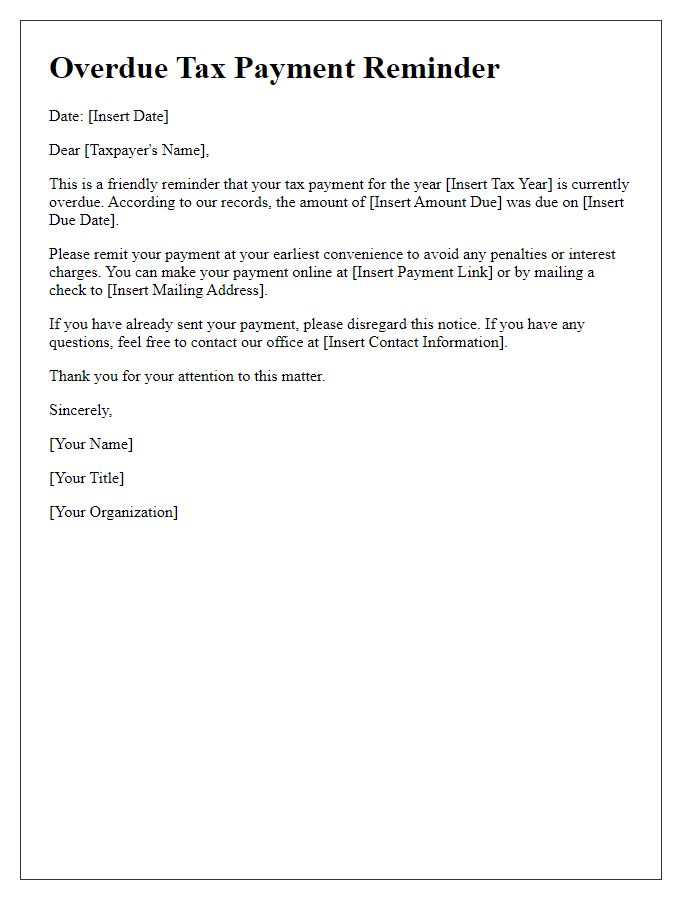

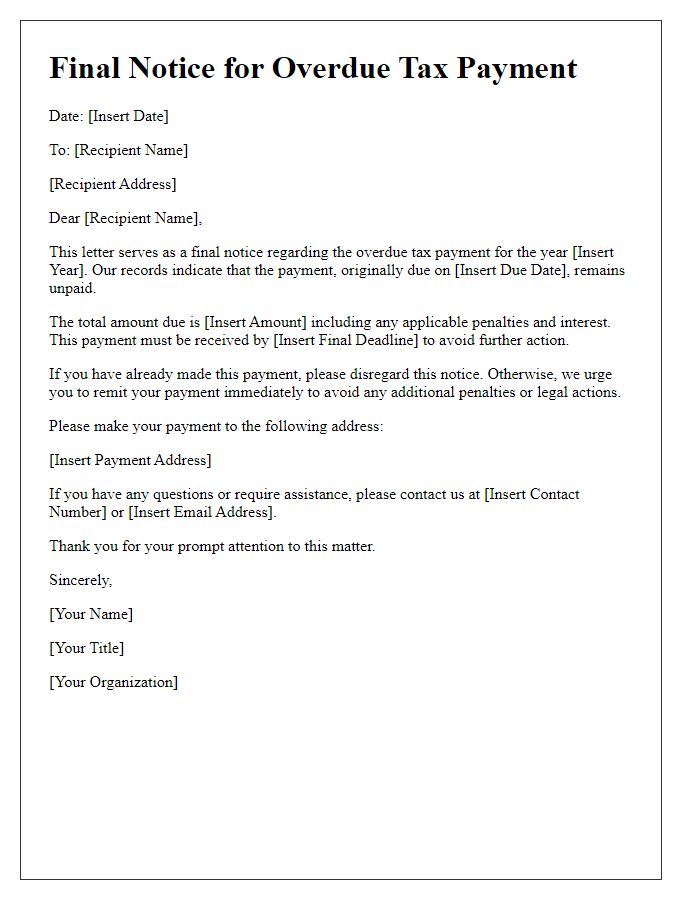

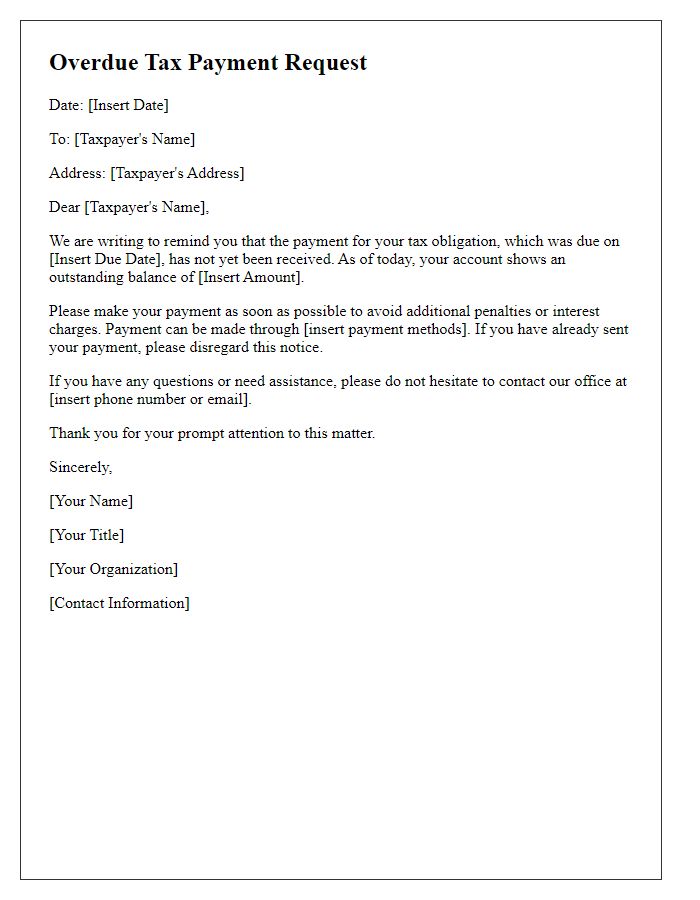

Are you grappling with the stress of an overdue tax payment? You're not alone, as many people find themselves in similar situations and need a little guidance. In this article, we'll provide you with a straightforward letter template that can help you effectively communicate with tax authorities regarding your overdue payment. So, if you're ready to tackle this issue head-on, keep reading to discover how you can craft that perfect notice!

Clear Subject Line

Subject: Urgent Notice: Overdue Tax Payment Reminder This overdue tax payment notice serves as a reminder for citizens who have not settled their outstanding tax obligations by the due date. The specific amount due may vary depending on individual assessments, which must be reviewed from tax filings, such as the IRS Form 1040 for personal income tax. Failure to pay on time can result in escalating penalties, including interest rates that accrue daily. For instance, the IRS typically charges a late payment penalty of 0.5% per month, up to a maximum of 25% of the total unpaid tax. Taxpayers are encouraged to address their balances promptly to avoid further complications. Payment options include electronic transfer via the IRS Direct Pay system or traditional methods such as checks mailed to local tax offices.

Recipient Information

Overdue tax payment notices are legal documents sent to individuals or businesses to remind them about unpaid taxes. These letters typically include the recipient's full name, address, and tax identification number (TIN) to ensure clarity and proper identification. The notice often specifies the outstanding amount, due date, and any penalties or interest accrued due to late payments. It might reference specific tax years or periods, such as the 2022 tax year, to highlight the obligation. Furthermore, the notice may encourage prompt action by providing contact information for payment options or personal consultations, ensuring the recipient understands their responsibilities and potential consequences of continued non-compliance.

Amount Due

