Are you curious about how dividends have impacted your investments over time? Understanding the history of dividend payouts can provide valuable insights into a company's performance and its commitment to returning value to shareholders. By reviewing this information, you can make more informed decisions about your holdings and future investments. Dive deeper into the details by reading more on how to effectively request this crucial data from your company.

Shareholder Identification

Shareholders seeking to obtain a comprehensive dividend history must first ensure accurate identification to facilitate efficient processing of their requests. Typically, companies require specific details such as shareholder identification number, full name, and contact information. This identification process is crucial, as many corporations maintain electronic records and databases that catalog their dividends distributed over preceding fiscal years. For example, shareholders may need to reference particular dates (e.g., quarterly payments paid as cash dividends) and specific amounts for each distribution. Accurate reporting ensures shareholders have access to critical financial information necessary for assessing their investments in the company's performance. Additionally, shareholders may require the company's registered address and SEC registration number to authenticate their inquiries.

Request Purpose

Shareholders may seek detailed historical dividend information to analyze the company's performance and profitability over time. Dividend history is crucial for evaluating yield trends, potential reinvestment strategies, and overall financial health. It encompasses data such as dividend payout amounts, declaration dates, and payment frequency across multiple fiscal years. Additionally, understanding dividend patterns can inform investment decisions, particularly in equity markets characterized by dividend-focused strategies. Companies listed on prominent exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ, are typically required to maintain clear records of this information for transparent investor relations.

Specific Dividend Periods

Shareholders often request detailed information regarding dividend history to facilitate investment decisions. For example, during the fiscal year 2022, a company may declare dividends in Q1, Q2, Q3, and Q4, with specific amounts for each period, such as $0.50 per share in Q1, $0.75 in Q2, $1.00 in Q3, and $1.25 in Q4. Historical dividend growth trends can be analyzed over specific periods, including 5-year or 10-year timelines, revealing patterns such as steady increases or fluctuations. Additionally, changes in dividend policies resulting from pivotal events like mergers, acquisitions, or significant economic downturns may also influence shareholder expectations and investment strategies. Requests for this information are typically directed to the company's investor relations department for comprehensive and accurate records.

Contact Information

Shareholders seeking detailed dividend history must request information through formal communication channels. Typically, this involves submitting inquiries to the Investor Relations department of the respective company. Key data to provide includes shareholder identification, such as a unique shareholder number, and pertinent contact details, including current mailing address and email, to facilitate efficient communication. Specific periods for dividend payouts, such as quarterly, semi-annual, or annual distribution dates, should be clearly stated in the request. It's advisable to mention the stock ticker symbol of the company for precise identification. Maintaining a formal tone ensures the request aligns with corporate communication standards.

Formal Closing and Signature

Shareholders seeking information regarding the dividend history of a publicly traded company often require specific details to better understand past distributions and decisions made by the board of directors. Requests typically detail the name of the company, its stock symbol, and the specific time frame for which dividend data is needed, as well as any pertinent shareholder identification information. A formal request ensures clarity, and including a polite closing statement enhances professional communication. In crafting the conclusion, a traditional sign-off such as "Sincerely" or "Best Regards" is often used, followed by the shareholder's name, title if applicable, and contact information, ensuring the correspondence appears polished and maintains a degree of formality appropriate for corporate communication.

