Are you feeling overwhelmed by your current tax installment agreement? Modifying your payment plan can be a smart solution to ease financial stress and ensure you stay on track. In this article, we'll walk you through the steps to request a modification effectively, focusing on key points to consider before reaching out to the IRS. Join us as we explore your options for a more manageable tax situation!

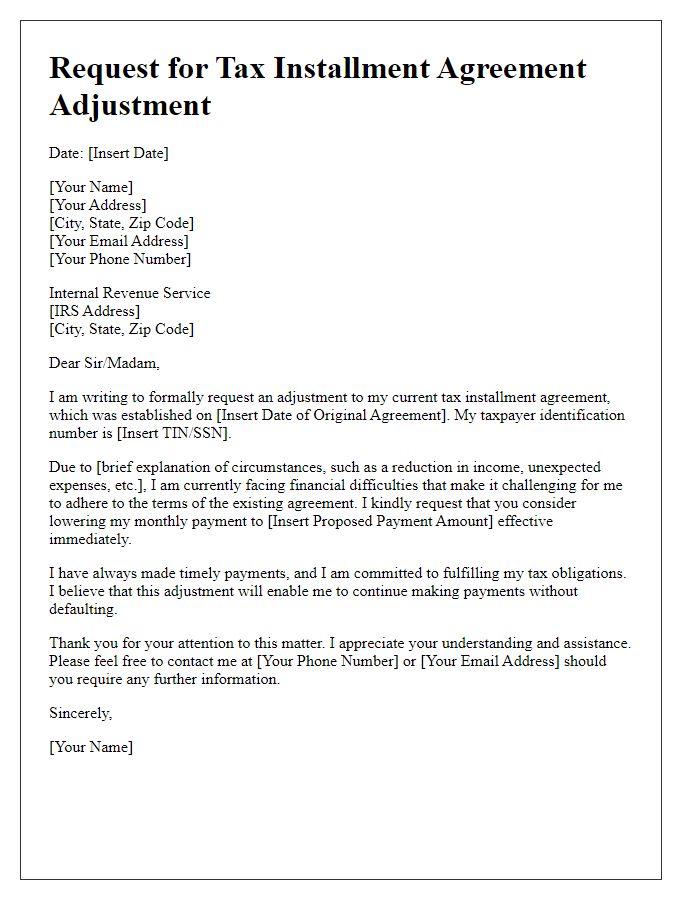

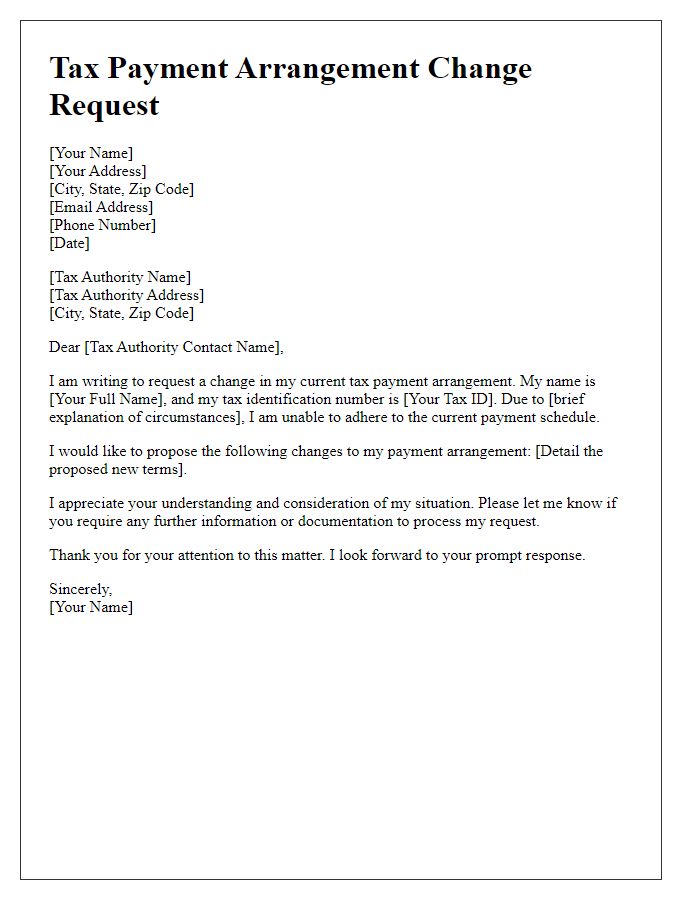

Account information and taxpayer identification

Taxpayer identification numbers for individuals, such as Social Security Numbers (SSN), are critical for tax records and account management. Modifying a tax installment agreement typically involves submitting a formal request to the Internal Revenue Service (IRS) or relevant tax authority. Account information must include specific details such as account number, current payment amount, and frequency of payments (e.g., monthly, quarterly). Providing accurate personal information ensures proper identification in the system and facilitates the modification process, allowing taxpayers to adjust payments in response to changes in financial circumstances or obligations. Clear documentation, including income statements and hardship letters, can support requests for modifications.

Current installment agreement details

