Are you looking for a straightforward way to create an account reconciliation statement? Crafting the perfect letter can help ensure that both parties are on the same page, making financial tracking a breeze. With a clear structure and concise language, your account reconciliation message will facilitate smooth communications and foster trust. So, if you want to streamline your financial processes, read on for practical tips and a useful template!

Accurate Client Information

Accurate client information is crucial for account reconciliation statements, ensuring financial records align effectively. Each client's name must match official documentation, such as government-issued identification or business registration details. Contact information, including phone numbers and email addresses, should be current to facilitate communication, especially regarding any discrepancies. Client account numbers must be unique identifiers, often unique to financial institutions like banks or credit unions, ensuring clarity and preventing errors in transactions. Additionally, verifying the address is essential for sending correspondence and tax documents, particularly for annual audits and compliance checks. All this information strengthens auditing processes and enhances trust in financial relationships.

Clear Statement Period

The account reconciliation statement outlines the financial transactions and balances for a specific statement period, typically spanning one month. During this period, all transactions such as deposits, withdrawals, and transfers are meticulously recorded to ensure accuracy. The statement period often concludes on the last day of the month, providing a clear overview of the account's financial health. Reconciliation involves comparing the bank's records with the account holder's records to identify discrepancies. This process ensures that both parties agree on the account balance, which is crucial for maintaining financial integrity and accountability. In addition, clear documentation such as invoices, receipts, and statements are essential during this reconciliation phase to verify the authenticity of each transaction.

Detailed Transaction Listings

Detailed transaction listings serve as a crucial component of an account reconciliation statement, providing comprehensive insights into financial activities within a specified period. These listings typically include dates of transactions (such as January 15, 2023, or February 3, 2023) alongside descriptions that elucidate the nature of each transaction, such as vendor payments, customer receipts, and bank deposits. Numerical data is prominently featured, showcasing transaction amounts (e.g., $1,250.00 for a service rendered or $450.00 for an office supply purchase) and account balances following each transaction. The documentation often references unique identifiers like invoice numbers or check numbers (such as Invoice #12345 or Check #67890) to enhance traceability. Additionally, discrepancies highlighted in comparison with bank statements can prompt investigative actions, ensuring all financial entries align accurately, facilitating precise cash flow management within organizations.

Discrepancy Identification and Explanation

Account reconciliation statements are essential financial documents used to identify and clarify discrepancies between two or more financial records. Discrepancies can occur due to various reasons such as timing differences, data entry errors, or unrecorded transactions. For instance, when comparing bank statements from a financial institution like Chase Bank with internal accounting records for the month of October 2023, discrepancies may arise if a $500 deposit is recorded in the accounting system but not reflected in the bank statement. Additionally, vendor invoices, such as those from Office Supplies Inc., if mistakenly recorded or missing, can contribute to balance differences. To address these inconsistencies, it is crucial to provide a detailed explanation of each discrepancy, including the date, amount, and nature of the error, fostering a clearer understanding of the financial standing and ensuring accuracy in financial reporting.

Contact Information for Queries

An account reconciliation statement provides critical financial snapshots for businesses, ensuring accurate tracking of discrepancies. This document typically includes essential details such as the company name, for instance, ABC Financial Services, and the reporting period, perhaps January 2023 to December 2023. Also, it contains contact information for queries, including a dedicated section for the finance department's email address (finance@abcfinancial.com) and a direct phone number (555-123-4567), which facilitates prompt resolution of any discrepancies. Moreover, including the physical address, such as 123 Main Street, Suite 100, Cityville, ensures clients can send documents or inquiries via traditional mail. Accurate records and contact information are vital for maintaining transparency and trust in financial dealings.

