Are you a shareholder seeking clarity on recent mergers? It can often be confusing to navigate the intricate details and implications of these significant changes within a company. Understanding how mergers affect your investments and the overall business strategy is crucial for making informed decisions. Join us as we delve deeper into this topic, providing insights and answers to common queries about mergers that every shareholder should know!

Clear Subject Line

In recent years, several high-profile mergers have reshaped industries across the globe, including the merger between telecommunications giants T-Mobile US and Sprint, which was valued at approximately $26 billion and completed in April 2020. Shareholders are increasingly interested in understanding the strategic implications of such mergers on market competition and shareholder value. Regulatory bodies, like the Federal Communications Commission (FCC) in the United States, closely scrutinize these transactions to prevent monopolistic practices, which can impact stock prices and investment decisions. Analyzing the merger's effect on operational efficiencies, market reach, and customer satisfaction will provide invaluable insights for shareholders navigating the complexities of corporate transformations.

Salutation and Introduction

Mergers in the business landscape can lead to significant shifts in shareholder value, particularly when discussing potential mergers between companies. As companies like Amazon and Whole Foods Market have demonstrated, mergers can create enhanced synergies, optimized supply chains, and improved market positioning. Shareholders often seek clarity on the strategic intent behind such mergers, understanding the projected financial impact, potential regulatory hurdles, and alignment with long-term corporate goals. Moreover, specific questions may revolve around the integration process, cultural compatibilities, and anticipated changes in leadership structures. Consequently, inquiries can help shareholders assess their investment strategies and gauge the future direction of their investments.

Purpose of Inquiry

Shareholders often seek clarity on mergers, especially concerning their impact on company value. Concerns may arise about potential dilution of shares, integration challenges, or shifts in corporate strategy. Specific details regarding merger terms, expected synergies, and timelines are crucial for informed decision-making. Additionally, assessing regulatory approvals and market conditions can influence investor confidence. Clear communication from corporate leadership fosters trust and mitigates uncertainty surrounding these strategic corporate actions.

Detailed Questions

Shareholders often raise critical queries concerning mergers to ensure transparency and understanding of the implications on their investments. Questions may include inquiries about the strategic rationale behind the merger decision, focusing on anticipated synergies such as cost savings or revenue growth projected at millions of dollars annually. Shareholders might also seek clarification on how the merger will impact share value, with specific interest in projections for the share price over the next quarter and annual earnings forecasts. Additionally, details related to the merger timeline, including key dates for regulatory approval and shareholder meetings, are frequently requested, emphasizing the importance of due diligence. Concerns regarding potential job cuts or changes in corporate culture post-merger are also prevalent, as these factors could significantly influence overall employee morale and productivity. Understanding the financing structure of the merger, including debt issuance or equity dilution tactics, is essential for shareholders to assess long-term viability and shareholder returns.

Contact Information and Closing

Shareholder inquiries regarding mergers often require clear communication regarding contact information and closing details to ensure effective correspondence. The contact information section should maintain entries such as the shareholder's name, corresponding phone number, and email address for direct engagement. In regards to the closing, it is important to express appreciation for the shareholder's time and consideration. A closing note might include a statement reassuring the shareholder of ongoing updates about the merger process, particularly emphasizing transparency and diligence in communications related to significant corporate events. Such practices reinforce trust and engagement between the company and its shareholders.

Letter Template For Shareholder Query Regarding Mergers Samples

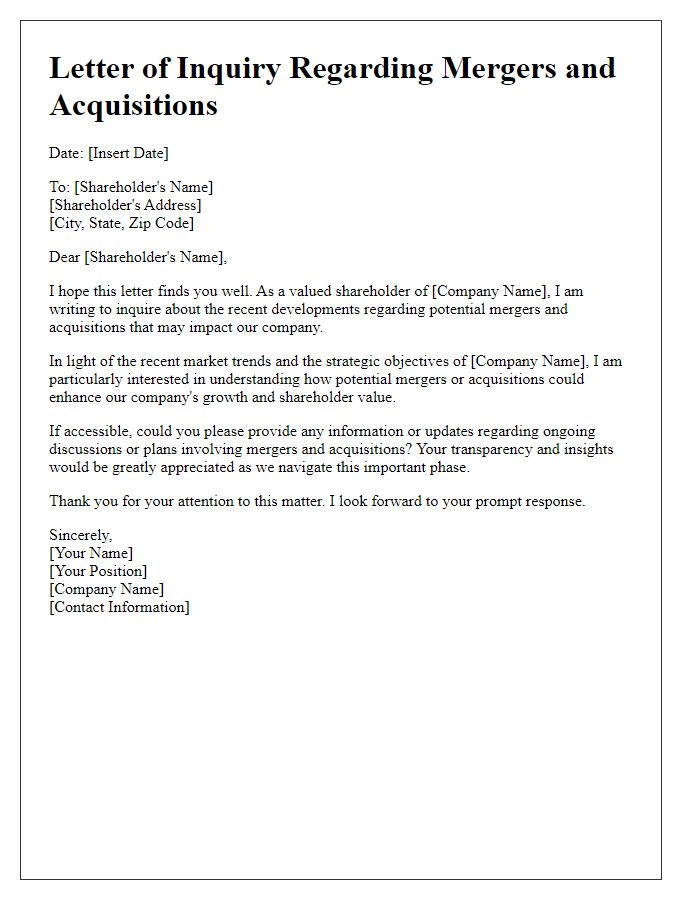

Letter template of inquiry for shareholders about mergers and acquisitions.

