Are you a landlord wrangling with the intricacies of returning a tenant's security deposit? Navigating the process can be daunting, but understanding the relevant protocols is essential for a smooth transaction. This guide will provide you with a clear template that outlines the necessary steps and information needed to ensure a hassle-free refund process. So, grab a cup of coffee, and let's dive into the details of creating an effective security deposit refund letter!

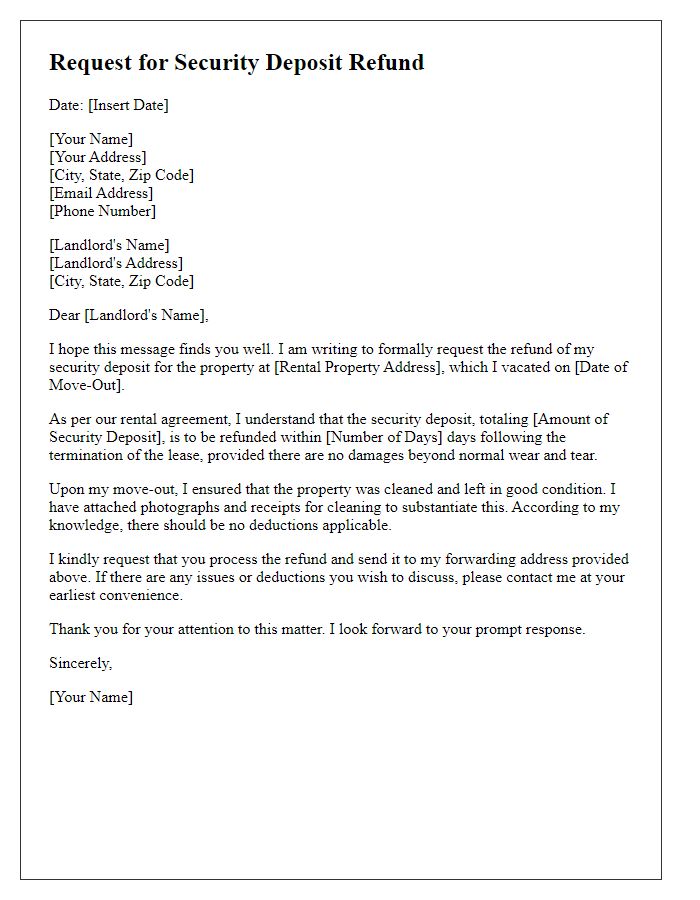

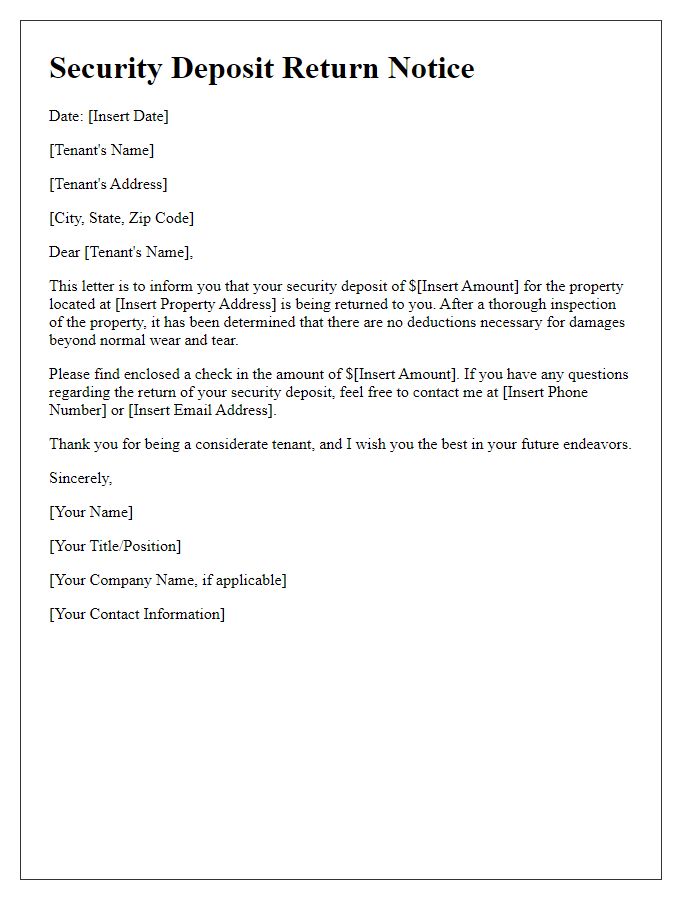

Tenant's full name and address

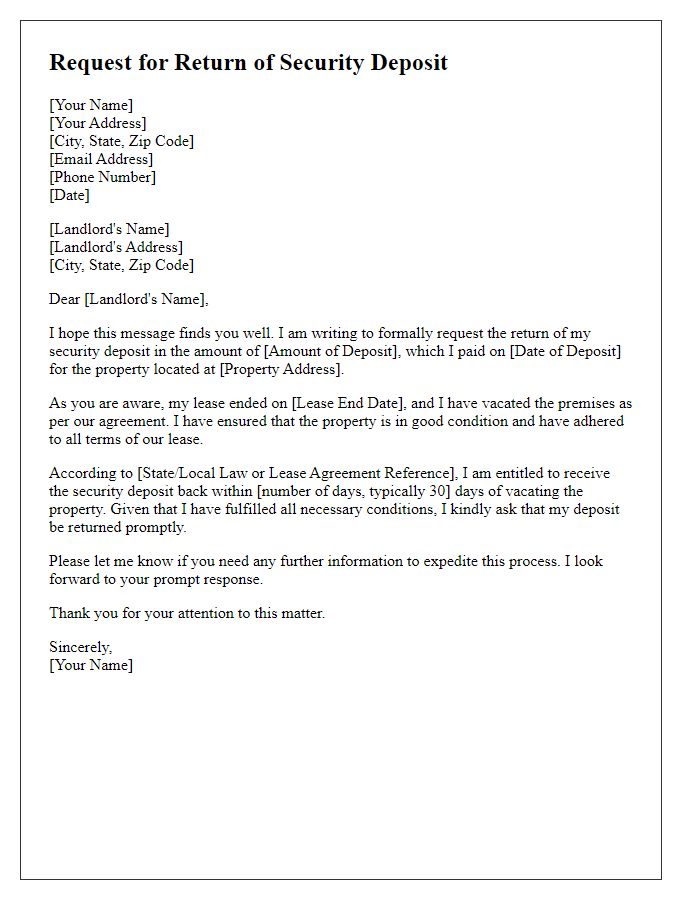

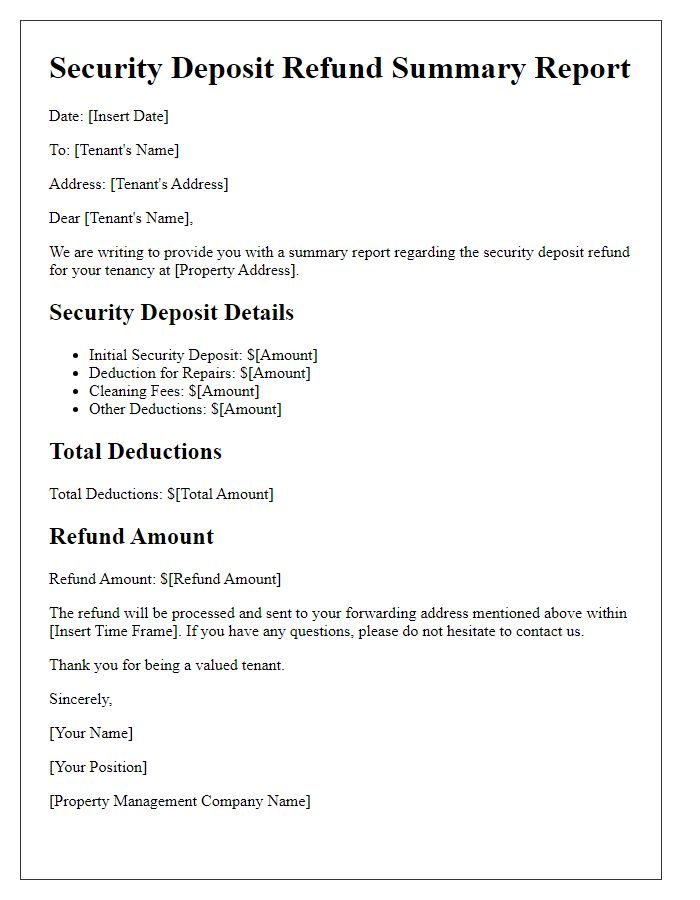

