Are you feeling overwhelmed by the stress of a late tax filing penalty? You're not aloneâmany find themselves in this frustrating situation, but the good news is that there are ways to dispute those penalties. In this article, we'll walk you through a helpful letter template that you can use to effectively communicate your case to the IRS. So, grab a cup of coffee and let's dive into how you can potentially resolve this issue with confidence!

Taxpayer Identification Information

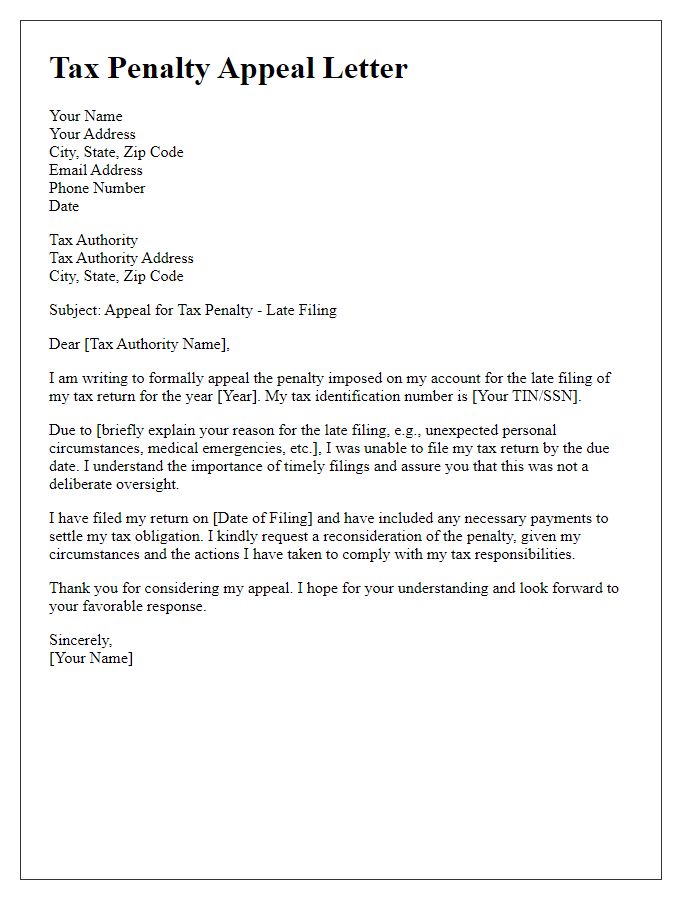

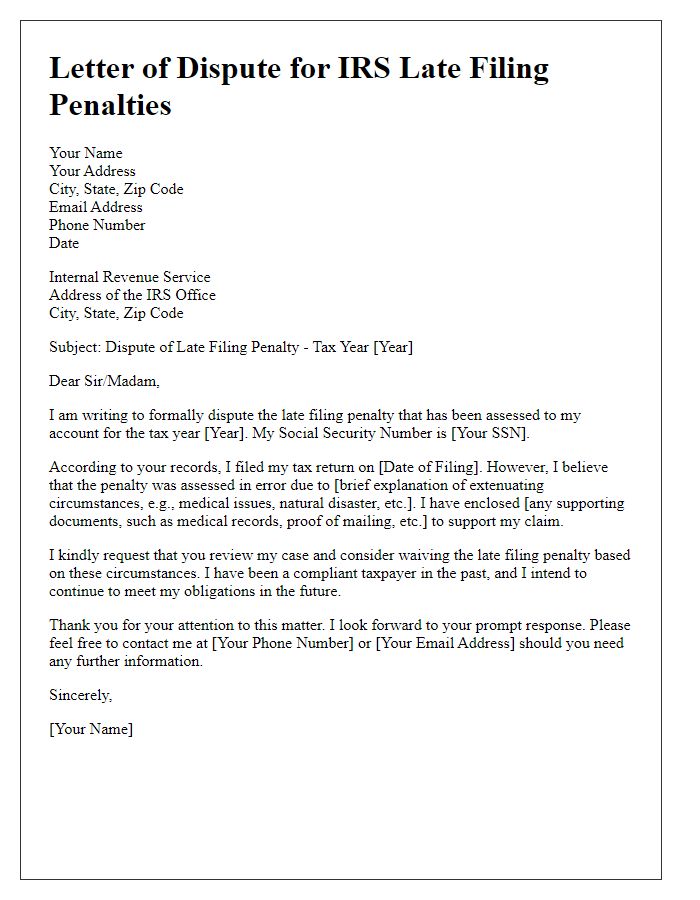

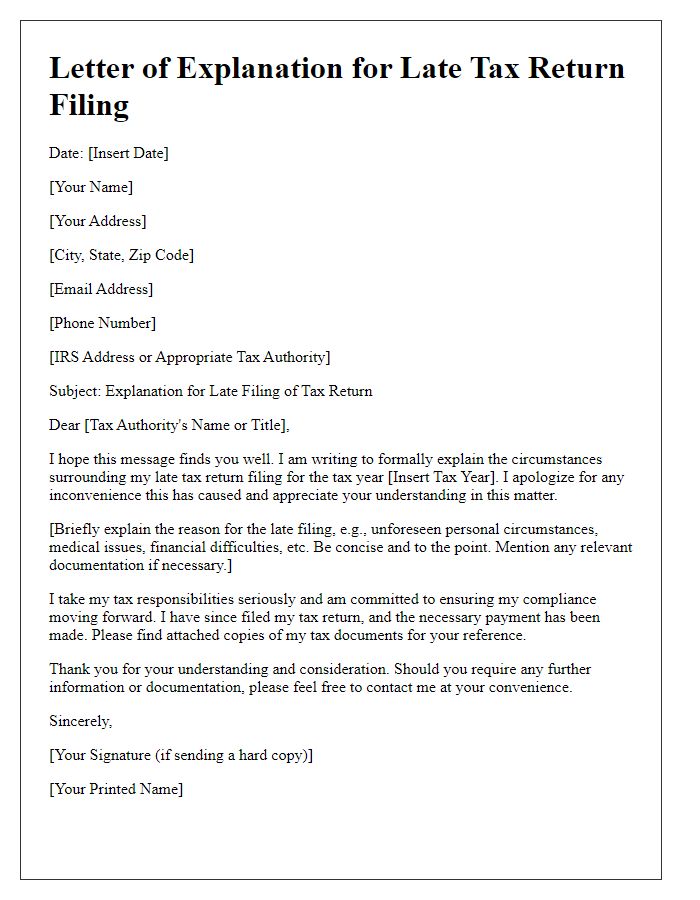

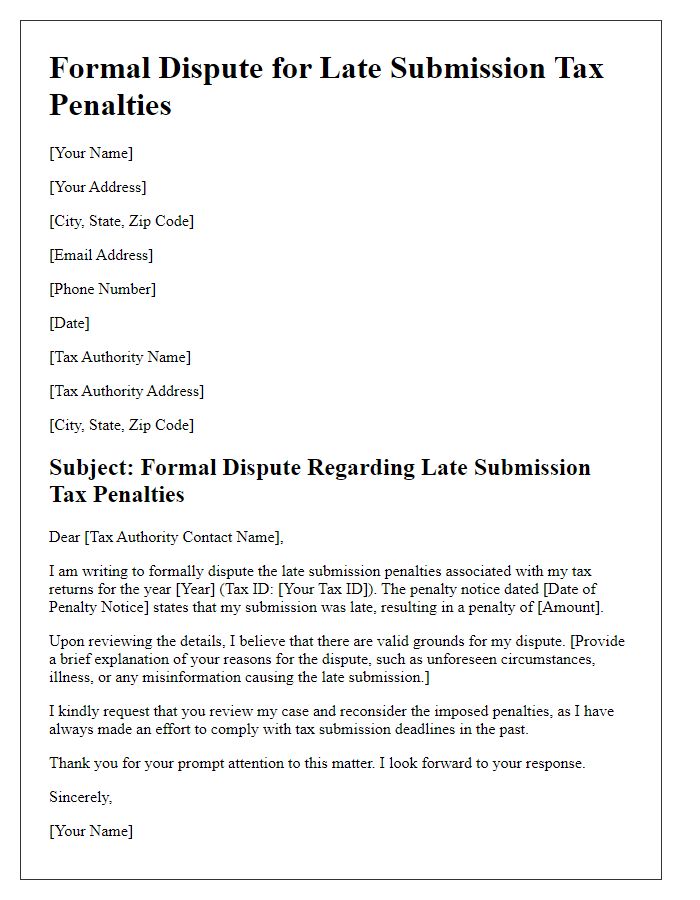