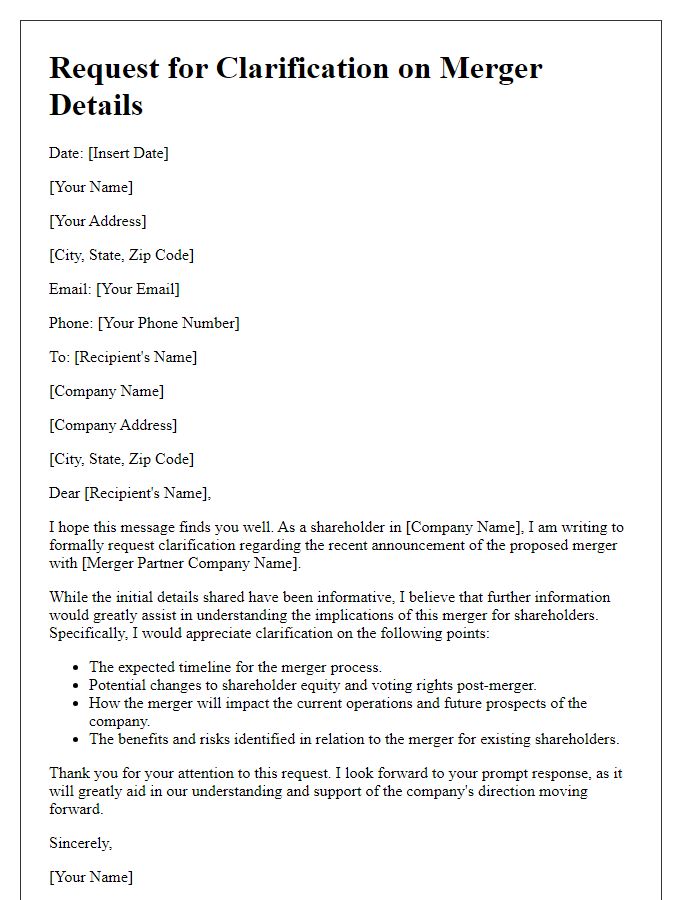

Letter template of request for clarification on merger details for shareholders.

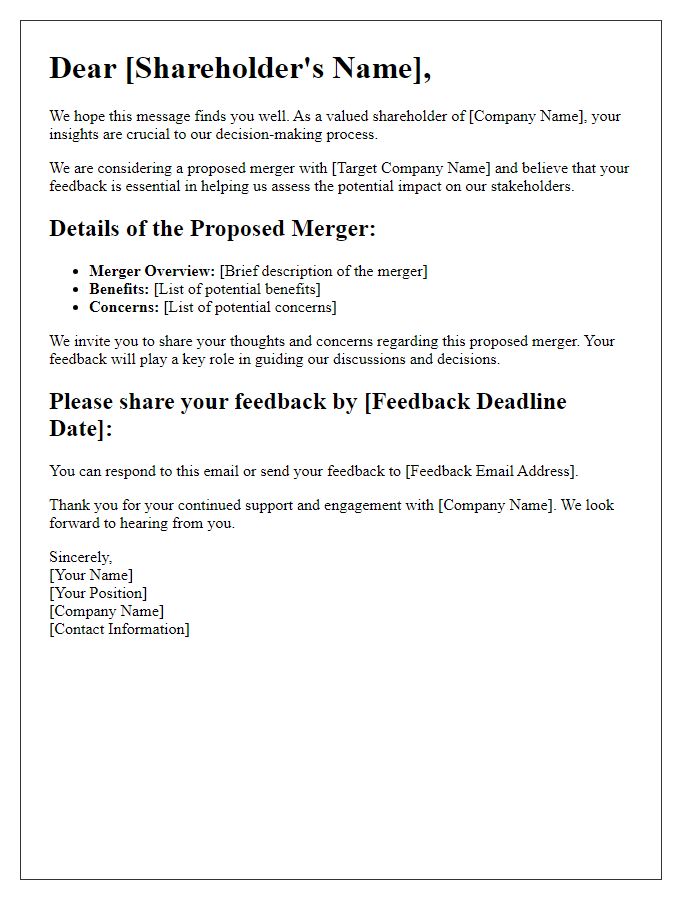

Letter template of feedback solicitation from shareholders regarding proposed mergers.

Letter template of update request from shareholders concerning merger negotiations.

Letter template of formal communication to shareholders regarding merger implications.

Letter template of questions for shareholders on the benefits of a merger.

Letter template of shareholder consultation regarding potential merger outcomes.

Letter template of notification to shareholders about upcoming merger discussions.

Letter template of explanation for shareholders about merger strategies.

Comments