Have you recently received a notification about a tax refund adjustment? It can be a bit overwhelming to navigate the details and understand how it impacts your finances. This article aims to break down what a tax refund adjustment means, why it might occur, and what steps you can take moving forward. So, if you want to demystify this process and ensure you're fully informed, keep reading!

Taxpayer's Information

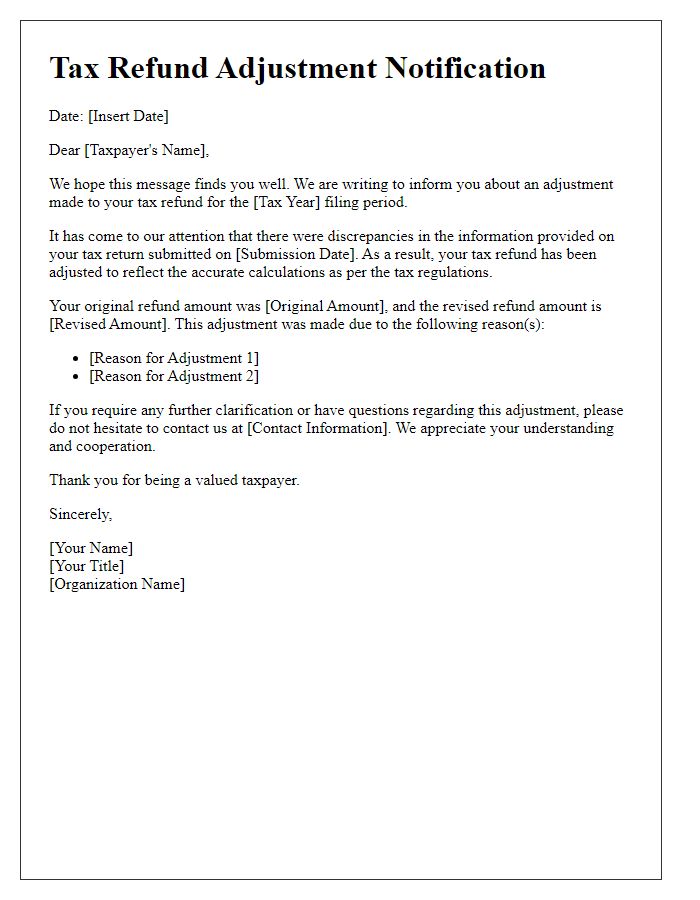

The notification of tax refund adjustment requires precise details regarding the taxpayer's information, including full name, Social Security Number (SSN), and current address. This information should be verified against official tax records to ensure accuracy. The notification should also specify the tax year related to the adjustment, such as the 2022 tax year, and the reasons for the adjustment, which could range from discrepancies in reported income to changes in tax credits. Additionally, the date of the notification should be included to provide a clear timeline for the taxpayer, ensuring they understand when the adjustment was processed. Providing a customer service contact number for further inquiries can also enhance communication and clarity for the taxpayer.

Reason for Adjustment

A notification of tax refund adjustment informs the taxpayer about modifications made to the original tax refund amount. Common reasons for this adjustment include discrepancies identified during the review of filed tax returns, such as reported income, deductions, or tax credits. For instance, if a taxpayer claimed a tax credit for education expenses that did not meet IRS criteria, the refund might be reduced accordingly. Other reasons could encompass clerical errors or changes in tax law affecting refund calculations. The notification will detail the specific adjustment reason, the previous refund amount, and the new adjusted amount, ensuring clarity for the taxpayer on what led to the revision.

Detailed Adjustment Explanation

Tax refund adjustments may arise due to various factors including discrepancies in reported income, changes in deductions, or updates in credit eligibility. For instance, if an individual reported an income of $60,000 for the tax year 2022, but the IRS identified a discrepancy leading to an adjusted income of $58,000, this would directly affect the total refund amount. Moreover, eligibility for credits such as the Child Tax Credit, worth up to $2,000 per qualifying child under the age of 17, plays a critical role in calculating tax refunds. Adjustments also occur due to changes in tax policies established by the Internal Revenue Service (IRS), which could impact standard deductions or specific tax benefits based on recent legislation. Increased scrutiny during audits can also initiate adjustments, ensuring taxpayer compliance with regulations established in the tax code.

