Are you in the process of closing a deal and need to send a letter requesting essential documents? Crafting a concise yet effective letter can make all the difference in getting the information you need promptly. In this article, we'll guide you through a letter template that ensures you cover all the necessary details while maintaining a professional tone. Ready to simplify your closing process? Let's dive in!

Clear Subject Line

A clear subject line for a closing document request could be "Request for Closing Documents - [Property Address/Transaction ID]." This succinctly conveys the purpose of the email, ensuring the recipient immediately understands its importance. Including the specific property address or transaction ID provides context, reducing confusion and streamlining communication. Timely requests for closing documents are crucial for real estate transactions, often involving potential buyers, sellers, and financial institutions, and ensuring smooth coordination among all parties involved. Attention to detail in the subject line can enhance efficiency and prompt a quicker response.

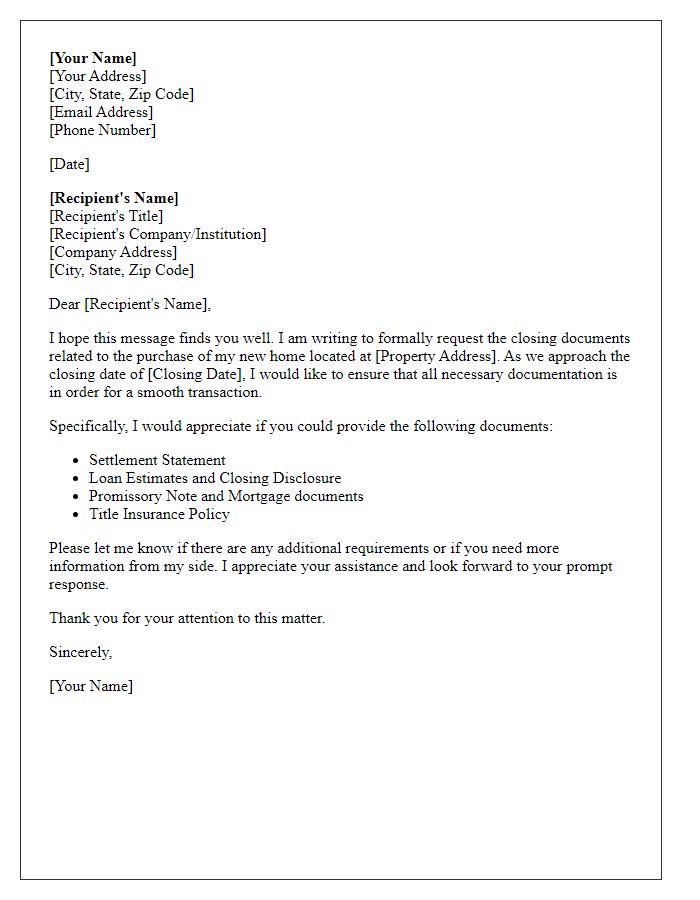

Sender's Contact Information

The closing document request process often involves detailed communication. Essential components include the sender's contact information, which should encompass full name, address, phone number, and email. This information facilitates clarity and ensures proper identification of the sender, whether for a transaction in a bustling city like New York or a quiet suburb. Including a reference number or property address can enhance the context of the request, providing a clear link to the specific transaction. Additionally, a concise subject line can improve the visibility and urgency of the request.

Recipient's Name and Address

The process of securing a closing document request involves submitting a formal inquiry to a specific recipient, often a financial institution or a legal entity, situated at a designated address. Accurate details such as the recipient's full name, institution title, and postal address (including city, state, and zip code) must be meticulously provided. The request can pertain to significant transactions, such as real estate purchases or loan closures, and may require additional identification details such as account numbers or property identifiers. Ensuring precision in this information is critical to avoid delays and facilitate a swift processing of the required documents.

