Are you struggling with the frustrating task of correcting an account number error? Whether it's a minor slip or a major oversight, addressing inaccuracies in your financial documents is crucial for smooth transactions. In this article, we'll provide you with a clear and concise letter template to ensure your request is communicated effectively. Let's dive in and help you get your account details straightened out!

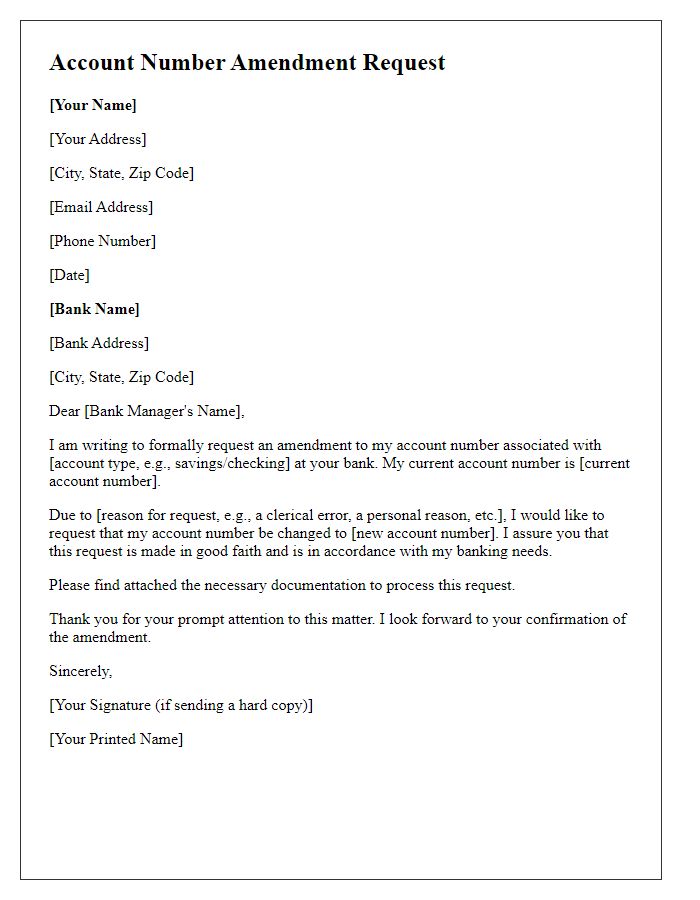

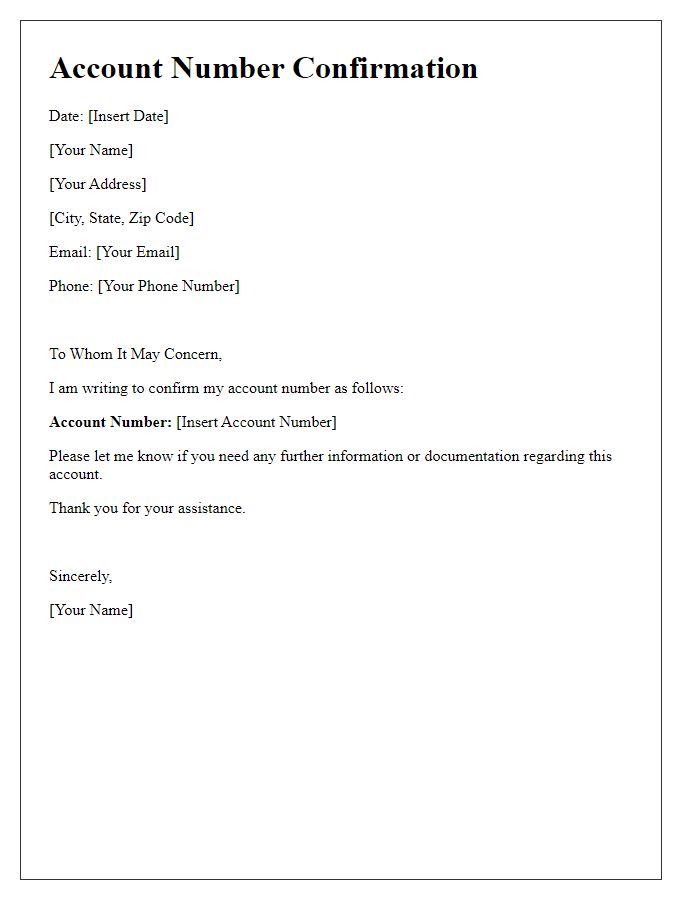

Sender's contact information

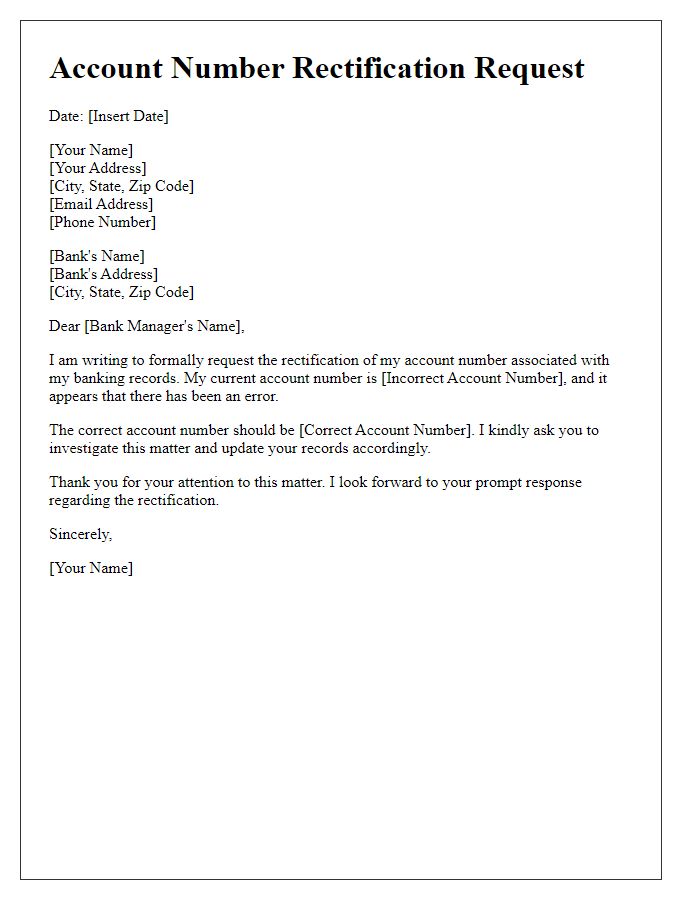

The process of correcting an account number typically involves addressing official correspondence to the appropriate financial institution, such as a bank or credit union. Accurate sender's information is crucial, including full name, mailing address (123 Main St, Springfield, IL 62701), and phone number (555-123-4567). Specific account details must be mentioned, such as the correct account number (987654321) and any previous account identifiers. Clear identification of errors, along with supporting documentation like forms of identification or prior statements, strengthens the request for correction. Promptness in receiving updates often relies on providing an email address for quicker communication.