Letter Template For Shareholder Request Of Dividend History Samples

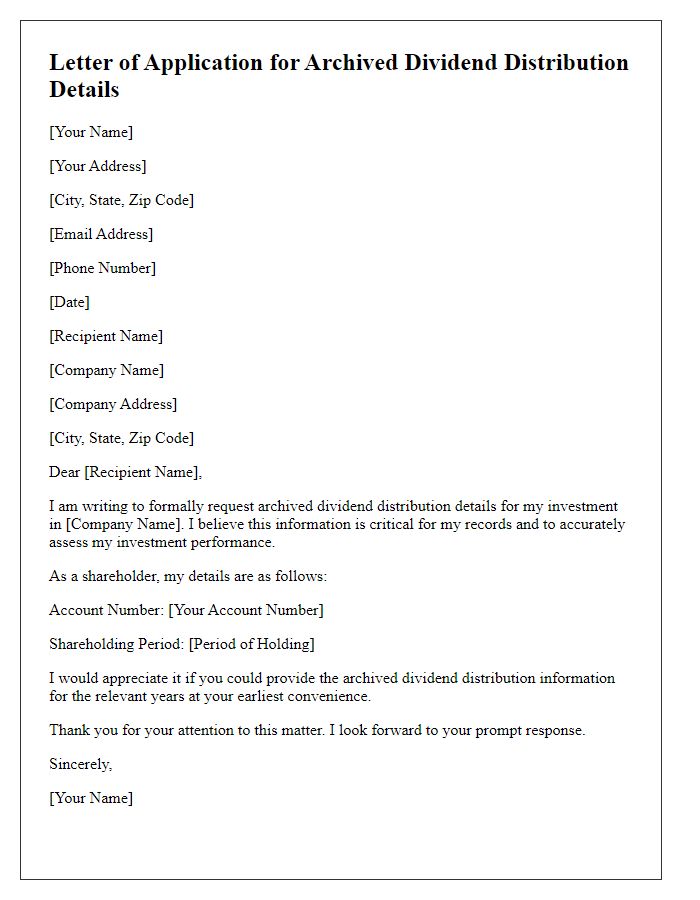

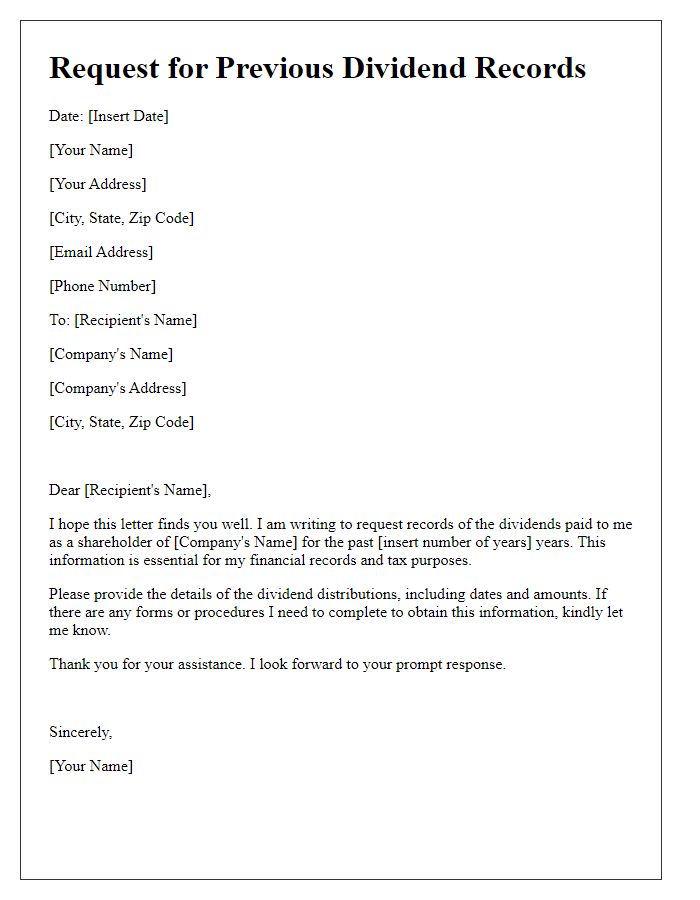

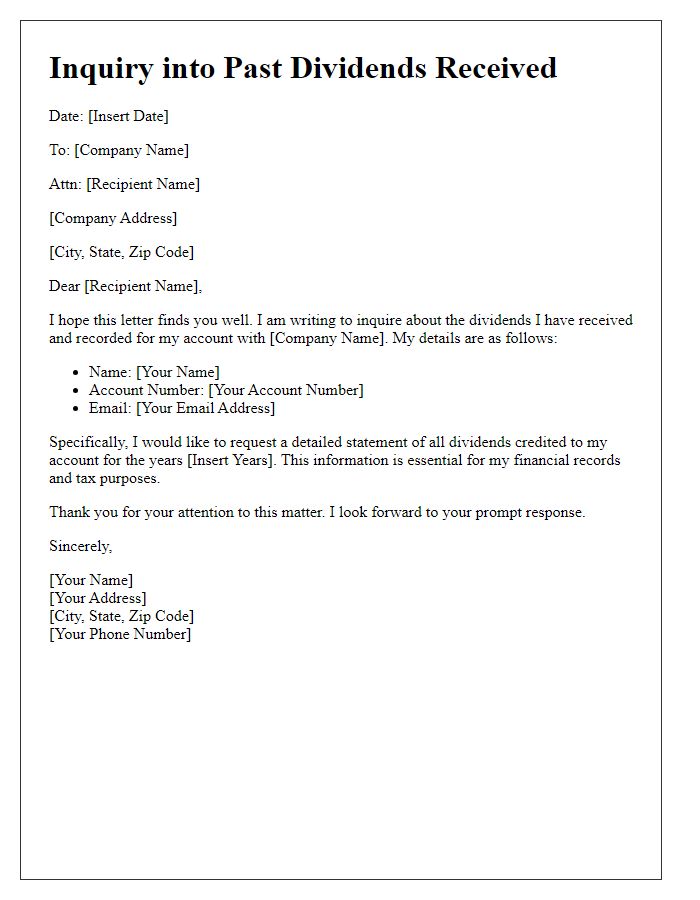

Letter template of application for archived dividend distribution details.

