Are you a bit perplexed by the complexities of financial planning? You're not alone! Many individuals and businesses grapple with managing their finances effectively, which is where our dedicated financial advisory services step in. If you're ready to take control of your financial future and explore tailor-made strategies that align with your goals, we invite you to read more about how we can help you thrive!

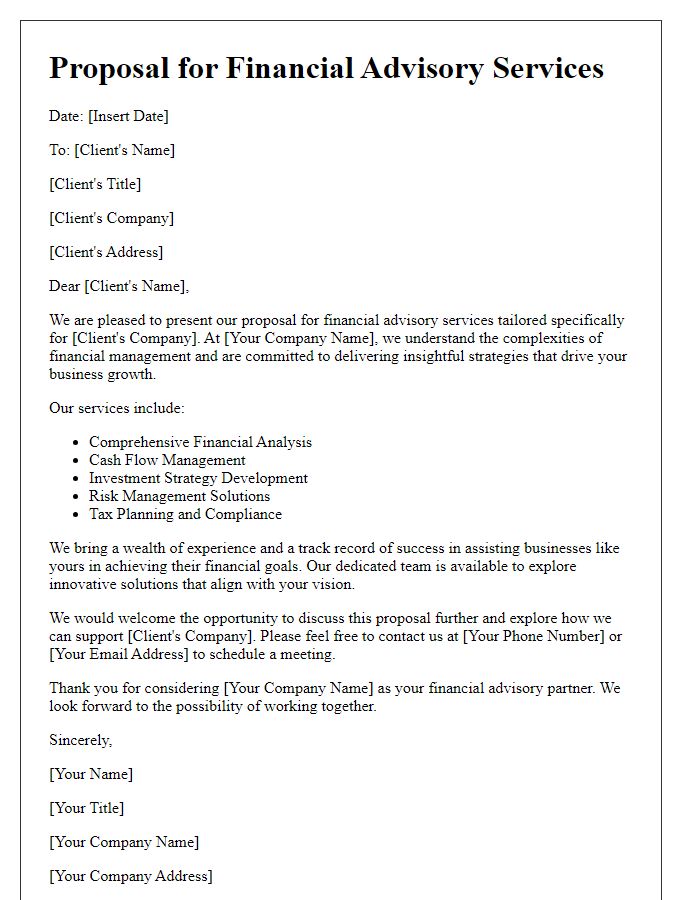

Personalization and Salutation

In the vibrant realm of financial advisory services, personalized strategies can significantly impact clients' financial well-being. Tailored investment portfolios based on individual risk tolerance (ranging from conservative to aggressive) and financial goals (such as retirement plans or children's education funding) create a solid foundation for wealth management. An initial consultation, typically lasting one hour, allows advisors to assess clients' current financial standings in locations like New York or California, providing insights into market trends and opportunities. By employing advanced analytical tools and personalized planning sessions, advisors ensure that each investment strategy not only aligns with clients' unique aspirations but also adapts to the evolving economic landscape.