A dispute regarding late tax filing penalties often hinges on accurate taxpayer identification information, which typically includes the Tax Identification Number (TIN), Social Security Number (SSN) for individuals, or Employer Identification Number (EIN) for businesses. This information is crucial for the Internal Revenue Service (IRS) to accurately associate the penalty dispute with the taxpayer's account. Details such as the tax year in question, the specific penalty amount levied, and any correspondence received from the IRS regarding the penalty are vital for the context. Additionally, including supporting documents, such as proof of timely filing (like confirmation receipts or postal service records), can enhance the validity of the dispute and provide necessary clarity to the reviewing agent.

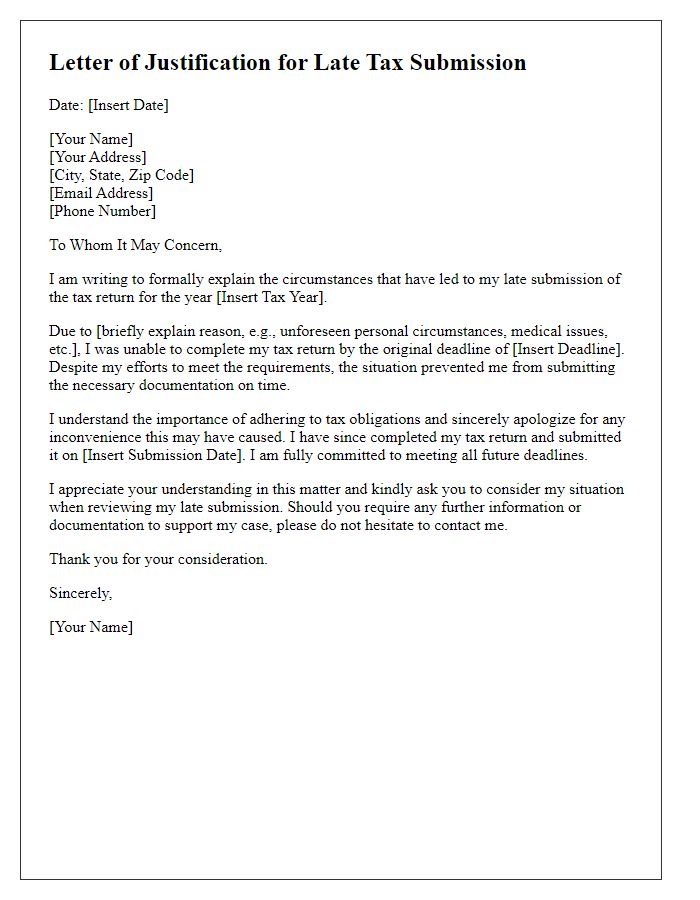

Explanation of Delay Circumstances

Individuals can experience delays in tax filing due to various personal circumstances. Medical emergencies can incapacitate taxpayers, such as hospital stays or serious illnesses, leading to inability to gather necessary documents. Unexpected life events, including job loss or family emergencies, may also hinder timely filing. Additionally, technical issues with digital tax platforms can result in filing delays, affecting individuals who rely on e-filing services. Natural disasters, like hurricanes or floods, can disrupt lives and prevent access to essential documents, causing further delays. Understanding these factors can provide context for penalty disputes related to late tax filings.

