When it comes to audit report reconciliation, having a clear and structured approach can make all the difference. Whether you're a seasoned accountant or new to the process, understanding the nuances of effectively communicating your findings is essential. Drafting an engaging letter can help present your data with clarity and professionalism, ensuring that all parties are on the same page. Ready to enhance your letter-writing skills for audit reconciliation? Let's dive deeper into the topic!

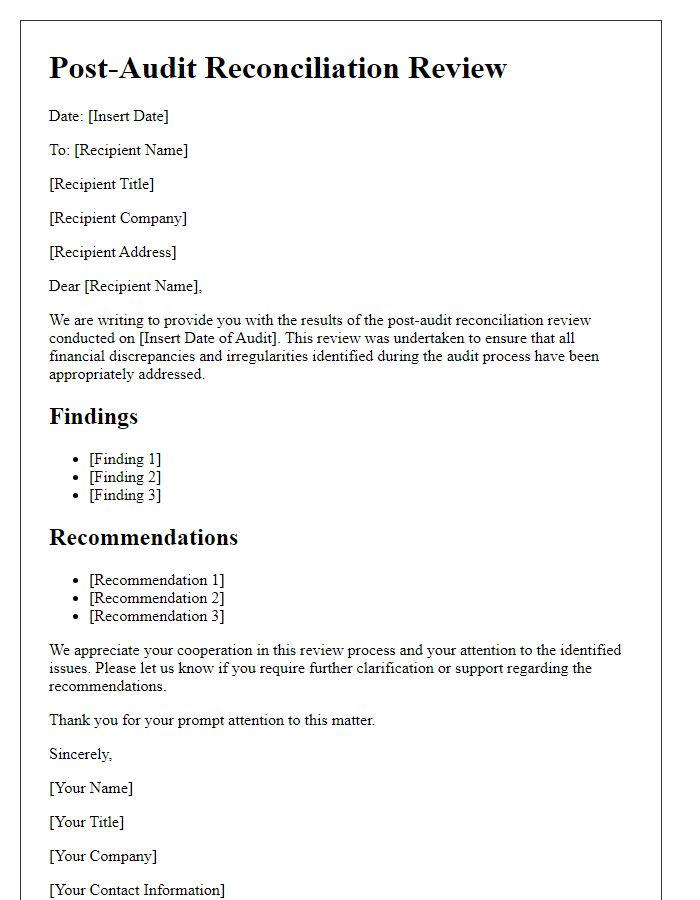

Clear Purpose Statement

An audit report reconciliation serves as a critical document that verifies the accuracy and completeness of financial records within an organization. This process involves meticulous examination of financial statements, such as balance sheets and profit and loss accounts, ensuring that all transactions are accurately recorded and discrepancies are identified. The reconciliation aims to align internal records with external documentation, like bank statements or supplier invoices, enhancing financial integrity and transparency. Furthermore, it provides stakeholders, including auditors and management, with assurance regarding compliance with financial regulations and standards, thereby fostering trust in the organization's financial practices. Key metrics, such as the total number of discrepancies found and resolved, along with the percentage of reconciled accounts, highlight the effectiveness of the reconciliation process and inform future financial operations.

