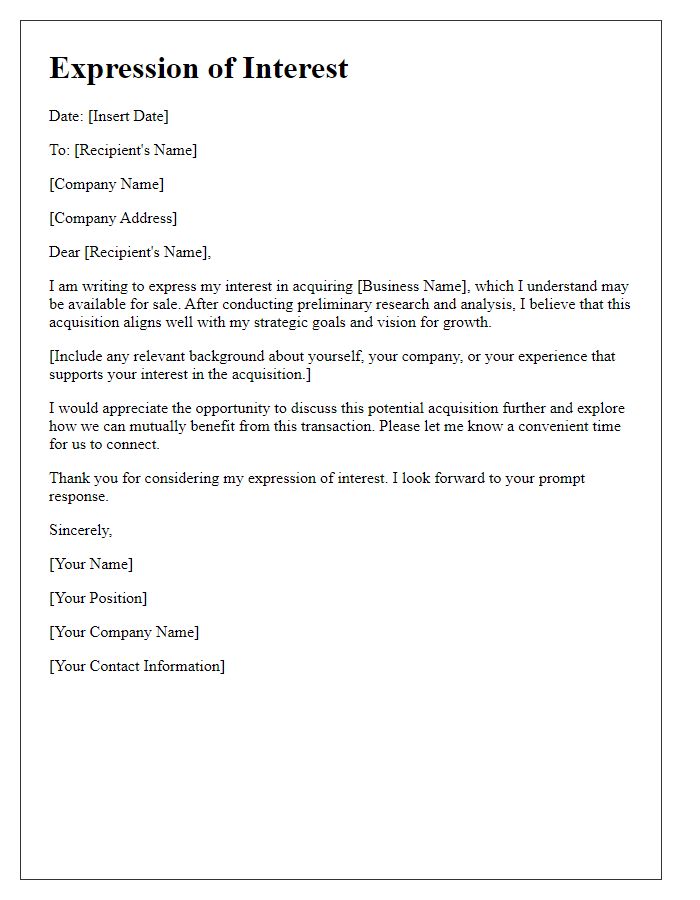

Are you considering a business acquisition and unsure how to present your offer? Crafting a compelling letter is essential to convey your intentions clearly and professionally. In this article, we'll explore key elements to include in your letter to ensure it resonates with the recipient and showcases the potential benefits of the acquisition. So, if you're ready to dive into the nuances of an effective acquisition offer, read on!

Clear Intent Statement

A clear intent statement for a business acquisition assesses and outlines the primary purpose and aspirations of the acquiring company (often a corporation or partnership). It establishes an understanding of the intent behind the acquisition, such as growth objectives, market expansion, or resource integration. The statement typically emphasizes aligning the core values and goals of both organizations, highlighting potential synergies, and detailing the strategic advantages anticipated from the merger. Additionally, a precise intent statement conveys confidence to shareholders, employees, and stakeholders about the future direction and collaborative vision of the newly formed entity or partnership.

Detailed Valuation

A detailed valuation is essential in formulating a strategic business acquisition offer, particularly for mid-market firms projected to yield annual revenues of approximately $10 million. Evaluating key assets, including inventory, equipment, intellectual property, and customer contracts, creates a comprehensive picture. Industry-specific multiples, such as EBITDA ( Earnings Before Interest, Taxes, Depreciation, and Amortization), provide a benchmark for valuation. As of Q2 2023, comparable transactions in the sector demonstrate an average EBITDA multiple ranging from 5x to 8x. Furthermore, assessing market conditions, competitive advantages, and growth potential is crucial, as firms operating in emerging markets like Southeast Asia exhibit strong growth trajectories, often attracting a premium in the acquisition process. Establishing a detailed valuation report streamlines negotiations, aligning expectations and facilitating a smoother transaction process.