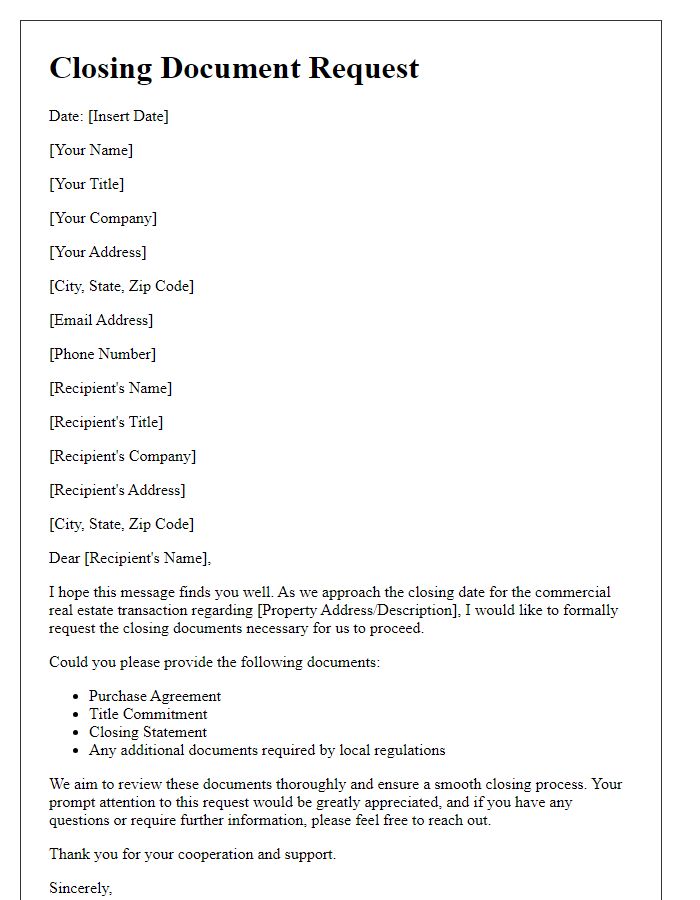

Reference to Previous Correspondence

An organized closing document request typically references previous correspondence to maintain clarity throughout the process. For instance, the request highlights pivotal communication dates, such as March 15 and April 10, between the involved parties, possibly a lender and borrower, regarding document submissions. Mentioning specific documents, such as the Loan Agreement dated February 1, 2023, or the Title Commitment issued by XYZ Title Company, can provide context. Including parties' contact information and addressing concerns brought up in earlier discussions, like the need for additional signatures, reinforces the continuity of communication and ensures a smooth closing process.

Purpose and Details of Request

Closing documents play a crucial role in real estate transactions, providing necessary information for both buyers and sellers. Essential items include the final settlement statement (HUD-1 or Closing Disclosure), title insurance policy, and warranty deeds, detailing property ownership transfer. A request for these documents is typically made to ensure all conditions outlined in the purchase agreement are met, confirming the transaction's completion. Timely access to closing documents facilitates property ownership assurance, ensuring compliance with local laws and mortgage lender requirements. Accurate and promptly provided closing documents safeguard against future disputes, establishing transparency in the real estate process.

