Navigating shareholder disputes can be a challenging experience, but it's a crucial aspect of sustaining healthy business relationships. Effective communication plays a significant role in conflict resolution, and crafting the right letter can set a positive tone for discussions. In this article, we'll explore a practical template designed to help you articulate your concerns and propose solutions clearly and concisely. So, let's dive in and discover how you can resolve disputes in a constructive way!

Context and Objective

Shareholder disputes often arise from conflicts over management decisions, profit distribution, or differing visions for company direction. For instance, a disagreement among shareholders in a tech startup, such as XYZ Innovations, regarding the allocation of profits (estimated at $1 million annually) can lead to serious tensions. Resolving these disputes effectively is crucial for maintaining operational stability and promoting shareholder satisfaction. The objective is to establish a clear framework for dialogue, mediation, and possible arbitration, ensuring that all parties feel heard and respected. Engaging a neutral third-party mediator with expertise in corporate governance can facilitate discussions and chart a path toward resolution, ideally avoiding prolonged litigation that can drain resources and damage company reputation.

Parties Involved

Shareholder disputes often arise within companies, particularly in instances involving differing opinions on business strategies, distribution of profits, or management decisions. Key players involved in these disputes can include individual shareholders, institutional investors, and the company's board of directors. In many cases, minority shareholders may feel sidelined in significant company decisions, leading to conflicts. Events, such as annual general meetings (often held in cities like New York or London), can provide platforms for voicing these disagreements. Mechanisms for dispute resolution, such as mediation or arbitration, are essential to foster productive dialogue and minimize disruptions within the organization. The legal frameworks guiding these processes often reference corporate governance laws relevant to specific regions, adding another layer of complexity to the resolution efforts.

