If you find yourself in the challenging position of dissolving a partnership, it's essential to approach the situation with clarity and professionalism. Crafting an effective letter template can help you communicate your intentions and lay out the terms of the termination clearly. In this article, we'll guide you through important elements to include in your partnership dissolution letter, ensuring that nothing is overlooked. So, let's dive in and explore how to handle this sensitive matter with grace and transparency!

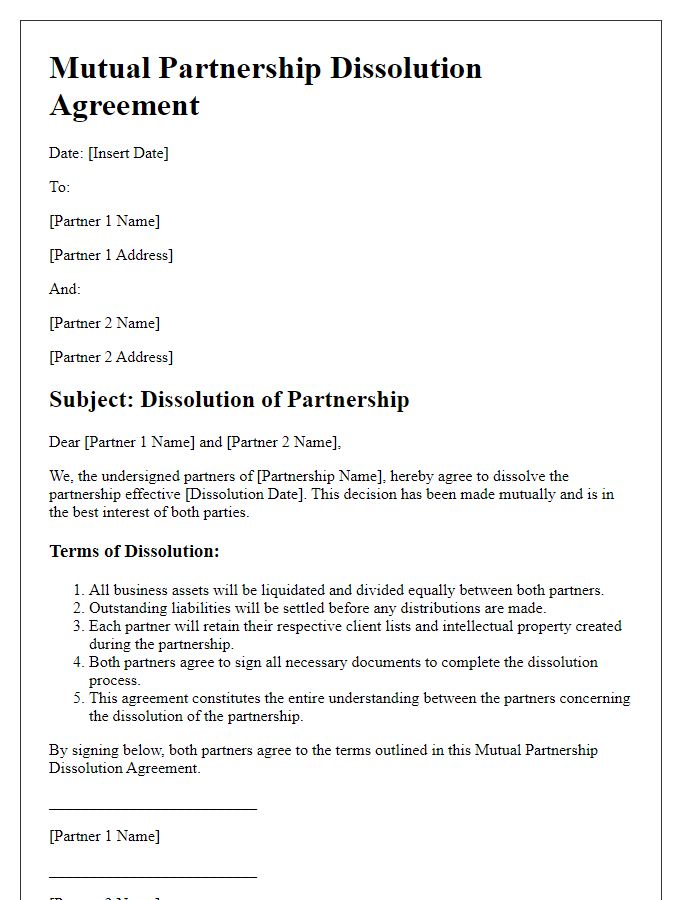

Clear identification of parties

In a partnership dissolution termination, clear identification of parties involved is crucial for legal clarity and accountability. Each party's full legal name, business address, and role within the partnership must be explicitly stated. For example, if partners are John Smith, a resident of 123 Main Street, Springfield, and Jane Doe, located at 456 Elm Avenue, Springfield, the document should explicitly mention these details. Furthermore, referencing the original partnership agreement date, for instance, March 15, 2020, provides a timeline and context for the dissolution process. Additional information such as their respective ownership percentages and any contributions made towards the partnership can help in determining distribution of assets and liabilities. Accurate identification not only facilitates a smooth termination process but also reduces potential disputes in future legal contexts.