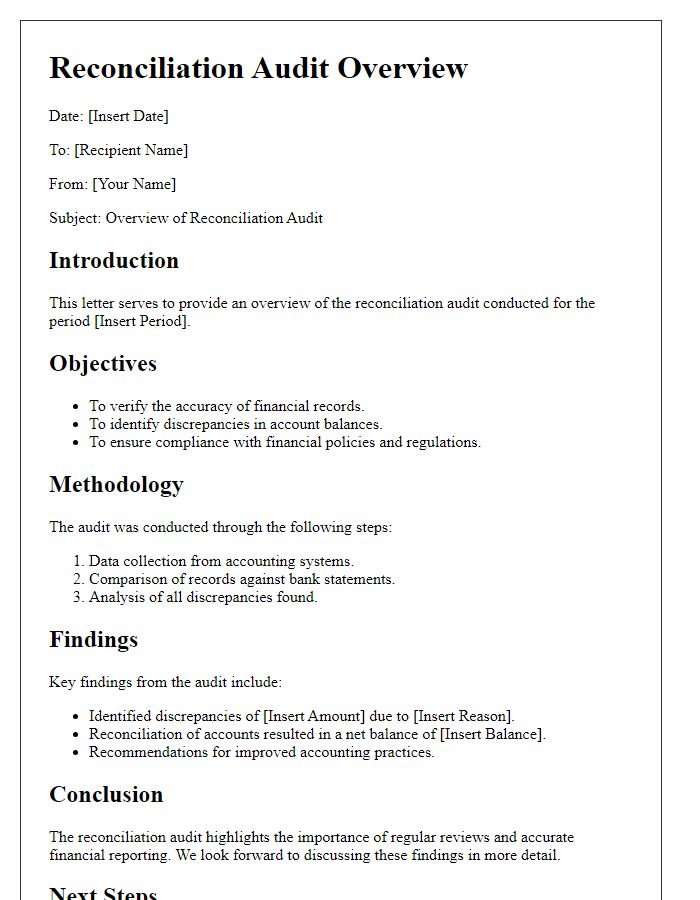

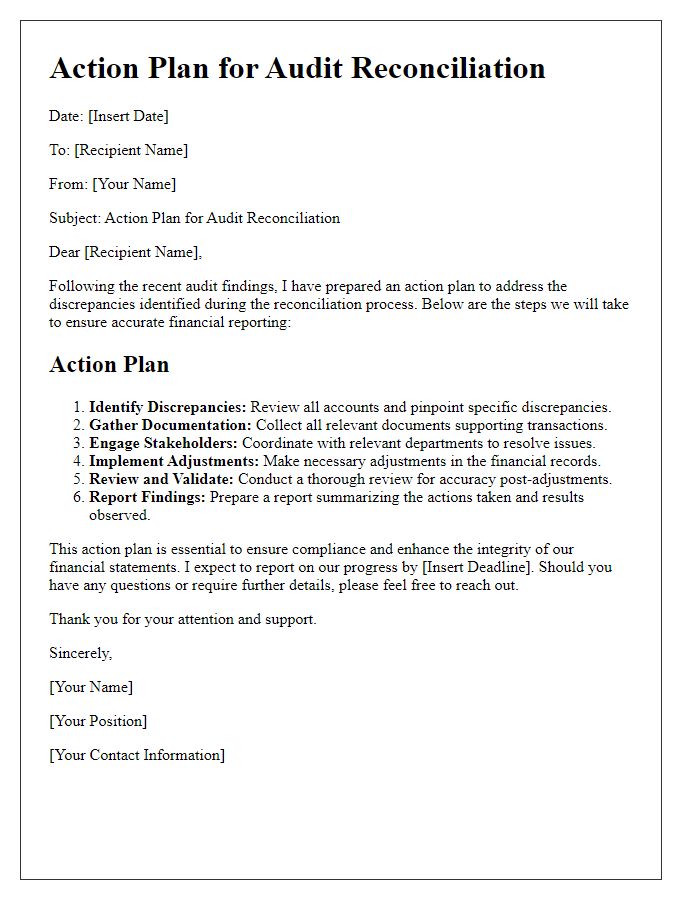

Scope and Methodology

The audit report reconciliation process involves a detailed analysis of financial statements and transactions within an organization, such as a corporation or a non-profit entity. The scope encompasses all financial records for the fiscal year 2022, including balance sheets, income statements, and supporting documentation. Methodology entails the use of a systematic approach, incorporating data sampling techniques and analytical procedures, ensuring adherence to set auditing standards like Generally Accepted Auditing Standards (GAAS). Auditors leverage tools such as Excel for data analysis and analytical software to identify discrepancies in financial reporting. This process may include interviews with key personnel in finance departments and reviews of internal controls to ensure accuracy and compliance with regulatory requirements, such as the Sarbanes-Oxley Act, promoting transparency and accountability. Proper documentation of findings will occur to prepare for any subsequent reviews or audits, providing a clear trail of the reconciliation process.

