Are you curious about capital improvement fees and how they might affect your finances? Understanding these fees can often feel overwhelming, but keeping informed is essential for making smart financial decisions. In this article, we'll break down what capital improvement fees are, why they matter, and how they can impact your property value in the long run. So, let's dive in and explore this important topic together!

Clear Subject Line

Capital improvement fees serve as essential funding for infrastructure projects in urban developments. These fees, often assessed during property transactions, contribute to improvements like road maintenance, parks, and public facilities, particularly in growing cities such as Austin, Texas. Understanding the specific calculations of these fees is vital for homeowners and developers alike. Recent changes in local legislation, effective from January 2023, may affect how these fees are calculated based on property size and location. Engaging with local government offices can provide clarity on updated fee structures, ensuring compliance with the latest municipal guidelines. Additionally, reviewing official documents or attending community meetings can offer insights into ongoing projects funded by these fees and the anticipated impact on property values.

Recipient's Contact Information

Capital improvement fees often arise in real estate developments and homeowners associations, impacting budget planning for property owners. These fees, usually intended for infrastructure improvements or community amenities, can vary significantly based on location, such as urban centers like New York City or rural areas. For example, in 2022, the average capital improvement fee in a metropolitan area was reported to be around $1,500, depending on the property size and type. Homeowners should inquire about specific details, including the calculation methodology, planned improvements, and upcoming payment schedules, to fully understand their financial obligations and ensure informed decision-making regarding property investments or community relations.

Introduction and Purpose

Capital improvement fees, essential financial contributions, are increasingly relevant in urban planning and development projects. These fees fund significant infrastructure upgrades (such as road enhancements, sewer system improvements, and park renovations) in growing areas, ensuring that community facilities keep pace with population growth. Stakeholders, including property developers and local residents, often raise inquiries about these fees, seeking clarity on implementation processes, rates, and the allocation of collected funds. Understanding the purpose and structure of capital improvement fees is crucial for informed decision-making and fostering transparent communication among all parties involved.

Specific Questions or Details Requested

Capital improvement fees serve as essential funding sources for local government projects, enhancing community infrastructure such as parks, roads, or public transportation systems. Typically calculated as a one-time charge, these fees vary based on project scope and location, often influenced by local economic conditions. Understanding the specific methodology used to assess these fees is crucial for stakeholders, as it reveals the anticipated benefits to the community. Additionally, it is important to inquire about the timeline for fee implementation and the processes involved in addressing community concerns. Overall, a clear understanding of capital improvement fees fosters informed decision-making within the community regarding future developments.

Courteous Closing and Contact Information

Capital improvement fees represent investments made by local governments and organizations to enhance infrastructure, services, and facilities. These fees often arise in municipalities such as San Francisco, where the city allocates funds to improve roads, public transportation, and parks. Analyzing past fiscal reports can reveal trends in revenue generated from these fees, which can be crucial for future development projects. When evaluating the impact on taxpayers, stakeholders often consider the overall budget allocation and how these improvements benefit the community. Engaging with financial statements published by the city's finance department can provide transparency into how capital improvement fees are utilized.

