Are you a shareholder looking to streamline how you receive important documents? Transitioning to electronic delivery can save you time and help the environment by reducing paper waste. In this article, we'll guide you through crafting a concise and effective letter to request electronic delivery of your shareholder materials. Join us as we explore the steps to make your request hassle-free and efficient!

Salutation and Addressing the Recipient

A shareholder request for electronic delivery can significantly enhance communication efficiency between the company and its investors. The request should begin with a formal salutation, addressing the recipient by their appropriate title, such as "Dear [Name/Title]," followed by the recipient's full name and designation within the company. Additionally, include the company's name and address to ensure clarity on the intended recipient. This structure reinforces professionalism while facilitating an organized flow of information, vital for seamless correspondence in corporate governance. Clarity in addressing can enhance engagement and foster a positive relationship between shareholders and the company.

Statement of Request for Electronic Delivery

Shareholders can benefit from electronic delivery of important documents, such as financial statements and meeting notices, for enhanced efficiency and accessibility. The request for electronic delivery often specifies the type of documents preferred, including annual reports and proxy statements. This can promote environmental sustainability by reducing paper waste associated with traditional mail. Additionally, the process may involve providing personal contact information, such as an email address, to ensure timely and secure transmission of sensitive materials. Companies typically schedule these requests to align with their communication strategies, enhancing shareholder engagement and reducing administrative costs.

Specification of Documents and Information

Shareholders often seek electronic delivery of documents and information to streamline communication and enhance accessibility. In compliance with regulations, companies maintain specific documents such as annual reports, financial statements, and proxy materials. These documents, typically provided in PDF format, can be accessed via secure online portals or email notifications. The request for electronic delivery must specify the type of documents desired, ensuring recipients receive timely updates on events like annual meetings or dividend announcements. Transitioning to electronic formats not only reduces paper waste but also facilitates immediate access to crucial updates, thereby fostering a more informed shareholder base.

Assurance of Secure and Confidential Handling

Many companies, including Fortune 500 firms, provide shareholders with the opportunity to receive electronic delivery of important documents such as annual reports, proxy statements, and dividend notices. This method utilizes email as a means of communication, increasing efficiency and reducing paper waste. Assurance of secure and confidential handling of shareholder information is critical, particularly in light of cybersecurity threats. Advanced encryption standards (AES-256) are often employed to protect personal data during transmission. Companies generally follow compliance regulations outlined by the Securities and Exchange Commission (SEC) and the General Data Protection Regulation (GDPR) to ensure the appropriate use and safeguarding of shareholder information. Moreover, electronic delivery can enhance shareholder engagement by enabling timely access to vital information, enabling quicker decision-making regarding corporate governance matters.

Contact Information for Follow-up and Questions

Shareholders increasingly prefer electronic delivery of important documents, such as annual reports and proxy statements. Implementing this method can streamline communication and reduce costs associated with printing and mailing. Entities, such as corporations and investment firms, can enhance shareholder engagement by providing the option for digital access. Stakeholders should provide their updated email addresses, including domain names for verification, ensuring they receive timely notifications about future documents. This shift to electronic communication aligns with sustainable practices while ensuring shareholders receive essential information promptly.

