Are you gearing up for your accountancy tax certificate renewal but feeling a bit lost on where to start? Don't worry, you're not alone; many find the process daunting. In this article, I'll walk you through a simple letter template that ensures all essential details are covered, making your renewal experience smooth and stress-free. So, let's dive in and make sure your tax certificate renewal is a breeze!

Proper Salutation and Recipient Details

Tax certificate renewal is a critical process for maintaining compliance with the Internal Revenue Service (IRS) regulations. Accountants often facilitate this renewal for businesses and individuals requiring up-to-date documentation to avoid penalties. Important dates, such as the deadline for renewal, typically fall on April 15, aligning with the annual tax filing date in the United States. Recipient details should include the taxpayer's full name, mailing address, and taxpayer identification number to prevent any processing delays. Incorporating a professional salutation, like "Dear [Recipient's Name]," ensures proper etiquette in communication, enhancing the document's formal tone.

Certificate Reference Number

The accountancy tax certificate renewal process, particularly for a Certificate Reference Number (CRN) involves submitting essential documentation and information to ensure compliance with local tax regulations. Tax authorities typically require entities to provide their unique Certificate Reference Number, indicating the specific tax certificate associated with the organization. This process often includes filling out application forms, attaching documents such as proof of income, tax returns for the previous year, and pertinent financial statements. The deadline for submission is often stipulated by tax authorities, and late renewals may incur additional fees or penalties. Ensuring accurate completion of all required forms and timely submission is crucial for maintaining valid status.

Renewal Request Statement

A renewal request for an accountancy tax certificate is essential for maintaining compliance with local financial regulations. An updated certificate is necessary for firms and individuals to affirm their eligibility for tax-related activities. The renewal process often requires submission to authorities, such as the Internal Revenue Service (IRS) in the United States, or relevant financial oversight bodies specific to the jurisdiction. Key documents may include previous tax returns, proof of ongoing professional development, and updated business information. Timely renewal, typically recommended at least 30 days before expiration, helps avoid penalties or interruptions in service. Accurate recordkeeping ensures seamless processing and demonstrates adherence to the law.

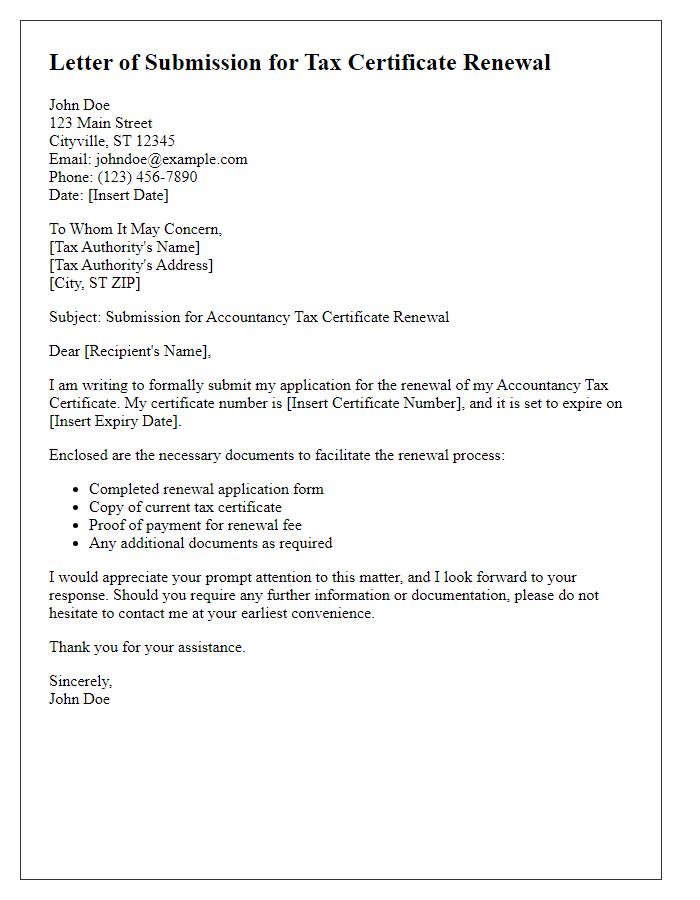

Required Documents and Information

To renew an accountancy tax certificate, specific documents and information are essential. Firstly, identification documents such as a government-issued ID (e.g., passport, driver's license) are required to verify identity. Secondly, previous tax returns (typically the last two years) must be submitted to demonstrate compliance with tax regulations. Additionally, a completed application form specific to the accountancy tax certificate must be provided, detailing current business activities and financial status. Proof of address, such as a utility bill or lease agreement, is necessary to confirm residency. Moreover, payment of renewal fees, which vary by jurisdiction, should be arranged to complete the renewal process. Finally, any additional documentation requested by the local tax authority must be included for a successful renewal.

