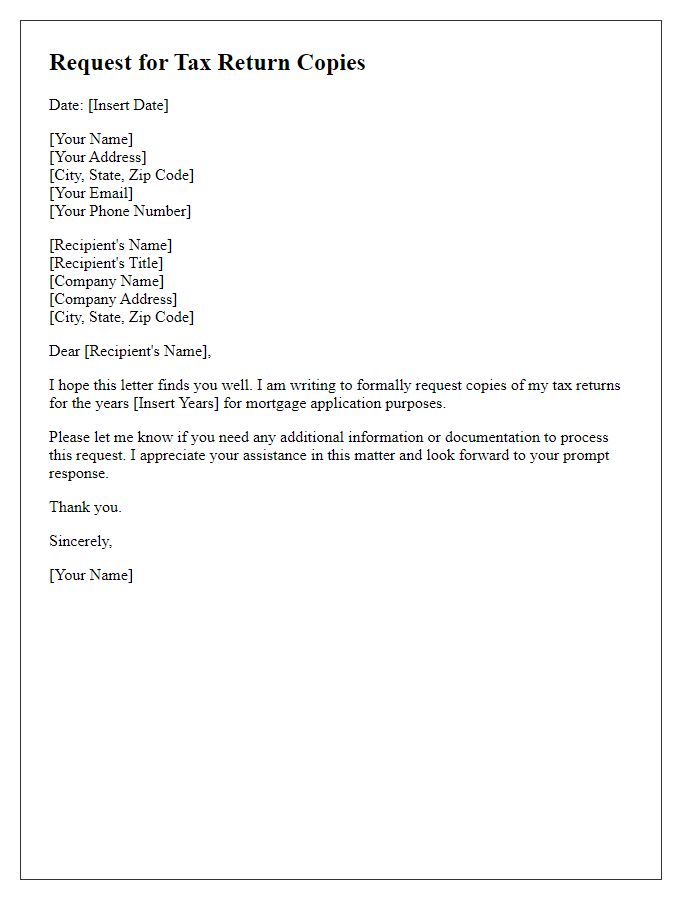

Are you looking to get your hands on copies of your tax returns? Whether it's for personal record-keeping, loan applications, or financial planning, requesting these documents doesn't have to be a headache. In this article, I'll guide you through a simple and effective letter template that will help ensure your request is clear and precise. So, let's dive in and make that process as smooth as possible!

