Are you ready to dive into the details of your annual tax deduction summary report? We know tax season can be overwhelming, but understanding your deductions can help you maximize your refund and minimize your stress. In this article, we'll break down everything you need to know about preparing your tax deduction summary, from the essential information to include to tips for making the process smoother. So, grab a cup of coffee and join us as we explore the ins and outs of your annual tax summary report!

Taxpayer Information

Taxpayer information includes essential personal details such as full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and contact information. The taxpayer's residential address, including street, city, state, and ZIP code, is vital for accurate processing. The reporting year, typically specified as January 1 to December 31, is included to determine the relevant tax period. Additionally, income sources must be outlined, including wages, self-employment income, and dividends. Finally, any applicable deductions or credits claimed should be documented, as these can significantly influence the final tax liability and potential refunds, usually filed with the Internal Revenue Service (IRS).

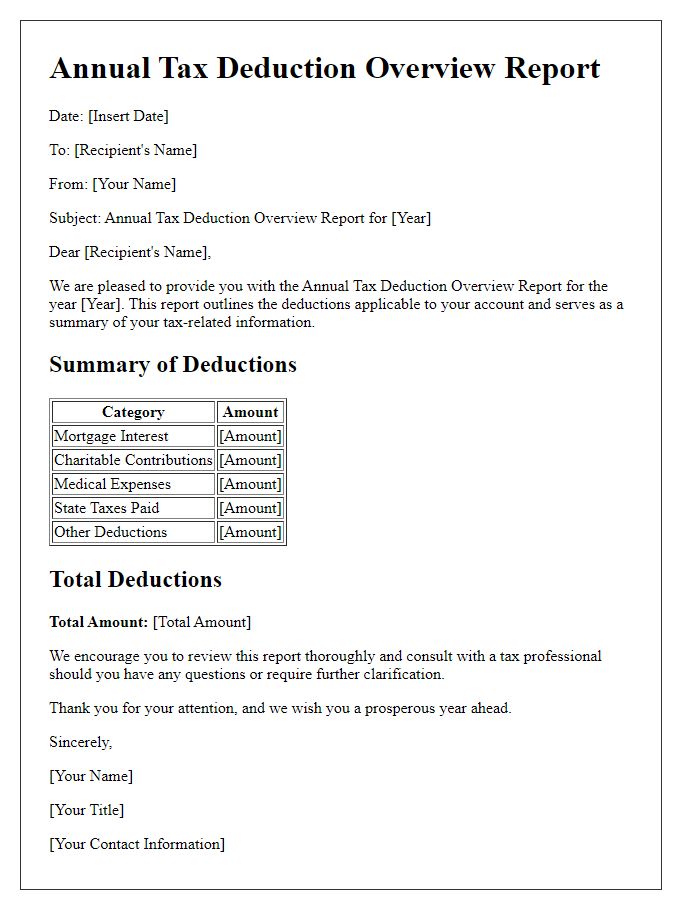