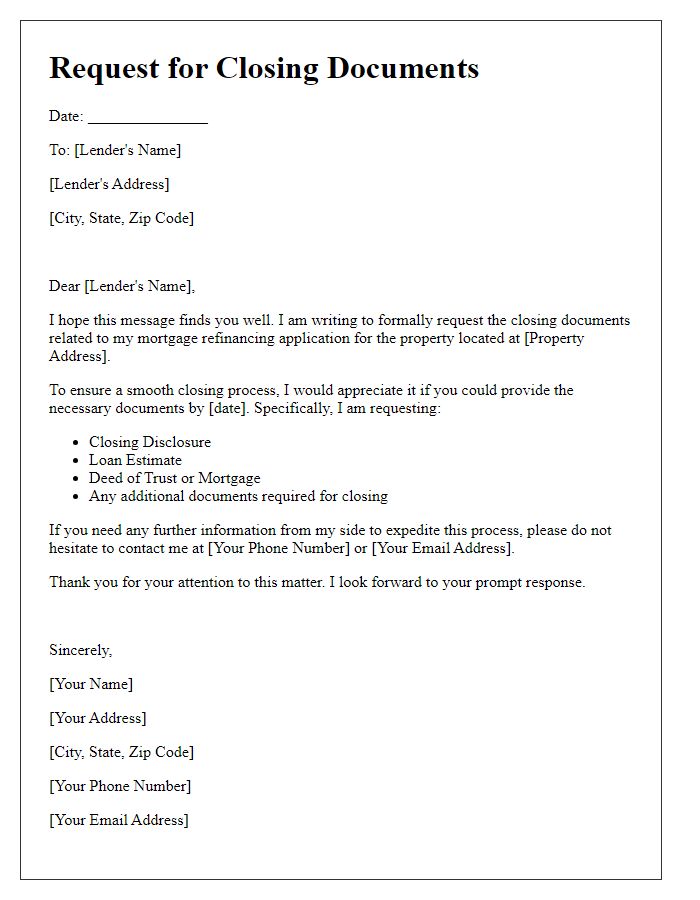

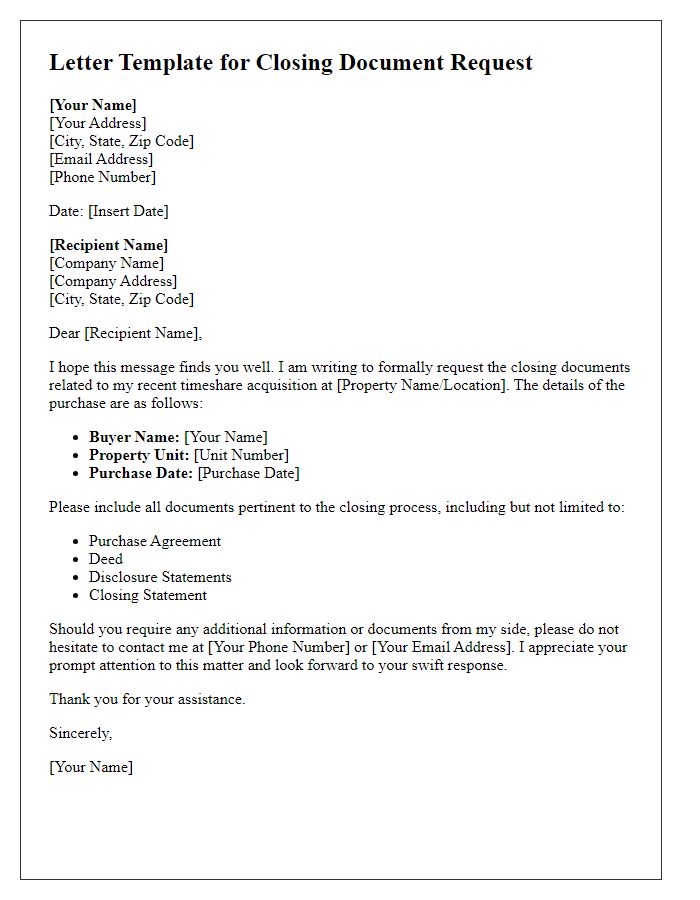

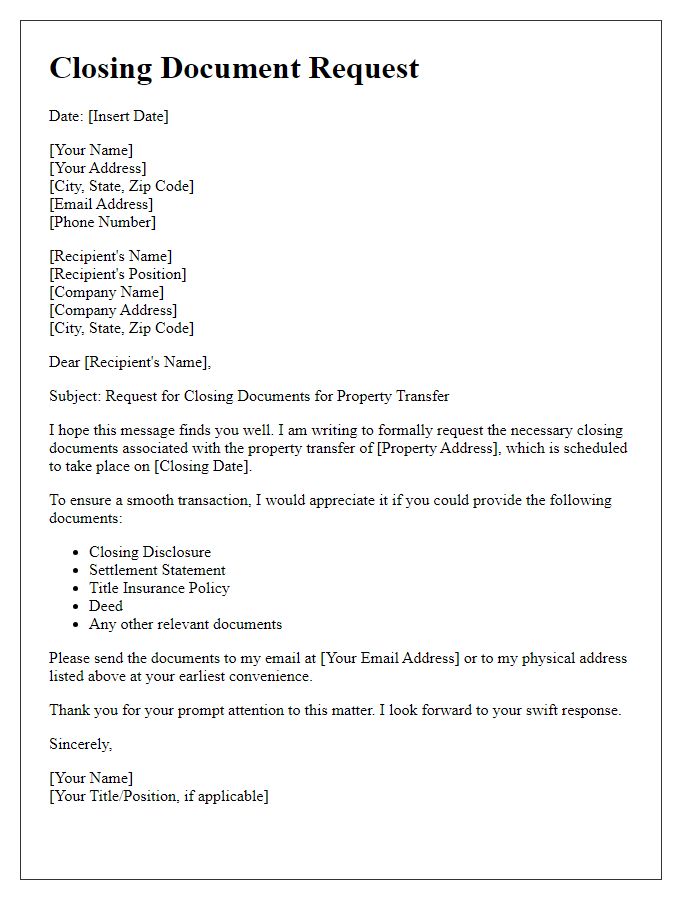