The tenant's full name must be clearly stated for identification purposes, followed by their current address, which may include the street name, city, zip code, and any apartment number if applicable. This ensures that the recipient of the letter can accurately verify the tenant's identity and ensure the security deposit refund reaches the correct location. Additionally, the information should affirm the tenant's lease agreement details, including move-in and move-out dates, to establish the timeline of occupancy and pertinent obligations related to the deposit. Accurate documentation of these elements is essential in maintaining professionalism and clarity in financial transactions.

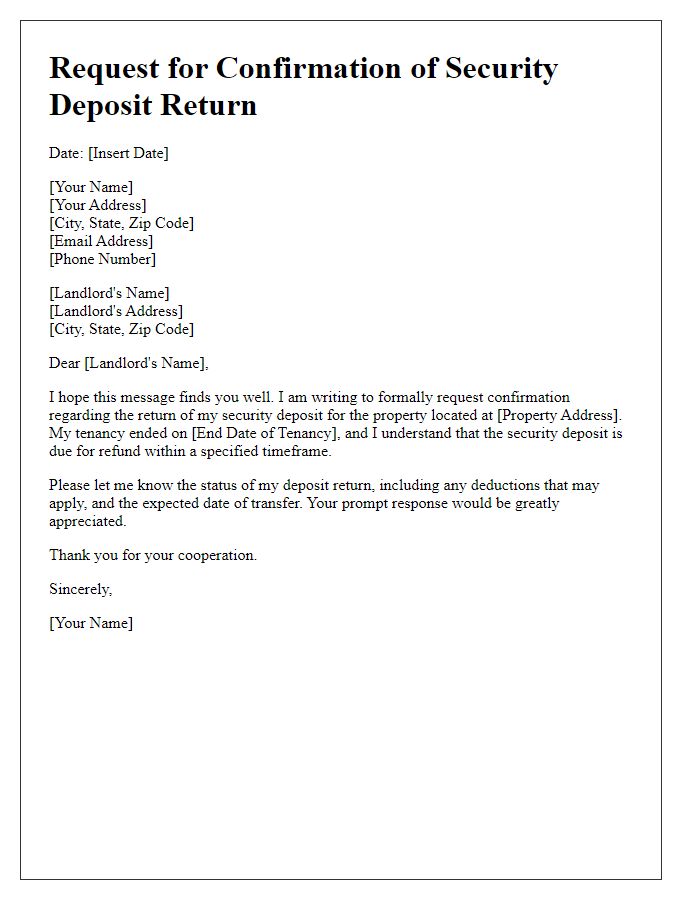

Rental property address

A tenant's security deposit refund can involve various legal and financial considerations, which may impact the amount refunded. The rental property address (for example, 123 Main Street, Springfield) must be clearly identified as it plays a crucial role in the lease agreement and any deductions taken from the deposit. Items such as unpaid rent, damages, or excessive wear and tear may influence the final amount returned. State regulations often dictate the timeline for the return, usually within 30 days post-lease termination, ensuring compliance with the law and fair practices. Communication regarding this refund, including a detailed breakdown of any deductions, is essential to avoid disputes and maintain a positive landlord-tenant relationship.