The current installment agreement, established for repaying an outstanding tax balance of $5,000 to the Internal Revenue Service (IRS), is set at a monthly payment of $300. The original agreement, initiated on March 15, 2022, stipulates a repayment timeframe of approximately 16 months, with the final payment due by July 2023. This agreement is linked to tax year 2021, during which the taxpayer faced financial hardships due to job loss in December 2020 and medical expenses totaling $2,500 in early 2021. Timely payments have been made, maintaining compliance with IRS regulations; however, recent unforeseen expenses, including car repairs amounting to $1,200, necessitate a modification request to adjust the monthly payment to $200 for the duration of the agreement.

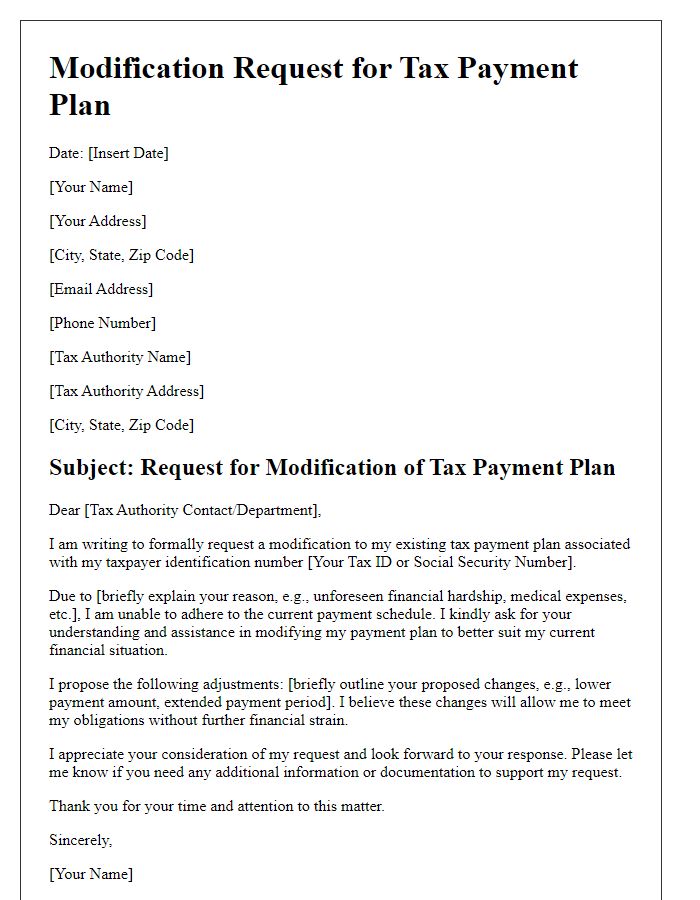

Justification for modification request

A tax installment agreement modification request often requires a clear and compelling justification. For example, an individual might experience unexpected financial hardship, such as a job loss, which can hinder the ability to meet the current payment terms established with the Internal Revenue Service (IRS). This person may provide specific details, such as a 30% reduction in monthly income since May 2023, and cite the struggle to balance essential expenditures like rent in Seattle ($2,500), utilities (approximately $300), and groceries (around $500 monthly). This context illustrates the need for a new agreement that reflects current financial realities. Furthermore, the taxpayer's consistent prior payment history, such as on-time payments for the preceding two years, may reinforce the credibility of the request and demonstrate a commitment to fulfilling tax obligations under reasonable conditions.

