Are you wondering about the intricacies of security deposit refunds? Navigating the world of rental agreements can be a bit perplexing, especially when it comes to getting your hard-earned money back. In this article, we'll break down the reasons why your security deposit might be withheld and clarify the steps you can take to ensure a smooth refund process. So, if you're ready to demystify this topic and learn how to safeguard your finances, keep reading!

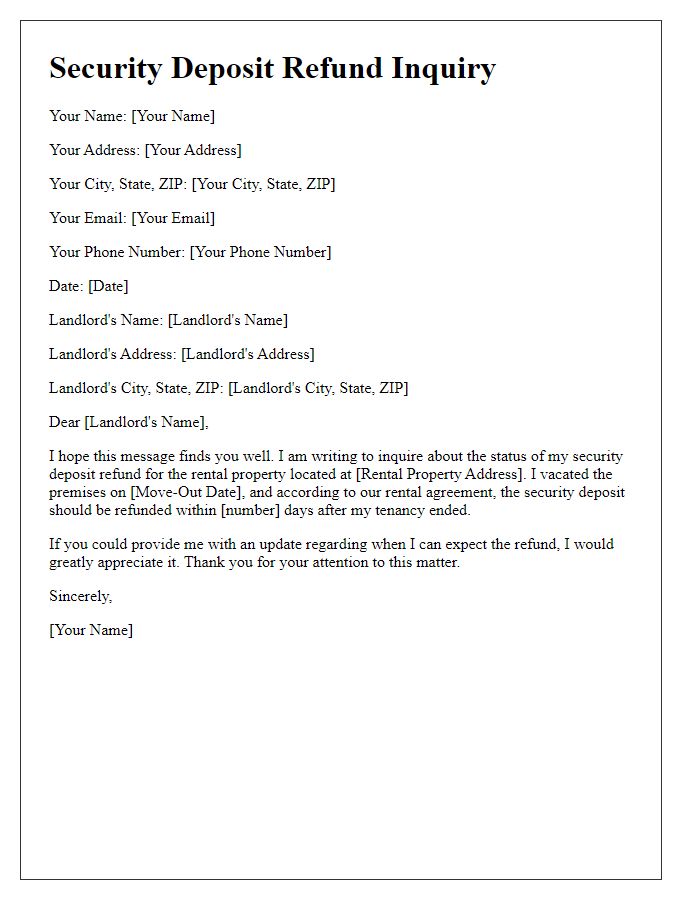

Tenant information and property address

Tenants experiencing delays in receiving their security deposit refunds can often face frustration regarding the process. Various reasons can lead to these delays, including unresolved maintenance issues, discrepancies in final utility bills, or required repairs--common circumstances outlined in lease agreements. In the state of California, landlords must return security deposits within 21 days after tenants vacate the premises, as per California Civil Code Section 1950.5. Additionally, landlords are required to provide a detailed itemized statement listing any deductions made from the security deposit, such as cleaning costs or damages assessed at the rental property located at 123 Maple Street, Los Angeles. Clear communication of timelines and processes ensures both parties understand their rights and responsibilities, promoting a smoother resolution.

Lease agreement terms and conditions

The security deposit refund process typically involves adherence to specific terms and conditions outlined in the lease agreement, which governs the landlord-tenant relationship. Most lease agreements stipulate a security deposit amount, often equivalent to one month's rent, held by the landlord during the rental period. Upon lease termination, a detailed inspection of the property, such as a two-bedroom apartment, occurs to identify any damages or unpaid rent. The landlord must comply with state laws, for instance, California's Civil Code Section 1950.5, mandating deposit refunds within 21 days post-move-out, accompanied by an itemized deduction list if applicable. Cleanliness standards may also be included, reflecting expectations regarding the property's condition. Accurate documentation, such as photographs of the apartment's condition upon vacating, can be pivotal in ensuring a smooth refund process and adherence to local tenant protection ordinances.