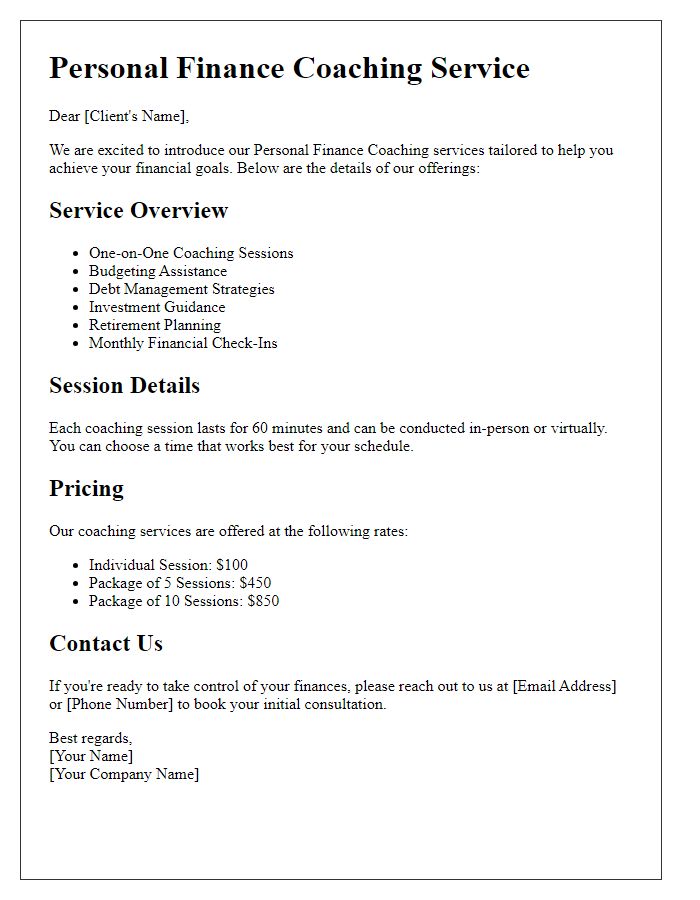

Service Overview and Benefits

Financial advisory services provide individuals and businesses with expert guidance on managing their finances to achieve their economic goals. Expert advisors analyze financial situations and create tailored plans that encompass investment strategies, retirement savings, tax planning, and risk management. Comprehensive services cover crucial aspects such as portfolio diversification, which reduces risks associated with market fluctuations, and tax optimization, maximizing deductions and minimizing liabilities. Utilizing sophisticated financial modeling, advisors present scenarios and projections that help clients visualize their financial trajectories, enabling informed decision-making. Regular reviews and adjustments to financial plans ensure alignment with changing life circumstances or market conditions, fostering long-term financial health and security.

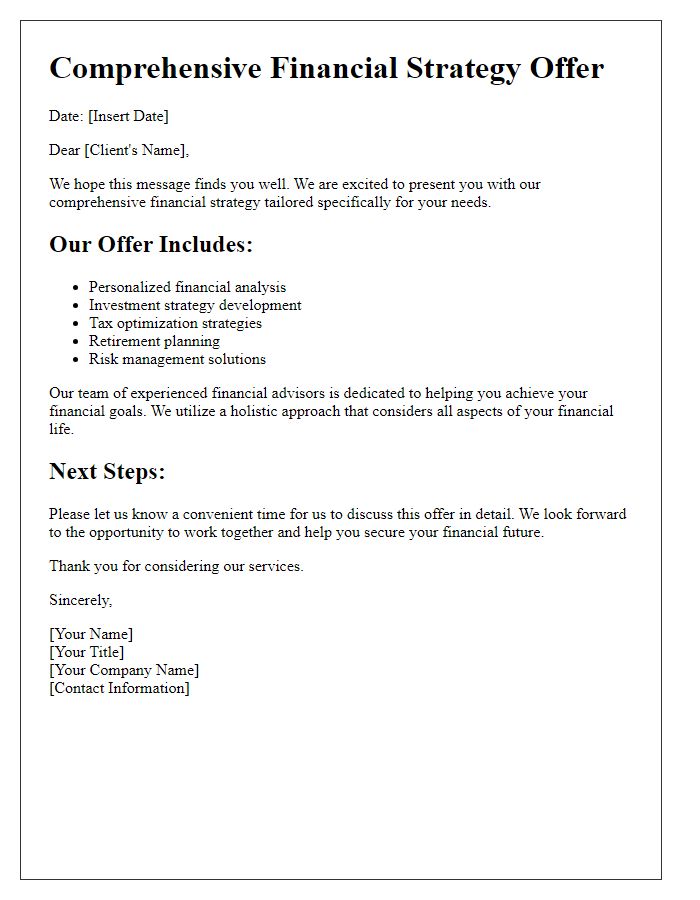

Unique Selling Points

Subject: Exclusive Financial Advisory Service Tailored for You Enhancing financial stability involves personalized strategies that cater to individual aspirations and investments. Our financial advisory service offers a unique blend of expertise and dedication, ensuring measurable results. With a track record of boosting client portfolio performance by an average of 15% annually, our experienced advisors utilize cutting-edge technology to conduct in-depth market analysis, presenting insights that shape successful investment decisions. Moreover, we prioritize transparent communication; clients receive quarterly updates detailing portfolio performance, market trends, and tailored recommendations. Our commitment to financial education ensures clients are equipped with the knowledge to make informed choices. Trust in a partnership that not only focuses on building wealth but also enhances financial literacy and confidence in navigating complex financial landscapes.

Call to Action

The financial advisory service market in 2023 is rapidly evolving, driven by technological advances and shifting client expectations. Targeted investment strategies provide valuable insights into asset management, allowing clients to optimize their financial portfolios. Comprehensive financial assessments, including risk tolerance evaluations and performance analytics, help identify tailored solutions that align with individual goals. With industry-leading expertise, financial advisors utilize data-driven approaches to navigate market volatility while fostering a client-centered experience. Competitively priced services, often significantly below national averages, ensure accessibility for a diverse range of individuals and businesses seeking financial guidance.

Contact Information and Closing

In the dynamic landscape of financial advisory services, clients can benefit greatly from tailored strategies and expert guidance. Comprehensive financial planning encompasses various aspects, such as retirement accounts, investment portfolios, and tax optimization. Specific tools, like the Certified Financial Planner (CFP) designation, signal expertise in providing sound advice. Additionally, adhering to regulatory frameworks, such as the Securities and Exchange Commission (SEC) guidelines, ensures compliance and trustworthiness. Establishing clear communication channels, such as email or phone contact, facilitates ongoing support and engagement. As markets fluctuate and personal goals evolve, having a dedicated financial advisor can yield significant advantages in navigating complex financial decisions, securing a prosperous future.

Comments