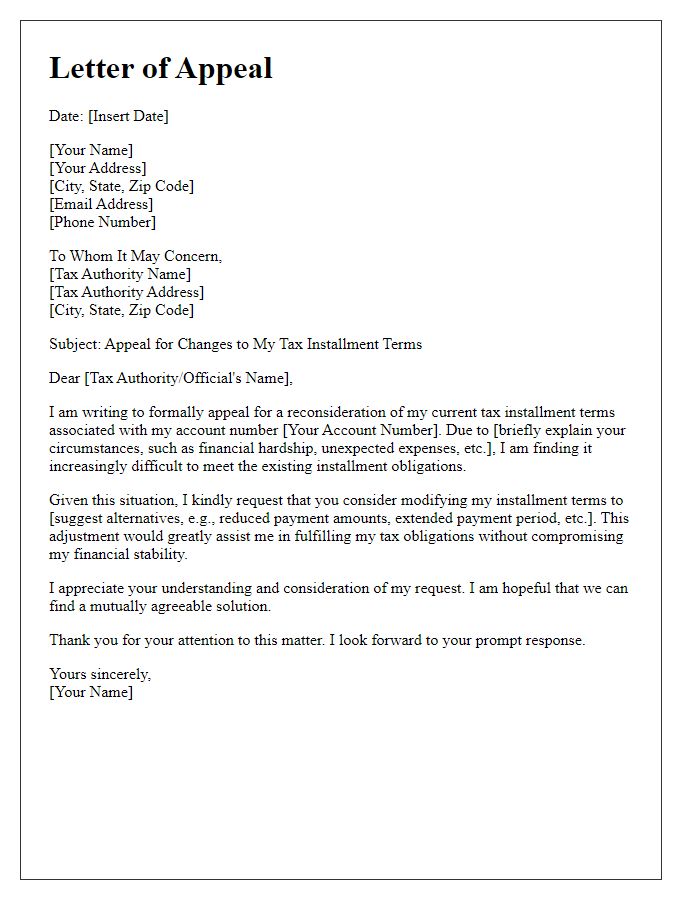

Proposed new payment terms

Tax installment agreement modifications may include updated payment terms to better suit financial circumstances. Taxpayers seeking to adjust monthly payments might propose a lower amount, for instance, a reduction from $300 to $200, based on altered income or increased expenses. This proposal should detail financial changes, like job loss or significant medical bills, to support the request. The modified agreement may extend the repayment period, for example, from 24 months to 36 months, providing relief while ensuring compliance with tax obligations. Clarity and accuracy in documenting these changes are crucial for successful negotiations with the tax authority, such as the Internal Revenue Service (IRS) in the United States.