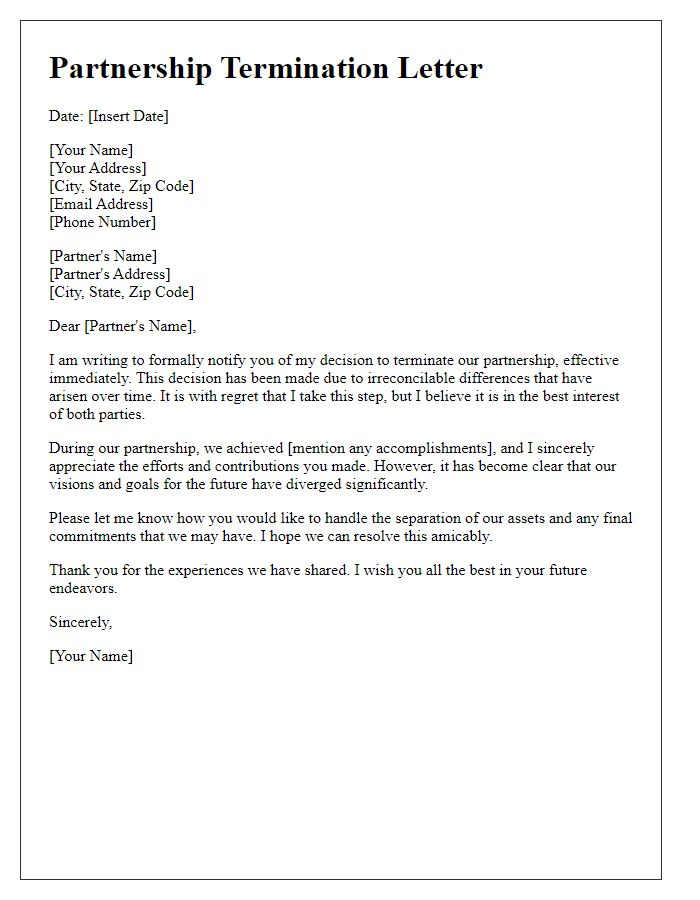

Reason for dissolution

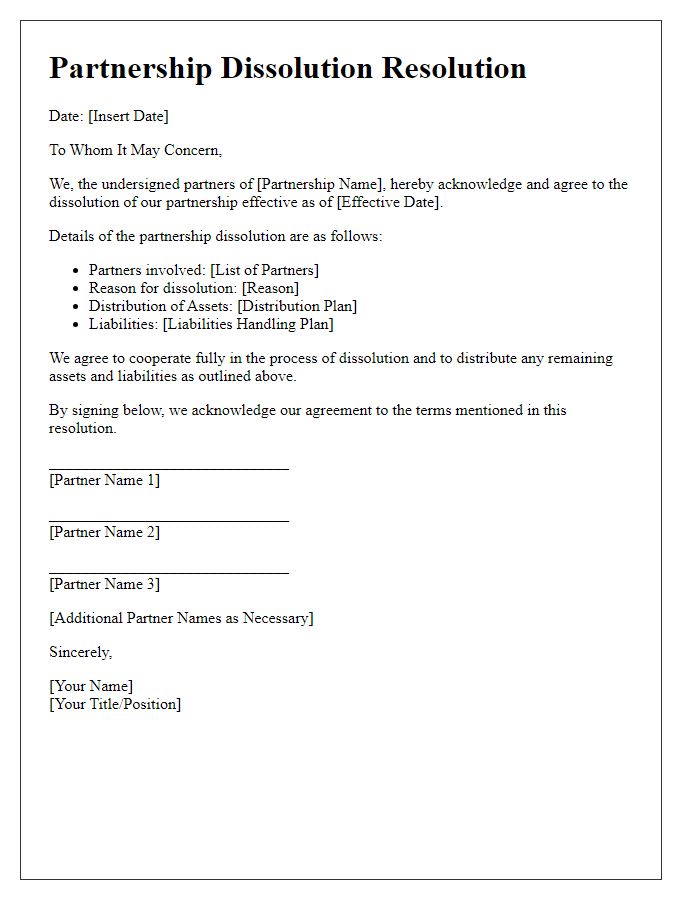

Partnership dissolution occurs when partners decide to end a partnership relationship. Common reasons for dissolution include irreconcilable differences in business goals, significant loss of profits or capital, changes in market conditions, or personal circumstances impacting partner availability. Legal disputes may also necessitate termination. The dissolution process requires financial assessments, settlement of debts, and proper distribution of remaining assets, ensuring compliance with local laws and partnership agreements. Documenting the dissolution is essential to avoid future conflicts, providing clarity on each partner's responsibilities and rights during the transition.