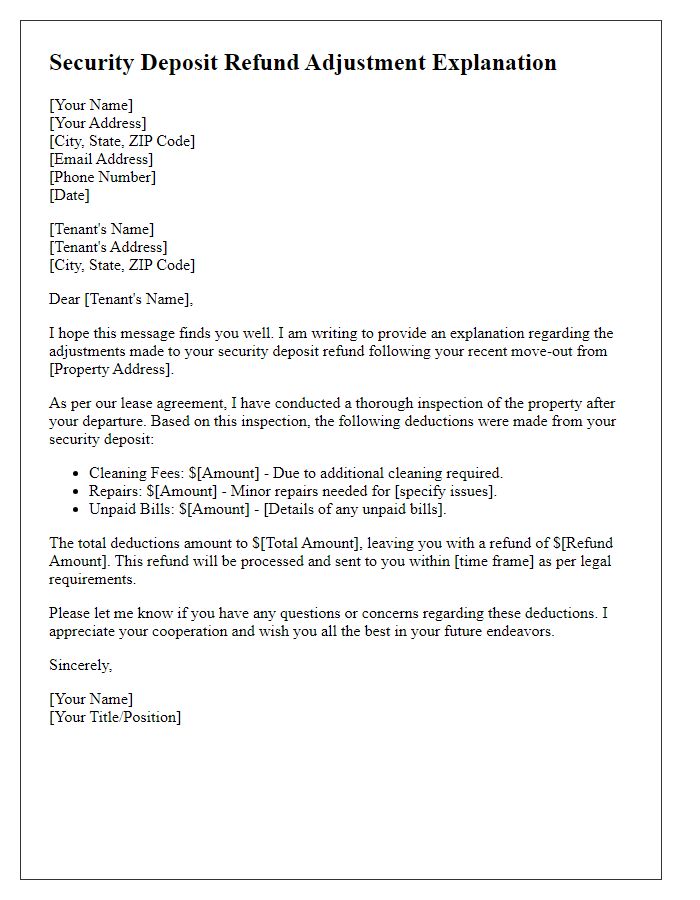

Itemized deductions and charges

When a tenant vacates a rental property, the security deposit, typically held to cover potential damages or unpaid rent, may be subject to deductions for various reasons. An itemized statement of deductions details expenses incurred by the landlord, such as repair costs for damaged fixtures, clean-up services for excessive dirt or debris, and unpaid rent or utility charges. For example, a broken window could incur a replacement fee of $150, while carpet cleaning might cost $100. Local regulations often stipulate that landlords must provide this detailed breakdown, usually within 30 days of the tenant's move-out date, to ensure transparency and compliance with security deposit return laws. This process helps protect both parties by outlining the specifics of any financial adjustments made against the initial deposit amount, ensuring clear communication regarding the return of the remaining balance.

Explanation of process and timeline for refund

The security deposit refund process usually begins within a stipulated period after the tenant vacates the rental property. In many jurisdictions, landlords have 30 days to return the security deposit, but this timeframe can vary, so it's vital to check local laws. During this period, property managers inspect premises for damages exceeding normal wear and tear, which may affect the refund amount. If deductions are necessary, itemized lists with corresponding costs are provided to justify the adjustments. The finalized refund amount is then calculated and typically returned via check or electronic transfer. Transparency and punctuality in this process ensure trust between landlords and tenants, fostering positive relationships and adherence to legal obligations.

Contact information for inquiries and disputes

A security deposit refund process involves several steps, including providing detailed contact information for clients to relay inquiries or disputes. Tenants in rental agreements, like those under the Residential Landlord and Tenant Act, should easily access communication channels. Key contact points might include the property management office, legal department, or landlord, with phone numbers (e.g., 555-0123) and email addresses (e.g., support@landlords.com). Timely communication is crucial, as disputes over deductions or refund delays can arise, emphasizing the need for a clear process. The local housing authority, such as the New York City Department of Housing Preservation and Development, may also serve as a resource for escalating unresolved issues.

Letter Template For Security Deposit Refund Explanation Samples

Letter template of security deposit refund denial explanation for tenants.

Letter template of security deposit refund compliance notice for landlords.

Comments