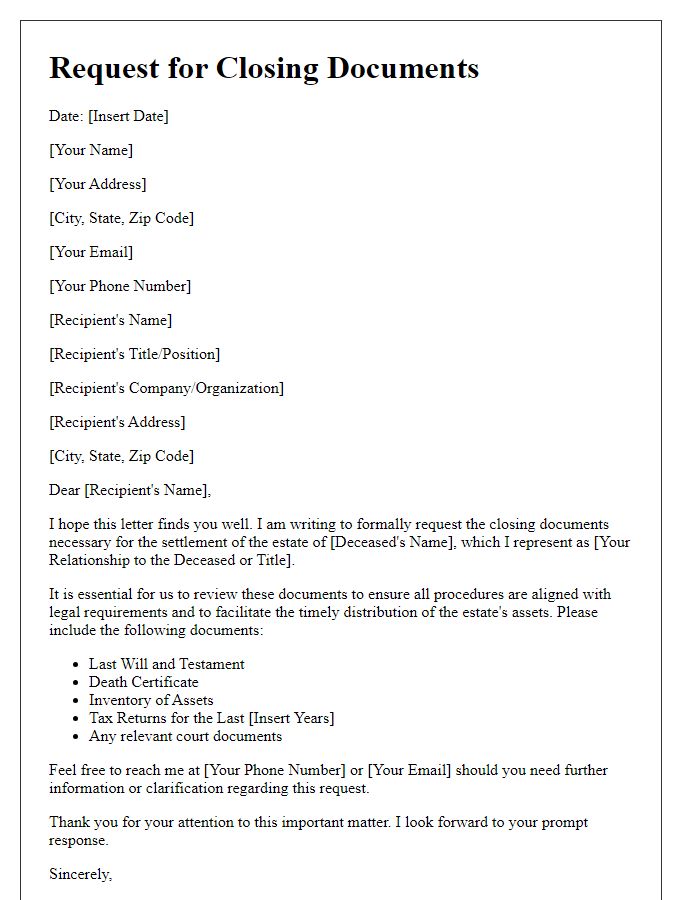

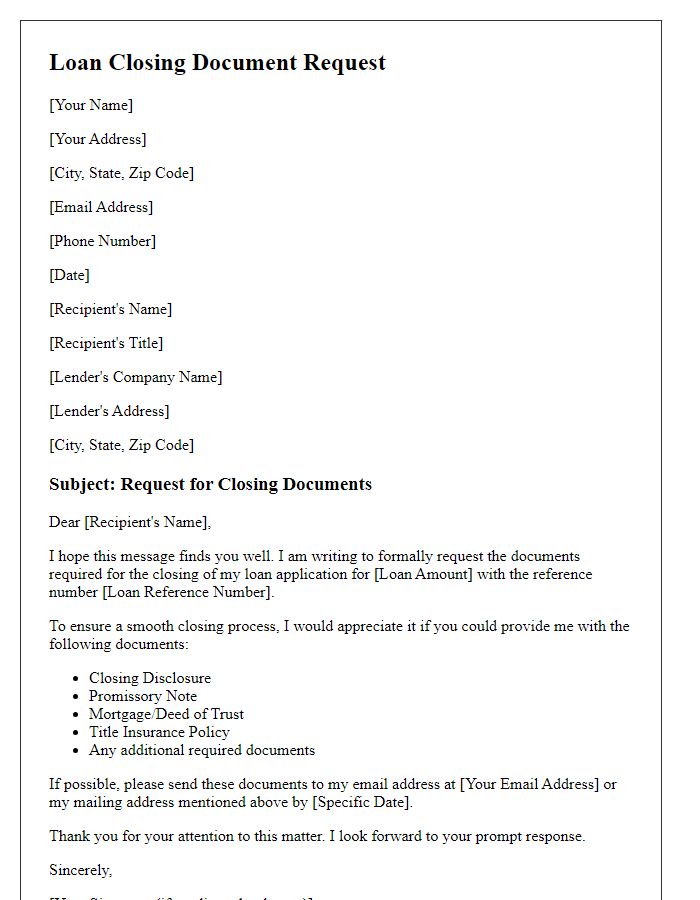

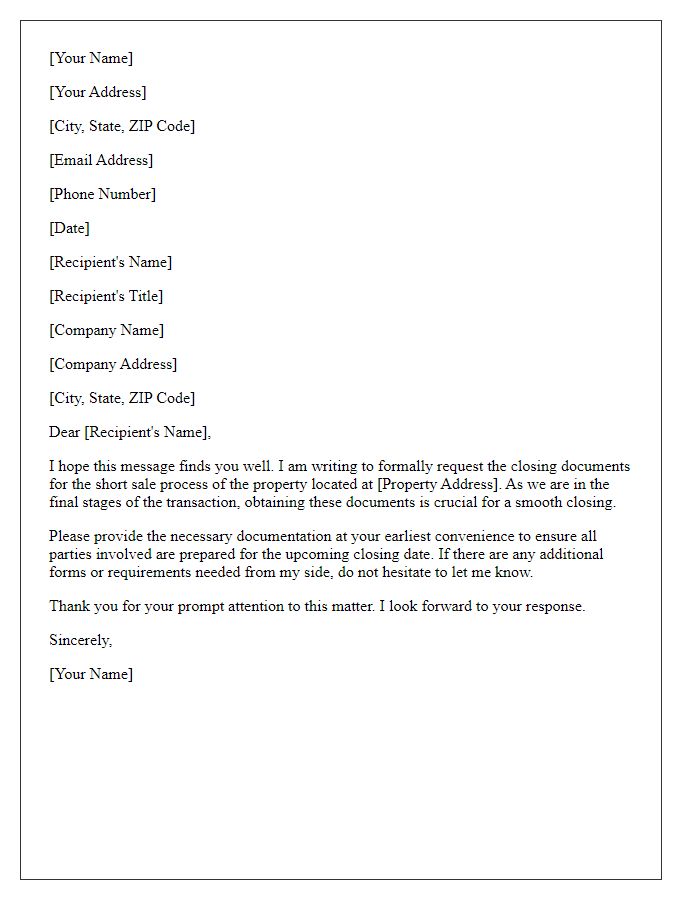