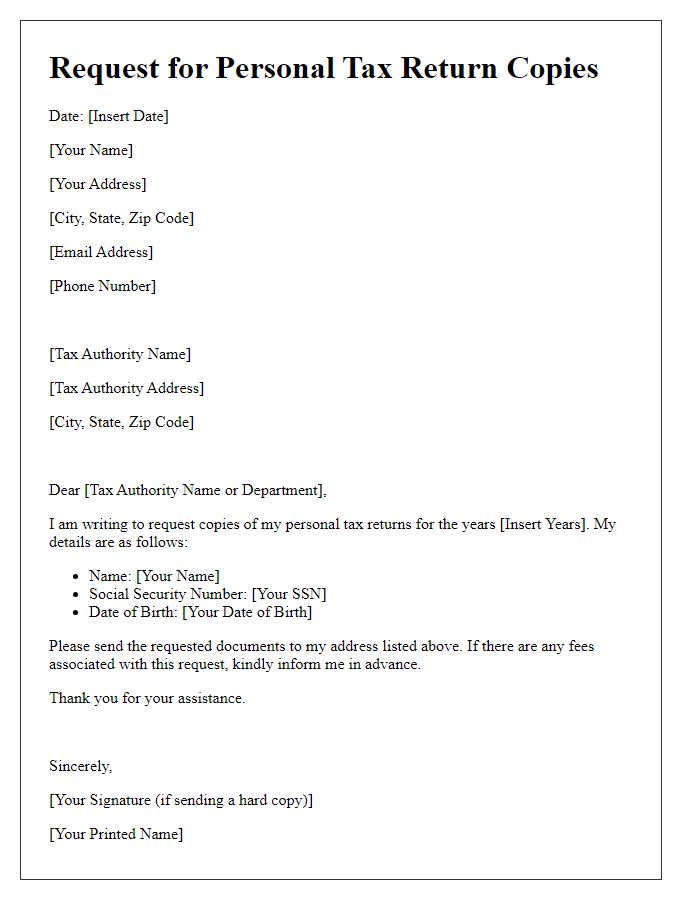

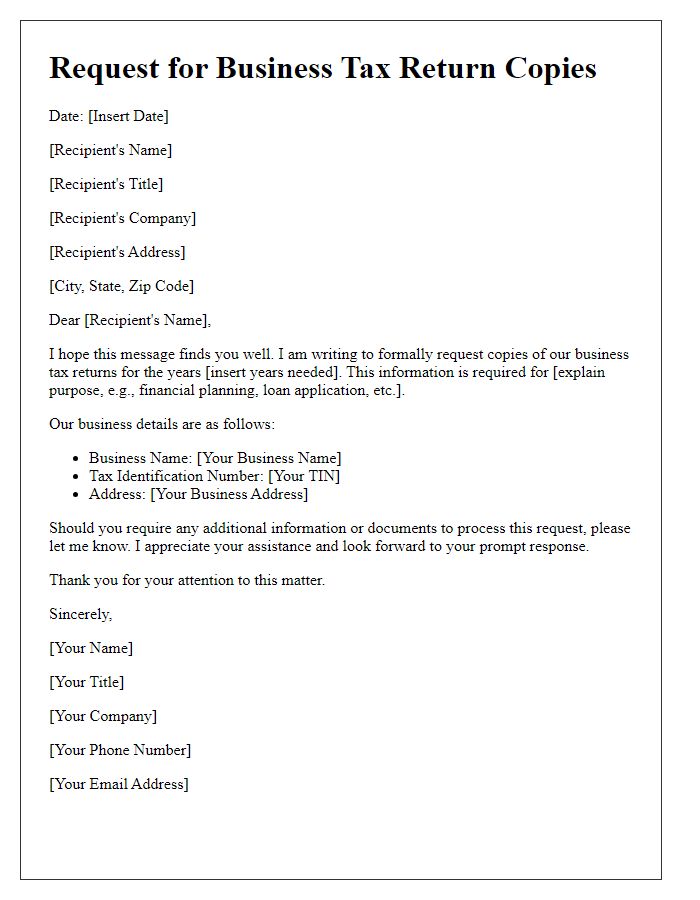

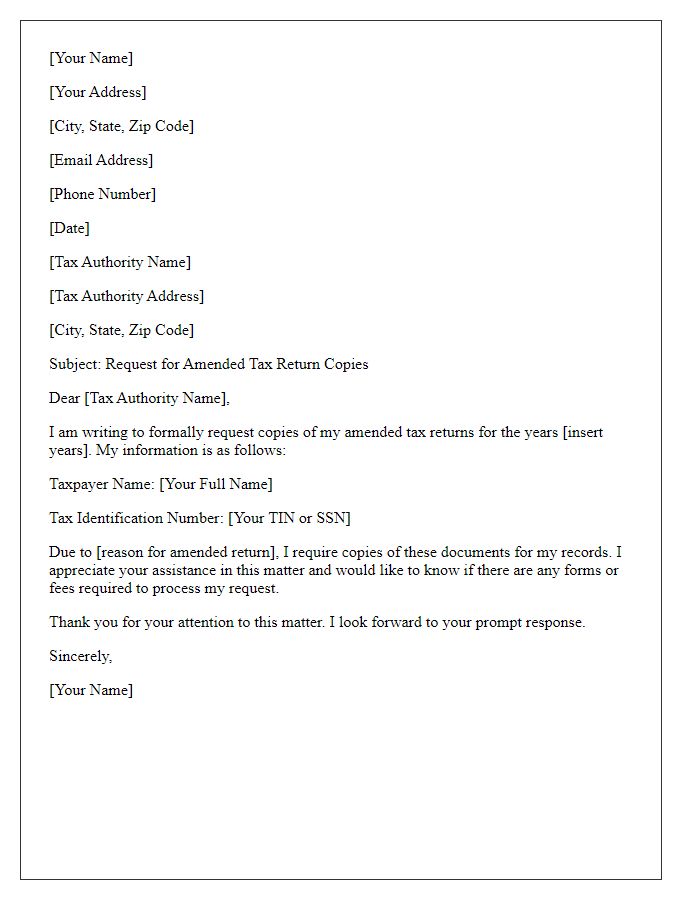

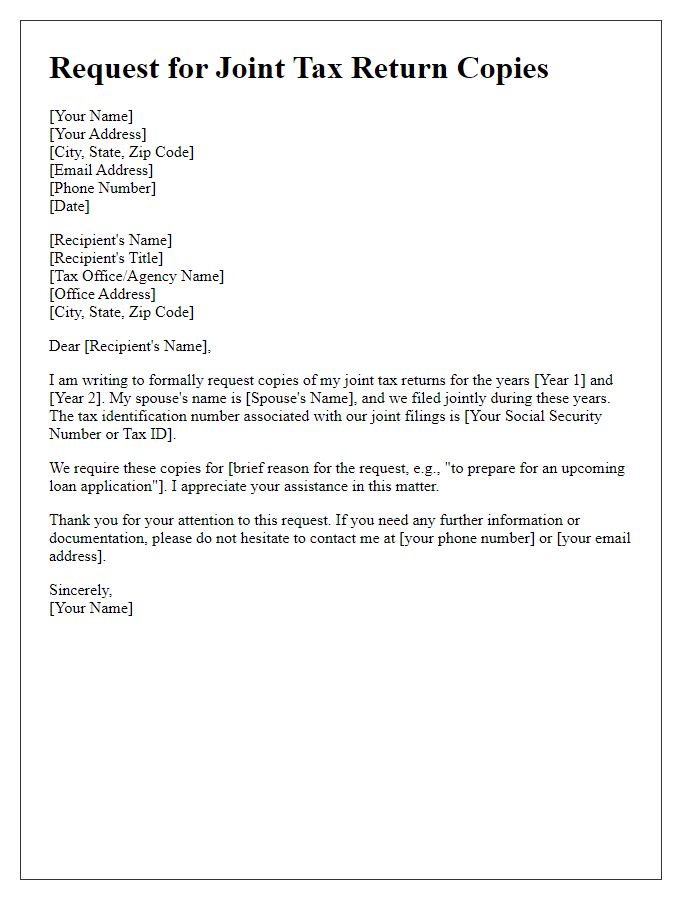

Personal Information

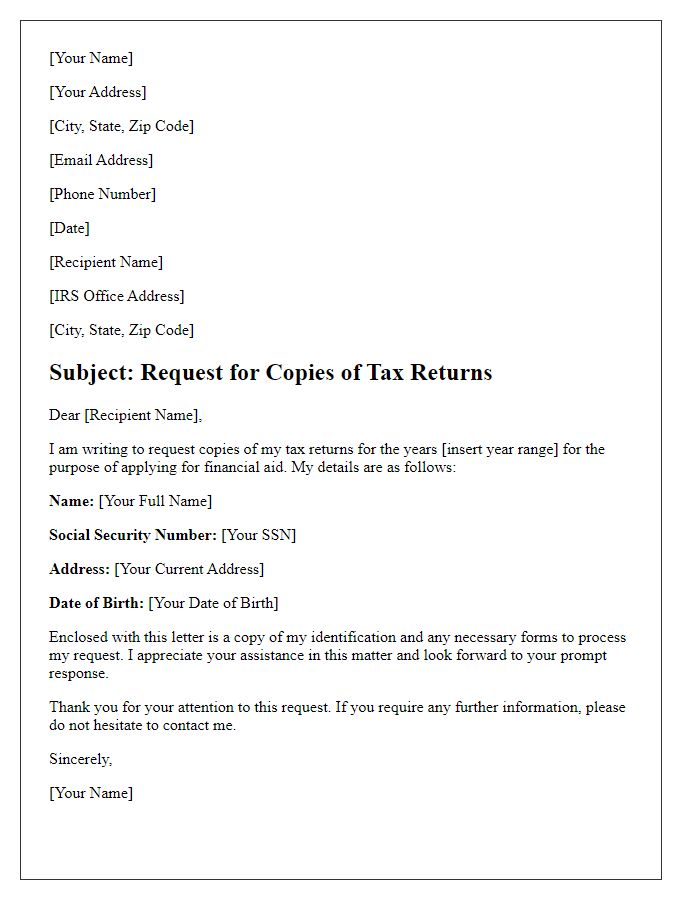

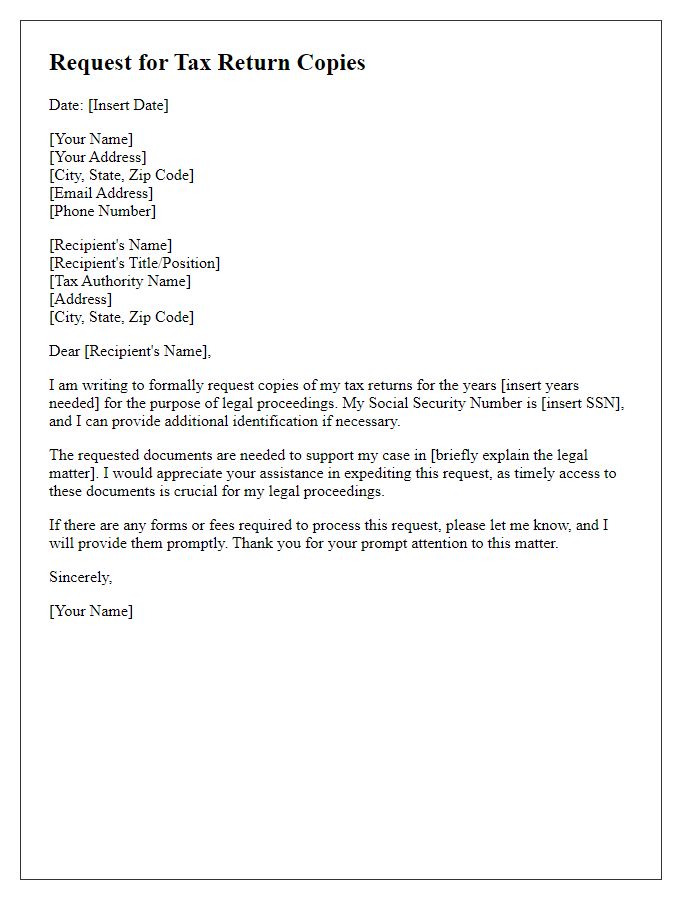

Tax return copies are essential for personal financial management and can play a crucial role during company audits, mortgage applications, or other financial transactions. A typical request may include personal information, such as full name, Social Security Number (SSN), and mailing address, ensuring accurate retrieval of documents. Important note: The Internal Revenue Service (IRS) requires that requests include relevant tax years, such as 2020, 2021, and 2022, for which copies are needed, often requiring affirmation of the taxpayer's identity. Including additional information, such as date of birth and any previous address used during tax filing, increases the chances of a swift response from tax authorities.