Letter Template For Capital Improvement Fees Inquiry Samples

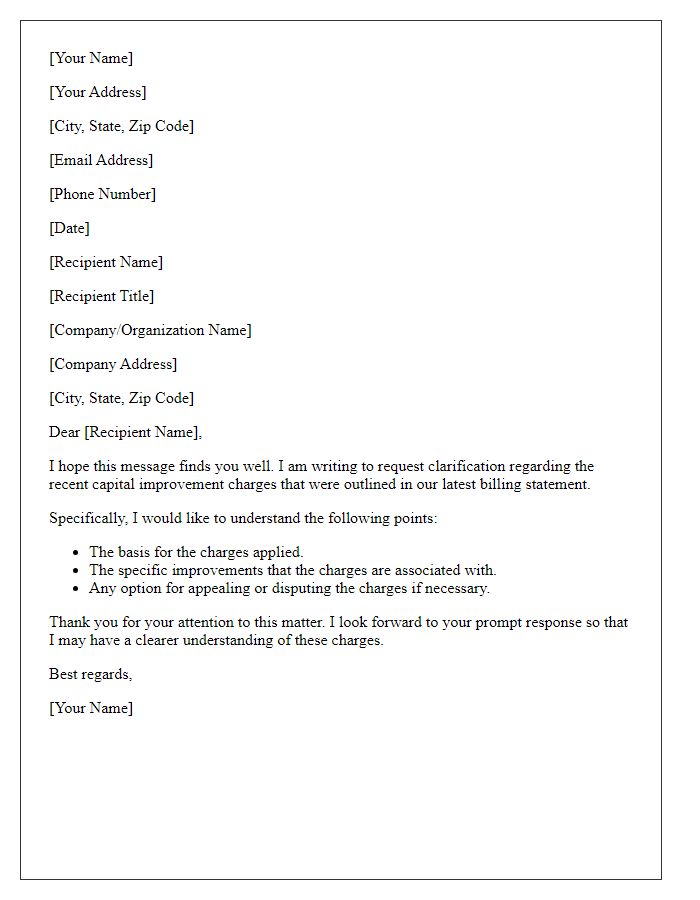

Letter template of request for clarification on capital improvement charges

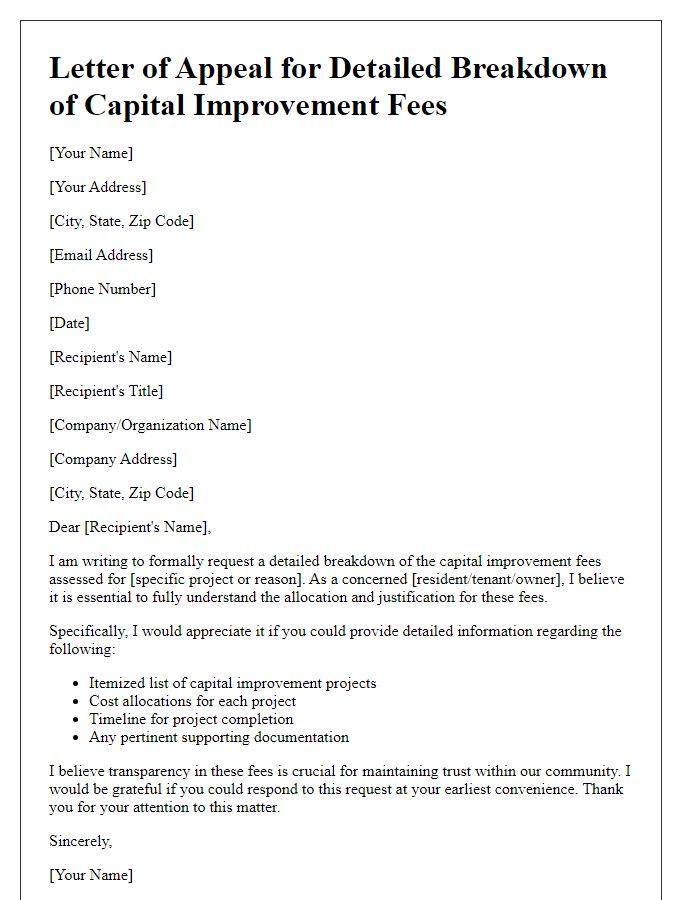

Letter template of appeal for detailed breakdown of capital improvement fees

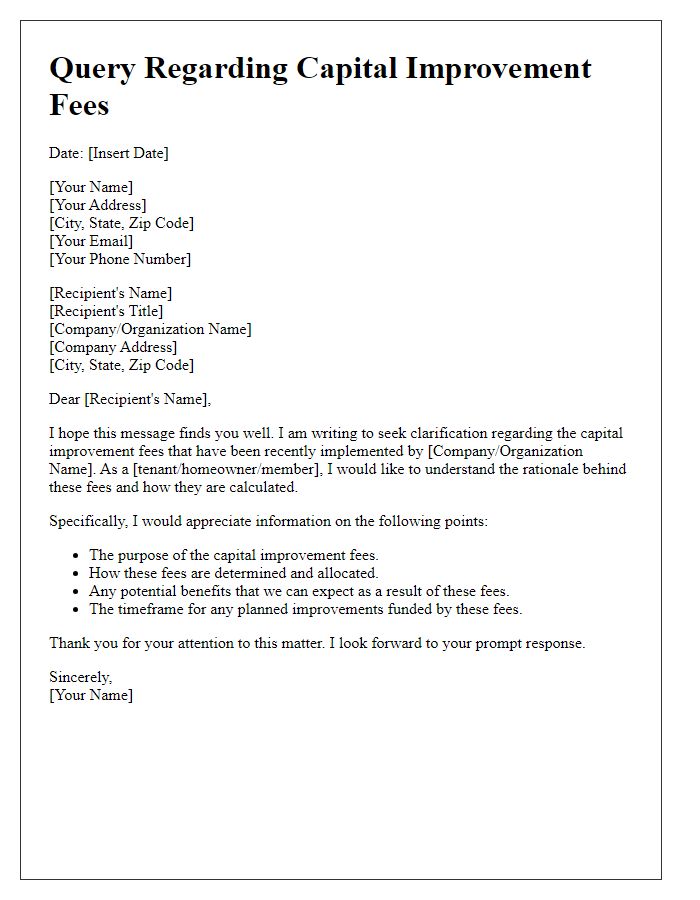

Letter template of query about the rationale behind capital improvement fees

Letter template of formal request for information on capital improvement costs

Letter template of submission for feedback on capital improvement fee structure

Comments