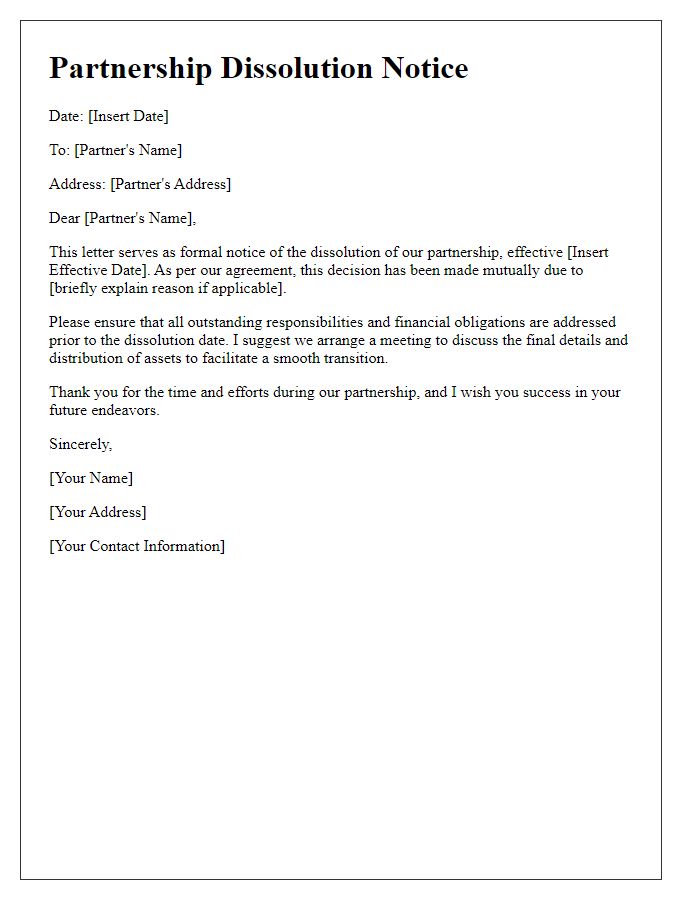

Effective termination date

The formal process of partnership dissolution generally involves legal documentation and clear communication regarding the termination of the partnership agreement. Key details include the effective termination date, which marks the official end of the partnership's legal status. This date must be specified in any dissolution agreement to provide clarity for all parties involved. The dissolution process often encompasses the settling of outstanding debts, distribution of assets, and notification to relevant agencies or customers. Each partner's responsibilities in this process should also be outlined, ensuring a smooth transition and the proper resolution of any remaining obligations or contracts. Proper adherence to local laws ensures compliance and protects the interests of all parties.

Obligations and responsibilities post-termination

Upon termination of the partnership, all parties must address their obligations and responsibilities, ensuring a smooth transition. Final financial statements must be provided, including balance sheets detailing assets and liabilities, invoices for outstanding payments, and documentation of any pending contracts tied to the partnership. Each partner must settle the division of partnership property, which could include real estate located at specific addresses, business equipment valued at market rates, or proprietary intellectual property such as patents or trade secrets. Additionally, a timeline for the settlement of debts, including loans or lines of credit under the partnership's name, should be established to prevent further liability. Any ongoing business relationships, particularly with suppliers or clients, must be reviewed to determine who will assume responsibility moving forward. Finally, confidentiality agreements regarding sensitive information should remain enforceable indefinitely to protect proprietary interests post-termination.