Revised Refund Amount

Tax refund adjustments can significantly impact personal finances and budgeting. The Internal Revenue Service (IRS), a U.S. government agency responsible for tax collection, issues notifications regarding changes in refund amounts. These adjustments may arise due to various factors such as inaccuracies in reported income, eligibility for credits, or changes in filing status. The communication typically outlines the revised refund amount, highlighting discrepancies that led to the adjustment. Timely notifications ensure taxpayers remain informed and can plan for the implications on their financial strategies. Understanding the reasons behind the revised amounts is essential for accurate future tax filings, maintaining compliance with tax regulations, and avoiding penalties.

Contact Information for Inquiries

The notification of tax refund adjustment includes essential contact information for inquiries to assist taxpayers in understanding changes to their refunds. This typically consists of a dedicated telephone number, such as 1-800-555-0199, for direct communication with knowledgeable representatives. An email address, for example, support@taxagency.gov, provides an alternative channel for questions regarding adjustments. Furthermore, the notification may detail an official website, like www.taxagency.gov/refundstatus, allowing individuals to check the status of their refunds online. Including office hours, such as Monday to Friday, 8 AM to 5 PM (EST), ensures taxpayers know when they can seek assistance. Adding a unique reference number on the notification enables efficient retrieval of information related to individual tax accounts.

