Navigating the customs clearance process can often feel overwhelming, but it doesn't have to be that way! Understanding the specific requirements and documentation needed for your shipments is crucial for a smooth transaction. From invoices to certificates of origin, each piece of paperwork plays a vital role in getting your goods through customs without a hitch. Ready to dive deeper into the essentials of customs clearance? Let's explore this topic further!

Sender and recipient information.

Customs clearance requirements encompass essential documentation for importing and exporting goods, including details of the sender and the recipient. The sender information typically includes the full name, address, phone number, and business identification number of the person or organization initiating the shipment. The recipient information also requires similar details, including the recipient's name, complete address, and contact information. INVOICES, PACKING LISTS, or CERTIFICATES OF ORIGIN may also be relevant documentation for customs declaration. Adequate preparation of this information significantly streamlines customs processing and ensures compliance with international trade regulations.

Detailed description of goods.

In the realm of international trade, precise customs clearance is paramount, especially concerning the detailed description of goods being imported or exported. For instance, electronic devices such as smartphones (units typically weighing 150-200 grams, valued at around $300 each), must include specific information: brand name, model number (e.g., iPhone 14), quantity (e.g., 100 units), and relevant harmonized system (HS) codes (e.g., HS Code 8517 for telecommunication equipment). Additionally, textiles like cotton shirts (potentially between 200-300 grams each, retailing at $25) require details about color, size, and fabric composition (100% cotton). Accurate descriptions facilitate compliance with regulatory requirements, avoid customs delays, and ensure proper duties are assessed based on the actual nature of goods, which vary significantly by category and region.

Applicable harmonized system codes.

Customs clearance processes necessitate the classification of goods using Harmonized System (HS) codes, which are internationally standardized numerical codes that categorize products based on their nature, composition, and use. The specific HS code facilitates the determination of applicable tariffs, trade regulations, and necessary documentation required for entry into various countries. For instance, electronic devices may fall under HS Code 8471, while textiles could be classified under HS Code 6201. Ensuring accuracy in HS code assignment is essential to avoid delays at customs checkpoints, potential fines, or seizure of goods. This classification must align with the guidelines provided by the World Customs Organization (WCO) and tailored to the trade agreements and regulations of the destination country.

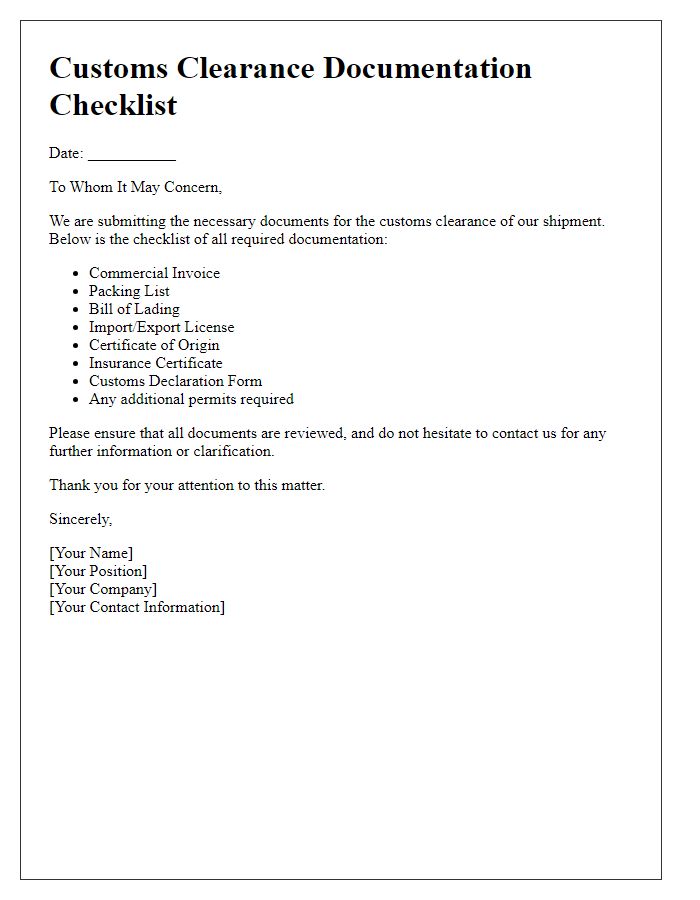

Relevant permits and licenses.

Customs clearance for imported goods requires relevant permits and licenses to ensure compliance with local regulations. Import permits may be necessary for controlled items, such as pharmaceuticals, chemicals, or agricultural products, which may require approval from specific governmental bodies, such as the Food and Drug Administration (FDA) or the Department of Agriculture. Documentation might include a Certificate of Origin, which certifies the country of manufacturing, and might be essential for trade agreements, affecting tariff rates. Certain goods could also necessitate additional licenses, like export licenses for restricted commodities, depending on international trade laws. Clear understanding of each document's validity duration is crucial, as expired permits may lead to delays or fines during the clearance process at locations like major ports or customs facilities.

Contact information for queries.

Customs clearance documentation requires precise contact information for queries. Typically, this includes the name of the primary contact person, such as a Customs Broker, located within the importer's or exporter's organization. The phone number should be a direct line, preferably a mobile or office extension, allowing swift communication. An email address must be clear and regularly monitored to facilitate timely responses. Any specific department or role related to customs matters, such as Logistics Coordinator or Compliance Officer, should be highlighted. Inclusion of the physical address of the company, including the postal code and country, provides context for location-based queries. Comprehensive contact information ensures smooth processing of shipments across international borders.

Comments