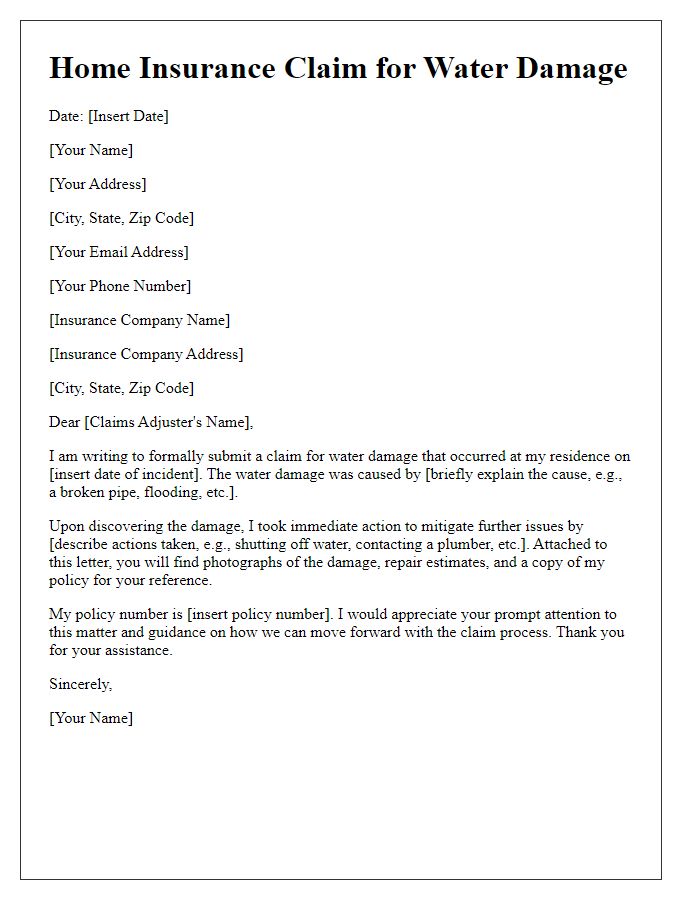

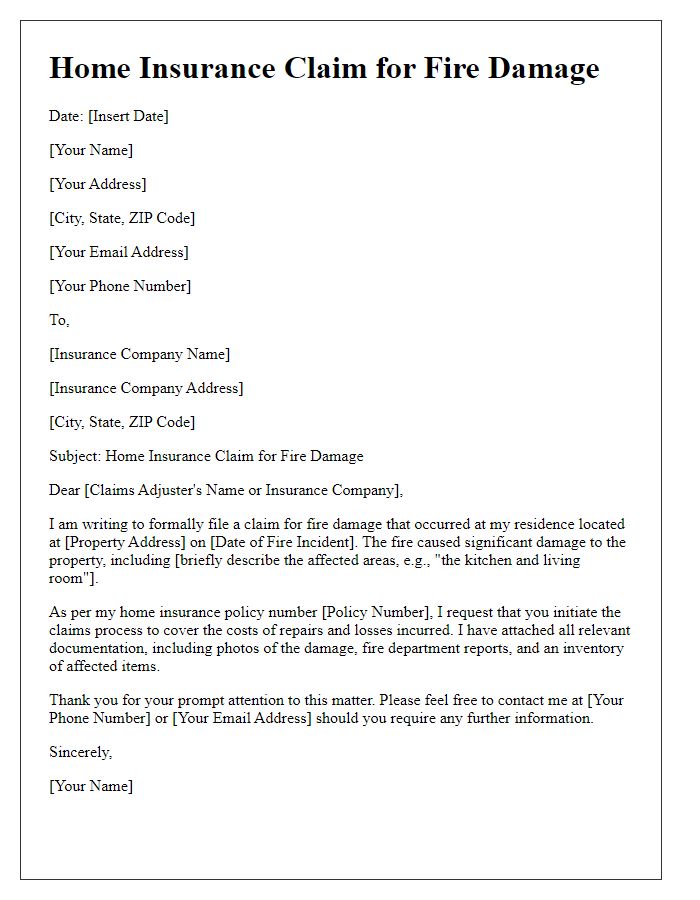

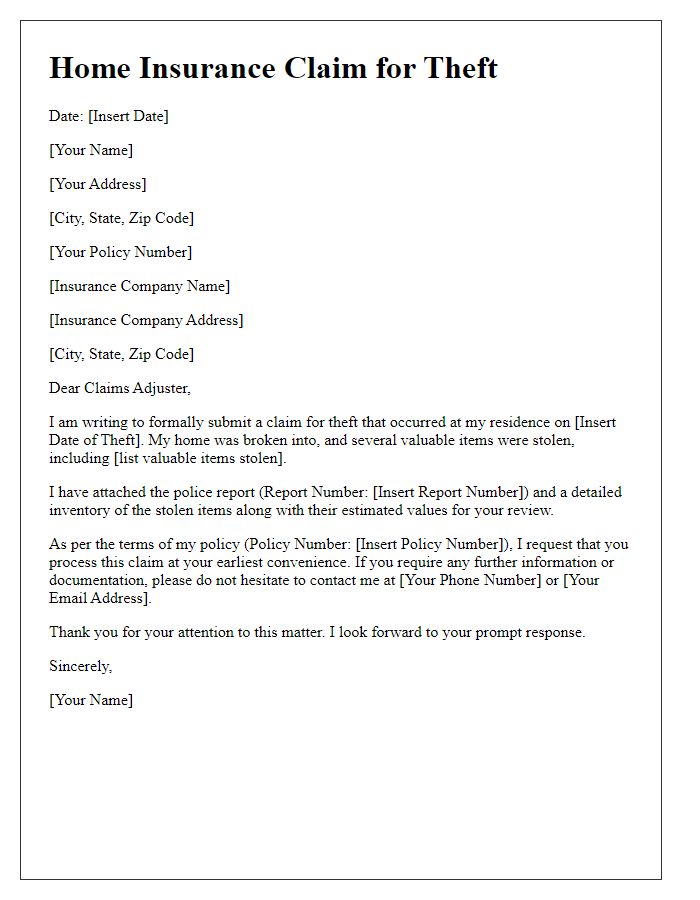

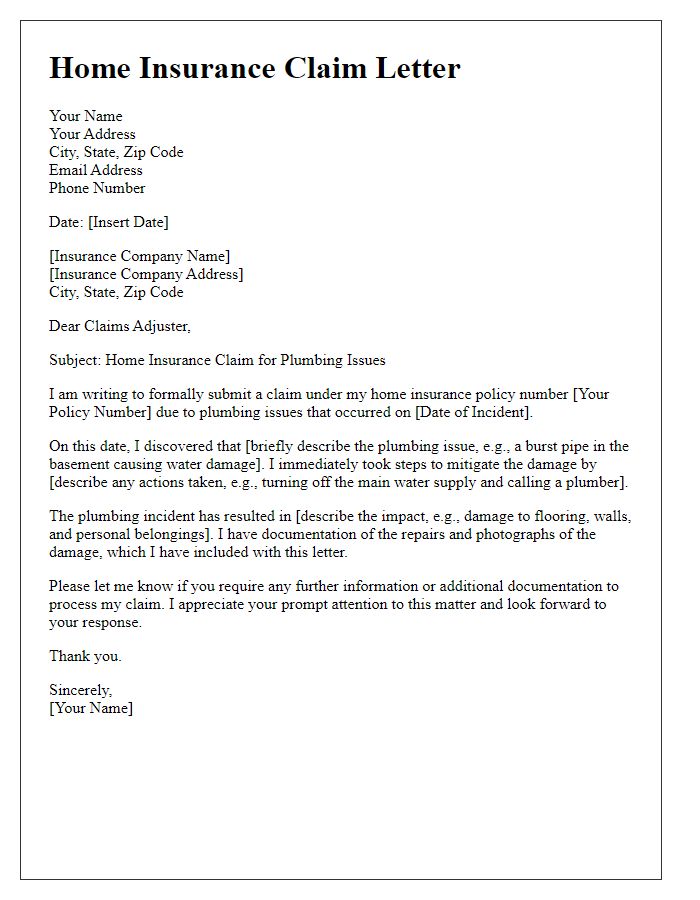

Are you navigating the often daunting process of filing a home insurance claim? You're not alone, as many homeowners find themselves uncertain about the steps to take after a loss. Understanding how to effectively communicate your situation with your insurance provider can make all the difference in getting the support you need. If you're ready to learn more about creating a compelling claim letter, continue reading to discover helpful tips and a handy template to guide you through the process!