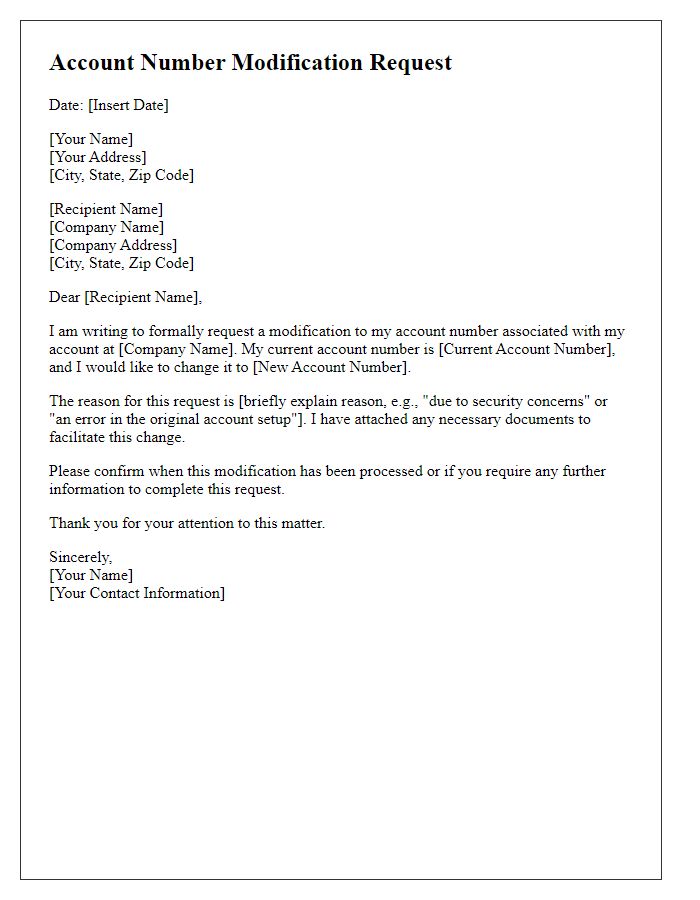

Recipient's contact information

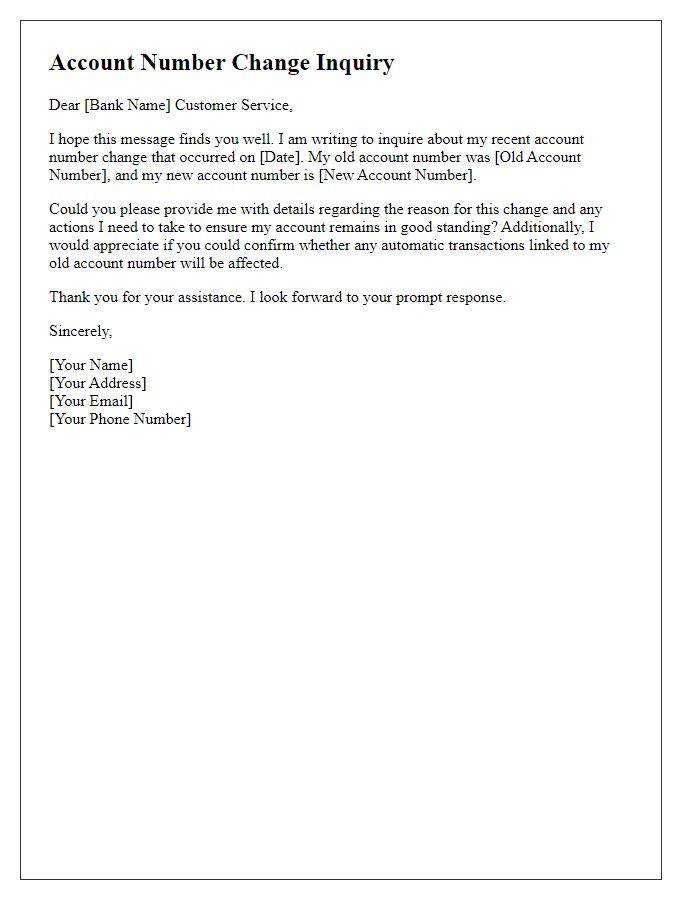

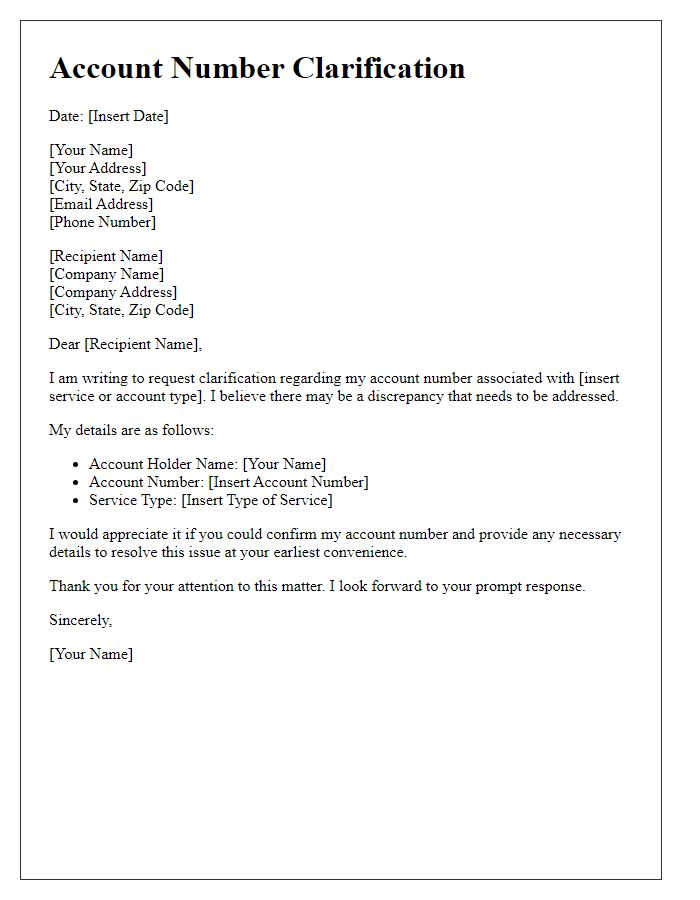

The process of correcting an account number requires clear communication and specific details regarding the recipient's contact information, including the recipient's full name, mailing address, phone number, and email address. Properly formatted contact details ensure the information reaches the correct department for timely resolution. The inclusion of an account number (the unique identifier assigned to clients or customers) alongside any previous correspondence provides context. Emphasizing urgency may involve a request for a confirmation upon receipt, enhancing the accountability and speed of processing the correction.

