When it comes to understanding your author royalty statement, it can often feel like navigating a maze of numbers and terms. Many authors find themselves scratching their heads, wondering exactly how their hard work translates into earnings. In this article, we'll break down the key components of your royalty statement, elucidate common misconceptions, and provide tips for maximizing your income as a writer. So, let's dive in and empower you to demystify your earningsâread on for more insights!

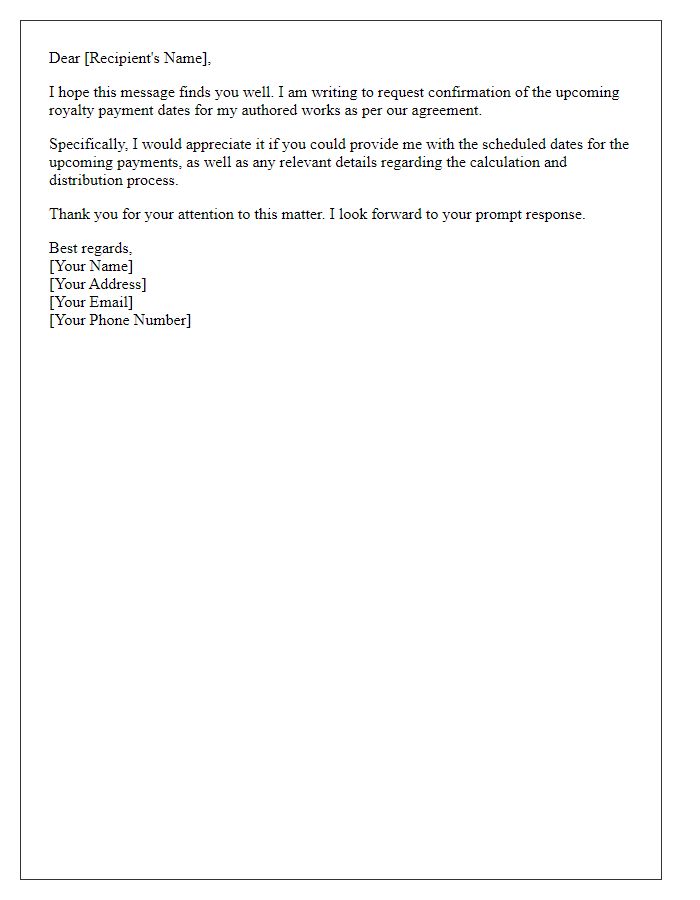

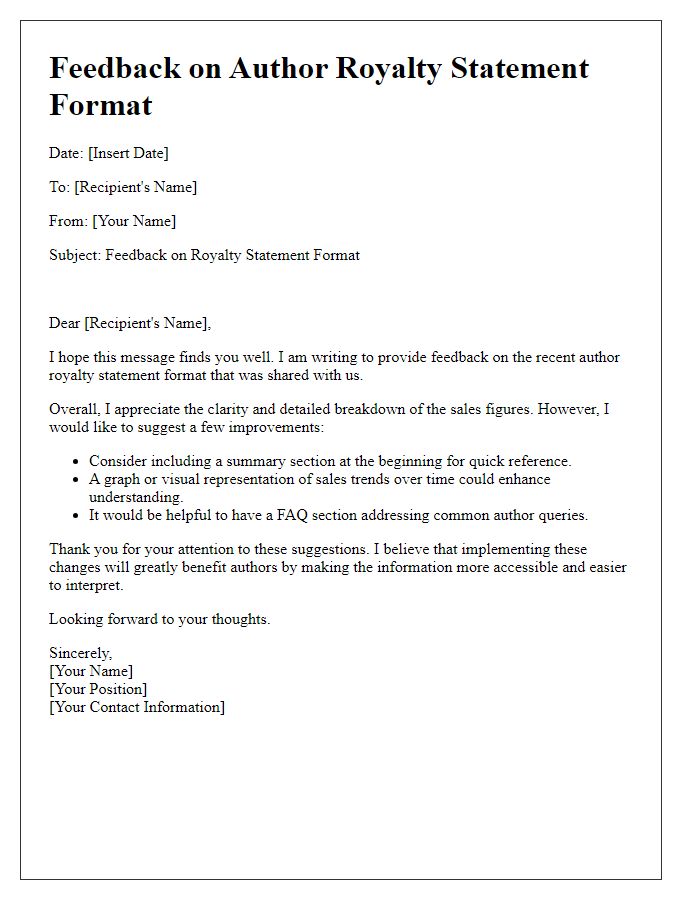

Clear identification of recipient and sender

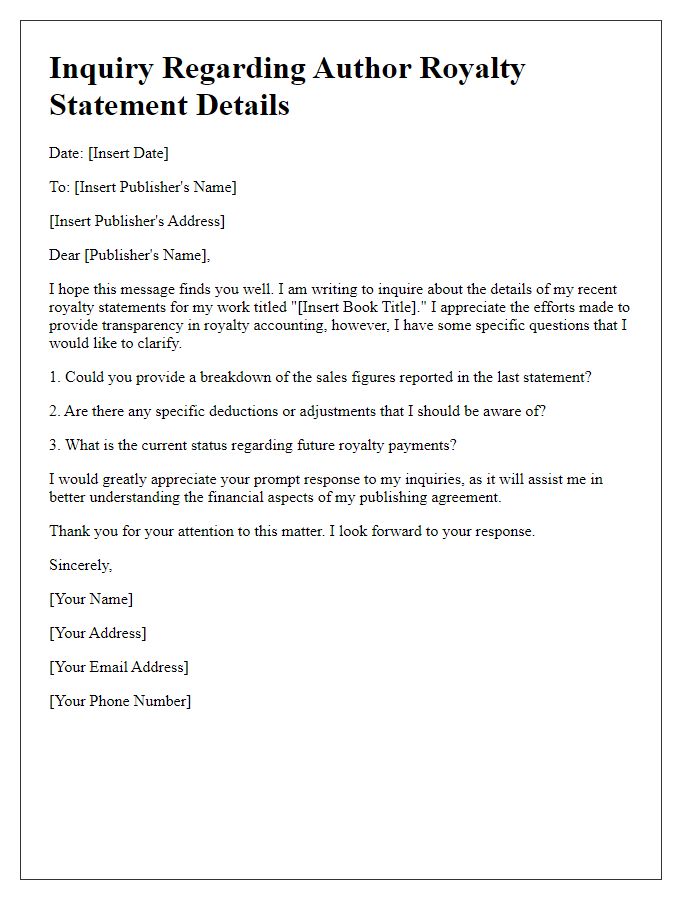

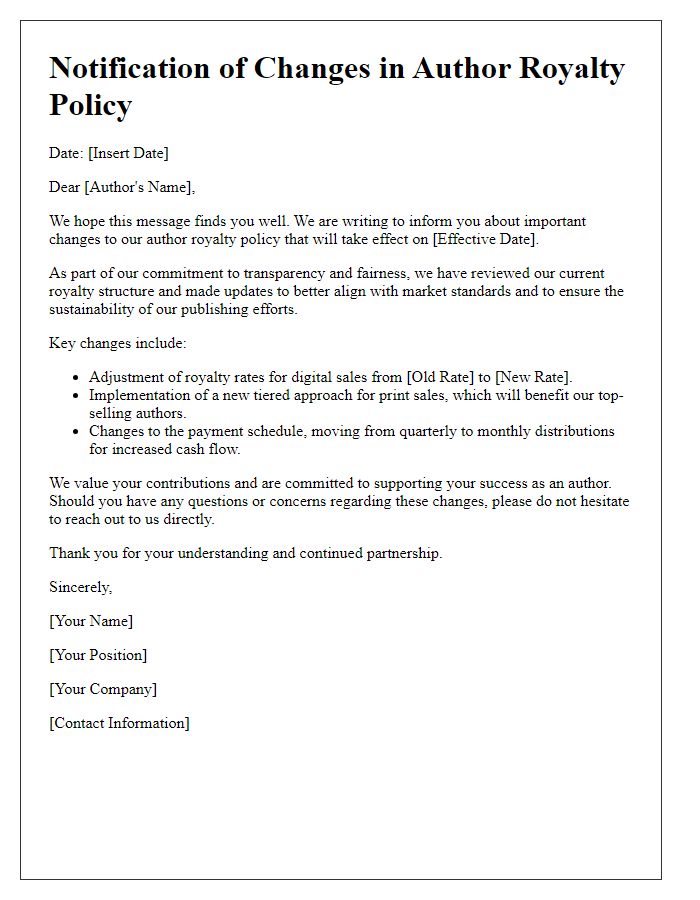