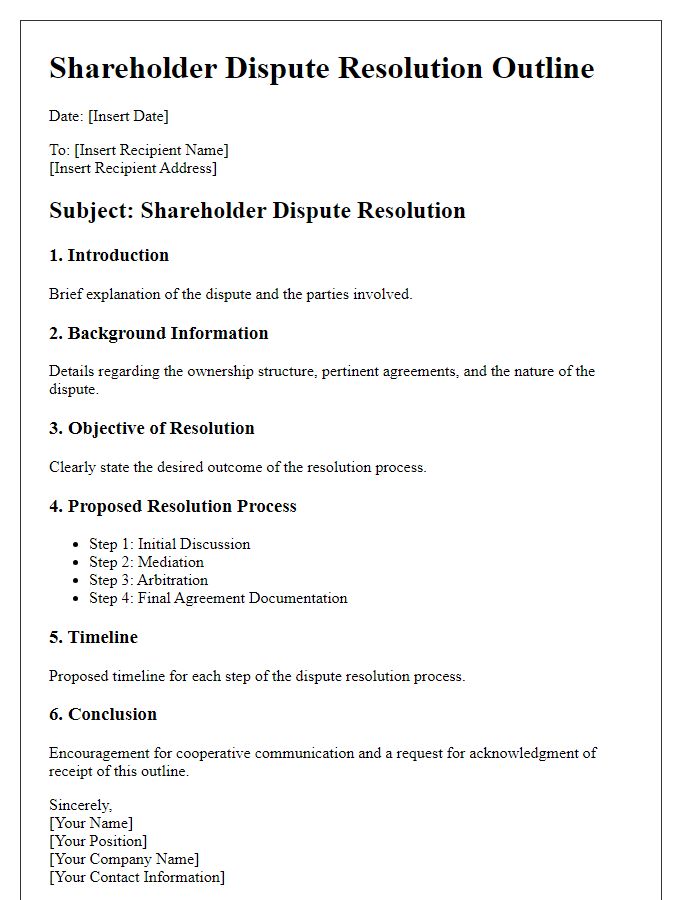

Dispute Overview

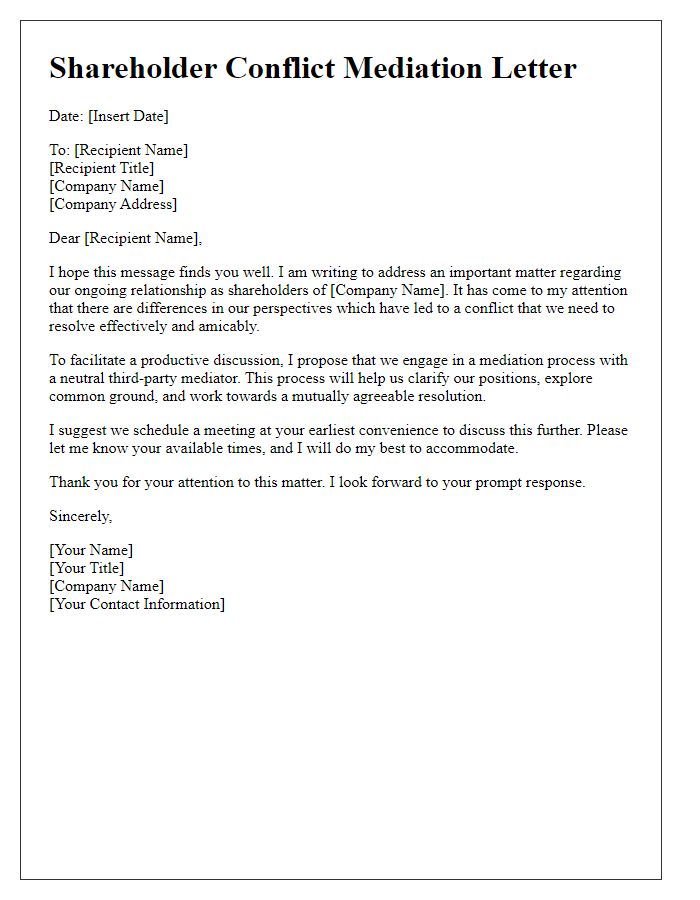

Shareholder disputes often arise in corporations when conflicts occur regarding ownership stakes, management decisions, and dividend distributions. These disagreements can lead to significant operational disruptions and potential financial losses. Mediation and arbitration (alternative dispute resolution mechanisms) can be employed to resolve issues without resorting to lengthy litigation processes, with the involvement of neutral third-party facilitators aiming to create solutions acceptable to all parties involved. Effective communication among shareholders is essential, as it fosters a collaborative environment that encourages dialogue and understanding. Legal guidelines governing shareholder rights and responsibilities, such as the Companies Act (specific to jurisdictions), play a crucial role in outlining the procedures for dispute resolution.