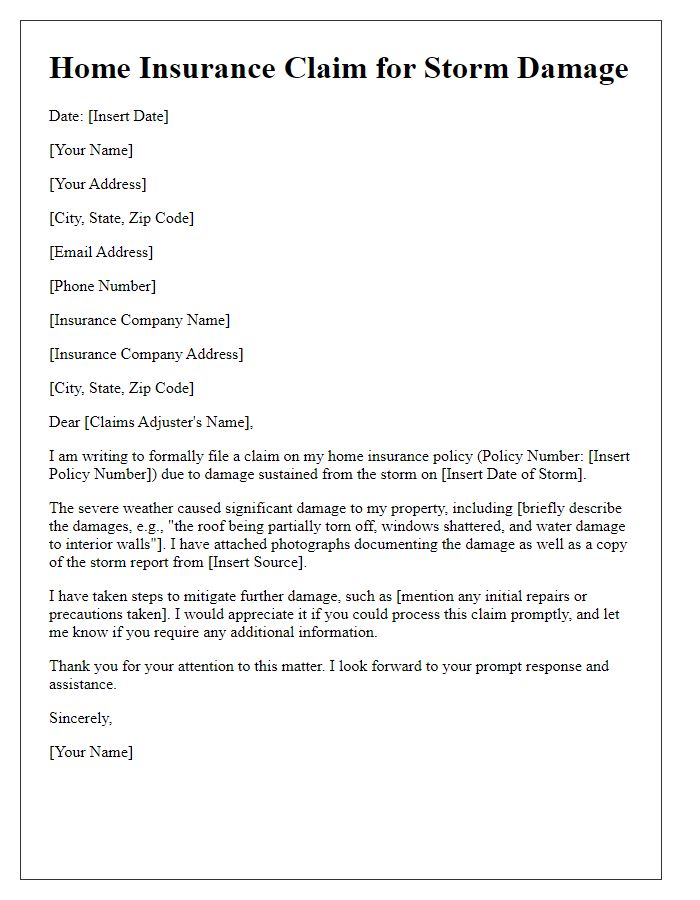

Policy Information

Filing a home insurance claim requires thorough documentation of policy information, especially details from the insurance policy, including the policy number, effective dates, and coverage limits. For example, homeowners typically refer to the policy number (a unique identifier assigned by the insurer) to expedite the claims process. Additionally, knowledge of effective dates, indicating when the coverage began and any amendments made during the policy term, is crucial. Coverage limits define the maximum amount payable for various insured events such as theft, fire damage, or natural disasters. Providing these details enhances clarity and aids the insurance adjuster in processing claims efficiently, ultimately facilitating a smoother resolution for homeowners facing loss or damage.

