Navigating the complex world of foreclosure can feel overwhelming, but you're not alone in this journey. Many homeowners face similar challenges, and there are resources available to help you safeguard your home and financial future. This article will guide you through essential steps and provide valuable information on foreclosure prevention assistance that can make a difference. So, let's dive in and explore the options that could help you keep your home!

Personal Information and Contact Details

Foreclosure prevention assistance programs are crucial for homeowners facing financial hardships related to mortgage payments. Reaching out to local organizations, such as the U.S. Department of Housing and Urban Development (HUD), can provide resources tailored to individual situations. Homeowners must gather personal information, including primary residence address, mortgage loan number, and details of monthly income and expenses. Key contact details, such as phone number and email address, should also be included for efficient communication. Timely engagement with these programs can prevent loss of property and reduce stress associated with foreclosure proceedings.

Explanation of Financial Hardship

Financial hardship often emerges from unexpected situations, including job loss, significant medical expenses, or natural disasters. For instance, in 2020, many homeowners faced difficulties due to the COVID-19 pandemic, leading to a nationwide spike in unemployment rates, which peaked at 14.8%. Individuals in areas like Louisiana or Texas experienced additional challenges from hurricanes, compounding issues of lost income and increased repair costs. These factors can lead to missed mortgage payments, which may ultimately result in foreclosure, impacting credit scores, housing stability, and overall financial health. Addressing financial hardship requires clear communication of the circumstances to lenders, emphasizing the need for assistance programs designed to support those facing potential foreclosure.

Request for Specific Foreclosure Prevention Options

Homeowners facing foreclosure can explore various options for prevention and financial relief. Government programs, such as the Home Affordable Modification Program (HAMP), offer modifications to mortgage payments for eligible borrowers, particularly those struggling in areas with high foreclosure rates like California and Florida. Local nonprofit organizations, including Habitat for Humanity and community action agencies, provide counselling and financial assistance to families in distress, often focusing on helping low-income households. Additionally, lenders may offer forbearance plans, which can temporarily suspend or reduce mortgage payments, allowing homeowners time to regain financial stability. Understanding these resources is critical in navigating the complex landscape of foreclosure prevention, ultimately aiming to keep families in their homes.

Income and Financial Details

In a foreclosure prevention assistance scenario, accurate income and financial details play a critical role in eligibility determination. Monthly gross income for households (including wages, salaries, bonuses) must be documented, while additional sources like Social Security, unemployment benefits, and child support should be included. Total monthly expenses, such as mortgage payments, property taxes, insurance, utilities, and living costs, need precise breakdowns. An updated bank statement from primary checking and savings accounts (covering at least the last two months) is essential to illustrate liquidity. Furthermore, documentation such as pay stubs or tax returns (for the last two years) is vital to verify income stability and assess the overall financial situation. Accurate reporting ensures timely processing of applications for assistance programs aimed at preventing foreclosure.

Documentation and Supporting Evidence

Foreclosure prevention assistance programs require comprehensive documentation from homeowners facing financial difficulties. Essential documents include a completed hardship letter outlining the reasons for financial distress, such as unexpected medical expenses or job loss, alongside proof of income, such as recent paycheck stubs or tax returns from 2022. Homeowners must also provide bank statements from the last two months, documenting finances, and a copy of the mortgage statement detailing current payment status. Additionally, lenders require copies of identification, such as a driver's license or state ID, to verify identity. Gathering these documents promptly can significantly increase the chances of obtaining effective assistance in preventing foreclosure.