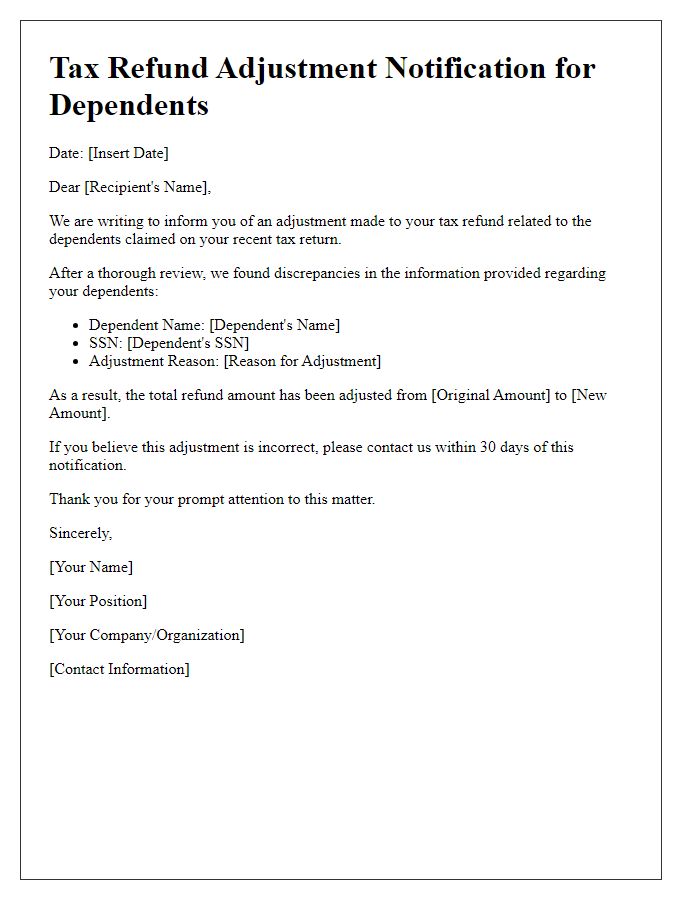

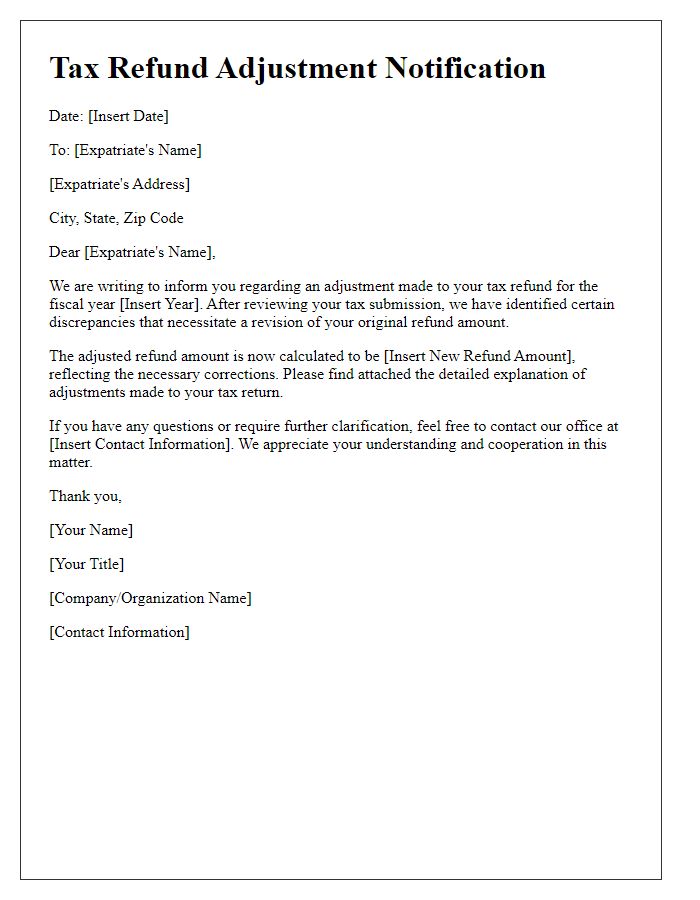

Letter Template For Notification Of Tax Refund Adjustment Samples

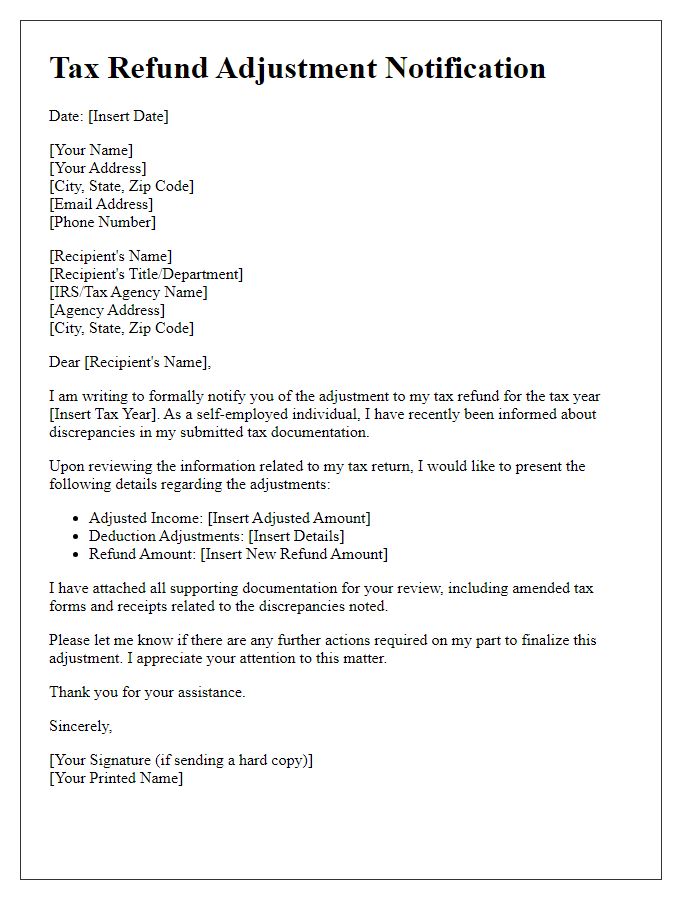

Letter template of tax refund adjustment notification for self-employed individuals.