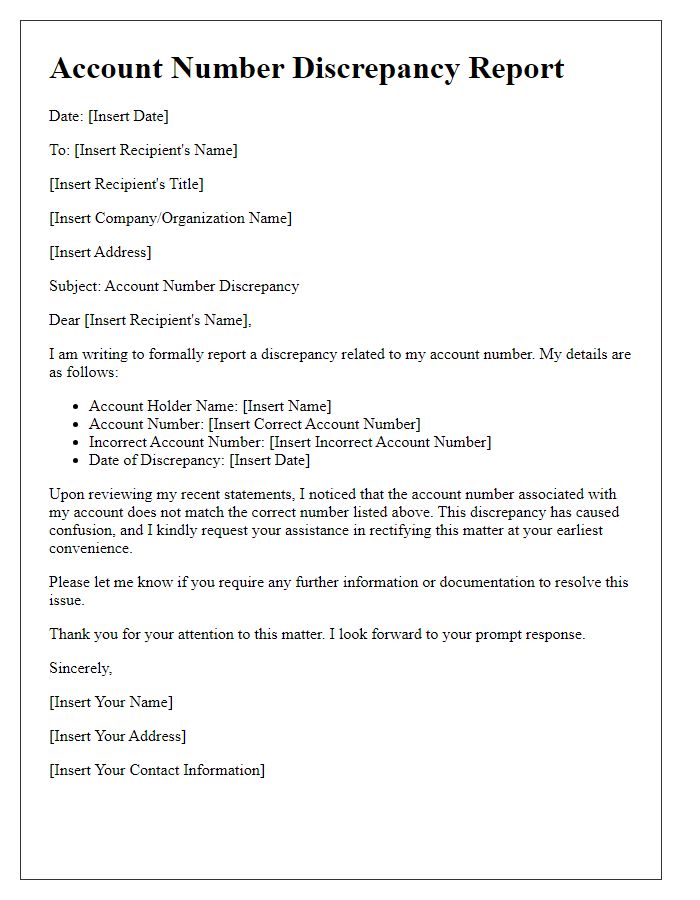

Clear subject line

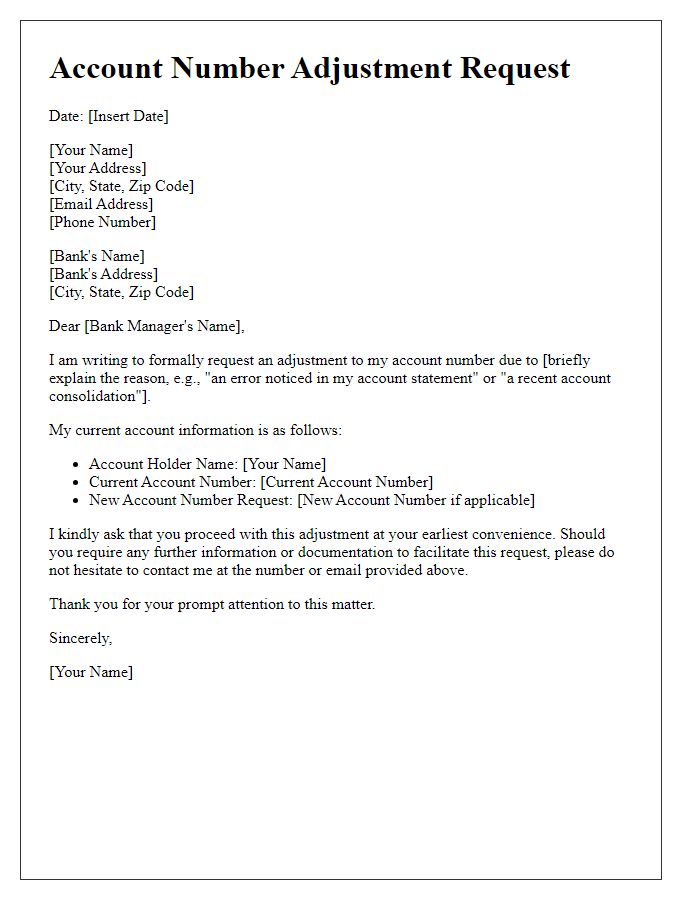

Request for Account Number Correction Verification To ensure the accuracy of financial transactions and protect personal information, it is crucial to address the correction of account numbers promptly. An erroneous account number can lead to misallocation of funds or communication discrepancies with financial institutions. For instance, an account number may be incorrect due to typographical errors during data entry, leading to confusion in banking transactions. A precise account number, typically comprising 10-12 digits, is essential for seamless processing. It is recommended that individuals provide supporting documentation, such as bank statements or transaction receipts, highlighting the discrepancy to facilitate the correction process. Clarity in communication with relevant parties ensures timely resolution of any issues related to account management, maintaining overall financial integrity.

Accurate account details

Accurate account details are crucial for financial transactions and customer satisfaction across banking institutions and service providers. For instance, a customer's account number (typically comprising 10 to 12 digits) needs to be precise to avoid transaction errors, such as failed transfers or misdirected payments. In 2022, banking sectors reported a significant rise in transaction discrepancies due to account number misentries, highlighting the importance of accurate details. Furthermore, strict regulatory compliance must be maintained in accordance with financial organizations like the Financial Industry Regulatory Authority (FINRA) to protect sensitive information. Therefore, ensuring that account details are correct not only enhances operational efficiency but also fosters trust and reliability in the financial ecosystem.