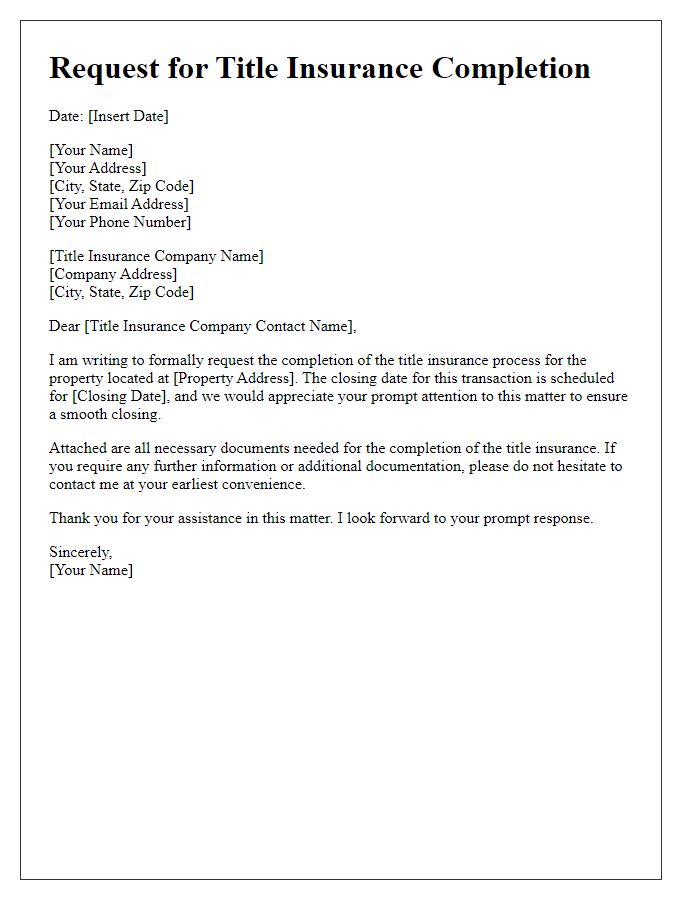

Letter Template For Closing Document Request Samples