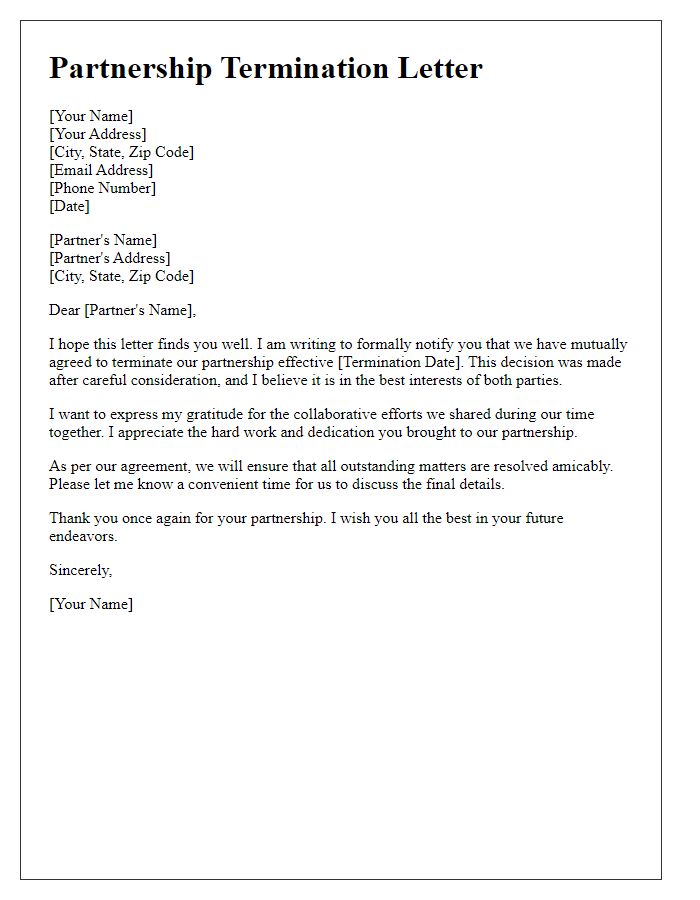

Contact information for further communication

Dissolution of partnership often requires clear communication regarding future contact. Essential details include the primary contact person's name, title (such as Partner or General Manager), and direct phone number. Email addresses should also be provided for both formal correspondence and informal discussions. Additionally, the physical address of the business or personal residences may be necessary for legal documents or final communication. It's important to specify a timeline for ongoing communication, including deadlines for settling financial matters or returning shared assets, ensuring both parties stay informed and engaged throughout the dissolution process.