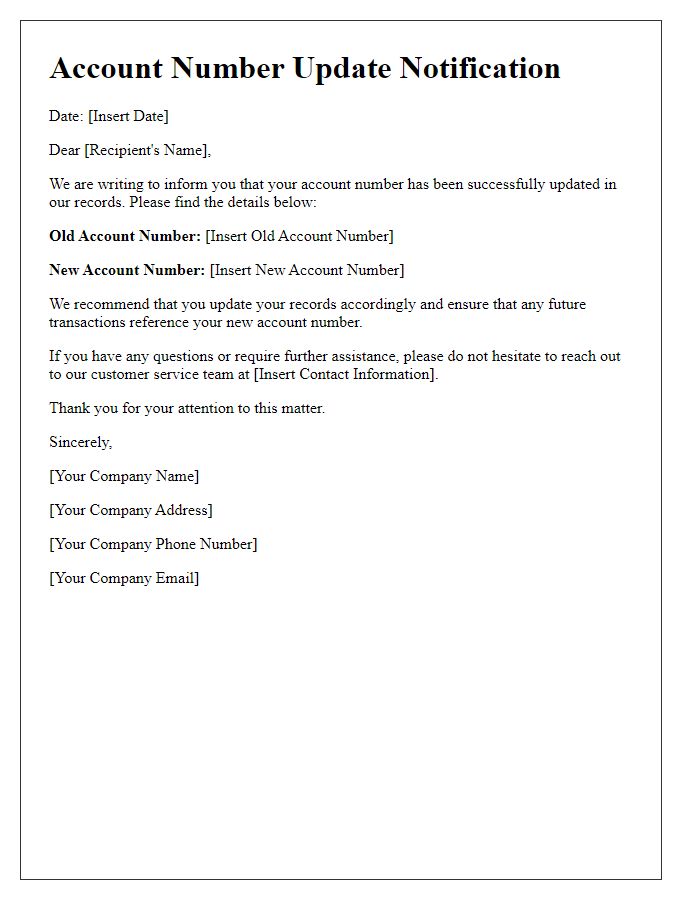

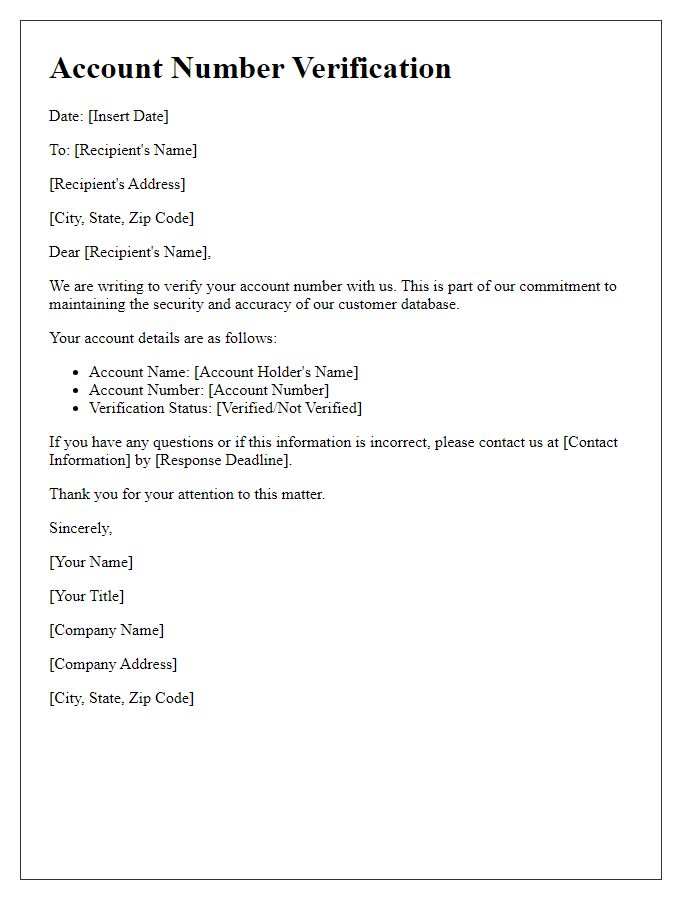

Request for confirmation and correction

A formal letter template serves as a structured document for requesting an accurate update to account numbers, a critical aspect of financial records that ensures seamless transactions and proper identification. The letter should clearly outline the current erroneous account number, the correct number, and the rationale behind the correction, emphasizing the importance of precision in financial dealings. Moreover, it should include a request for confirmation, aiming for accountability from the recipient institution, whether a bank or service provider, thereby enhancing the transparency of the process. Personal details, such as the account holder's name and contact information, add context, enabling efficient communication regarding the matter.

Comments