Contact Details for Queries

The renewal process for an accountancy tax certificate typically requires clear communication and designated contact points for queries. Utilize dedicated email addresses or phone numbers, such as a support line (e.g., +1-800-555-0199) specifically for tax inquiries. Consider including office locations, such as the headquarters in New York City or regional offices in Chicago, to enhance accessibility. Ensure that working hours (e.g., Monday to Friday, 9 AM to 5 PM) are specified to manage expectations for response times. Additionally, providing a FAQ section can assist clients with common questions, streamlining the renewal process effectively.

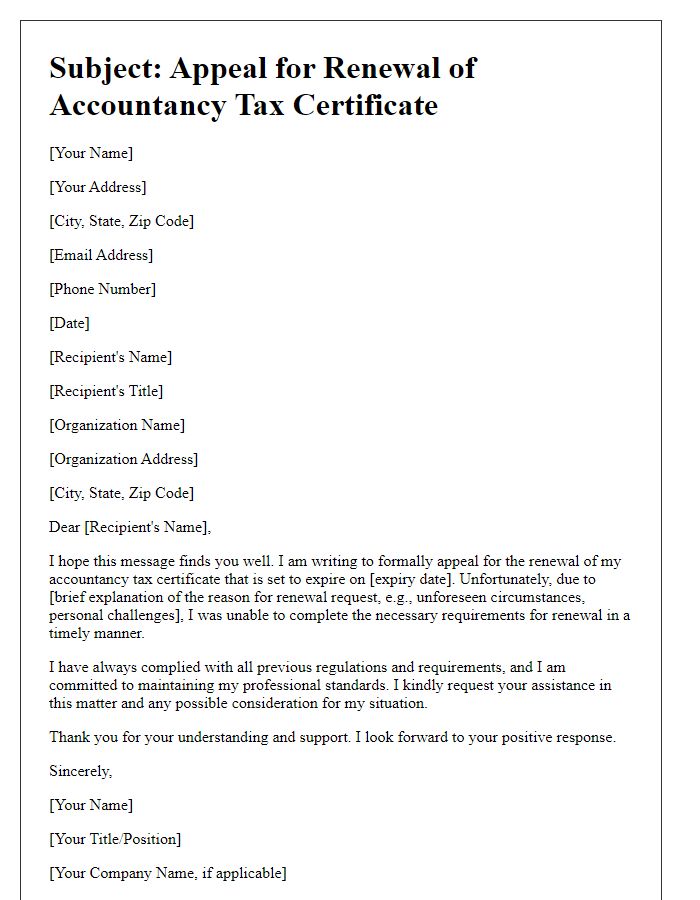

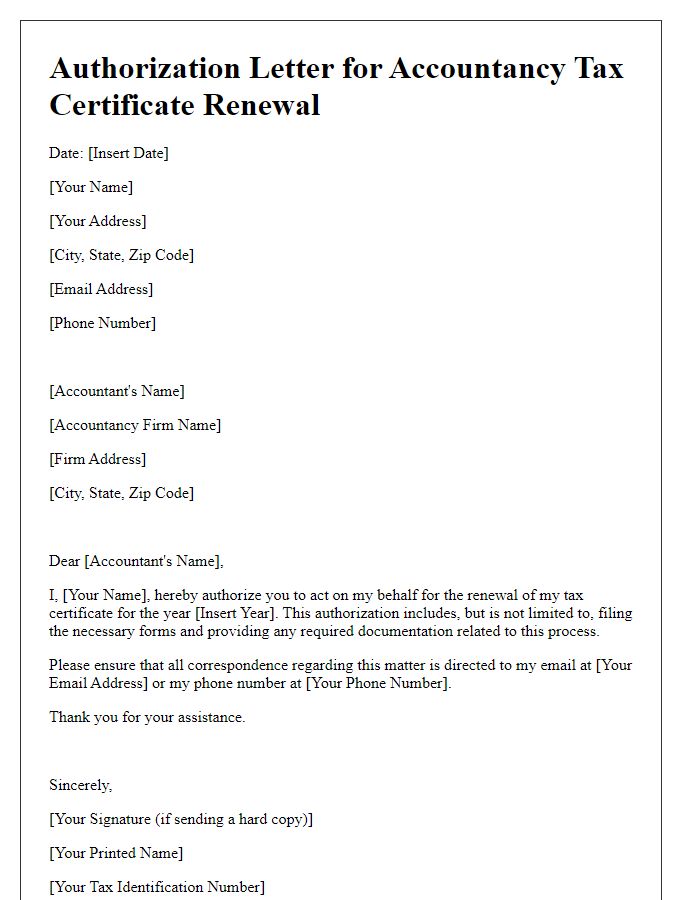

Letter Template For Accountancy Tax Certificate Renewal Samples

Letter template of inquiry regarding accountancy tax certificate renewal

Letter template of acknowledgement for accountancy tax certificate renewal

Comments