Letter Template For Account Reconciliation Statement Samples

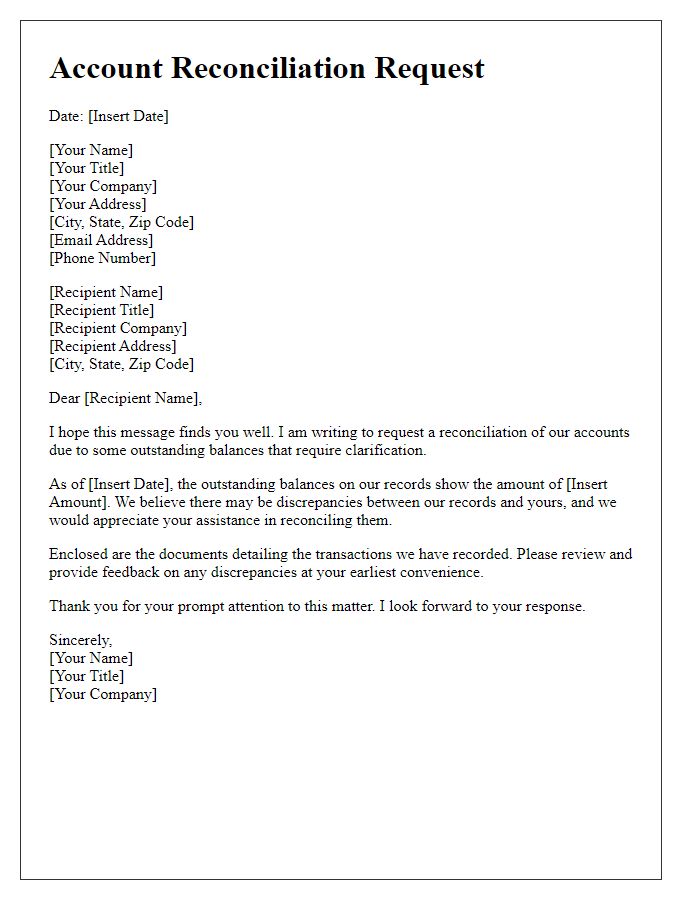

Letter template of account reconciliation request for outstanding balances

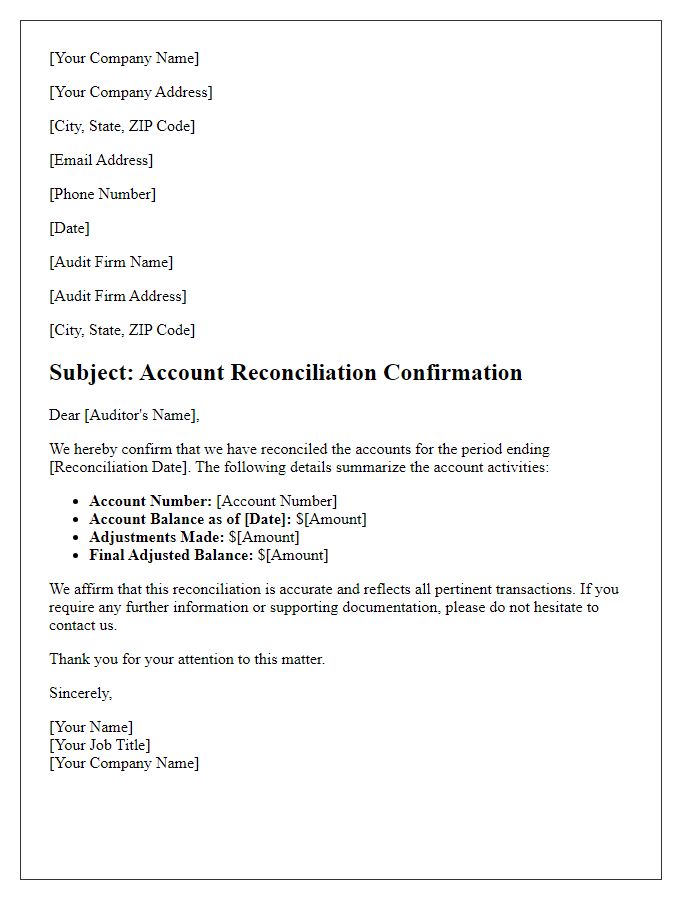

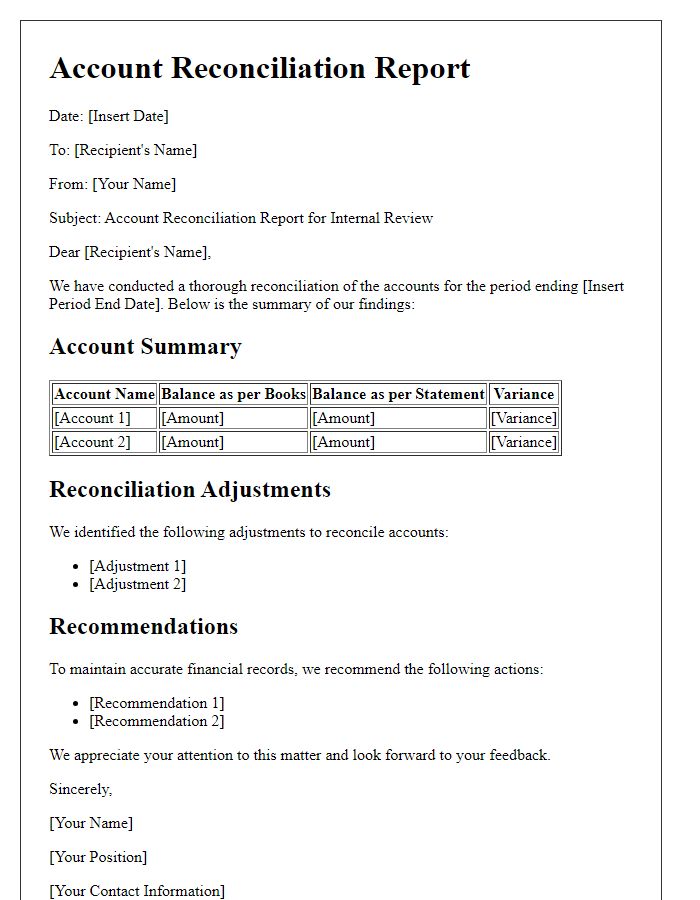

Letter template of account reconciliation confirmation for audit purposes

