Are you curious about how to maximize your education tax benefits? Navigating the complexities of tax regulations can feel overwhelming, especially when it comes to figuring out your eligibility for education-related deductions and credits. Understanding these benefits not only helps reduce your tax burden but also supports your investment in education. Join us as we delve deeper into the specific criteria and tips that can help you take full advantage of these opportunities!

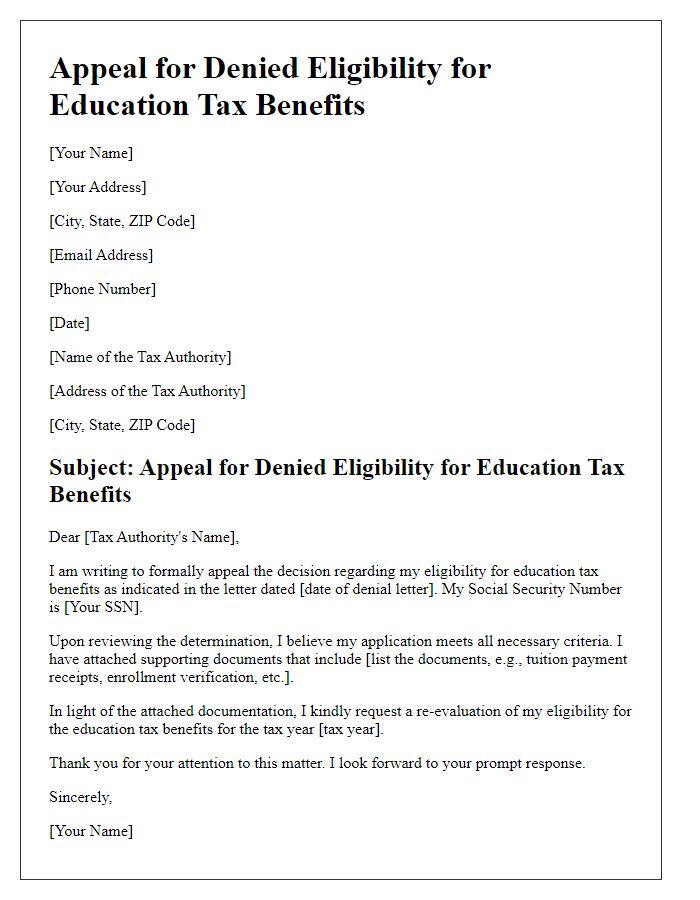

Applicant's personal and contact information

Education tax benefits play a crucial role in alleviating financial burdens associated with higher education expenses. Eligibility criteria for these benefits often include the applicant's level of enrollment, income limits, and type of institution attended, such as accredited colleges, universities, or vocational schools. Personal information includes full name, Social Security number, and date of birth, while contact information typically consists of a permanent address, phone number, and email address. For instance, a taxable income threshold often caps at around $70,000 for single filers, determining eligibility for credits like the American Opportunity Tax Credit or Lifetime Learning Credit. Accurate documentation is essential for verifying qualifications and maximizing potential financial aid.