The author royalty statement provides crucial financial insights for authors. Each statement details the sales figures from books published by specific publishers, illustrating how many copies were sold within a designated period, typically quarterly or annually. The royalties earned are calculated based on varying percentages of sales revenue, dependent on the author's contract terms. This statement often breaks down earnings by formats, such as hardcover, paperback, and digital editions, providing transparency. Additionally, it includes identifiers like the ISBN (International Standard Book Number) to specify each book and the publisher's name for clear attribution. Accurate tracking of these financial statements is vital for authors to assess their earnings and understand their market performance.

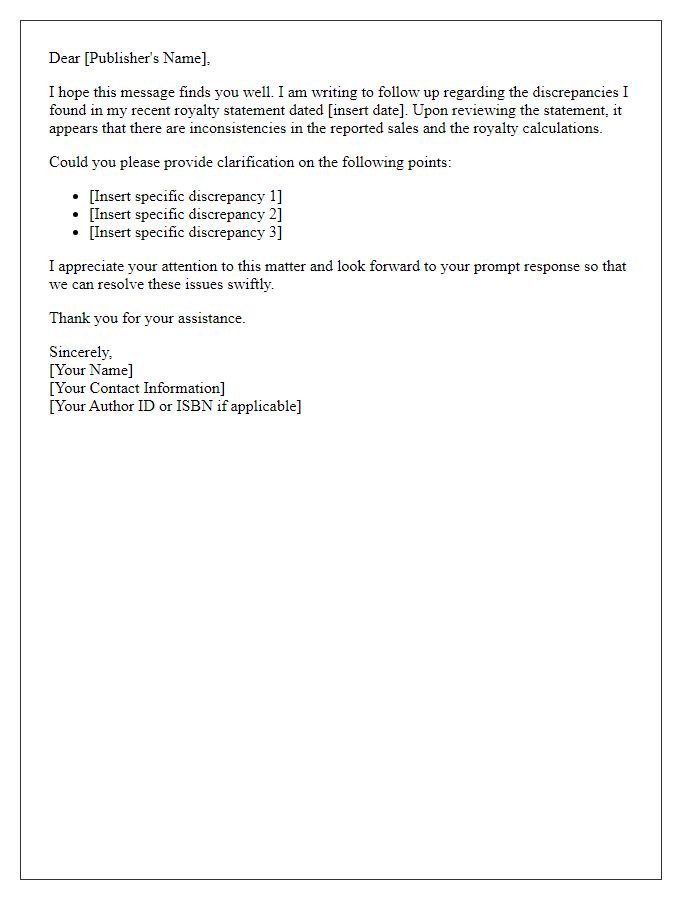

Reference to specific royalty statement in question

The royalty statement from January 2023, pertaining to the publication "The Enchanted Forest" by Harper Collins, reveals a total earned amount of $1,200. This figure reflects sales of 6,000 copies across various platforms including Amazon and Barnes & Noble. The statement outlines deductions for production costs and promotional expenses, totaling $300. Additionally, the royalty rate of 15 percent applied due to the book's hardcover sales can be scrutinized for accuracy based on our contract terms from 2021. Clarification regarding the discrepancies in reported sales figures compared to inventory data would be beneficial for a comprehensive understanding of earnings.