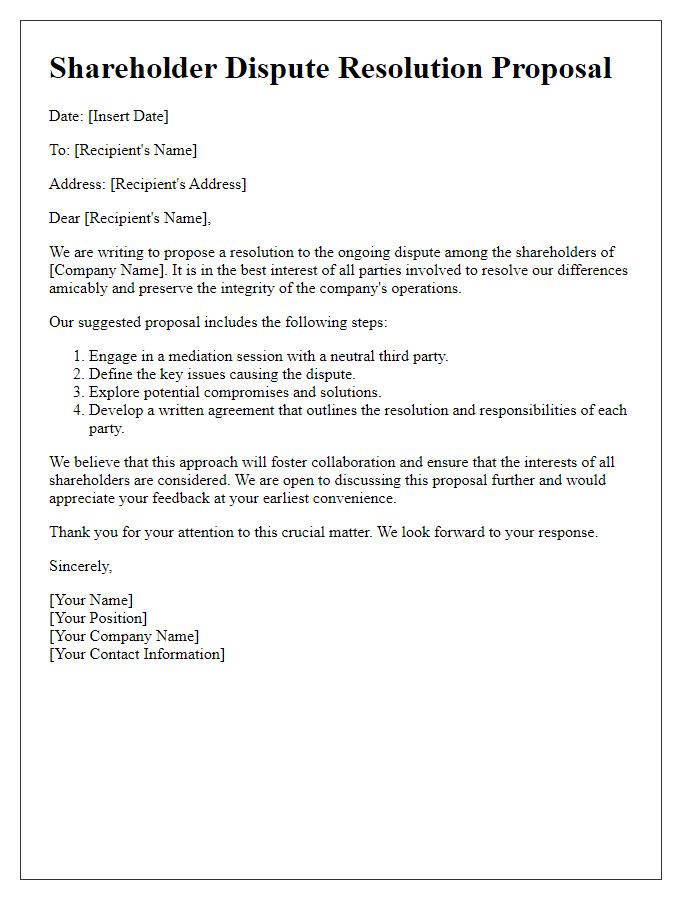

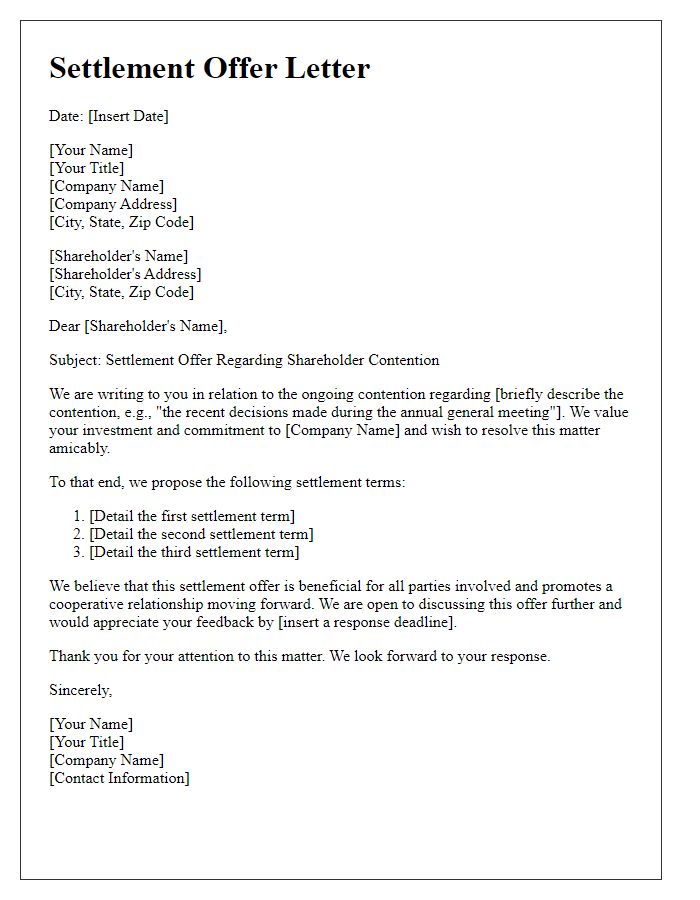

Proposed Solutions

Shareholder disputes often arise in dynamic corporate environments, impacting decision-making processes and overall business health. Various proposed solutions can be implemented to resolve these conflicts effectively. Mediation serves as an informal approach, allowing parties to negotiate with an unbiased third-party mediator, fostering open dialogue in a neutral setting. Arbitration offers a more formal resolution mechanism where an arbitrator makes binding decisions, often expediting the resolution process. Implementing clear communication channels and regular updates can build trust, helping to preempt misunderstandings. A revision of corporate governance documents, such as bylaws or shareholder agreements, can address potential areas of contention and ensure transparency. Finally, establishing an internal dispute resolution committee can provide shareholders with ongoing support and guidance, promoting a collaborative atmosphere in the organization.