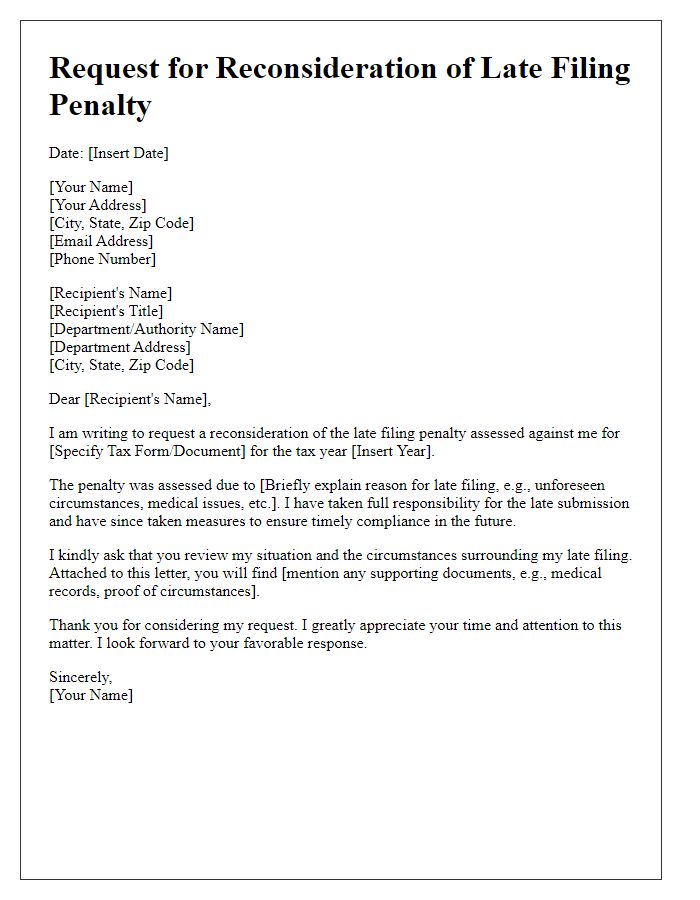

Evidence or Supporting Documents

To dispute a late tax filing penalty with supporting evidence, it's important to focus on specific documentation that substantiates your claim. Gathering essential documents such as IRS notices, prior tax returns, bank statements, and proof of timely efforts to file, like dated correspondence or receipt confirmations, is crucial. Include details like the tax year in question, specific dates (for example, if the return was submitted on March 15 instead of April 15), and relevant tax forms (such as Form 1040 or Form 941). Additionally, note any extenuating circumstances (such as natural disasters or medical emergencies) that affected timely filing to strengthen your position. These elements collectively provide the necessary context and credibility to support your dispute effectively.