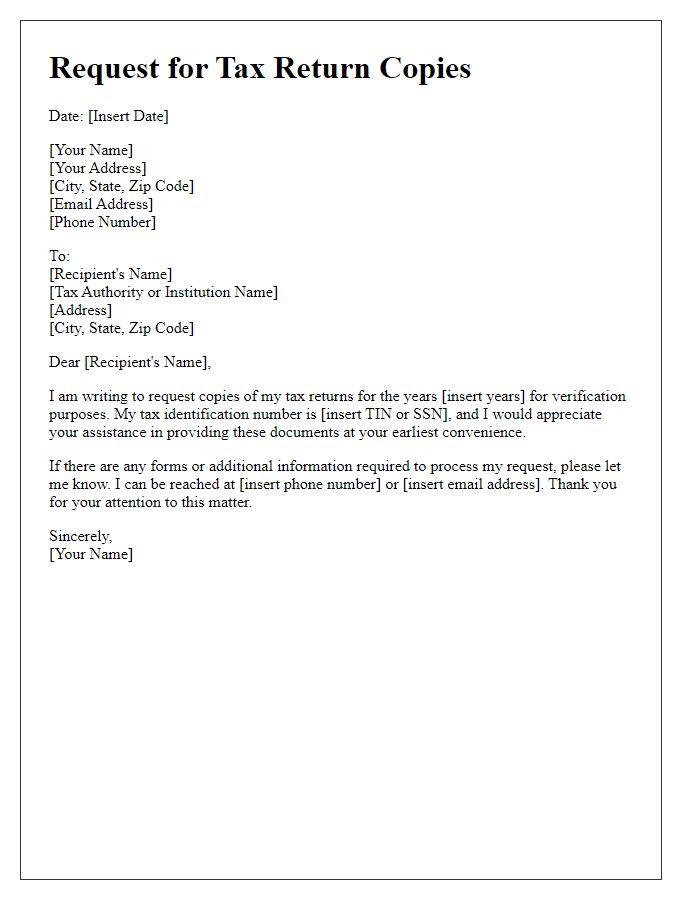

Tax Year Details

Tax return copies are essential for reviewing financial records and preparing future filings. Tax Year 2022 stands out, with significant changes in regulations impacting deductions, particularly for self-employed individuals. The Internal Revenue Service (IRS), a U.S. agency governing tax collection, maintains these records. Requesting copies of tax returns can be done via Form 4506 for a fee. It's crucial to provide specific information, including the taxpayer's Social Security number, address, and the exact years of interest to ensure accurate retrieval. Processing times can vary, typically taking 10 to 30 days, depending on the IRS's workload.

