Are you a service member or veteran looking to understand your tax benefits? Navigating the world of military tax benefits can feel daunting, but it's essential to be aware of the potential savings available to you. From deductions to credits tailored specifically for military personnel, there are various ways to maximize your tax return. Let's dive deeper into the details and uncover how you can benefitâread on!

Subject Line Precision

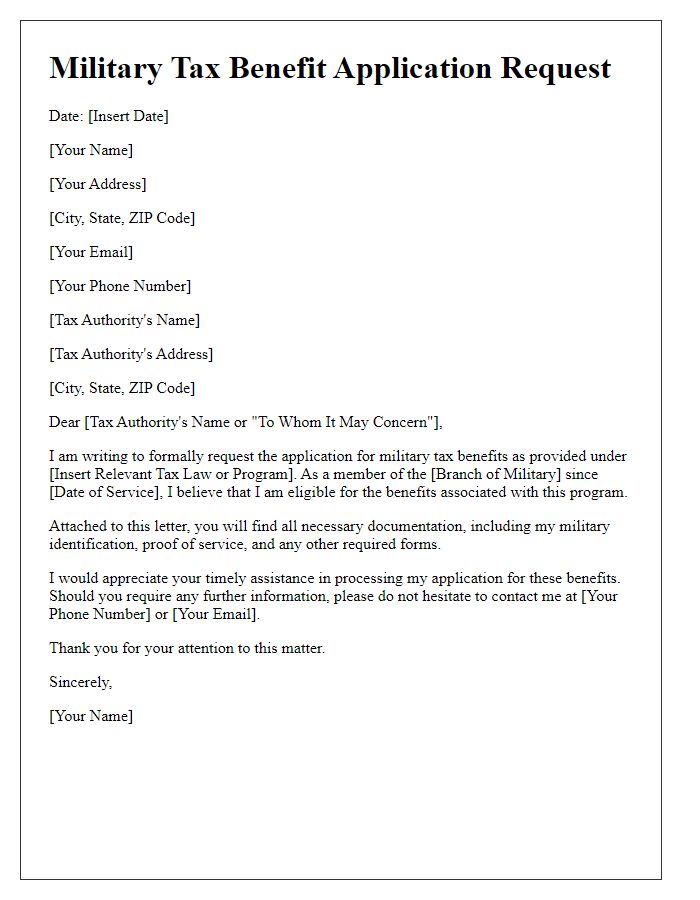

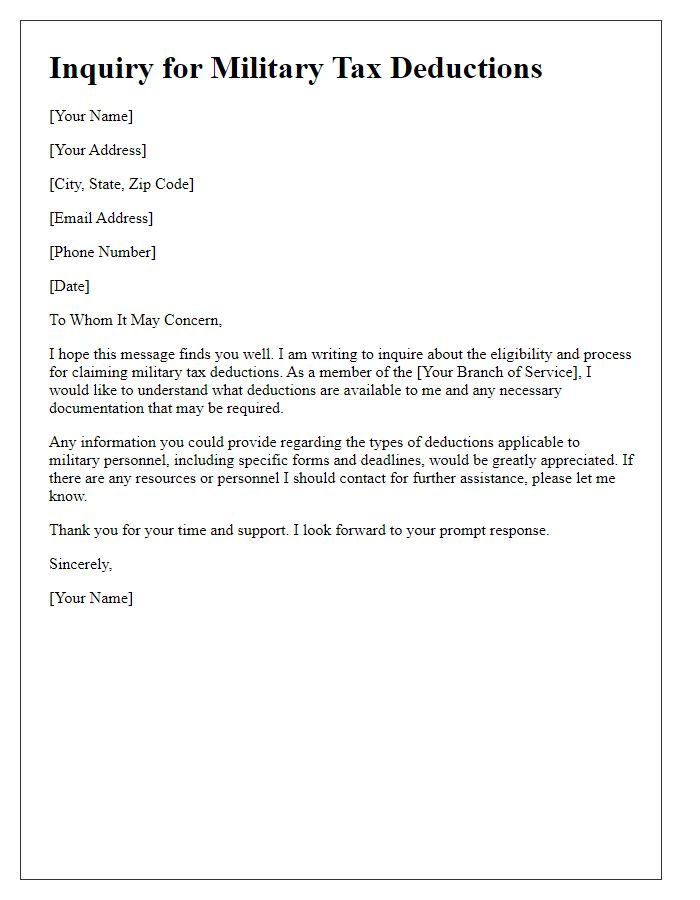

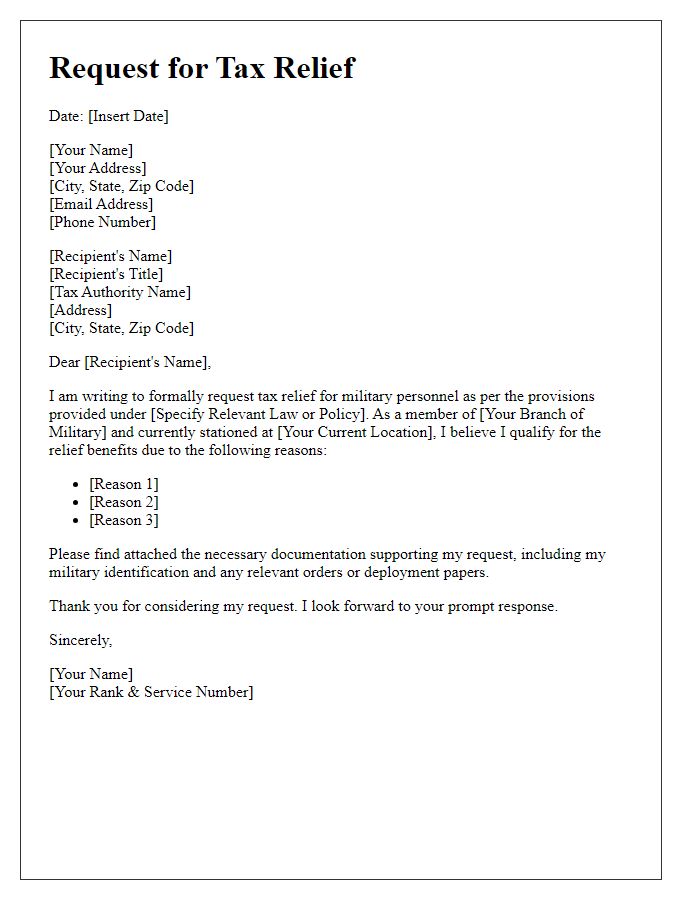

Military personnel seeking tax benefits must file specific forms to ensure eligibility for deductions and credits. Important documentation includes DD Form 214, which verifies military service, and state-specific forms that detail tax exclusions. Benefits such as the Armed Forces Tax Advantage may apply, providing financial relief for active duty members stationed in combat zones, like Iraq or Afghanistan. Timely submission of these documents, typically due by April 15th, is crucial to avoid penalties and ensure access to these financial resources. Moreover, understanding both federal and state tax regulations, including the Servicemembers Civil Relief Act, enhances awareness of potential benefits.

Formal Salutation

Active-duty military personnel often seek specific tax benefits aimed at alleviating financial burdens associated with service. Tax provisions such as the Servicemembers Civil Relief Act (SCRA) offer protections like lower interest rates on existing debt and exemptions from state income taxes in certain jurisdictions. Additionally, benefits including the Combat Zone Tax Exclusion (CZTE) allow members deployed in designated combat zones to exclude income earned during periods of service from federal tax obligations. Understanding eligibility requirements and documentation, as well as navigating filing procedures, is essential for maximizing these benefits and ensuring compliance with IRS regulations.

Clear Request Statement