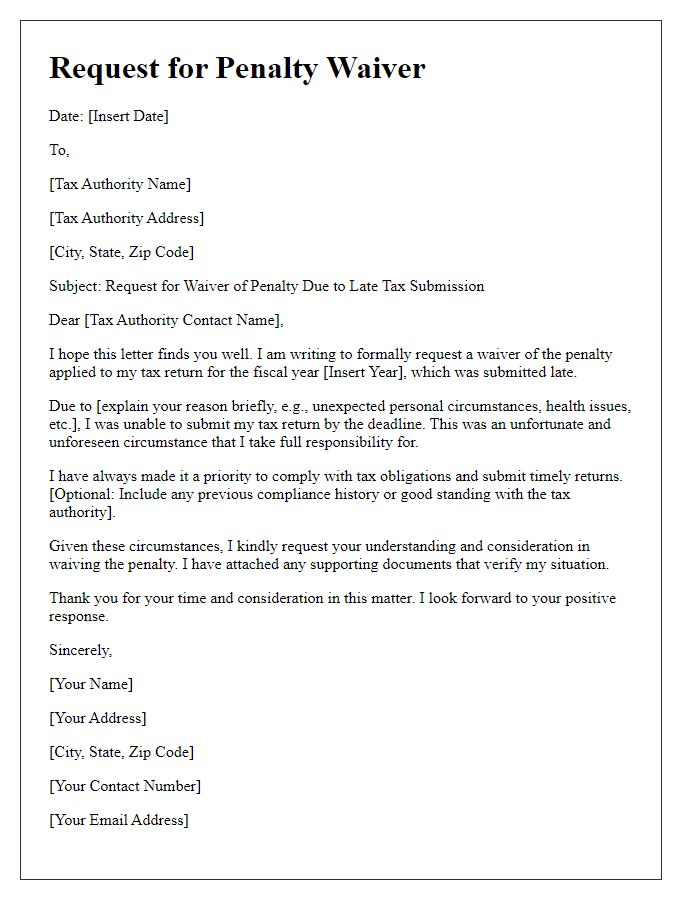

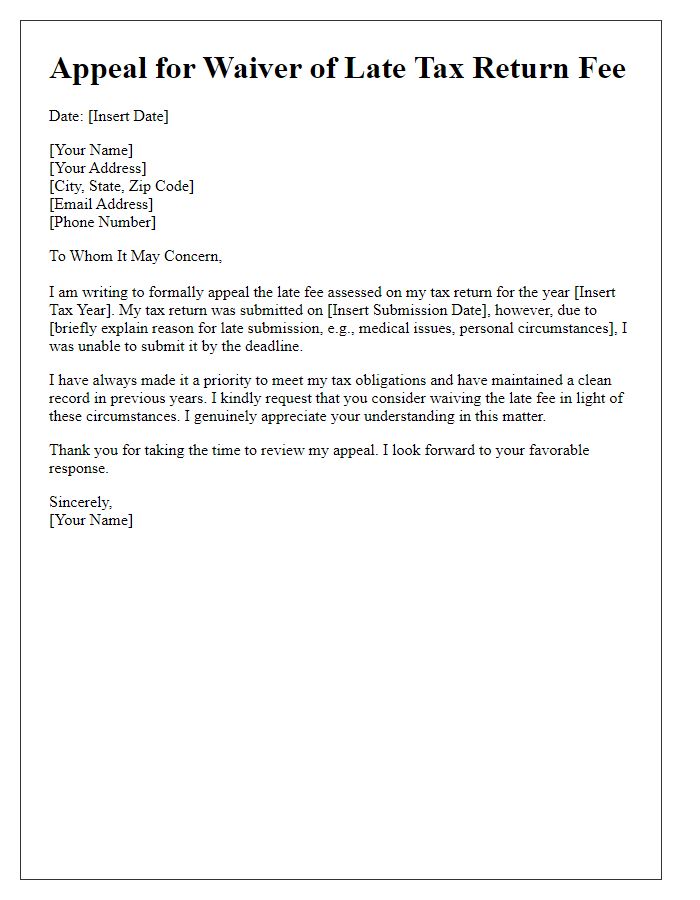

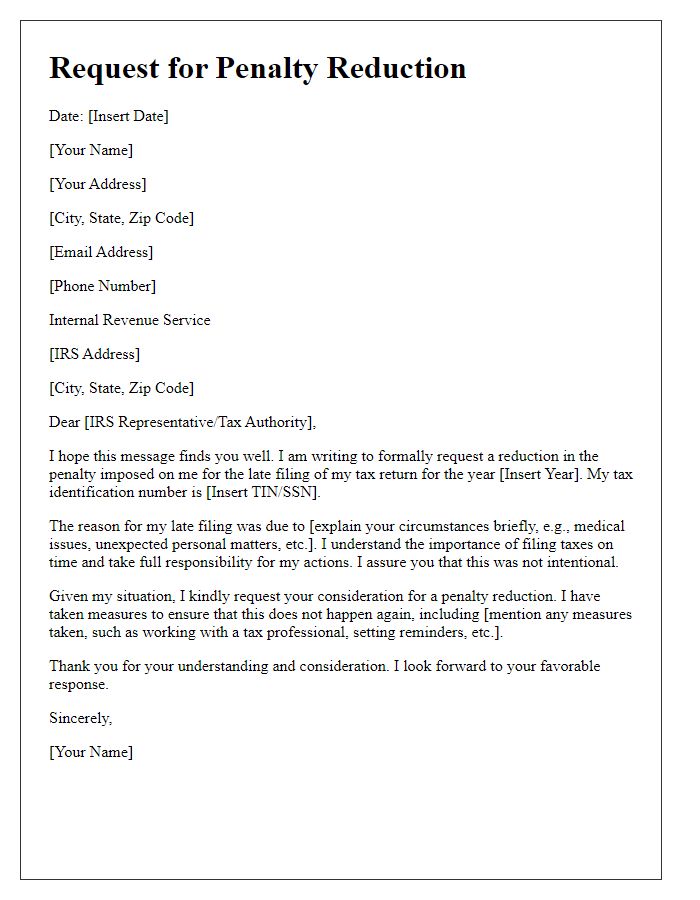

Request for Penalty Waiver

Late tax filings can result in significant financial repercussions, such as penalties imposed by the Internal Revenue Service (IRS) in the United States. Taxpayers may encounter penalties, often calculated as a percentage of unpaid taxes, that can accumulate rapidly over time. The penalty rate for late filing typically amounts to 5% of the unpaid taxes per month, with a maximum penalty cap of 25%. Certain qualifying circumstances, such as natural disasters in places like Florida or a serious illness, may warrant a request for a penalty waiver. To initiate this process, taxpayers must provide specific documentation supporting their claims, including financial records, communication with tax professionals, or medical documents that verify their situation.

Contact Information for Follow-Up