Letter Template For Shareholder Request For Electronic Delivery Samples

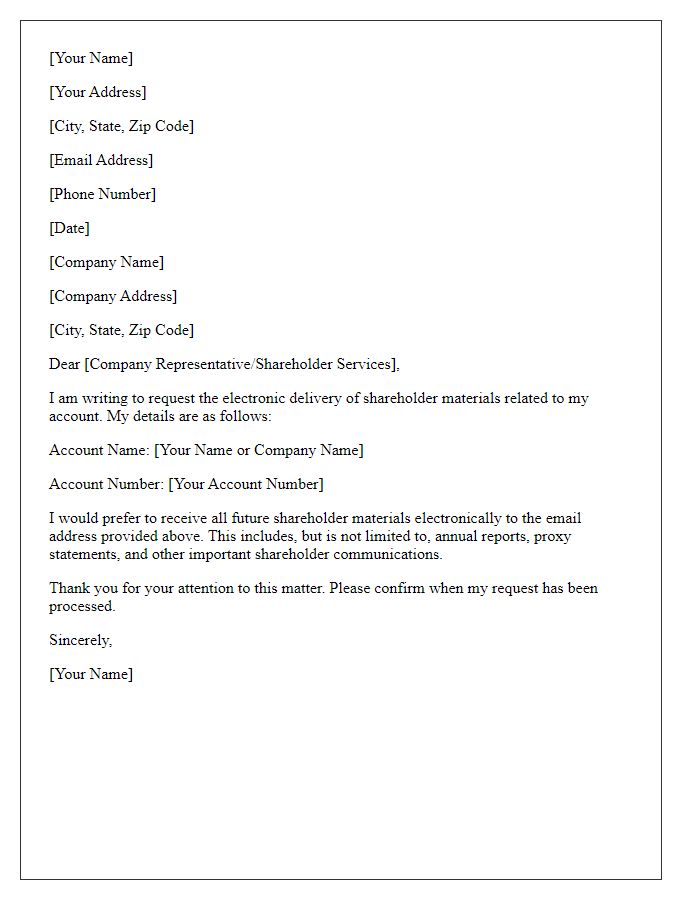

Letter template of request for electronic delivery of shareholder materials

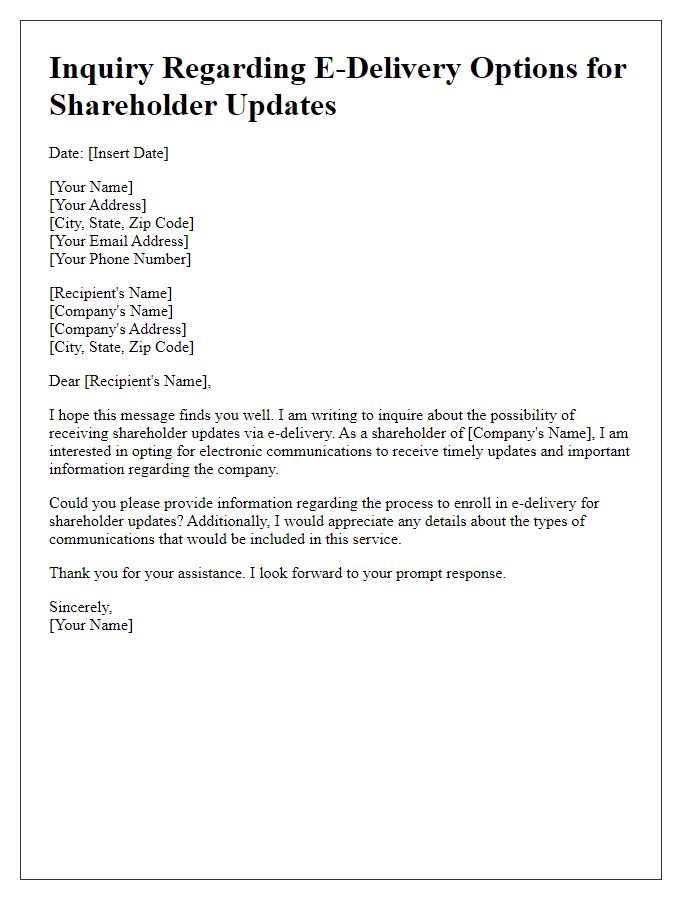

Letter template of inquiry for e-delivery option for shareholder updates

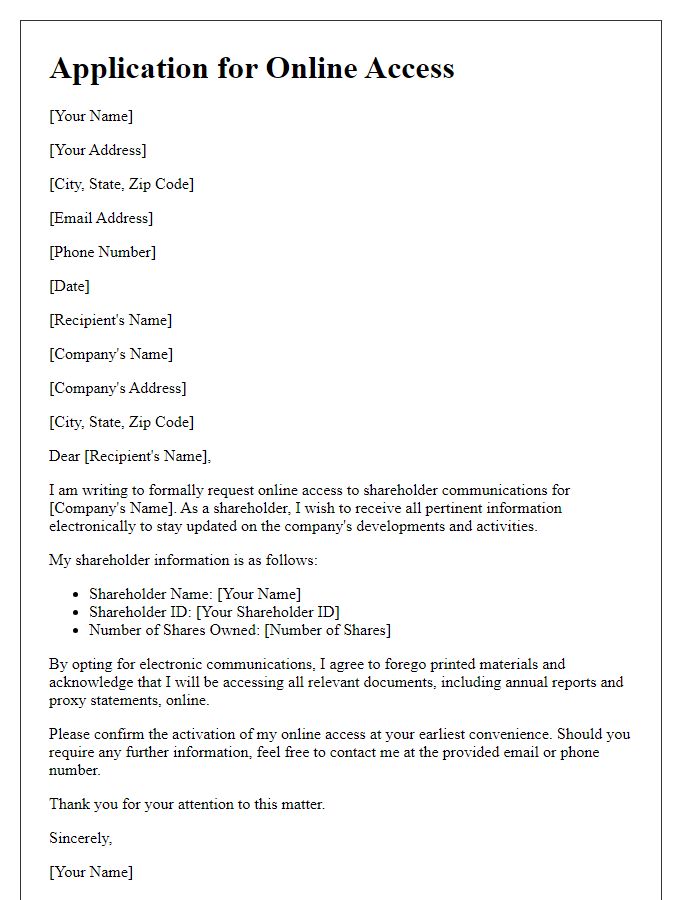

Letter template of application for online access to shareholder communications

Letter template of request to opt-in for electronic document distribution

Letter template of notice for switching to digital shareholder notifications

Comments