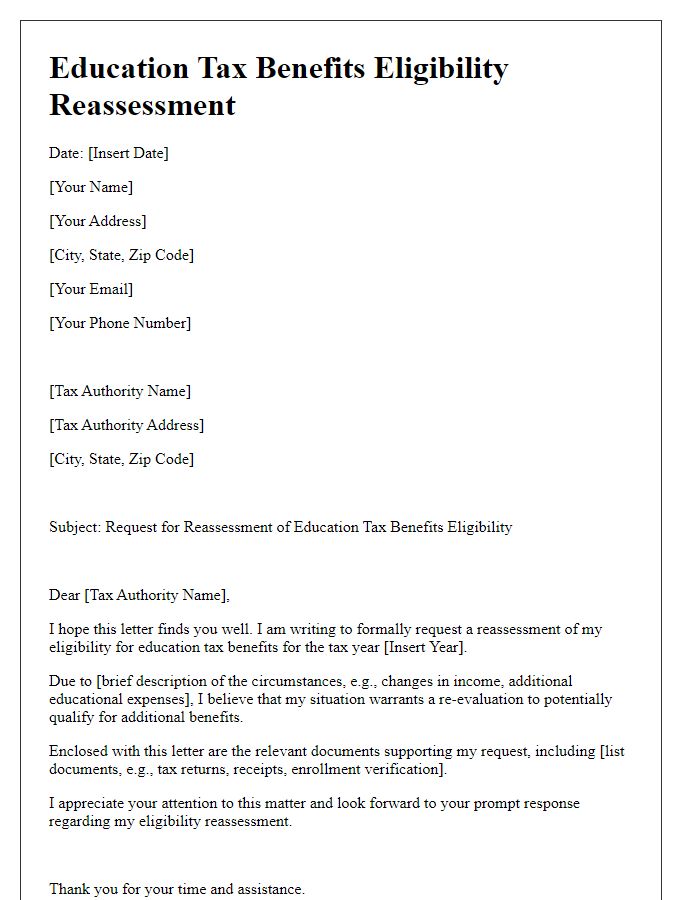

Verification of enrollment status

Educational institutions often require verification of enrollment status for determining eligibility for education tax benefits. This process typically involves confirming the student's active enrollment in qualified programs. For instance, full-time status at a community college, such as Los Angeles Community College, may impact eligibility for the American Opportunity Tax Credit, which can provide up to $2,500 per eligible student. Furthermore, institutions must often provide documentation, such as a current enrollment report, detailing course load, program duration, and attendance status. Accurate verification is essential for students seeking to reduce their tax burdens while pursuing higher education.

Detailed tax identification number

Educational tax benefits play a crucial role in alleviating financial burdens for students and their families. The Internal Revenue Service (IRS), established in 1862, offers various programs, such as the American Opportunity Tax Credit, which can provide up to $2,500 in tax credits per eligible student annually. To qualify for these benefits, individuals must possess a detailed tax identification number (TIN), which serves as a unique identifier for taxpayers within the IRS's database. This number can be either a Social Security Number (SSN) for citizens or a taxpayer identification number for non-residents. Accurate reporting of qualifying educational expenses, such as tuition, fees, and course materials, is essential to optimize claims for tax credits and deductions. Institutions like universities and community colleges often provide necessary documentation, including Form 1098-T, detailing tuition costs that further aid in determining eligibility for these beneficial programs.