Request for detailed breakdown of earnings and deductions

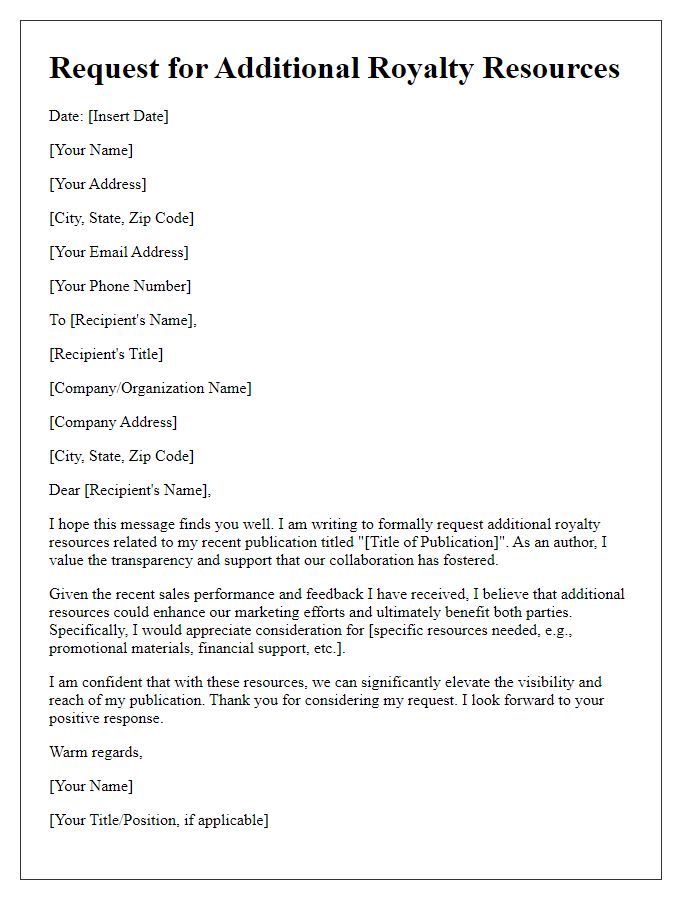

An author royalty statement requires clarity regarding earnings and deductions. Authors often receive royalties based on book sales or licensing fees. Common deductions may include printing costs, distribution fees, or advances against future earnings. Notably, specific royalty rates can vary by publisher, ranging from 10% to 25% of net sales depending on the contract terms. Additionally, various formats (eBooks, audiobooks, print) may generate different earnings. Timely reports are crucial for authors to assess their financial situation and determine the profitability of their works. A detailed breakdown will enhance transparency, facilitating better financial planning and future negotiations.

Inclusion of contact information for further communication

Authors often receive royalty statements detailing earnings from book sales. Inclusion of contact information is crucial for clarifying any discrepancies or questions regarding these statements. Easy access to contact details such as an email address or phone number ensures that authors can communicate effectively with the publisher's accounting department. This facilitates prompt resolution of issues, like calculations of earned royalties related to specific titles, ensuring authors are accurately compensated for their work. Clear communication channels help maintain author-publisher relationships, fostering transparency and trust within the publishing process.

Expression of appreciation and anticipation for prompt response

An author royalty statement plays a crucial role in the financial aspects of publishing. Understanding the details within this statement, including sales figures, royalty percentages, and payments, is essential for authors. These statements provide transparency regarding the revenue generated from book sales--both physical and digital--over specific periods. An accurate overview can clarify any discrepancies in expected earnings. Authors often communicate with publishers or royalty managers for clarification on these statements, ensuring the integrity of financial reporting. Timely responses from publishing houses promote strong professional relationships and foster trust between parties involved in the literary marketplace.

Letter Template For Author Royalty Statement Clarification Samples

Letter template of confirmation request for author royalty payment dates

Comments