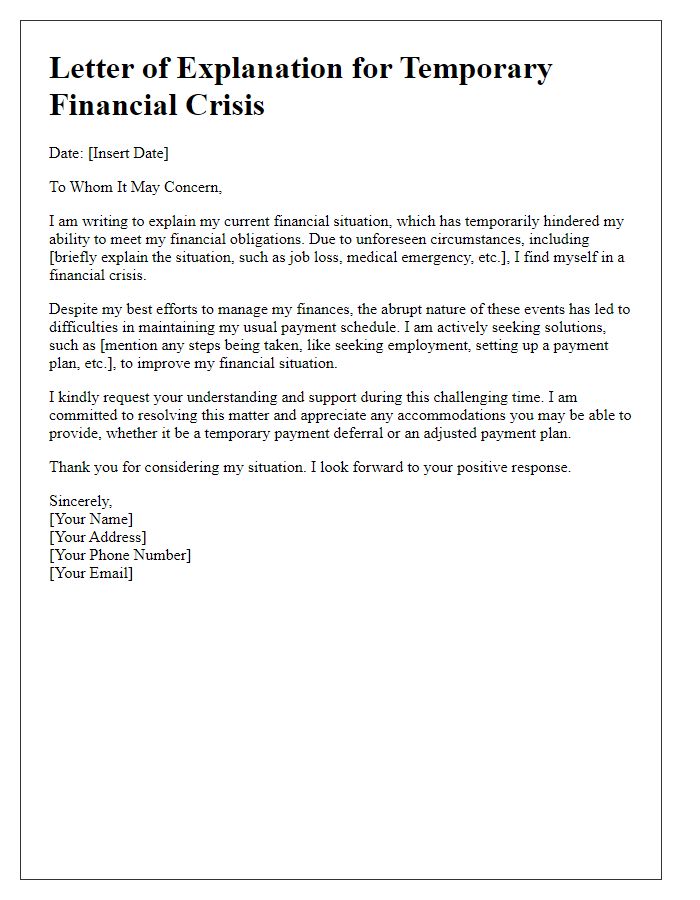

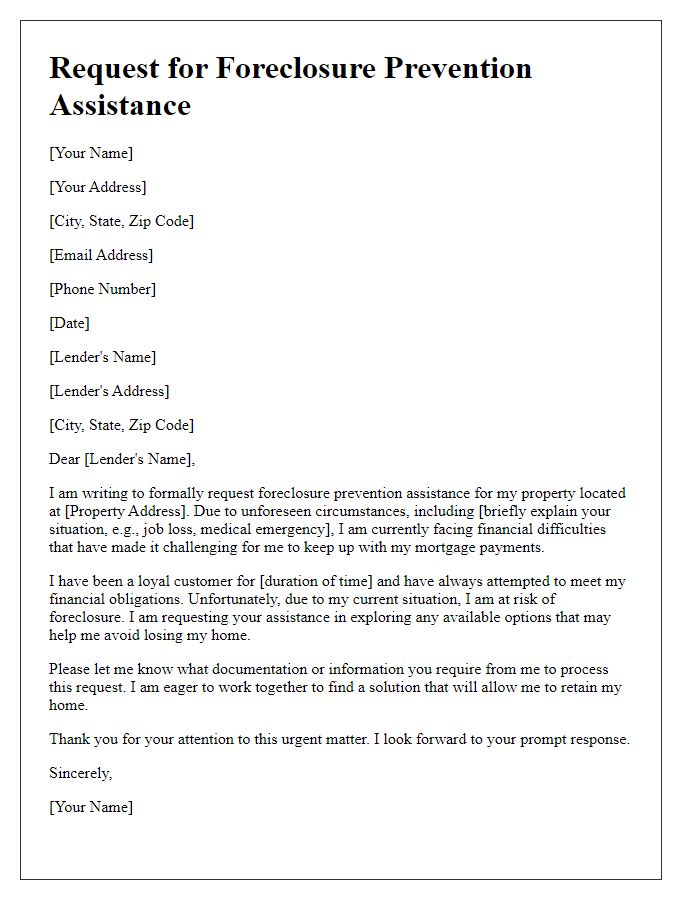

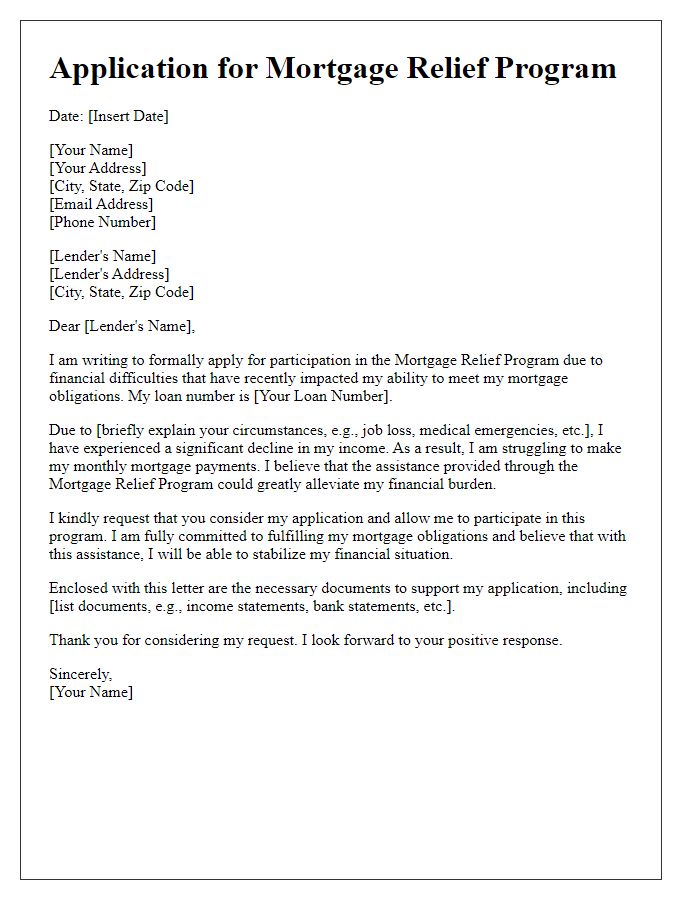

Letter Template For Foreclosure Prevention Assistance Samples

Letter template of explanation for temporary financial crisis intervention.

Comments