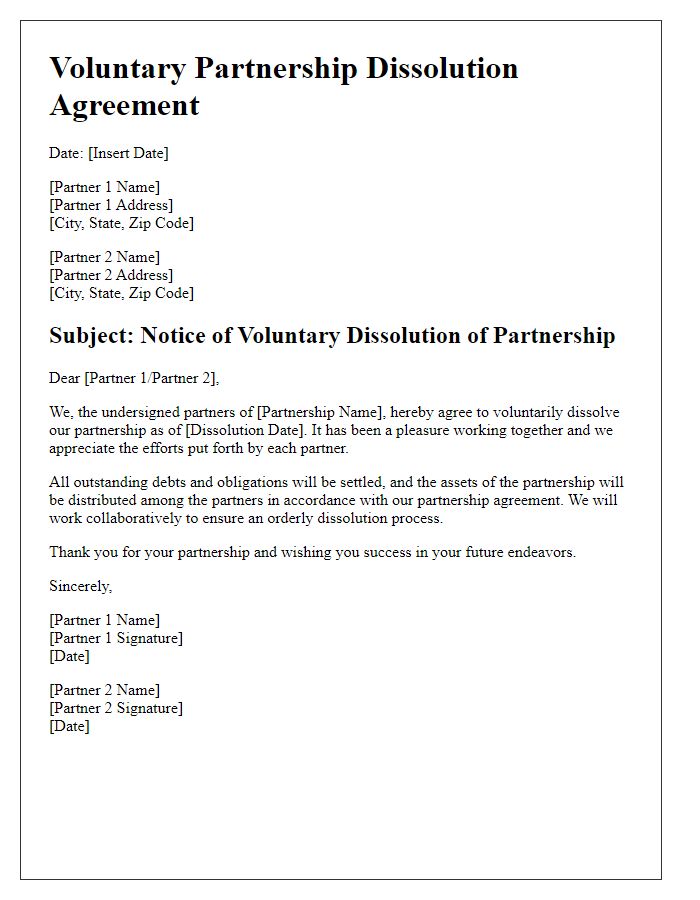

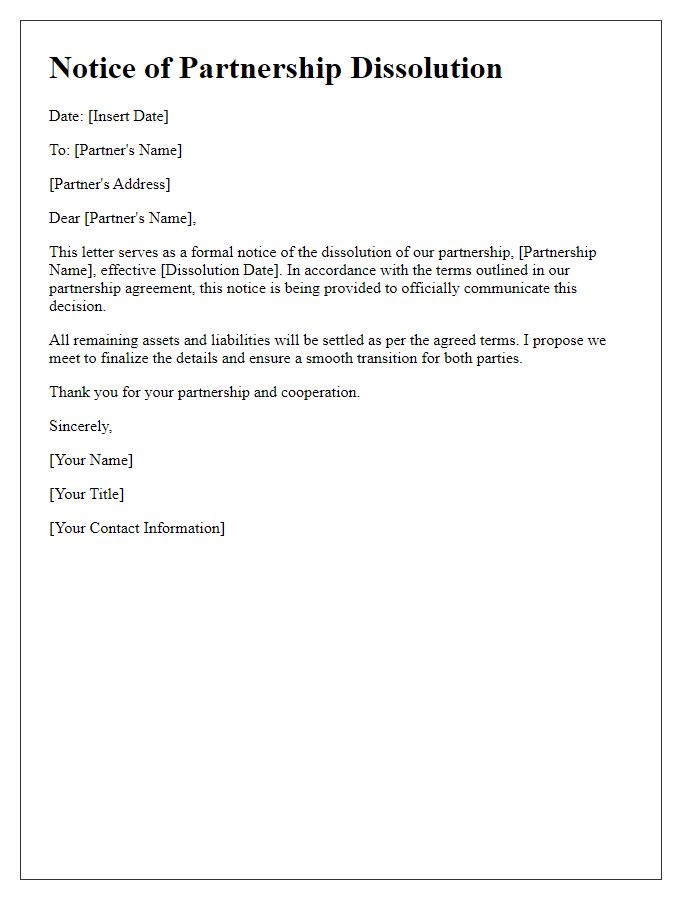

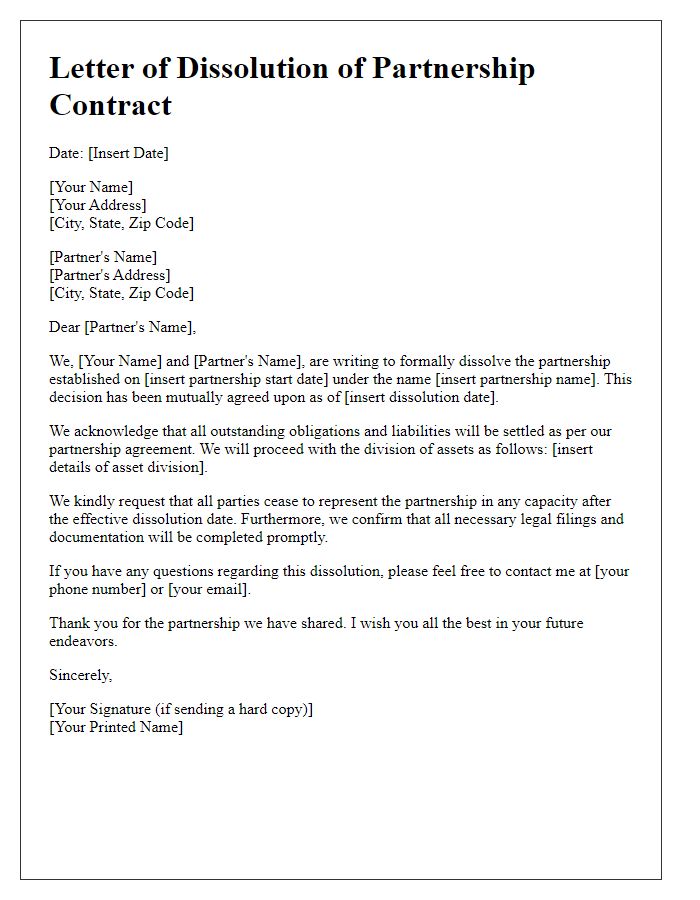

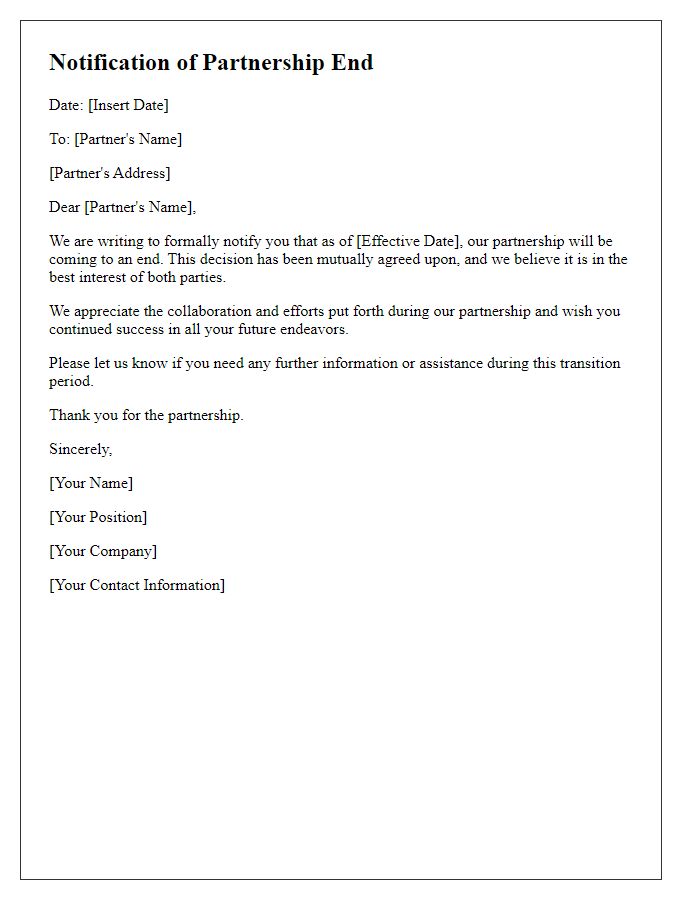