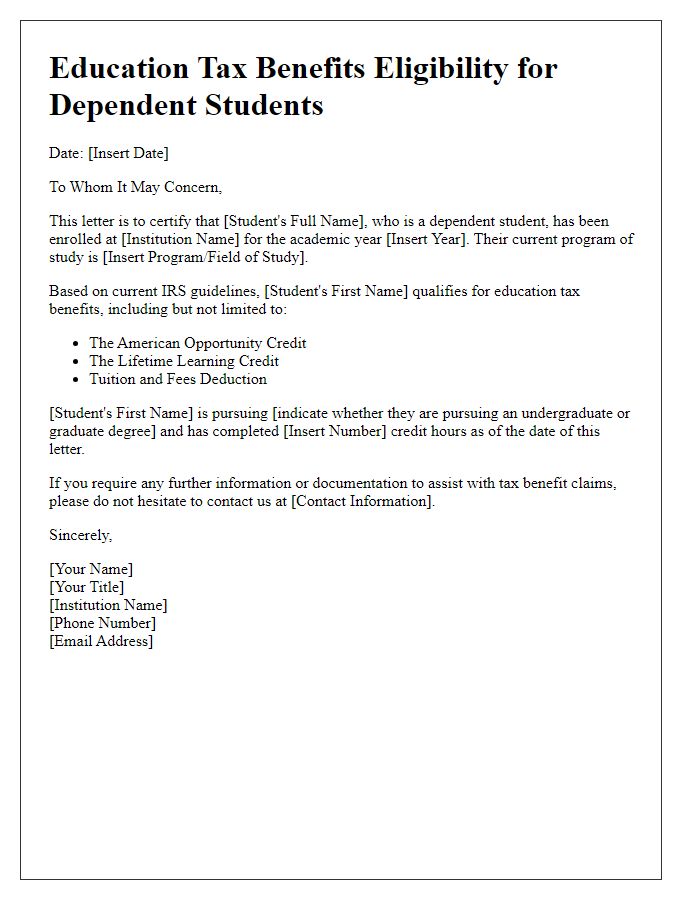

Documentation of qualified education expenses

Qualified education expenses include tuition fees, mandatory enrollment fees, and course materials required for attendance at accredited institutions, such as universities and colleges. Documentation for these expenses must be precise, including receipts or invoices that clearly outline the specific amounts paid (e.g., $10,000 for tuition at the University of California) and the date of payment (e.g., payment made on August 15, 2023). Additional qualifying expenses may include textbooks (for example, a $200 purchase at a local bookstore) and required equipment like computers or software programs, necessary for completing coursework. Ensure organized records of these documents, as they are essential for verifying eligibility for education tax benefits, such as the American Opportunity Tax Credit or Lifetime Learning Credit, when filing federal tax returns. Accurate documentation can lead to significant tax savings and provide clearer insight into overall educational expenditures.

Compliance with income eligibility criteria

Educational tax benefits, such as the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC), require compliance with specific income eligibility criteria. For the AOTC, an adjusted gross income (AGI) of below $80,000 for single filers (and $160,000 for married couples filing jointly) is essential to qualify for the full credit, providing taxpayers with up to $2,500 for qualified education expenses. The LLC allows individuals with an AGI of up to $58,000 (and $116,000 for married couples) to claim a credit up to $2,000 per tax return for post-secondary education expenses. Compliance with these income thresholds ensures taxpayers can benefit from significant tax savings while pursuing education at accredited institutions across the United States.