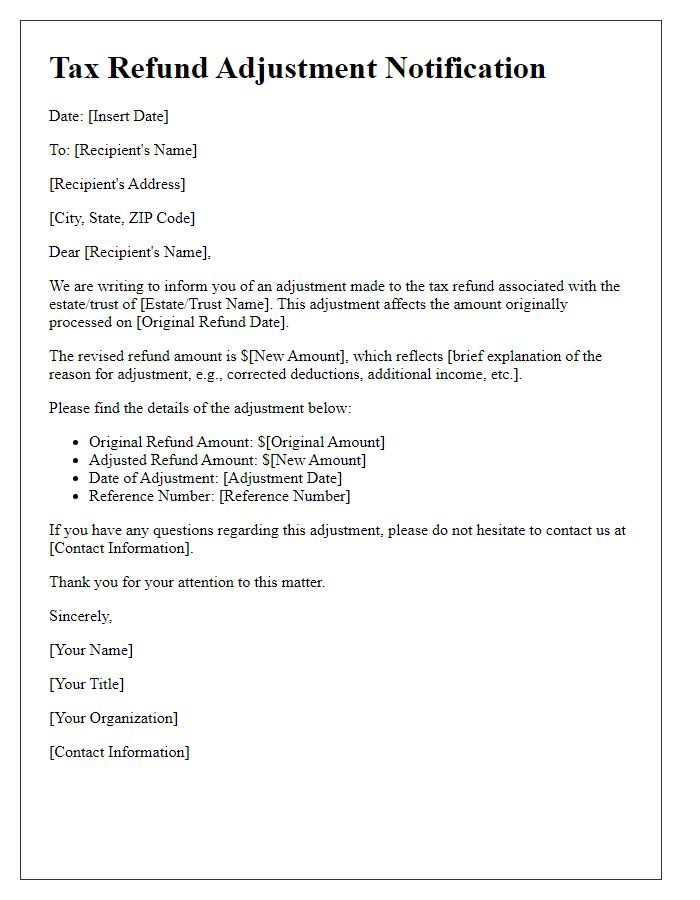

Letter template of tax refund adjustment notification for estates and trusts.

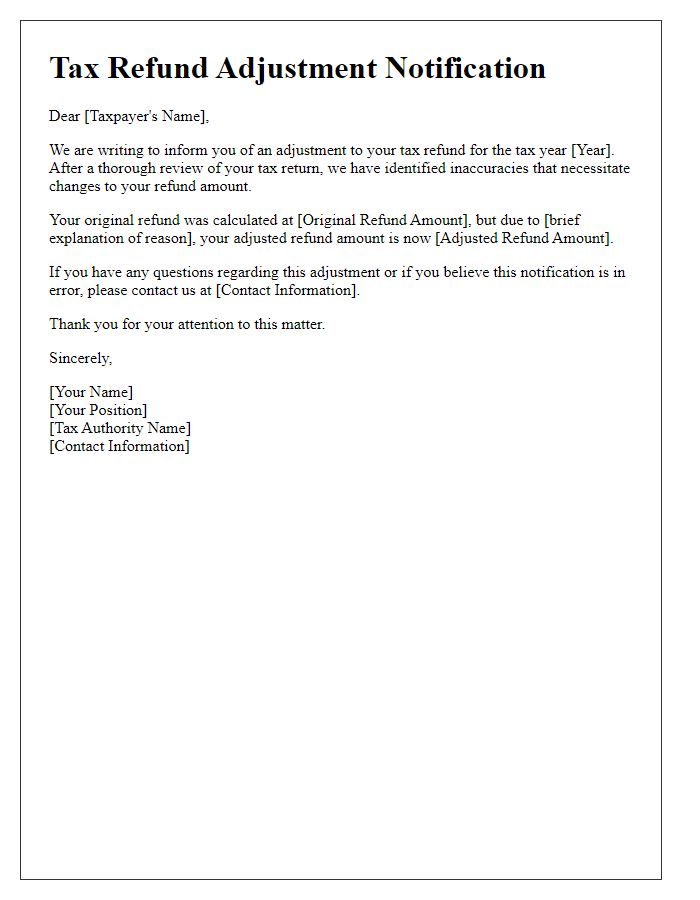

Letter template of tax refund adjustment notification for non-resident taxpayers.

Comments