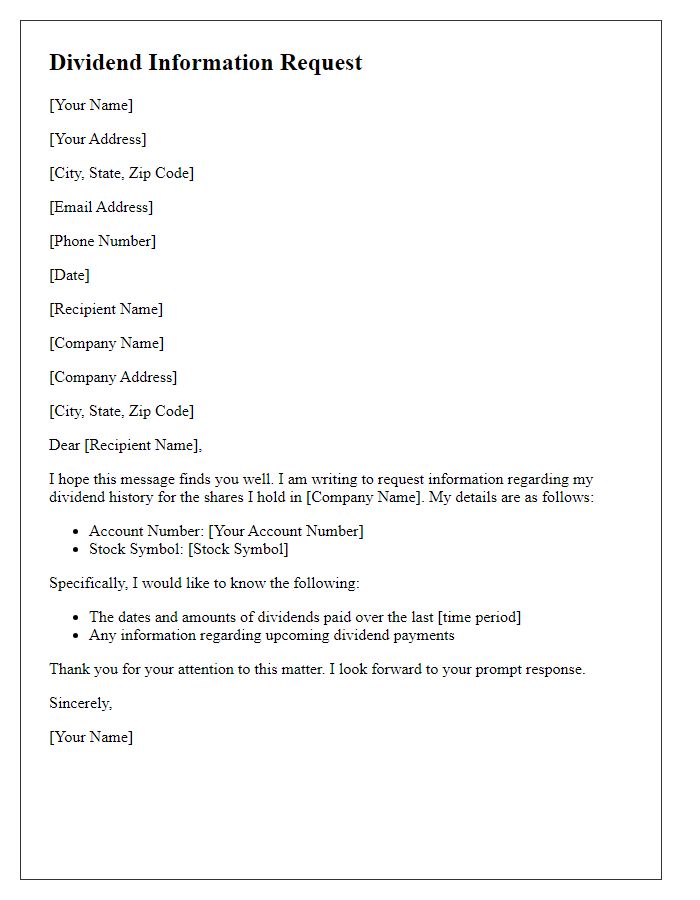

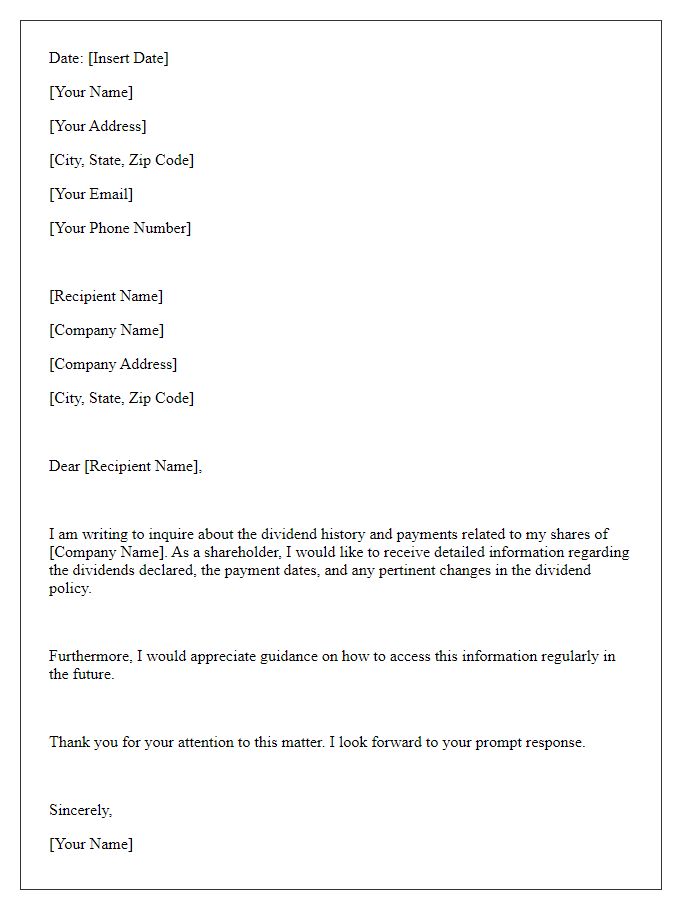

Letter template of notification request for dividend information history.