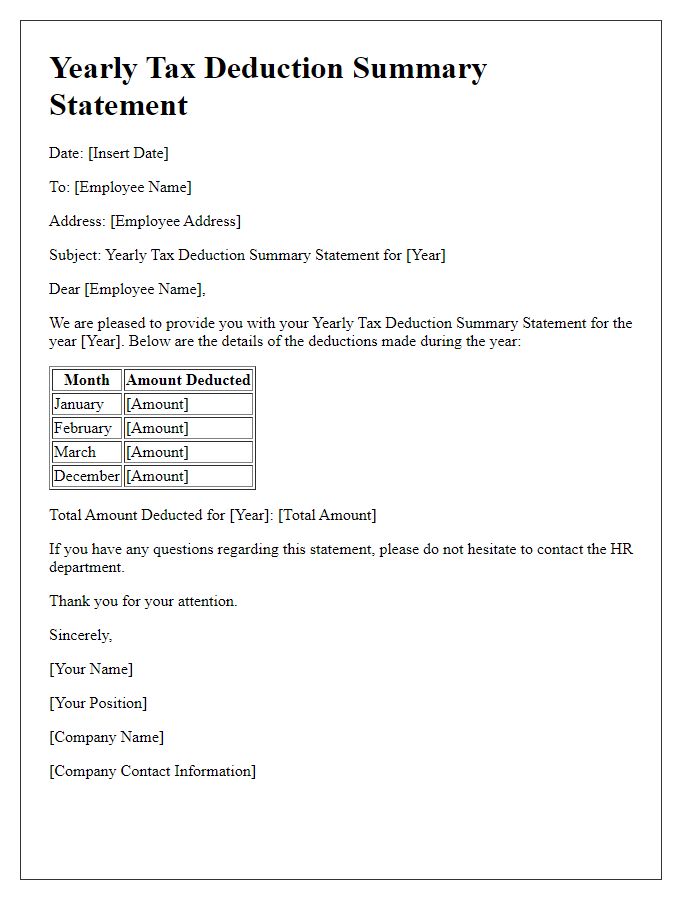

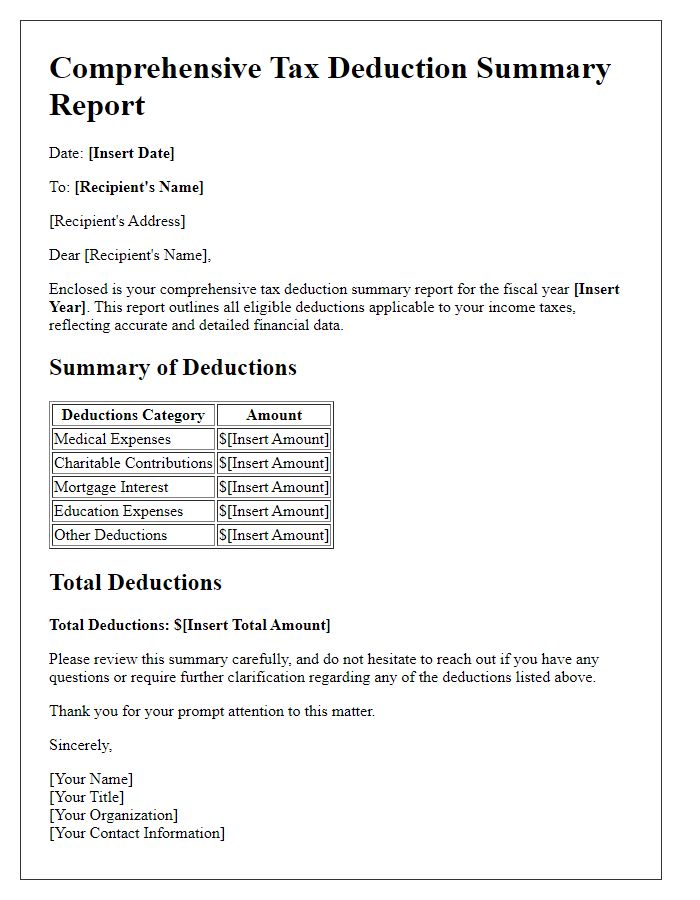

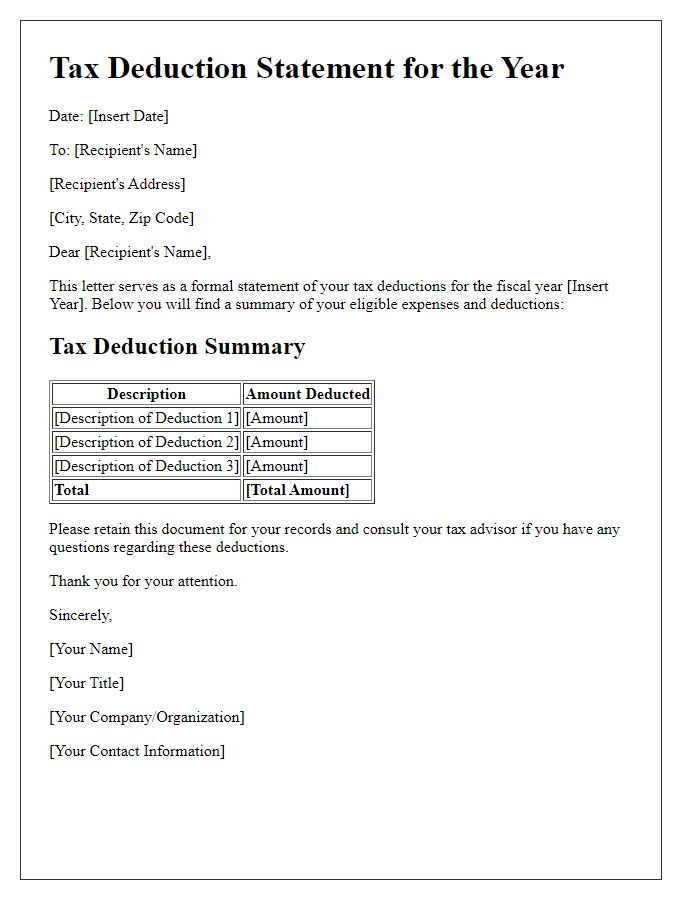

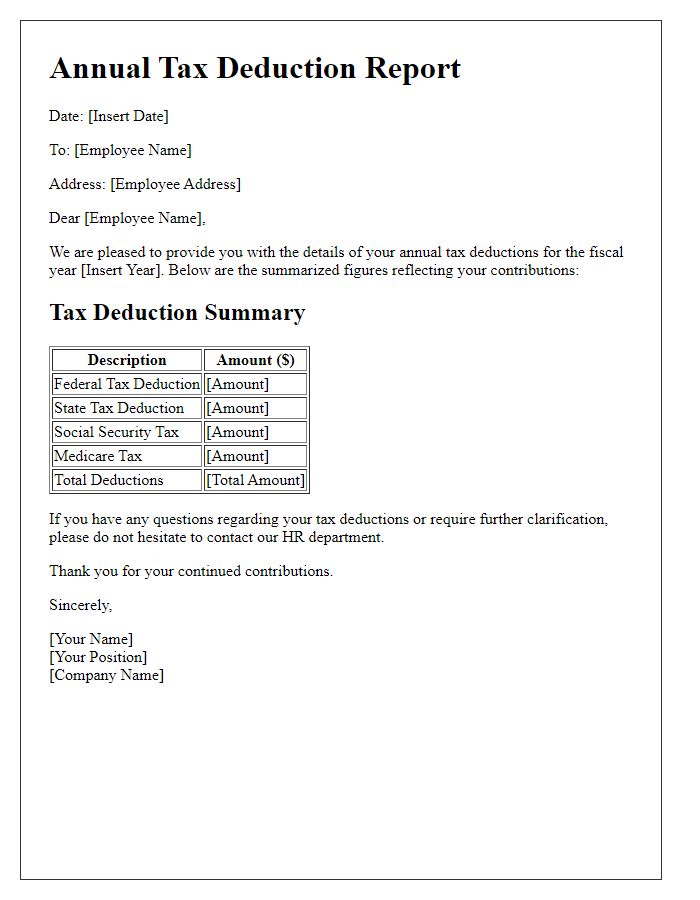

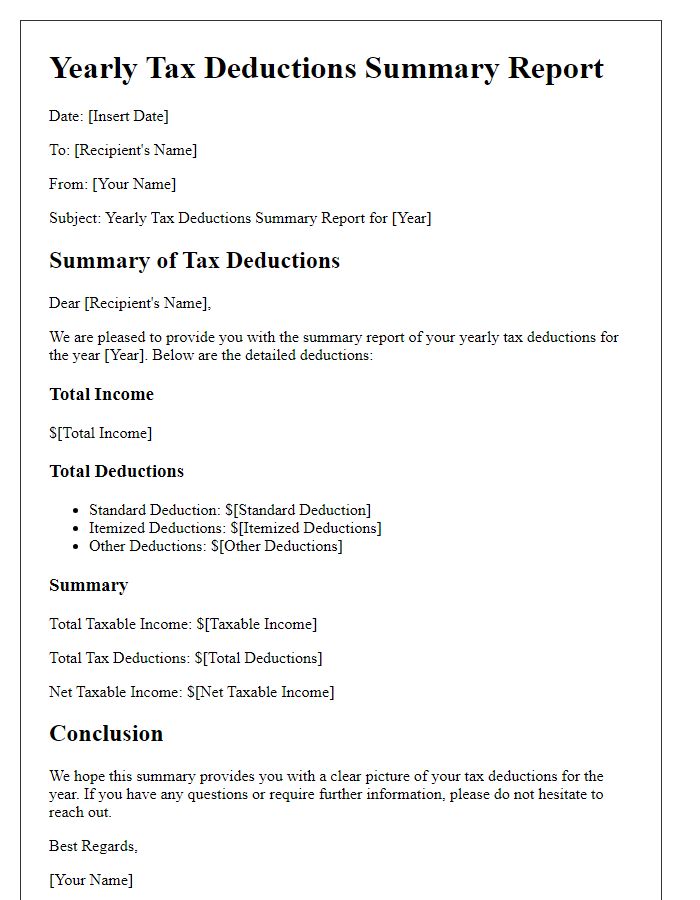

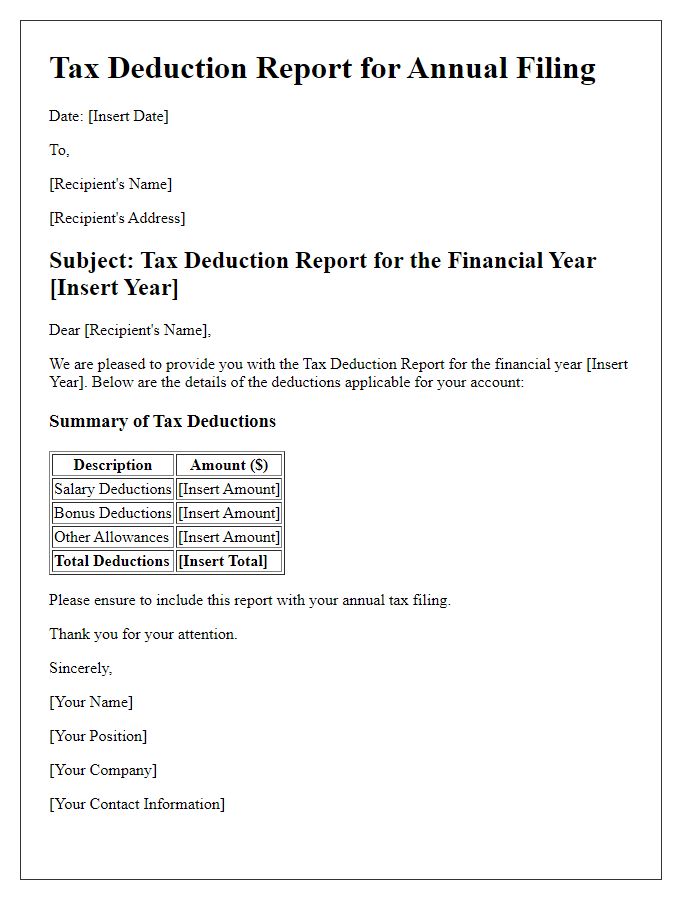

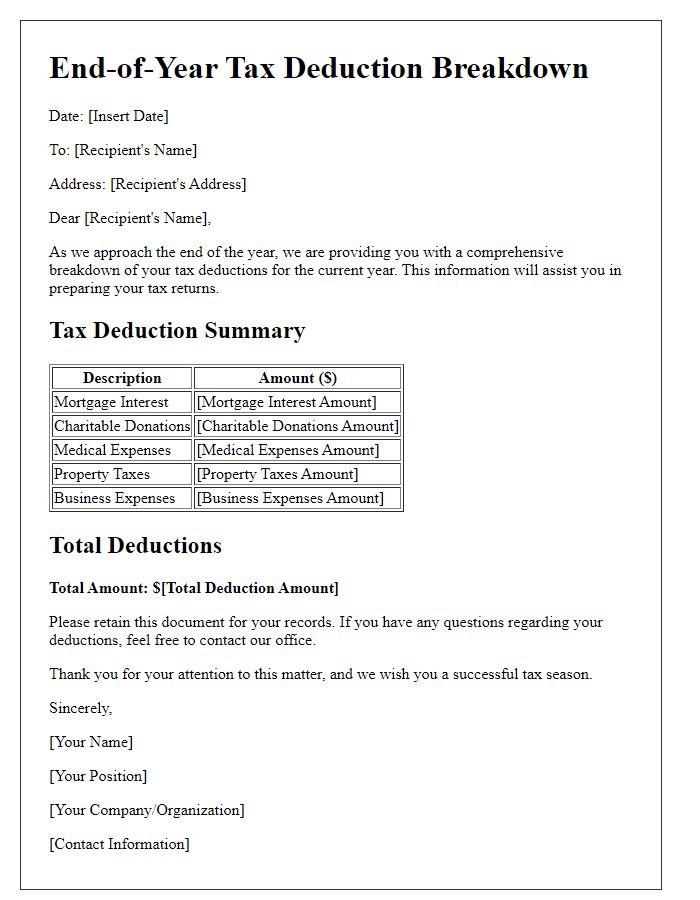

Summary of Deductions

The annual tax deduction summary report provides a detailed overview of eligible deductions that taxpayers can claim. Common categories include mortgage interest payments, which can significantly reduce taxable income by thousands of dollars, medical expense deductions that may allow taxpayers to deduct out-of-pocket costs exceeding 7.5% of adjusted gross income (AGI), and charitable contributions which can lead to deductions for cash donations or valued goods to registered organizations. Business expenses, crucial for self-employed individuals, can include costs related to travel, supplies, and home office, potentially resulting in substantial savings. Educational expenses such as tuition and fees may also qualify for deduction, impacting the overall tax burden. The report ensures clarity for both individual taxpayers and financial advisors in navigating the evolving tax regulations and maximizing deductions.