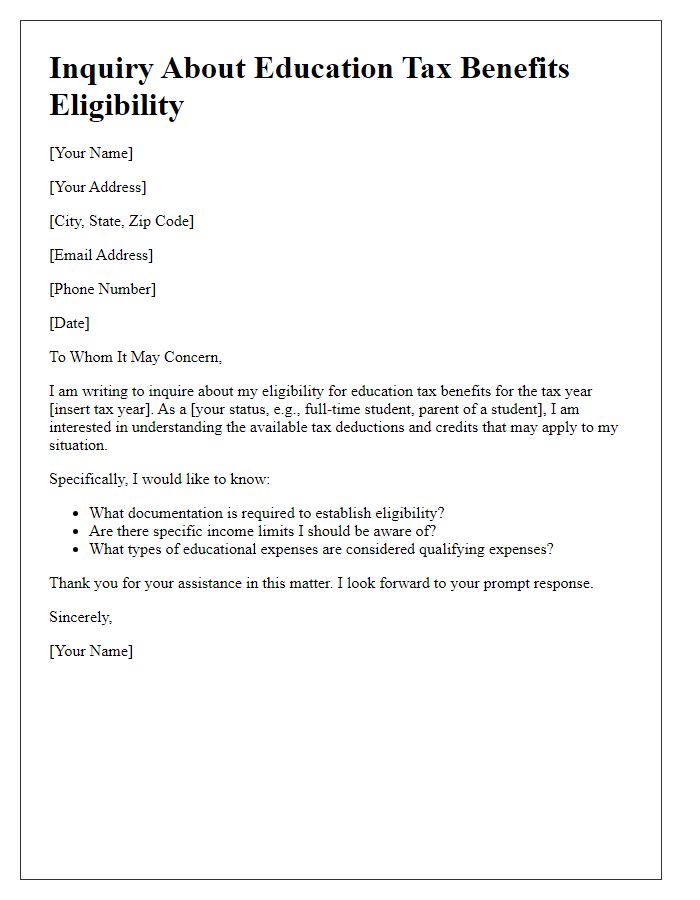

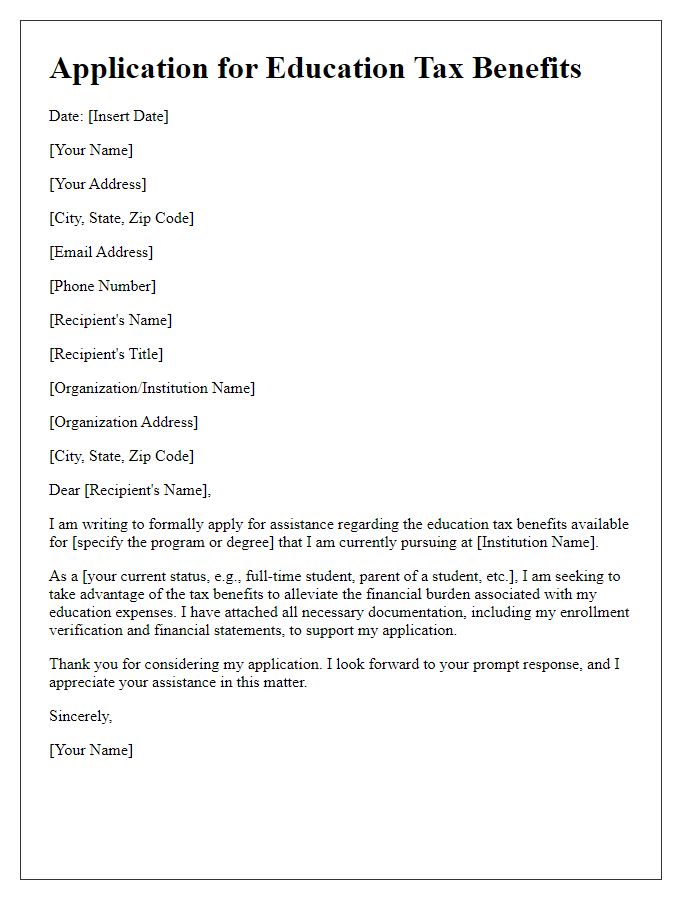

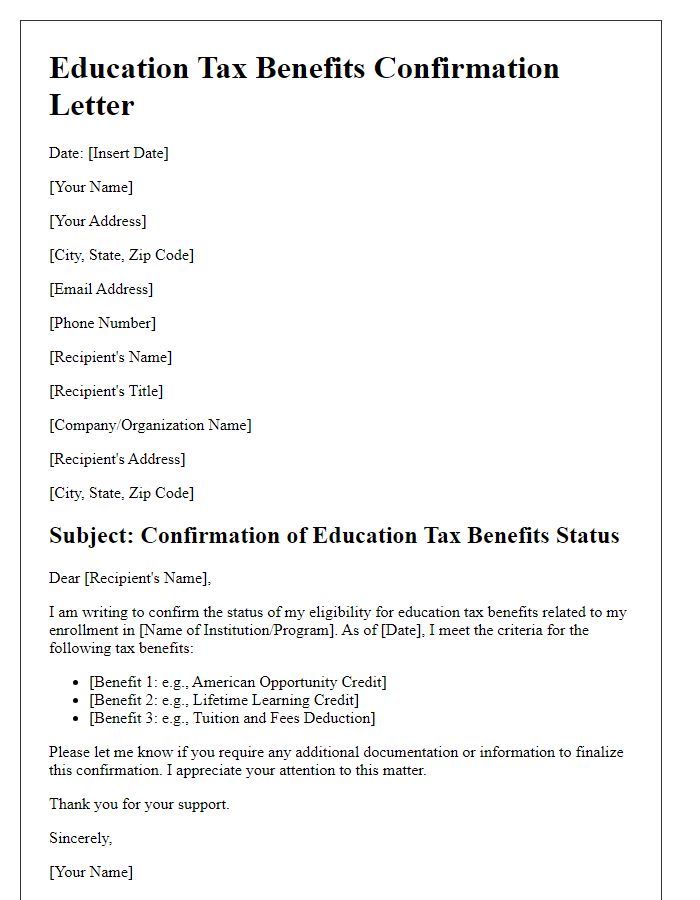

Letter Template For Education Tax Benefits Eligibility Samples

