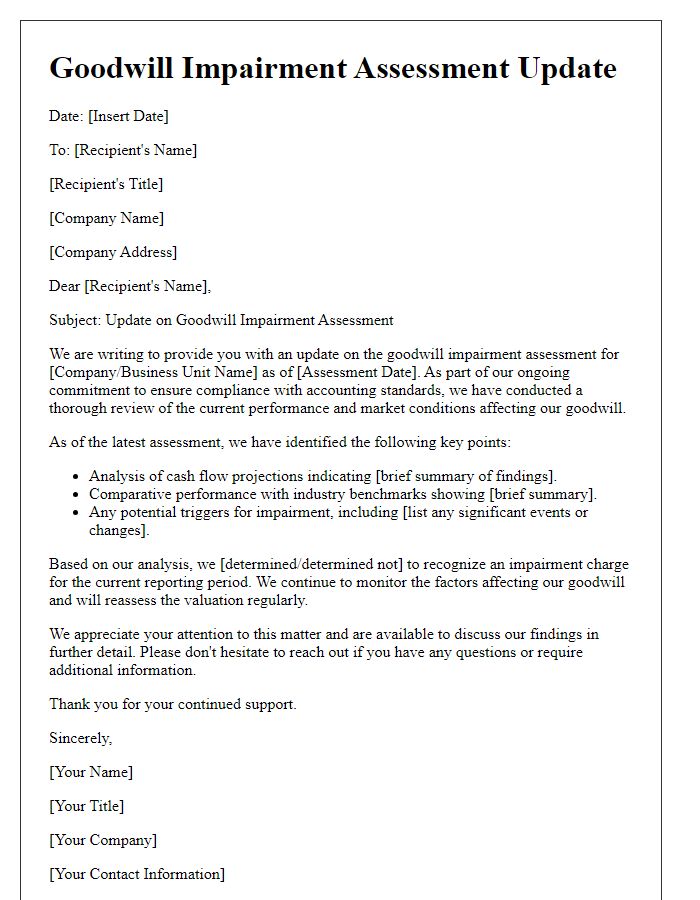

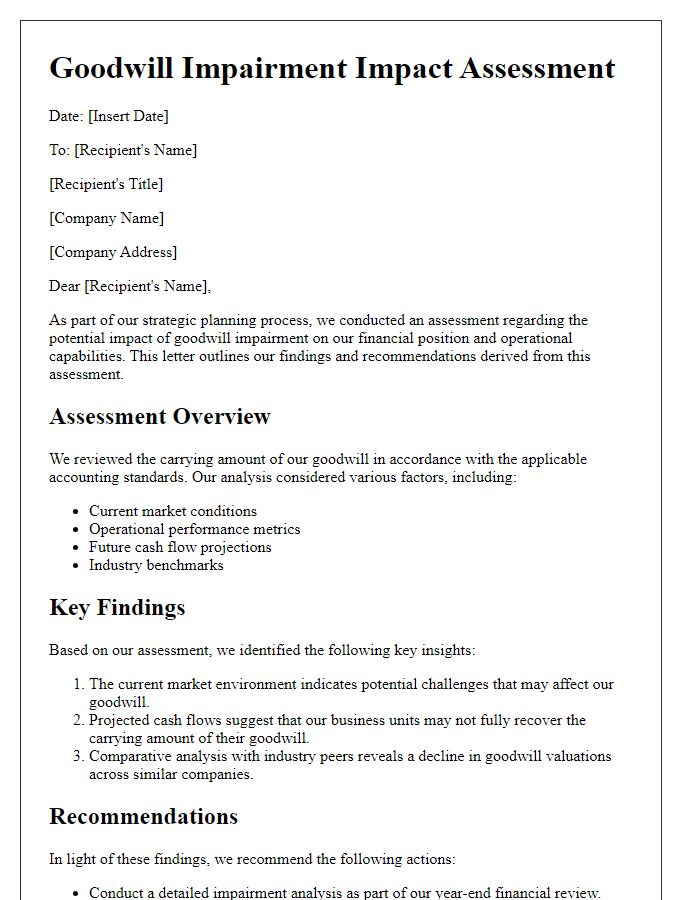

Goodwill impairment occurs when the carrying value of goodwill on a company's balance sheet exceeds its fair value. Factors contributing to this impairment can include changes in market conditions, overall economic downturns, or declining performance of the acquired business. For instance, a significant drop in revenue, combined with an increase in competition within the industry, may lead to a reassessment of the business's worth. Additionally, if a merger or acquisition fails to achieve anticipated synergies or growth targets, this can further necessitate an impairment review. Proper reconciliation of goodwill impairment involves evaluating the remaining intangible assets, adjusting future cash flow projections, and considering macroeconomic trends impacting both the parent and subsidiary entities.

Methodology Used for Valuation

Goodwill impairment tests utilize various valuation methodologies to assess the fair value of reporting units. Common approaches include the Income Approach, which calculates the present value of expected future cash flows, and the Market Approach, analyzing comparable company transactions. The Income Approach often employs discount rates that reflect the risk profile, typically ranging from 8% to 12%. Market comparables assess multiples, such as Price-to-Earnings ratios from similar companies within the same industry. Additionally, the cost approach may be utilized, evaluating the replacement cost of tangible and identifiable intangible assets. Annual assessments, conducted in accordance with ASC 350, require management to determine the useful life of the asset, ensuring that the valuation reflects the most accurate forecast of financial performance over the identified period.

Financial Impact and Projections

Goodwill impairment refers to the reduction in the book value of goodwill, an intangible asset that represents the excess paid over the fair value of identifiable assets during an acquisition. Significant impairments, such as those seen in 2020 during the COVID-19 pandemic, can drastically affect financial statements. Companies might report a decline in share prices, decreased equity valuations, or increased liabilities during this reassessment phase. Projections for future performance often hinge on factors like market conditions, competitor performance, and macroeconomic indicators, with analysts closely monitoring sectors such as technology, healthcare, or consumer goods. Reporting frameworks like GAAP or IFRS provide guidelines for calculating and presenting goodwill impairments, ensuring transparency for stakeholders. As organizations navigate these financial complexities, they must prioritize strategic planning to mitigate the impacts of impairments on their overall revenue forecasts and investor confidence.

Management's Commentary and Outlook

Goodwill impairment represents a significant accounting adjustment reflecting the reduced value of acquired goodwill recognized during mergers or acquisitions. Companies must routinely evaluate goodwill assets as mandated by the Financial Accounting Standards Board (FASB) under Accounting Standards Codification (ASC) 350. Factors influencing impairment may include changes in market conditions, overall economic performance, or shifts within specific industries. For instance, a leading technology firm operating in Silicon Valley may report a substantial impairment due to increased competition from emerging startups. Effectively managing and reconciling these impairments is essential for stakeholders, ensuring transparent financial reporting. The outlook for recovery from goodwill impairments will depend on strategic initiatives, innovation, and market dynamics, potentially impacting future valuation assessments and investor confidence in the company's long-term prospects.

Comments