Navigating the escrow process can feel overwhelming, but it doesn't have to be! Essentially, escrow is a secure way to ensure that both buyers and sellers fulfill their obligations during a real estate transaction. By holding funds and documents in a neutral third-party account, escrow protects everyone involved until the deal is finalized. If you're curious about how this process works and why it's so essential, keep reading to uncover the details!

Clear definition of escrow

Escrow is a financial arrangement where a third party, known as the escrow agent, safely holds funds or assets on behalf of two parties involved in a transaction. This process ensures that the seller receives payment only when specific conditions are met, such as the transfer of property ownership or completion of services. Commonly used in real estate transactions, escrow protects both buyers and sellers by providing a neutral space for the exchange. The escrow agent is responsible for verifying that all agreed-upon terms are satisfied before releasing funds or initiating asset transfers. Typical escrow durations can vary from a few days to several months, depending on the complexity of the transaction and terms set forth in the agreement.

Step-by-step process overview

The escrow process involves several crucial steps to ensure a secure transaction between parties, typically in real estate or online transactions. First, the buyer and seller agree upon terms and select a neutral third-party escrow agent or company to oversee the process. Second, the buyer deposits funds, such as earnest money (usually 1-3% of the purchase price), into the escrow account, which holds the funds until all transaction conditions are met. Third, the seller provides necessary documents, including the property title and disclosures, to the escrow agent for verification. Fourth, contingencies are addressed; common clauses include home inspections and financing approvals taking 10-30 days to resolve. Fifth, upon successful review and satisfaction of all conditions, the closing documents are signed by both parties. Finally, funds are released from escrow to the seller, and ownership is officially transferred to the buyer. Throughout the process, communication occurs between the escrow agent and both parties to ensure clarity and compliance. Timely coordination often influences overall transaction efficiency, with escrow typically lasting 30-60 days from start to closing.

Roles and responsibilities of involved parties

The escrow process involves multiple parties, each fulfilling distinct roles and responsibilities to ensure a smooth transaction. The escrow agent, often a neutral third-party entity like a title company or an attorney, manages the escrow account, safeguards the funds, and ensures that all contractual obligations are met before finalizing the transaction. The buyer, who typically provides the earnest money, must submit necessary documentation, complete inspections, and secure financing as per the agreement. The seller, in turn, is responsible for providing accurate property disclosures, facilitating inspections, and transferring the property's title upon completion of the process. Additionally, lenders may be involved, scrutinizing buyers' financial qualifications and providing financing. All parties' roles are crucial in maintaining transparency, security, and compliance throughout the transaction, ultimately protecting everyone's interests.

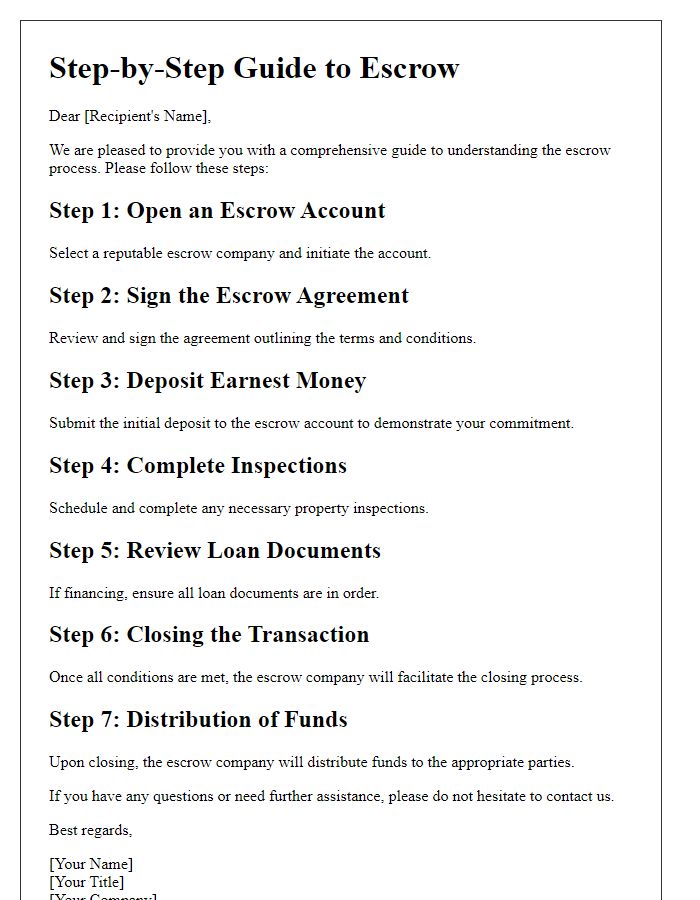

Key dates and timelines

The escrow process in real estate transactions typically involves crucial key dates and timelines that ensure a smooth transition of property ownership. After the purchase agreement is signed, the earnest money deposit is typically due within 3 days, securing the buyer's commitment. An escrow period often lasts between 30 to 60 days, during which various contingencies, such as home inspections and financing, must be addressed. Important dates include the completion of the inspection, often scheduled within the first 10 days, and the appraisal, which generally occurs shortly after. Approximately one week before closing, the final walkthrough allows the buyer to confirm the property's condition. The closing date represents the final milestone, where financial transactions occur, and ownership is officially transferred, often facilitated by a title company in a designated location. Timely communication with all parties involved, including real estate agents, lenders, and attorneys, is essential to adhere to these critical timelines.

Handling of funds and legal documentation

The escrow process involves the secure handling of funds and legal documentation within real estate transactions, typically mediated by an impartial third party known as the escrow agent. This agent, often a title company or attorney, holds the buyer's earnest money deposit (ranging from 1% to 3% of the property purchase price) in a dedicated escrow account until all contractual obligations are fulfilled. Legal documents, such as the purchase agreement (a legally binding contract specifying terms between buyer and seller) and title report (a document confirming property ownership and encumbrances), are meticulously reviewed and managed. Once all contingencies, including inspections and financing, are satisfied, the escrow agent coordinates the closing process, ensuring that funds are disbursed to the seller and relevant parties (such as real estate agents and lenders). The meticulous orchestration of these elements within the escrow process creates a secure environment, safeguarding both buyer and seller interests throughout the transaction.

Comments