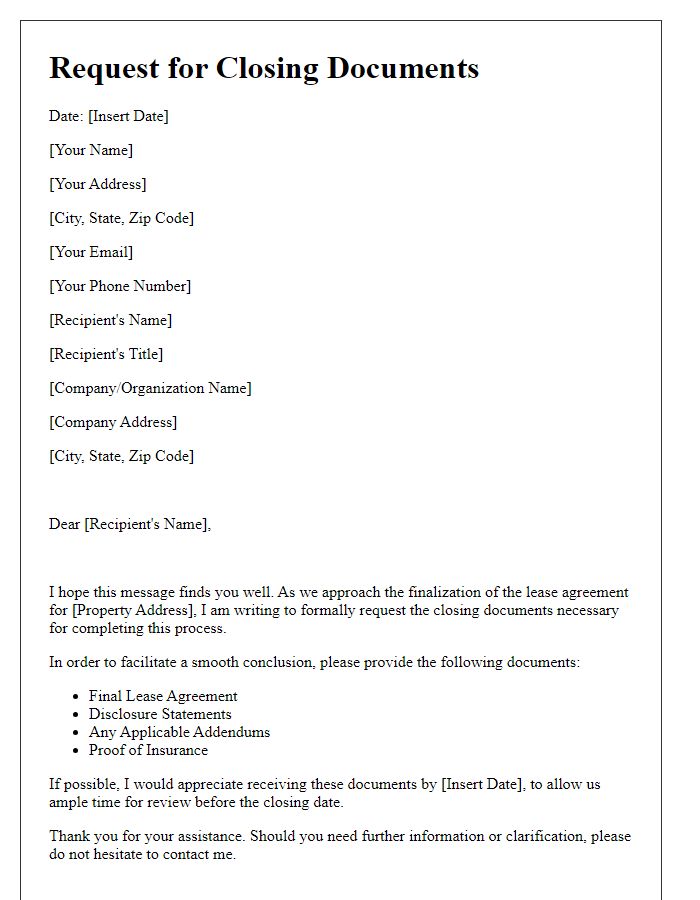

Letter template of closing document request for lease agreement finalization

Comments