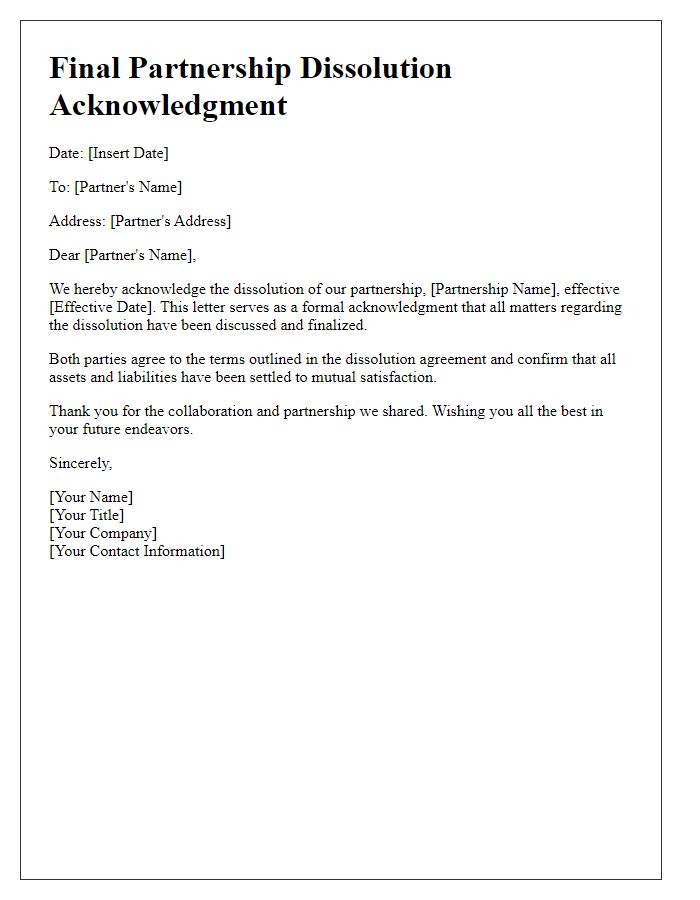

Letter Template For Partnership Dissolution Termination Samples

Letter template of partnership termination due to irreconcilable differences

Comments