Lease end date

Upon the conclusion of a residential lease agreement on a specified lease end date, tenants are entitled to a security deposit refund, which typically amounts to a predetermined sum withheld during the rental term. Security deposits generally range from one to two months' rent, and safeguarding procedures must be adhered to in accordance with local regulations and real estate laws. After the lease end date, landlords should conduct a thorough inspection of the rental unit to assess any damages beyond normal wear and tear. Deductions from the security deposit may include repair costs, unpaid rent, or cleaning fees, while the remaining balance should be returned to the tenant within a stipulated timeframe, often 30 days. Documenting the condition of the property during move-out helps ensure transparency in the refund process, fostering trust and accountability between landlords and tenants.

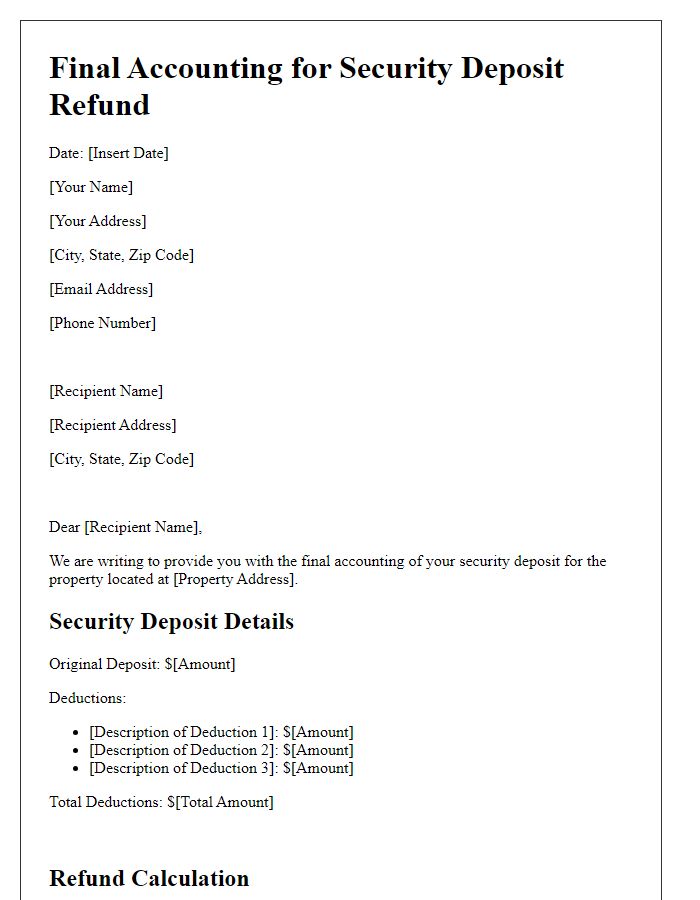

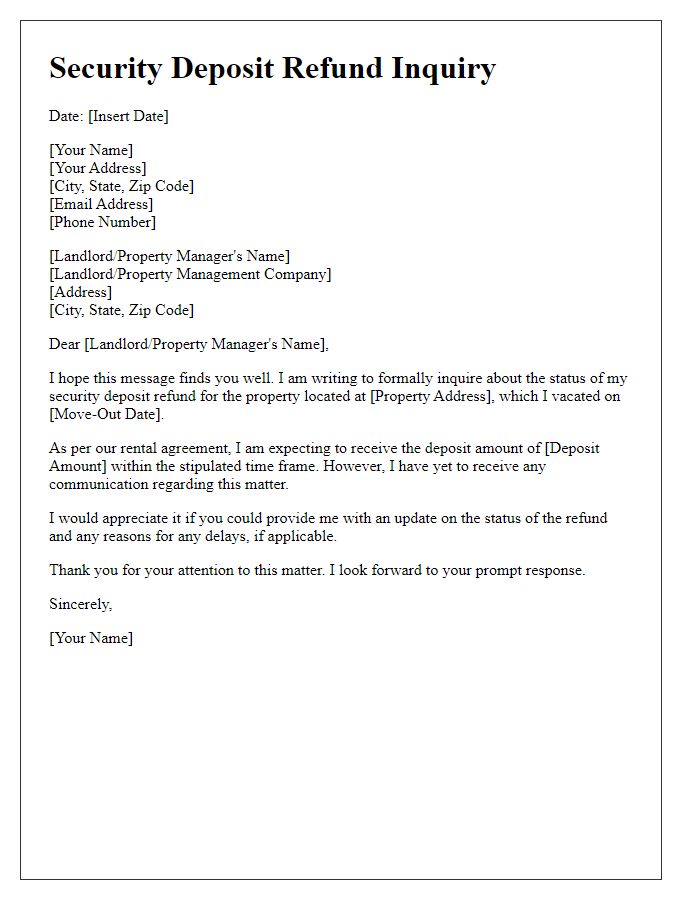

Itemized deductions (if applicable)

Return of security deposits often involves compliance with state laws regarding itemized deductions. Deductions may include repair costs, painting expenses, and cleaning fees. For example, if the former tenant occupied a residential property in California, a detailed statement outlining