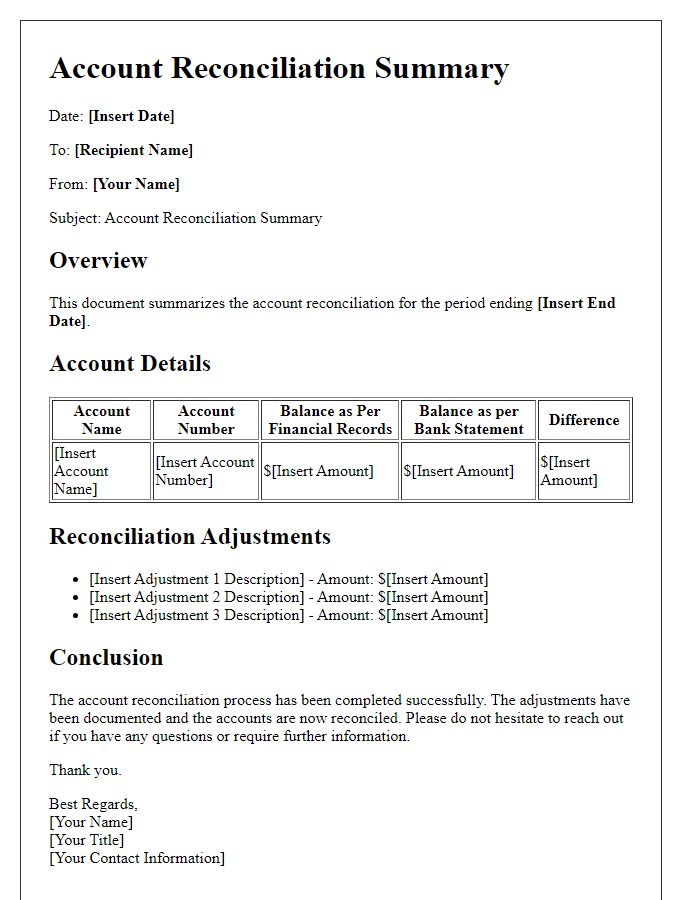

Letter template of account reconciliation summary for financial analysis

Letter template of account reconciliation inquiry for missing transactions

Letter template of account reconciliation notification for year-end closing

Comments