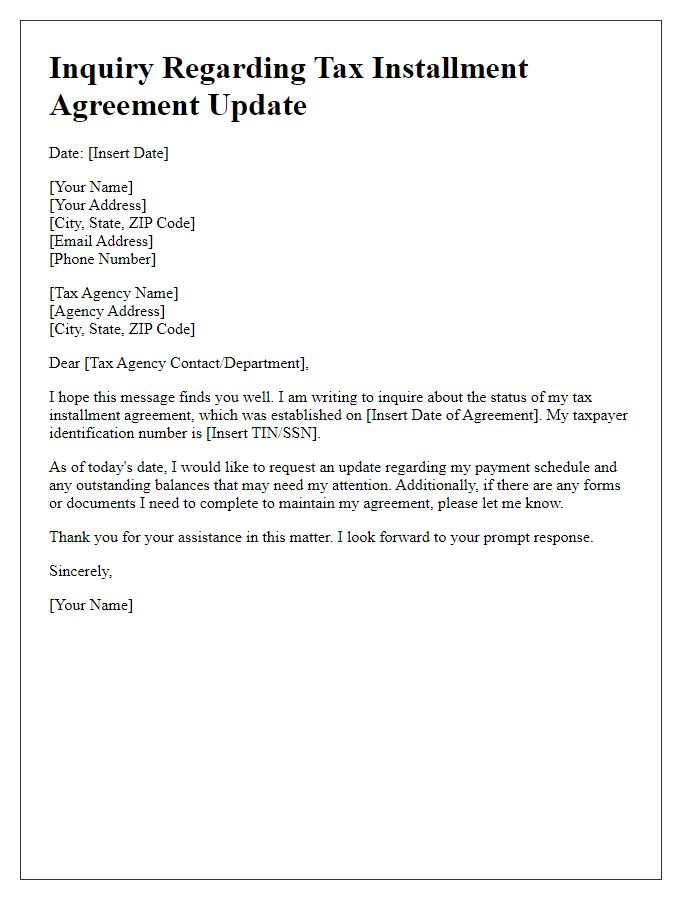

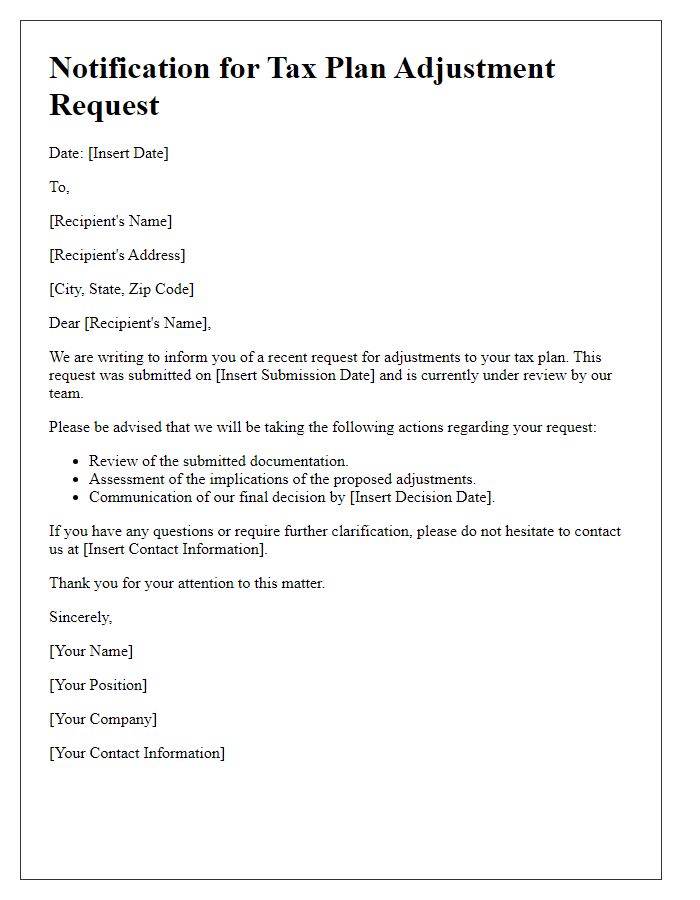

Contact information for follow-up

A tax installment agreement modification can significantly impact an individual's financial management strategy. When considering modification requests, individuals should provide updated contact information, including their home address, phone number, and email address to the Internal Revenue Service (IRS). This ensures smooth communication regarding the modified plan, including payment schedules, amounts, and potential fees associated with changes. Taxpayers should also reference their unique Taxpayer Identification Number (TIN) to facilitate efficient processing of their request. Providing comprehensive financial details, such as current income and expenses, can support the rationale for modification and ensure alignment with IRS requirements.

Comments