deductions must be provided within 21 days of lease termination. Itemized deductions can include specific repairs, such as fixing holes in the walls, replacing broken appliances, or cleaning carpets that were excessively dirty (subject to documentation and proof of costs). It's crucial to include any invoice numbers, labor costs, and material expenses to substantiate these deductions clearly. A well-documented refund statement increases transparency and can prevent disputes.

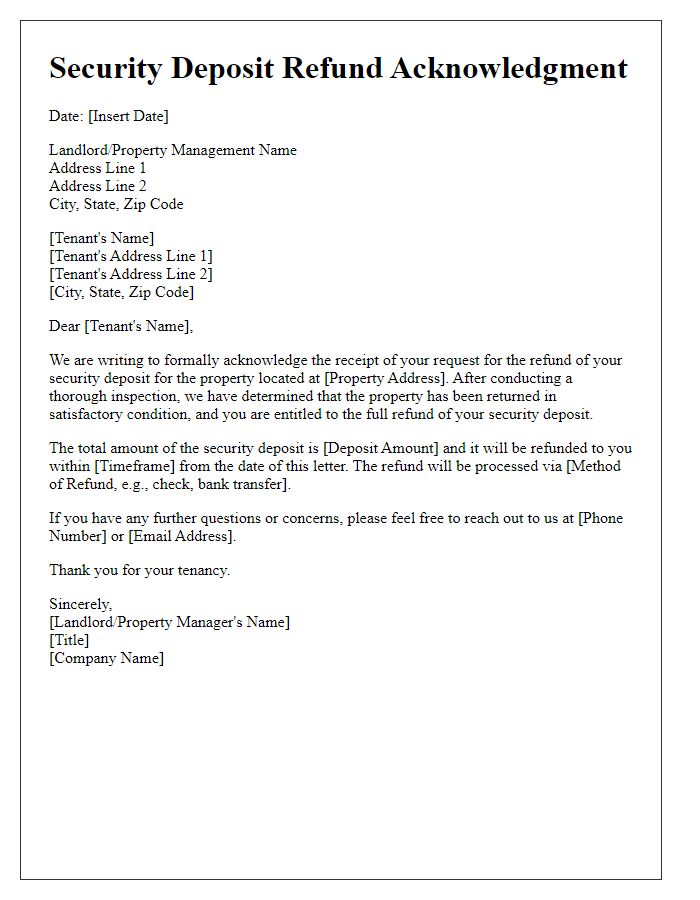

Refund amount and method of payment

A tenant's security deposit refund involves a number of important details to ensure a clear understanding between both parties. The refund amount, typically equivalent to the initial security deposit minus any deductions for damages, cleaning fees, or unpaid rent, should be explicitly stated. The refund process often follows local landlord-tenant laws, which can dictate timeframes for issuing refunds, usually within 30 days after lease termination. Preferred methods of payment may include bank transfer, check, or other electronic payment platforms like PayPal or Venmo, ensuring convenience and security for the tenant. Proper documentation, such as a breakdown of deductions if applicable, further enhances transparency and trust in the transaction.

Comments