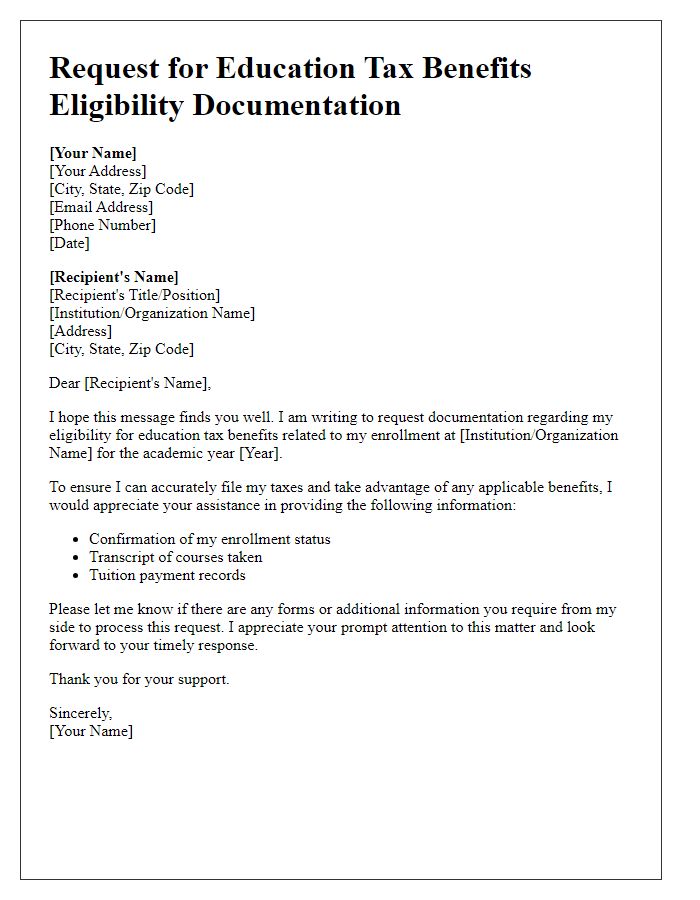

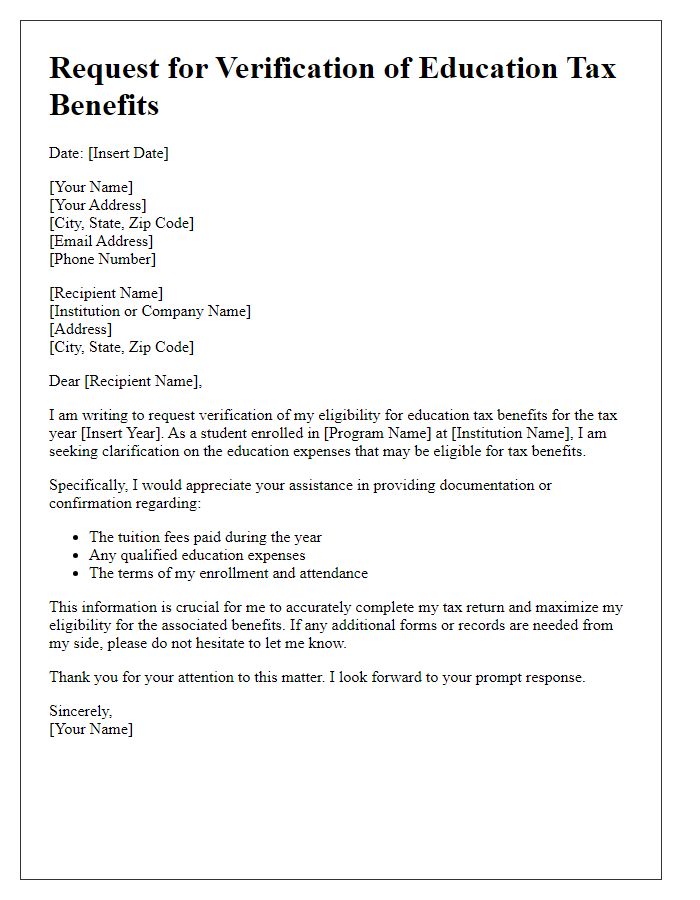

Letter template of education tax benefits eligibility documentation request

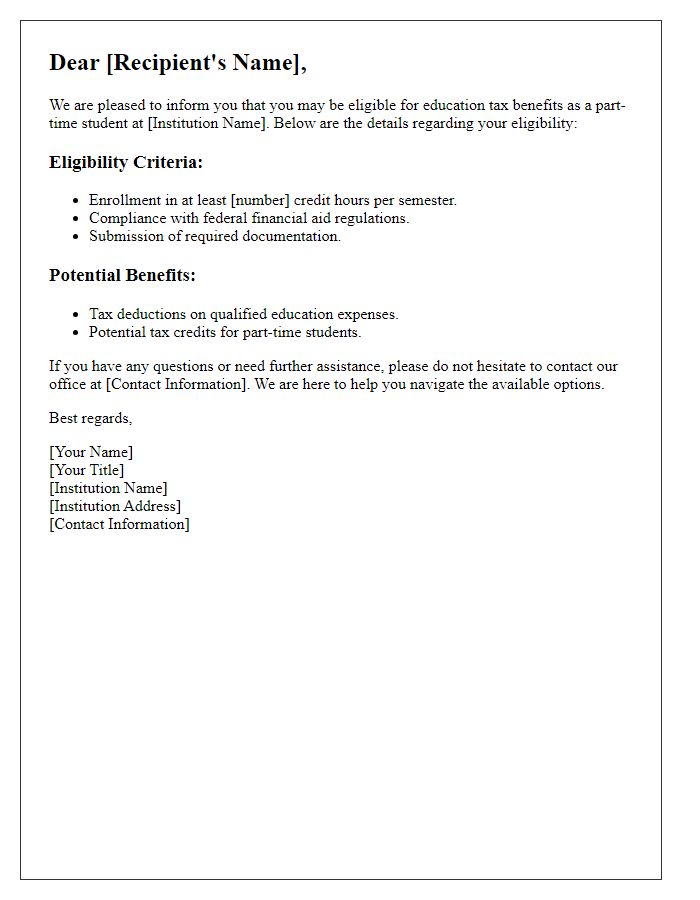