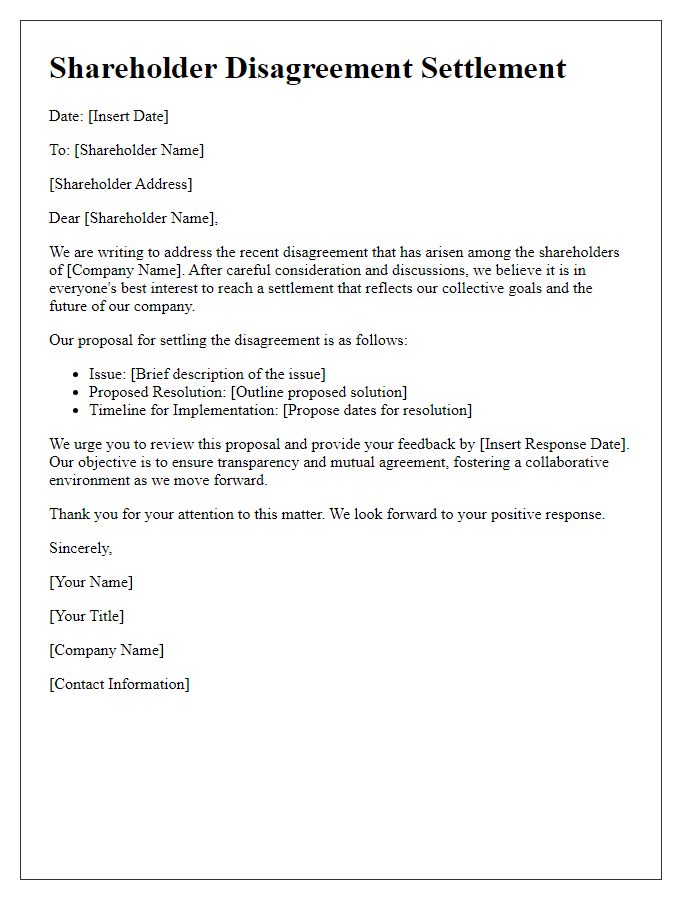

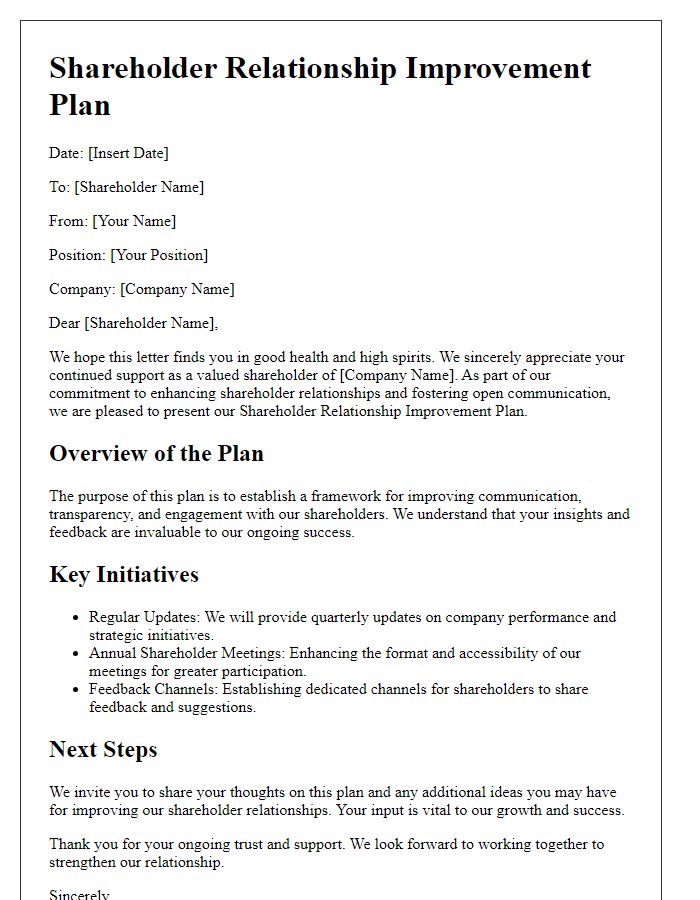

Call to Action

In corporate environments, shareholder disputes can lead to significant disruptions. Proactive communication is essential to address conflicts effectively. A call to action should clearly outline steps for all parties involved. Begin with identifying the key stakeholders, such as individual shareholders, the board of directors, and legal representatives. Specify the nature of the dispute, whether it involves voting rights, dividend distribution, or corporate governance. Encourage shareholders to participate in mediation sessions scheduled at specific locations, such as the corporate headquarters in New York City, or virtual meetings through secure platforms. Emphasize the importance of collaboration to reach a mutually beneficial agreement, fostering a healthier corporate atmosphere. Highlight potential outcomes, like revised shareholder agreements or changes in board composition, to motivate participation in the resolution process. Providing a clear timeline for resolution actions can also enhance engagement among stakeholders.

Comments