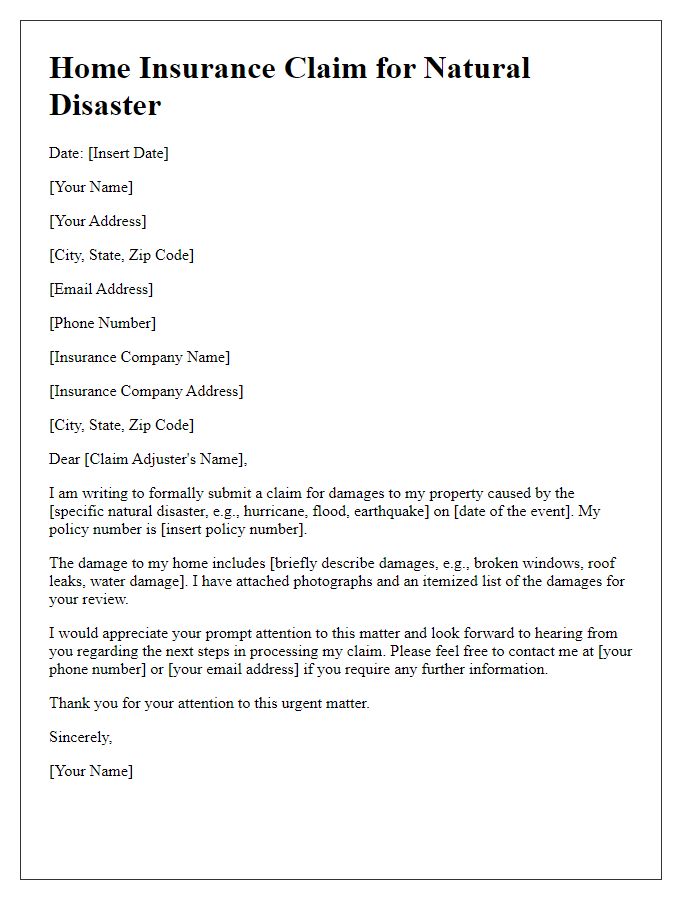

Incident Description

During a severe thunderstorm on March 15, 2023, my property located at 123 Maple Street, Springfield, sustained significant damage due to high winds and heavy rainfall. The roof suffered extensive damage, with several shingles torn off, exposing the structure to potential water intrusion. Interior spaces, particularly the living room (approximately 300 square feet), experienced water leaks that resulted in damage to drywall and hardwood flooring. Additionally, the storm uprooted a large branch from the oak tree in my front yard, causing damage to my car parked in the driveway. Immediate repair assessments indicate that the estimated cost for roof restoration and interior repairs could exceed $15,000. This incident has not only compromised the integrity of my home but also created a hazardous living environment for my family.