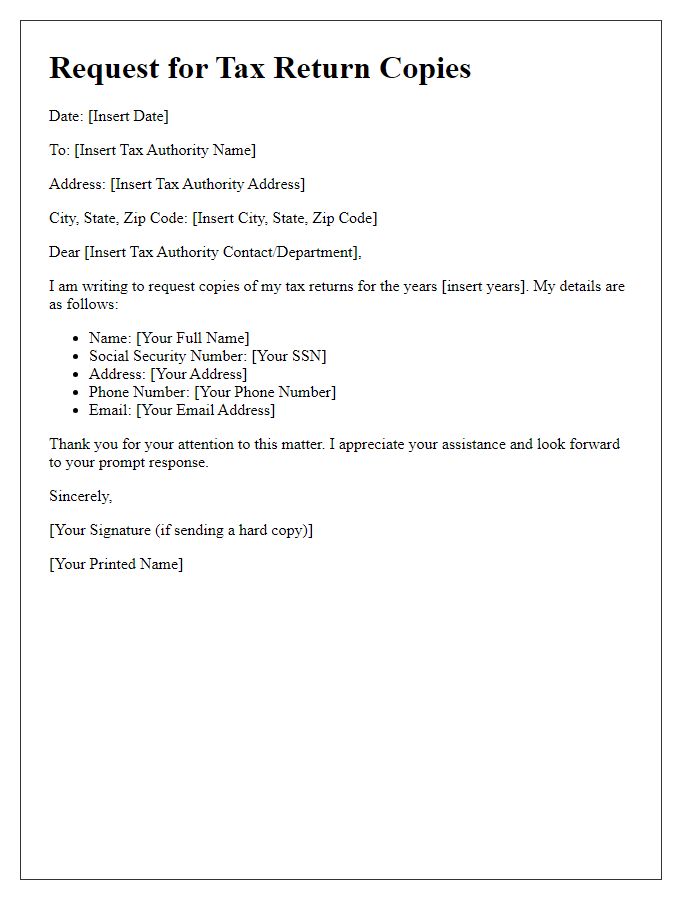

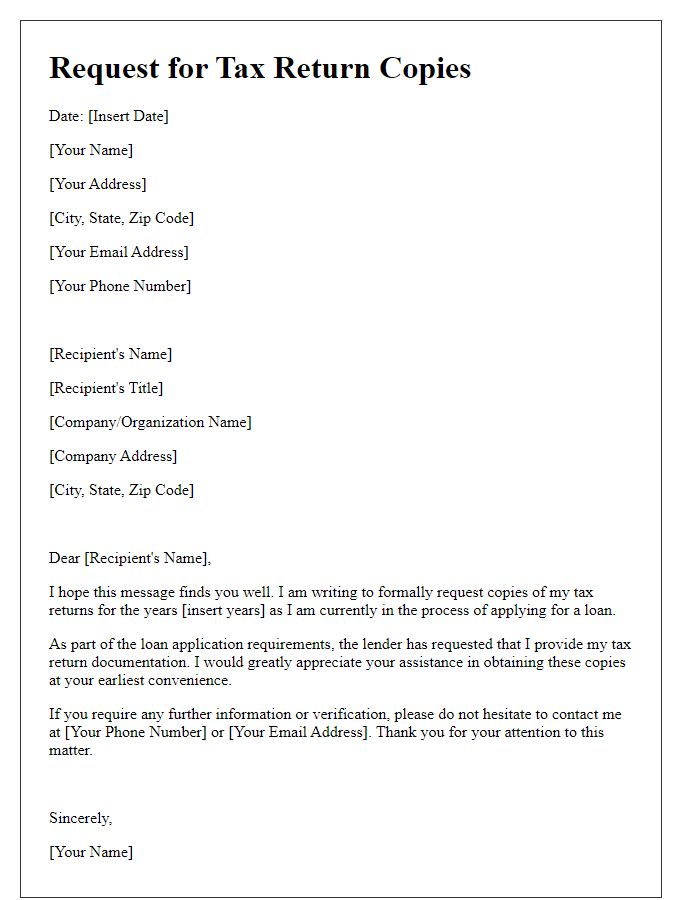

Document Request Purpose

Individuals often require copies of their tax returns for various purposes, such as loan applications, financial aid, or personal record-keeping. Tax returns, specifically Form 1040 for individual taxpayers, provide critical information regarding income, tax liability, and filing status. Typically, taxpayers retain copies of their filed returns for at least three years, in accordance with IRS guidelines, but additional copies may be necessary for specific situations. The process to request copies involves completing IRS Form 4506, which can be submitted electronically or via mail, with a nominal fee of $50 for each tax return requested. Individuals should provide accurate details, including their Social Security number, address, and the tax year for which copies are needed, ensuring a swift retrieval from the IRS database.

Authorization Statement

The process of requesting tax return copies often entails drafting a formal authorization statement to facilitate the retrieval of sensitive financial documents. In this context, individuals or businesses may need access to past tax returns, due to events such as audits or financial planning. The IRS forms, such as Form 4506, typically require the inclusion of pertinent details like the taxpayer's identification number, address, and the specific tax years in question. Effective communication with the IRS office, including adherence to their guidelines, can ensure that the request is processed smoothly. Additionally, understanding timelines for processing requests (which can take up to 75 days) is essential for planning purposes.

Contact Information

When requesting copies of tax returns, it is important to include clear and specific contact information for efficient processing. Relevant details may include full name, current address for correspondence (including city, state, and ZIP code), telephone number for follow-up inquiries, and an email address for electronic communication. It is also advisable to specify the tax years needed, such as 2020, 2021, and 2022, to help the tax authority locate the correct documents swiftly. Providing this detailed contact information ensures that tax agencies, such as the Internal Revenue Service (IRS) in the United States, can verify the requester's identity and expedite the retrieval of the necessary tax return copies.

Comments