Supporting Documentation List

The annual tax deduction summary report outlines essential supporting documentation necessary for accurate tax filings, such as W-2 forms (showing annual wages and tax withheld), 1099 forms (indicating income from self-employment or freelance work), receipts (verifying deductible expenses like business costs or charitable donations), bank statements (confirming income deposits and expenses), and records of property taxes (detailing amounts paid for real estate). Additionally, documentation may include proof of medical expenses (invoices or bills from healthcare providers), educational expense receipts (tuition statements from accredited institutions), and IRS forms (like Schedule A for itemized deductions). Ensuring comprehensive and organized documentation aids in maximizing eligible deductions and supports compliance during audits.

Contact Information

The annual tax deduction summary report includes essential contact information for accurate processing and communication. The name of the individual or organization submitting the report is critical, alongside the complete address (including street number, city, state, and postal code), which ensures proper record-keeping. A primary phone number (preferably a landline) and secondary email address facilitate prompt communication regarding any queries or clarifications. Additionally, the inclusion of a tax identification number (TIN) or employer identification number (EIN) is crucial, as it links the report to the respective tax records in databases managed by agencies like the Internal Revenue Service (IRS) in the United States. Ensuring this information is clearly presented enhances the report's legitimacy and expedites review processes.

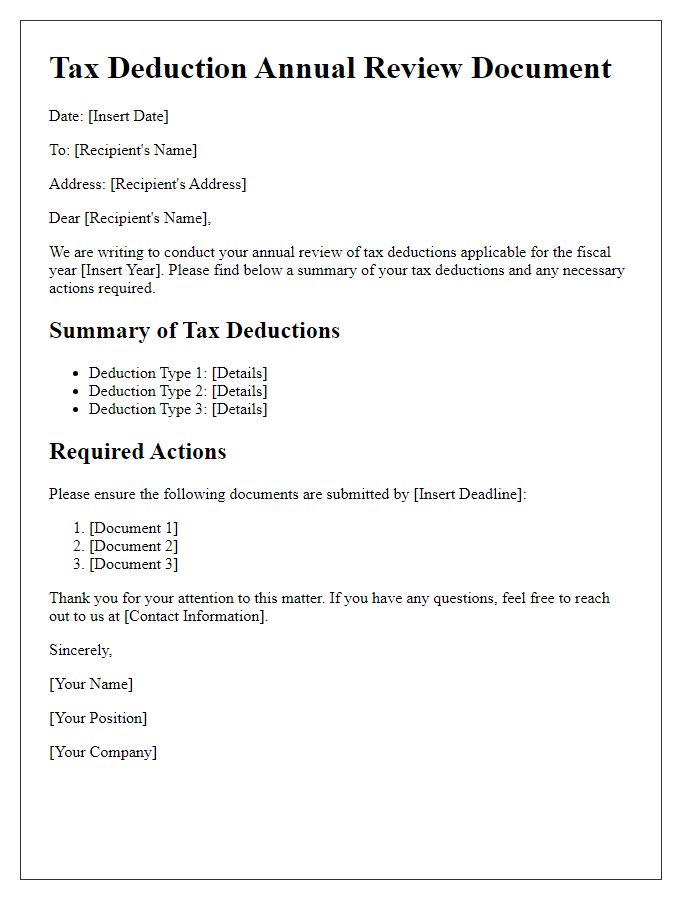

Compliance and Disclosure Notes

The annual tax deduction summary report for the fiscal year 2023 outlines critical compliance benchmarks required by the Internal Revenue Service (IRS) for individual taxpayers and corporations alike. Key elements include itemized deductions such as mortgage interest (capped at $750,000 for new loans), state and local taxes (with a limit of $10,000), charitable contributions (with varying limits based on income percentages), and healthcare expenses exceeding 7.5% of adjusted gross income. This report also addresses the disclosure requirements mandated by the IRS, detailing necessary transparency in taxpayer information, particularly regarding foreign assets (including accounts exceeding $10,000), and any applicable penalties for non-compliance. The summary aims to facilitate an understanding of deductions and ensure accurate filing to avoid potential audits, while providing taxpayers with essential information to maximize their tax benefits efficiently.

Comments