When disputing a late tax filing penalty, it is crucial to provide accurate contact information for effective follow-up. Use precise details such as your full name, Social Security Number (last four digits), and their tax identification number if applicable. Include a current phone number, ideally direct, to ensure the IRS can reach you quickly. Additionally, provide an email address, as digital communication may expedite responses. Address the envelope to the specific IRS office listed on the penalty notice, possibly in Ogden, Utah, where many tax disputes are directed. Include a clear subject line in your correspondence referencing the penalty notice number for quick identification. Consider attaching previous correspondence or proof of timely filing to further support your dispute.

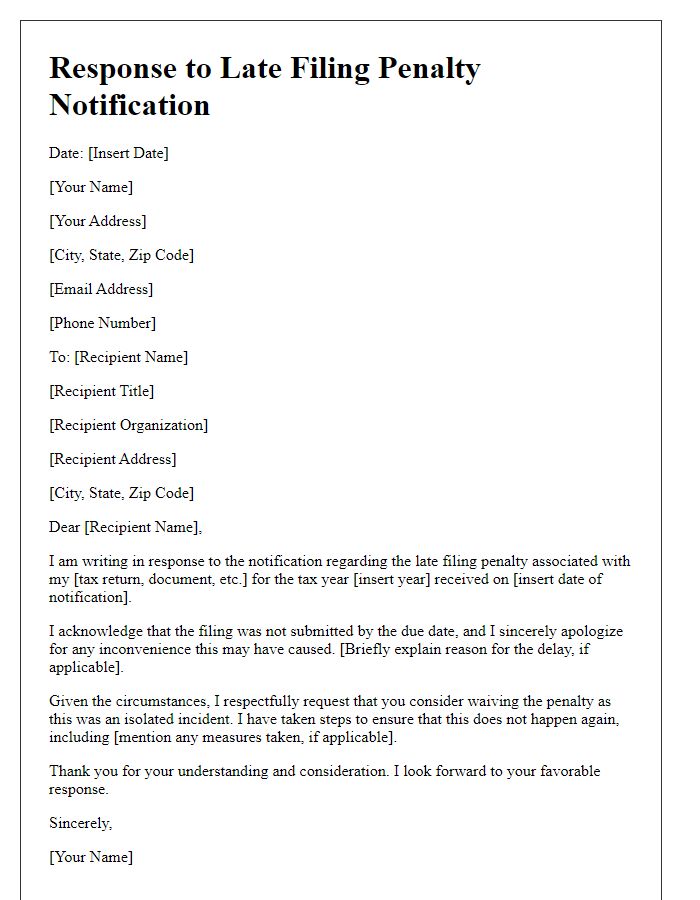

Letter Template For Late Tax Filing Penalty Dispute Samples

Letter template of request for penalty waiver due to late tax submission

Comments