Letter template of education tax benefits eligibility for part-time students

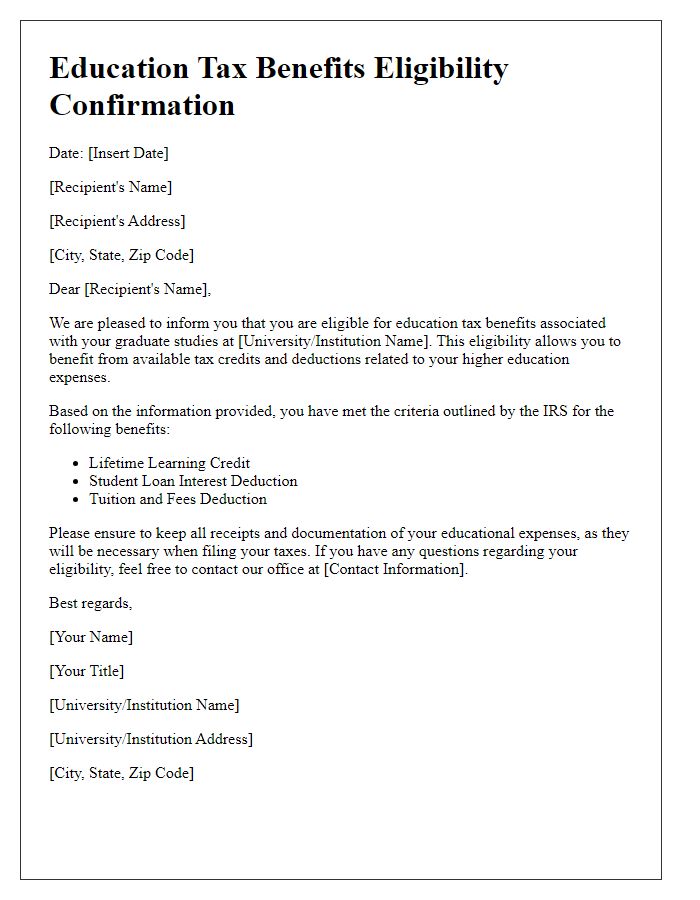

Letter template of education tax benefits eligibility for graduate studies

Comments