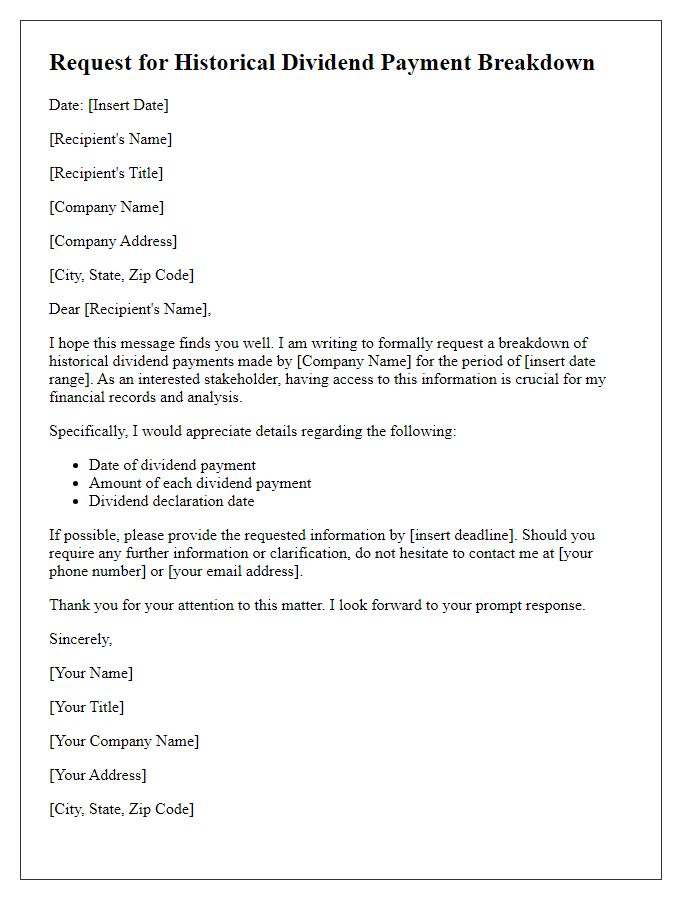

Letter template of formal request for historical dividend payment breakdown.

Comments