Overdue tax payments, such as the federal income tax assessed by the Internal Revenue Service (IRS), can result in significant penalties and interest charges. As of October 2023, the current interest rate for unpaid taxes can reach up to 6% annually, compounding monthly. The outstanding amount due often escalates quickly, leading to stress for individual taxpayers in places like New York City, where tax laws are stringent. Ignoring notices from tax authorities can escalate the situation, potentially resulting in wage garnishments or liens against property. Timely addressing the amount due is critical to avoid additional financial burdens.

Payment Instructions

Individuals who have not paid their taxes by the specified deadline must be aware of the implications of overdue tax payments. Tax authorities typically accept payment through various methods, including electronic payment systems, checks, or money orders. Payment options may vary by jurisdiction (such as the Internal Revenue Service in the United States) and can include online payments (through secure portals often requiring taxpayer identification numbers), phone payments, or in-person transactions at designated local offices. In many cases, late payments incur additional penalties or interest rates, increasing the overall amount due. Taxpayers are advised to review their specific tax obligations and promptly contact the tax authority for assistance and to prevent further complications.

Consequences of Non-Payment

Failure to pay overdue taxes can lead to significant financial repercussions and legal consequences. Penalties often accumulate at a rate of 1% to 1.5% per month on the outstanding amount, escalating the total owed substantially. After a period of 120 days, the tax authority, such as the Internal Revenue Service (IRS) in the United States, may initiate a lien against personal property, which can affect credit ratings and hinder future borrowing capabilities. Furthermore, continued non-payment may result in wage garnishments, where a portion of income is withheld to satisfy tax debts. Legal actions can also ensue, including court appearances and additional fines, potentially culminating in forfeiture of assets. Taxpayers should assess these risks and consider reaching out to professional tax advisors to develop solutions and payment plans to mitigate adverse consequences.

Comments