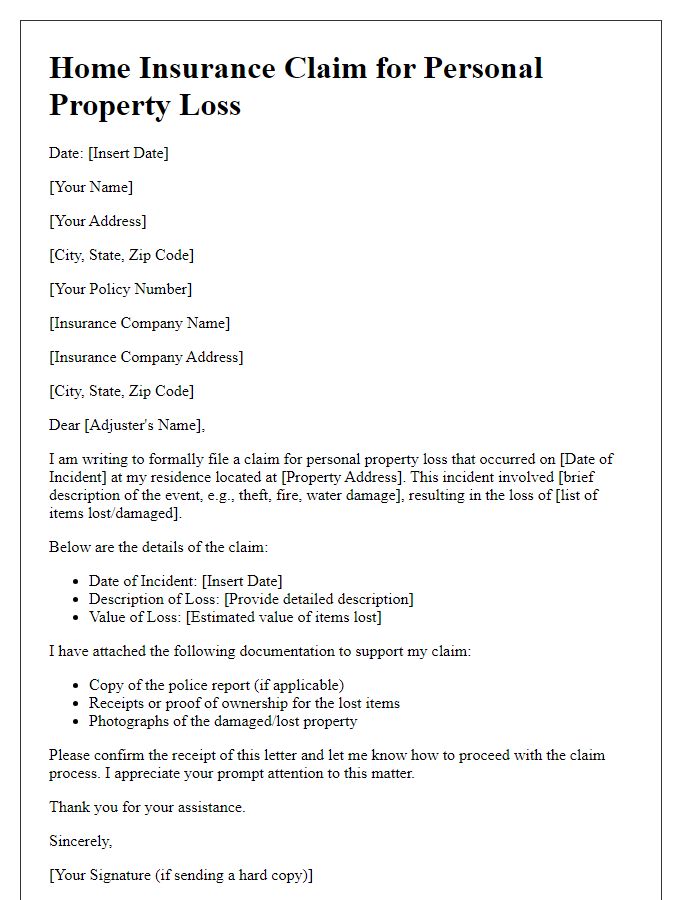

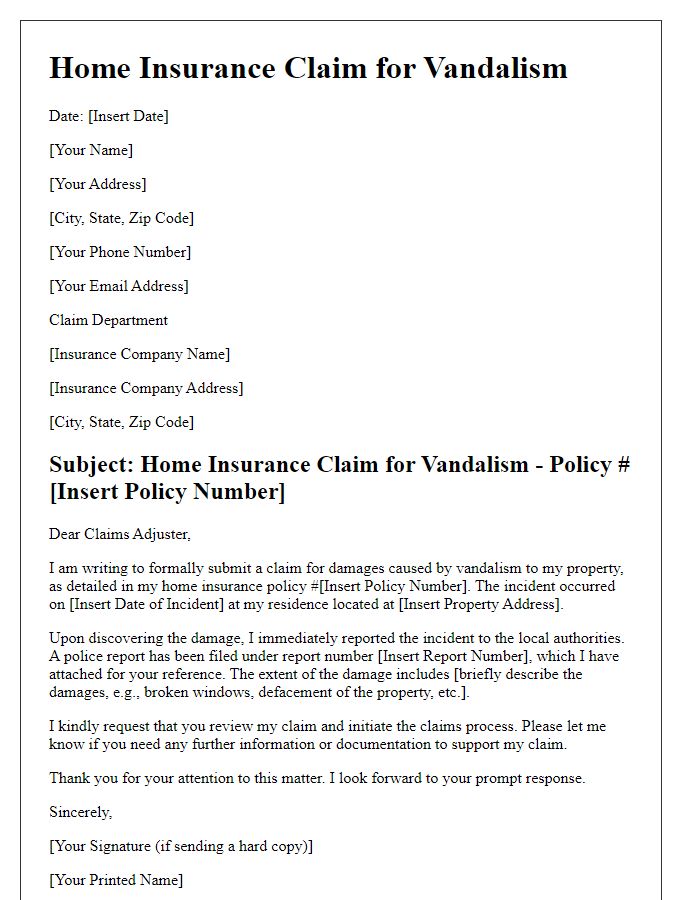

Documentation and Evidence

Documentation and evidence are crucial aspects in successfully processing a home insurance claim, particularly following events such as natural disasters (hurricanes, floods, wildfires) or incidents like theft (property burglary). Photographic evidence, preferably timestamped and dated, can substantiate the extent of damage to the property, including structural damage (roof leaks, broken windows) and loss of personal belongings (furniture, electronics). Additionally, compiled repair estimates (from licensed contractors) and receipts for previous purchases can strengthen the claim by demonstrating both the costs involved and the value of the loss. Reports from local authorities or fire departments can provide further context regarding the incident, while policy documentation (terms, coverage limits) is essential for verifying claim eligibility. Properly organizing this information enhances the likelihood of a prompt and fair settlement.

Loss and Damage Details

A home insurance claim typically involves various key elements that need to be addressed. When detailing loss and damage, it is essential to specify the type of incident, such as water damage caused by a burst pipe or fire damage resulting from an electrical failure. For example, a residential property in Springfield suffered significant damage on July 22, 2023, due to heavy rainfall exceeding 3 inches in 24 hours, leading to basement flooding. The estimated damage to the flooring (approximately $3,000) and the replacement of damaged appliances like a washer and dryer (valued at $1,500) should be accounted for in the claim. Additionally, including photographs of the damage, repair estimates from licensed contractors, and details of any temporary repairs made can enhance the clarity of the claim submitted to the insurance company. Make sure to document timelines for repairs, correspondence with adjusters, and any related expenses incurred during the mitigation process.

Contact Details and Signature

Home insurance claims often require precise documentation and personal identification to facilitate the process. Customers must provide detailed contact information, including names, mailing addresses, and phone numbers, ensuring insurance agents can reach them quickly regarding claim updates. A clear, legible signature is essential, typically involving the policyholder's full name. This signature validates the authenticity of the claim submitted, confirming that all information provided, such as incident descriptions and associated damages, is accurate. Complete submissions expedite the claims process, enabling timely financial support during recovery.

Comments