Military personnel often seek tax benefits related to their service, including deductions for travel expenses, uniforms, or moving allowances. Specifically, these benefits can provide substantial financial relief given deployment or relocation requirements. It is essential to clearly outline the type of tax benefit required, such as adjustments to income tax liability or eligibility for specific credits. Accurate documentation of military service, including deployment dates and station assignments, plays a critical role in substantiating the request. Furthermore, providing a detailed account of expenses incurred due to military duties fortifies the case for the benefit, ultimately aiming to ease the financial burden faced by service members during and after their active duty.

Documentation Reference

Military families often qualify for specific tax benefits that can significantly ease their financial burden. Essential documentation such as military service records, deployment orders, and proof of residency (often tied to states with favorable tax laws for service members) is crucial for substantiating claims. Specific dates of service, especially those involving combat zones, influence eligibility for certain deductions or exemptions. Understanding the nuances of tax filings for the Department of Defense (DoD) personnel can ensure that benefits align with IRS guidelines, maximizing potential refunds. Accurate completion of federal forms and corresponding state filings (varies by jurisdiction) is necessary to fully leverage these financial advantages.

Contact Information

The request for military tax benefits requires accurate contact information. Essential details include the full name of the service member, including rank and branch of service (such as Army, Navy, Air Force, or Marine Corps). The address must include full street address, city, state, and zip code, ensuring the correct jurisdiction for tax processing. Additionally, provide a valid email address for timely communication and a direct phone number for follow-up inquiries. Incorporating the Social Security Number is crucial for identity verification and service eligibility, safeguarding all personal information according to legal regulations.

Comments