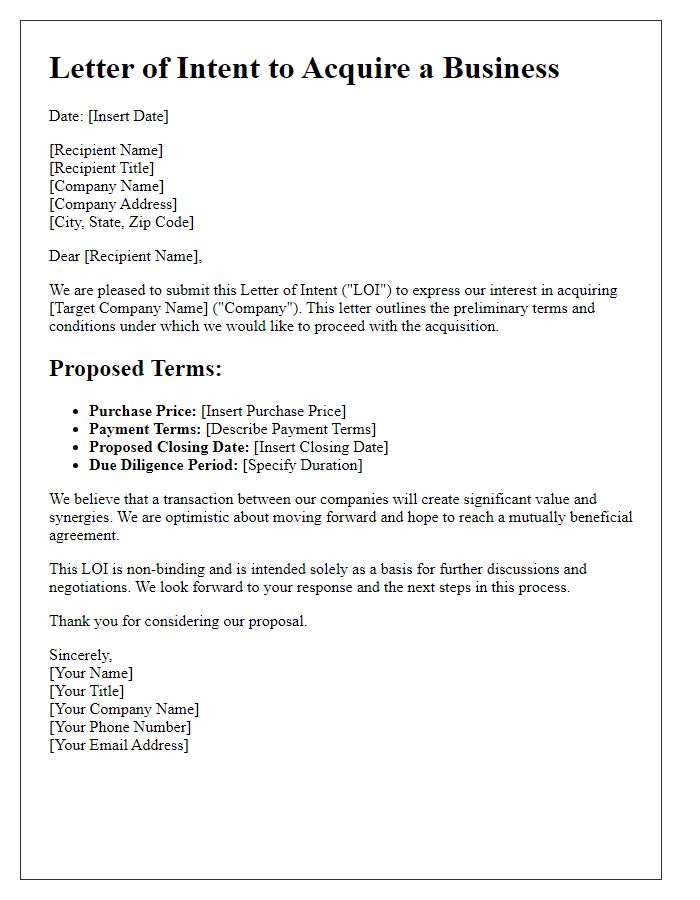

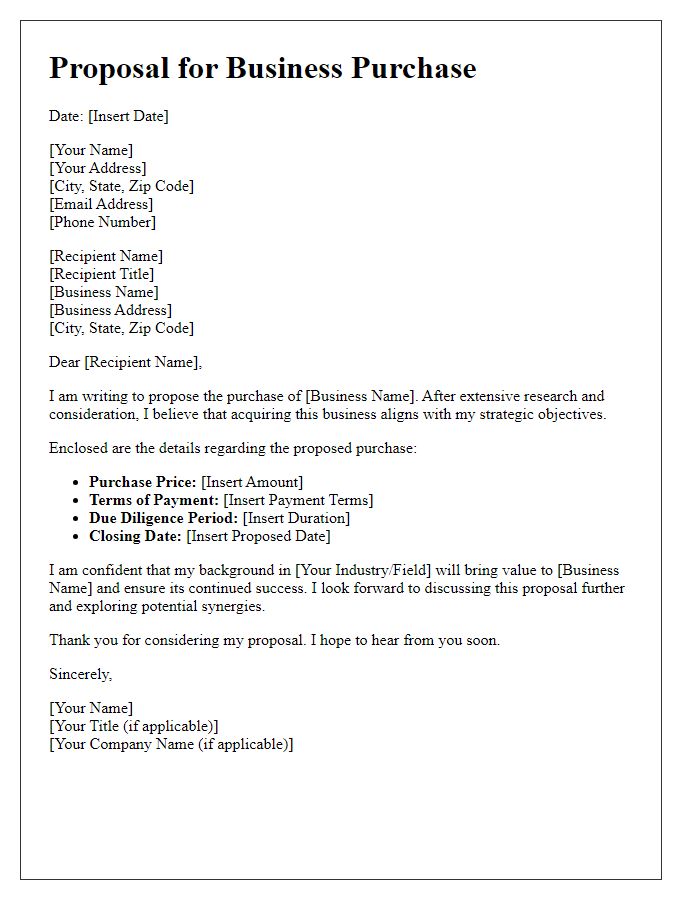

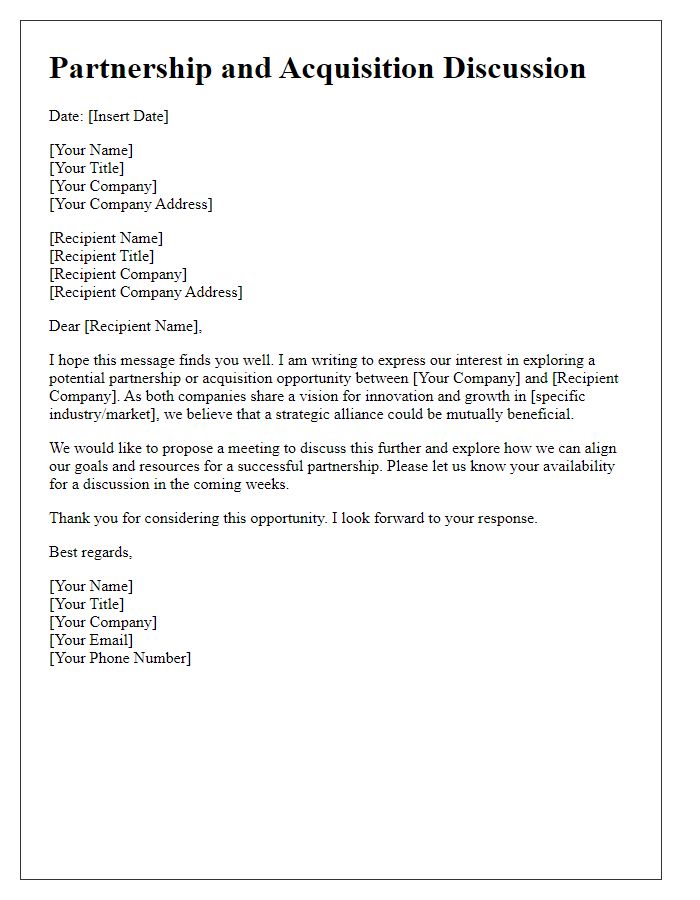

Terms and Conditions

A business acquisition offer requires detailed terms and conditions to ensure clarity and mutual understanding between parties involved in the transaction. Key elements such as purchase price specifies the total financial consideration for the acquisition, while closing date outlines the agreed timeline for the completion of the deal. Representations and warranties detail the assurances provided by the seller regarding the condition and legality of the business, including aspects like financial statements and regulatory compliance. Indemnification provisions establish liability limits and protections for both parties against unforeseen issues arising post-acquisition. Confidentiality clauses protect sensitive information exchanged during negotiations, ensuring confidentiality is maintained. Finally, governing law indicates the jurisdiction that will oversee any disputes, such as New York State law, which may influence how terms are interpreted and enforced.

Contingencies and Due Diligence

A business acquisition offer requires careful consideration of contingencies and due diligence processes. Contingencies, such as securing financing from institutions like banks or private equity (evaluating credit limits and interest rates), are critical for ensuring the transaction's success. Additionally, due diligence covers thorough investigations of financial statements, typically the last three years' income statements and balance sheets, assessing the target company's liabilities, market position, and legal standing (including any ongoing lawsuits). Another important aspect involves analyzing customer contracts and supplier agreements, which can significantly impact future revenue streams. Timely completion of these steps, often outlined within a timeframe of 30 to 90 days, is essential before finalizing the acquisition agreement, guaranteeing transparency and mutual benefit in the transition process.

Timeline and Next Steps

When planning for a business acquisition, creating a detailed timeline is essential to ensure all parties are aligned. For instance, conducting due diligence may take approximately four to six weeks, allowing for a thorough examination of financial records, contracts, and operations. Following due diligence, negotiations can commence, typically lasting two to three weeks, where terms of the acquisition, such as purchase price and payment structure, will be addressed. Once negotiations are finalized, drafting and signing a Letter of Intent (LOI) often occurs within a week, outlining key agreements. Then, legal documentation preparation may take an additional two weeks. Post-agreement, the integration phase can begin, expected to span several months, focusing on merging company cultures and aligning business operations effectively. Regular communication and updates with stakeholders throughout this process will be crucial to ensure transparency and address any concerns proactively.

Comments