Summary of Findings

The audit report reconciliation revealed significant discrepancies within the financial statements of XYZ Corporation for the fiscal year ending December 31, 2022. Detailed analysis uncovered an overstatement of revenue totaling $150,000, primarily due to erroneous entries in the accounts receivable ledger. Additionally, an underreporting of expenses was identified, amounting to $75,000, which stemmed from unrecorded invoices from key suppliers such as ABC Supplies and DEF Services. Further investigation into payroll records indicated inaccuracies affecting employee compensation, leading to potential compliance issues with fair labor standards. These findings necessitate corrective actions to align reported figures with the actual financial performance, ensuring transparency and accuracy in quarterly reporting for stakeholders.

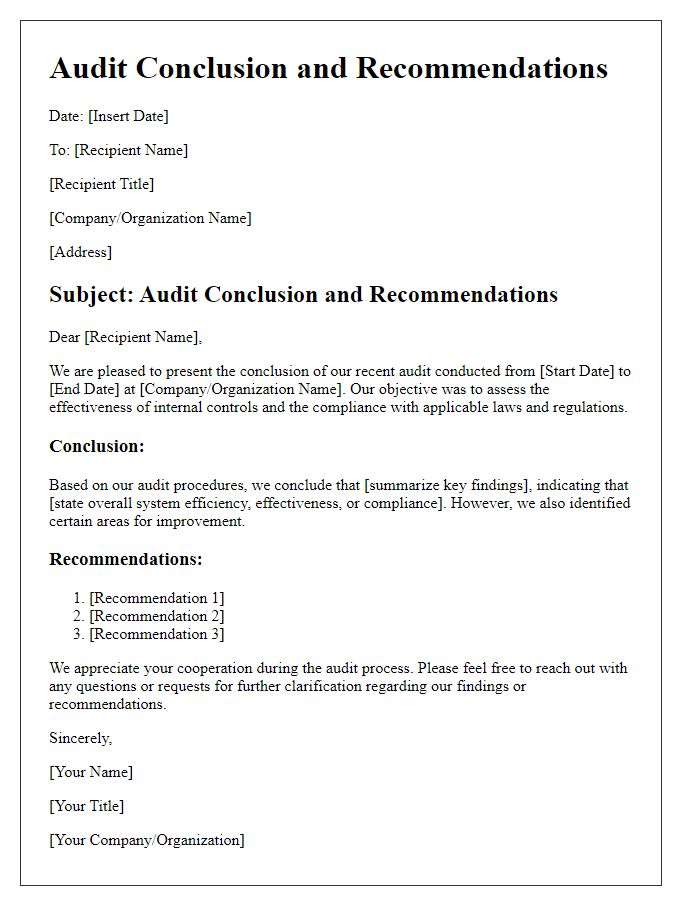

Conclusion and Recommendations

The audit report reconciliation process aims to ensure the accuracy and consistency of financial records, specifically for fiscal year 2022 at XYZ Corporation. Discrepancies identified totaled approximately $250,000, primarily linked to improper categorization of expenses and unrecorded revenue streams. It is crucial to enhance the internal control framework, focusing on training staff on proper reconciliation procedures. Implementing automated reconciliation software can significantly reduce errors and improve efficiency. Regular audits, scheduled quarterly, will help maintain the integrity of financial reporting moving forward. Additionally, establishing a dedicated reconciliation team within the finance department will ensure ongoing oversight and accountability.

Signature and Contact Information

An audit report reconciliation requires precise documentation and verification of financial records. Essential elements include the auditor's signature, ensuring accountability and authenticity. Additionally, the contact information must be included, comprising the auditor's name, position, email address, and phone number, facilitating subsequent communication for clarifications or inquiries. Such details are crucial in formalizing the audit findings and establishing a channel for ongoing dialogue between entities involved, particularly in financial institutions or corporate finance settings. Clear presentation of this information enhances the report's professionalism and ensures compliance with audit standards.

Comments